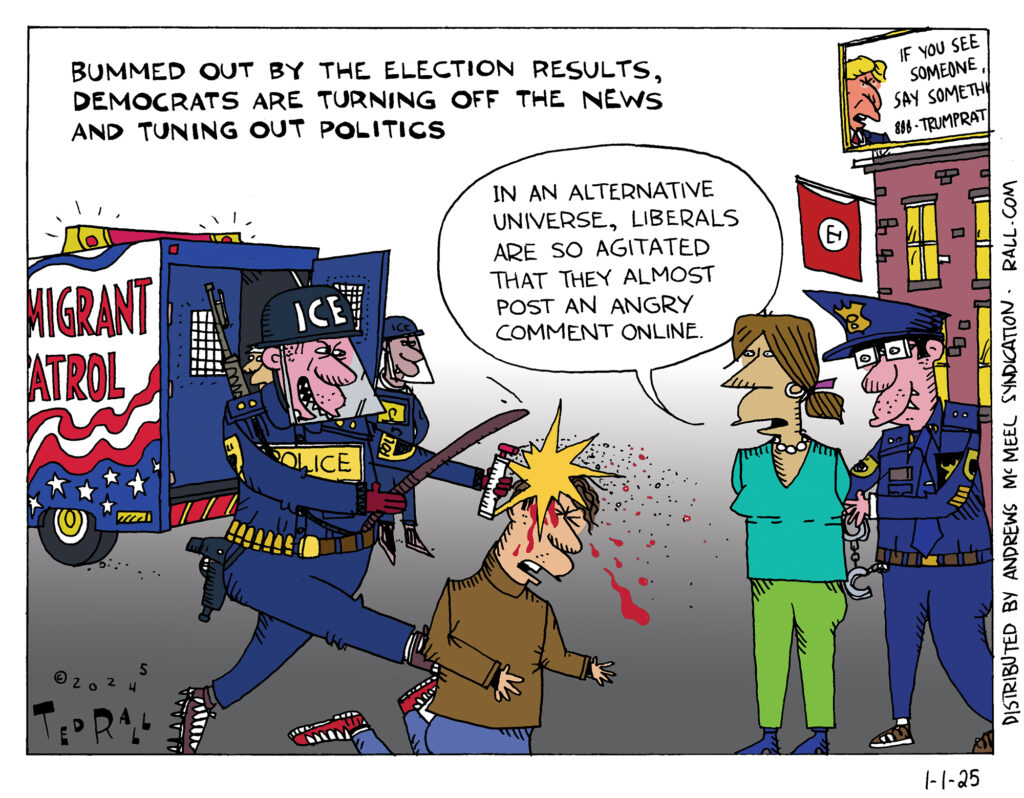

The DMZ America Podcast’s Ted Rall (on the Left) and Scott Stantis (on the Right) are joined by David Fitzsimmons, Cartoonist and Columnist for the Arizona Daily Star, to discuss David’s role as a Democratic activist and the future of the Democratic Party following Biden’s dropping out of the race and the defeat of Kamala Harris.

Non-voters are the biggest (potential) voting bloc in American politics. In midterm, state and local elections, more eligible voters choose not to exercise their franchise than to do so.

Non-voters are the biggest (potential) voting bloc in American politics. In midterm, state and local elections, more eligible voters choose not to exercise their franchise than to do so.