Many Foreclosed Houses Are Infested by Mold

The next time someone tells you that capitalism is efficient, remember the mold houses.

I used to be a banker. Some of my customers had trouble making their loan payments. We usually had recourse to some sort of collateral—often real estate. But my bank really didn’t want to foreclose.

“We’re bankers,” my boss told me the first time this issue came up. “Not landlords.”

Back in the 1980s most banks held this view. Bankers sat on their butts in air-conditioned offices. They didn’t want to manage vacated properties, much less try to sell them. They understood banking. Banking was a straightforward business: take deposits, issue loans, collect the difference in interest as profit.

It was boring. Just the way they liked it.

My bank did a lot to avoid declaring a default. We lowered interest rates. We allowed skipped payments. Sometimes we even reduced principal.

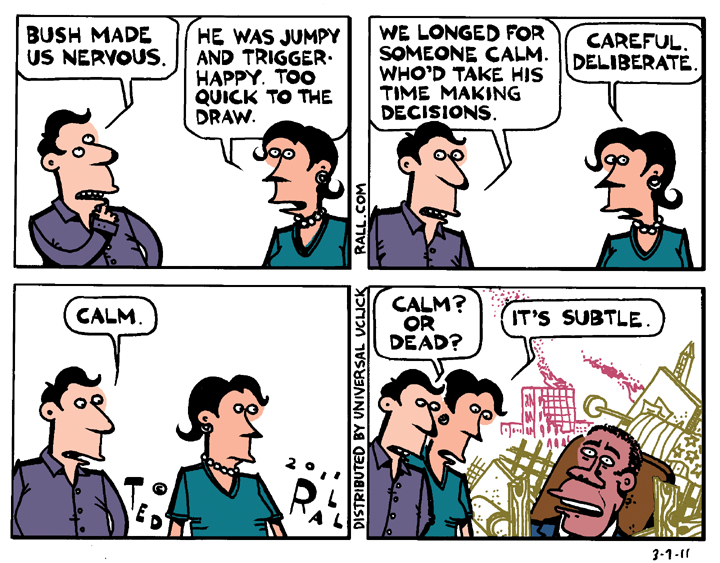

Banking became exciting during the 1990s. Glass-Steagall got repealed, allowing formerly staid bankers to compete with high-flying Wall Street financiers in the securities business. Bank consulting firms invented big new fees for services that used to be free, like using an ATM.

Banks issued millions of home loans to borrowers whom they knew couldn’t afford to pay them back. Crédit Suisse estimates that such “liars’ loans” accounted for 49 percent of originations by 2006. Why they’d do it? Like mobsters, bank executives were “busting out” their companies—generating false short-term profits in order to collect annual performance bonuses. By the time the toxic chickens came home to roost, as they did in the form of the September 2008 financial crisis, they and their paychecks had moved on.

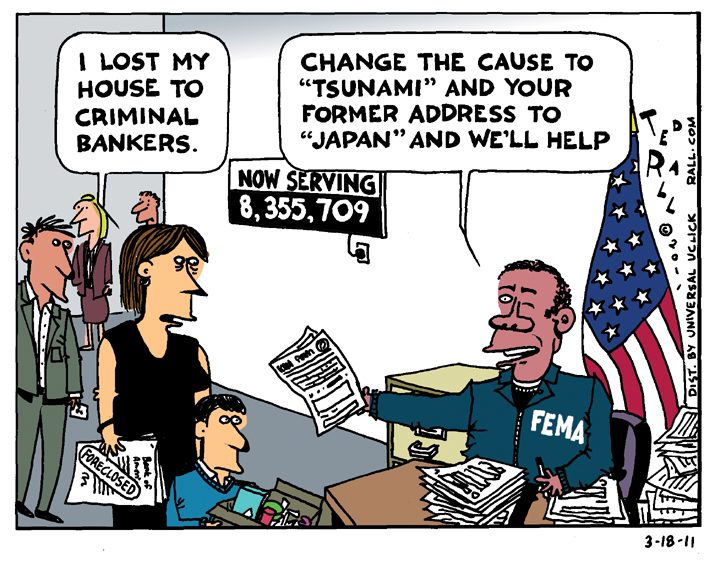

As the global financial system was in the midst of total collapse, greedy bankers conjured up a way to profit from the very misery they had caused. Rather than work with distressed homeowners who faced foreclosure (for example, refinancing subprime and adjustable rate mortgages into old-fashioned 30-year fixed mortgages) they dragged out the process in order to collect more late fees.

Banks were eager to foreclose. They were merciless. They evicted homeowners while they were on active-duty serving in Iraq and Afghanistan, a violation of federal law. They even evicted people who didn’t owe them a cent.

Now banks are sitting on top of nearly a million homes. “All told, [banks] own more than 872,000 homes as a result of the groundswell in foreclosures, almost twice as many as when the financial crisis began in 2007, according to RealtyTrac, a real estate data provider,” reports The New York Times. “In addition, they are in the process of foreclosing on an additional one million homes and are poised to take possession of several million more in the years ahead.”

Which is where the wonderful tragic tale of the mold houses comes in.

“In most homes,” reported NPR recently, “as residents go in and out and the seasons change, natural ventilation sucks moisture up to the attic and out through the roof. It’s called the ‘stack effect.’ And in many parts of the country, it’s driven by air conditioning in the summer and heat in the winter. But no one is going in or out of most foreclosed homes—regardless of climate—and the effects can be devastating.”

Far from the profit center imagined by freshly-minted analysts with MBAs, empty houses depreciate faster than a new car driving off the lot. They fall apart quickly. Mildew and mold sets in, some of it toxic.

“In some states, it’s estimated that more than half of foreclosed homes have mold and mildew issues,” reported NPR. “Realtors across the country say they’re seeing the problem in everything from bungalows to mansions.”

Turns out those old-fashioned bankers were on to something. Bankers shouldn’t become landlords.

A minor mold problem starts at $5,000 and can easily run $20,000 or more. Considering that the average house in the Midwest is valued at $136,000, that’s not insignificant. Many houses with toxic mold have to be demolished.

Greed may be good. But it doesn’t always pay.

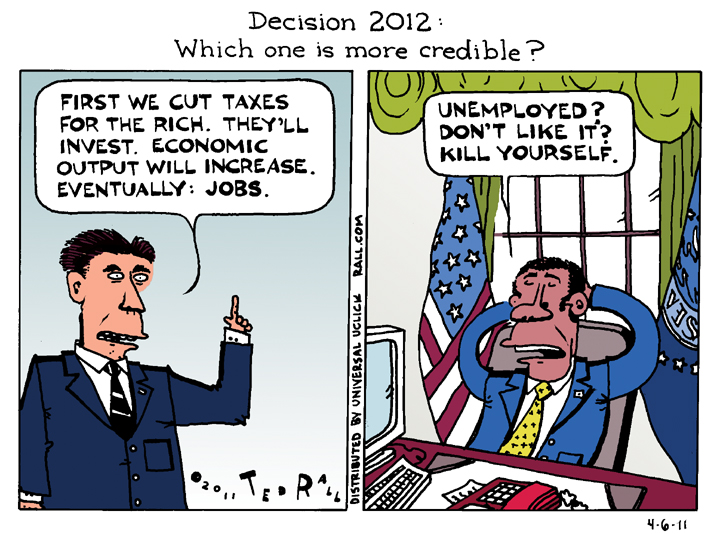

(Ted Rall is the author of “The Anti-American Manifesto.” His website is tedrall.com.)

COPYRIGHT 2011 TED RALL