Non-voters are the biggest (potential) voting bloc in American politics. In midterm, state and local elections, more eligible voters choose not to exercise their franchise than to do so.

Non-voters are the biggest (potential) voting bloc in American politics. In midterm, state and local elections, more eligible voters choose not to exercise their franchise than to do so.

Pundits and political sociologists ignore non-voters. Nobody polls them. Nobody asks them why they don’t vote. Nobody asks them what issues they care about. Nobody asks them what it would take to get them to vote, or who they would vote for if they did. Whether this lack of interest in non-voters is due to a lack of imagination or contempt based on the belief that they are lazy and apathetic, the result is that we don’t know much about the political leanings and motivations (or lack thereof) of the majority of our fellow citizens. There are tens of millions of them. They are an untapped resource and, until recently, there has been little attempt to reach out to them.

Democratic Party strategists largely assume that there is little point dedicating precious campaign resources to an attempt to lure non-voters to the polls. From Bill Clinton in 1992 to Kamala Harris in 2024, the party has been primarily focused on trying to appeal to swing voters and moderate Republicans, even though there don’t seem to be very many of them.

Donald Trump’s first win disproved the hypothesis that you can’t get the third or more of eligible citizens who normally sit out presidential elections to come to the polls. 15% of the people who cast a ballot in November 2016 were first-time voters, up from 9% in 2012. True, Donald Trump’s coalition included people who vote Republican no matter what as well as traditional conservatives. But the key to his takeover of the GOP was his ability to motivate people who previously weren’t even registered to vote.

The 2016 election also highlighted the political impact of non-voting. Non-voters skewed Democratic, accounting for 55% as opposed to 41% for Republicans. Hillary Clinton lost because she wasn’t able to motivate enough of her own party’s supporters.

The cliché of the non-voter is that they are politically disengaged. If that is true, it falls short of painting the full picture. 3.5% of those who voted for Bernie Sanders in the 2016 primaries sat out the general election; they were more than enough to cost Clinton the race. But primary voters are far more engaged than general election voters. They didn’t forget to vote for Hillary. They made an active choice to be passive because they disliked both major-party candidates.

Non-voters were even more powerful this year. An astonishing 19 million Americans who voted for Joe Biden in 2020 considered the choice between Kamala Harris and Donald Trump and picked the couch.

She lost by 2.3 million votes.

These 19 million people were registered to vote. We know that they know how to vote; they did it four years ago in the middle of a pandemic. And we know that they voted Democratic! More states have early voting and mail-in ballots, so it was easier to vote in 2024. Logically, a more appealing Democrat than Kamala Harris might have received their support.

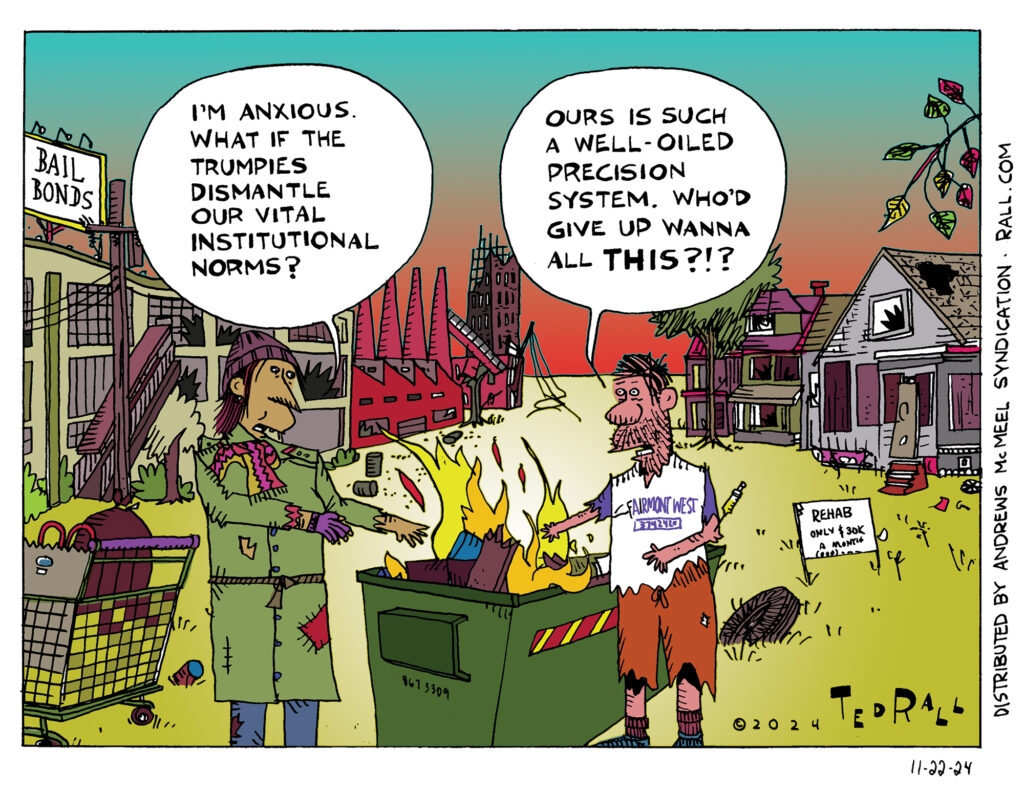

A full picture of American public opinion would include numerous thorough studies and surveys of people who sometimes vote and sit out elections at other times (this year’s Trump campaign reached out to these “irregular” and “low propensity” voters), those who never vote but are registered to vote, and those who are not registered. But the biggest factor here is obviously the defining characteristic of U.S. electoral politics: the two-party system. Democracies with two-party systems tend to have lower voter turnout than parliamentary democracies where multiple parties representing a wide range of ideological orientations are viable and active participants. The increasing percentage of Americans who self-identify as “independent” means that it is constantly less likely that a voter will agree with one of the two candidates of two polarized parties.

In a two-party system like ours, a voter who doesn’t much care for either candidate has three choices. They can suck it up and choose “the lesser evil,” vote for a third-party candidate who almost certainly doesn’t stand a chance, or sit out the election.

A significant subset of the first category is the negative message voter, who casts a ballot for the challenger in order to indicate their displeasure with the incumbent. With only two parties to choose from, these voters flail back-and-forth. Since a vote is a vote and doesn’t come with a footnote attached to it, neither the parties nor the news media ever receives the message. As more voters realize the futility of rage and spite voting, there is a general trend toward not voting at all.

Because they are oblivious to the left-leaning voters they are failing to motivate, Democrats have more to worry about in the short term. In the long run, however, the realization that non-voters are making an active choice not to bother with the political system is a major warning that the whole system may not be viable for much longer.

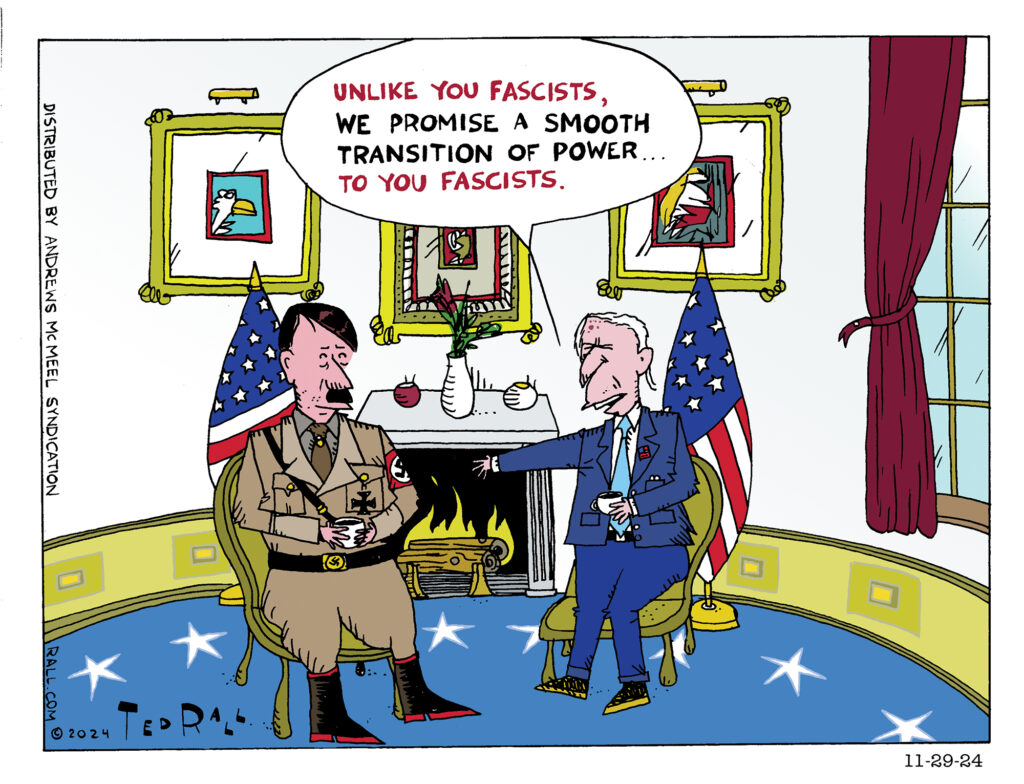

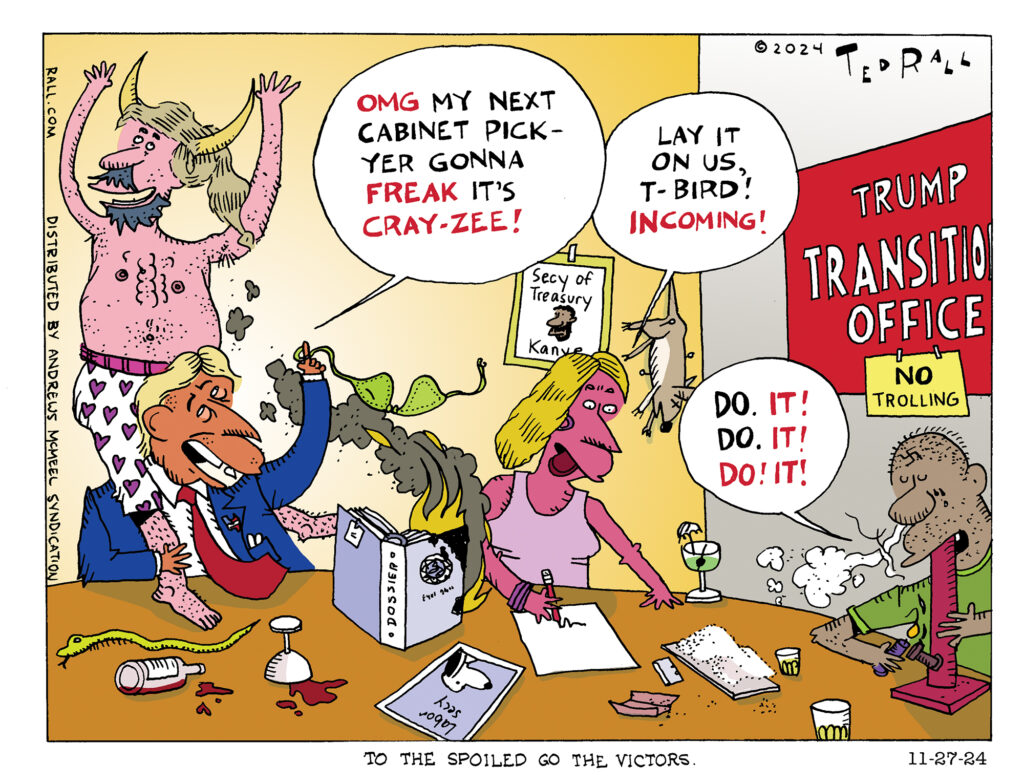

(Ted Rall (Twitter: @tedrall), the political cartoonist, columnist and graphic novelist, co-hosts the left-vs-right DMZ America podcast with fellow cartoonist Scott Stantis and The TMI Show with political analyst Manila Chan. His latest book, brand-new right now, is the graphic novel 2024: Revisited.)