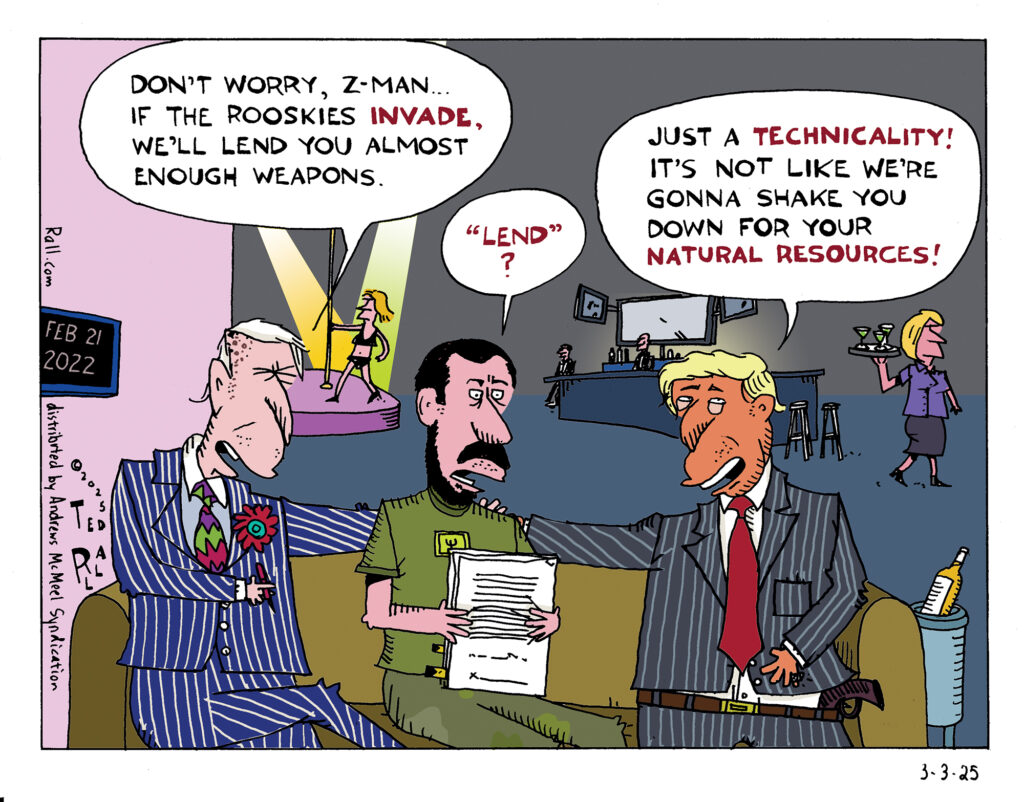

Of course it’s galling to see Donald Trump shake down his ally Ukraine for a massive share of its mineral resources. But let’s not forget, Joe Biden set the stage by offering assistance to Zelensky in the form of a loan rather than a grant.

Donald Trump and the Republicans are unleashing a tsunami of extremist executive orders and policy changes. But the Democrats who one would normally expect to lead the resistance are not reacting, explaining that they are in “wait and see mode” because they are still despondent about the election results.

When a marriage is in crisis,

When a marriage is in crisis,