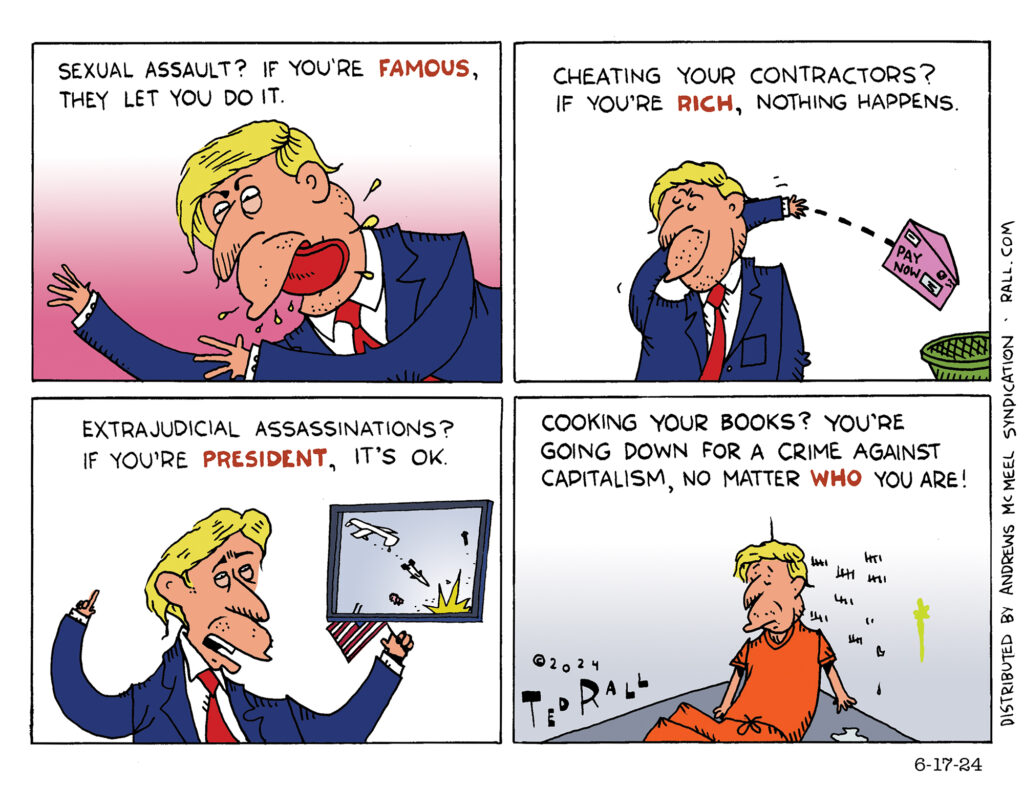

Donald Trump committed countless crimes without being held accountable. So it’s a weird reflection of our societal priorities that the one offense for which he is being held accountable is a relatively trivial paperwork charge.

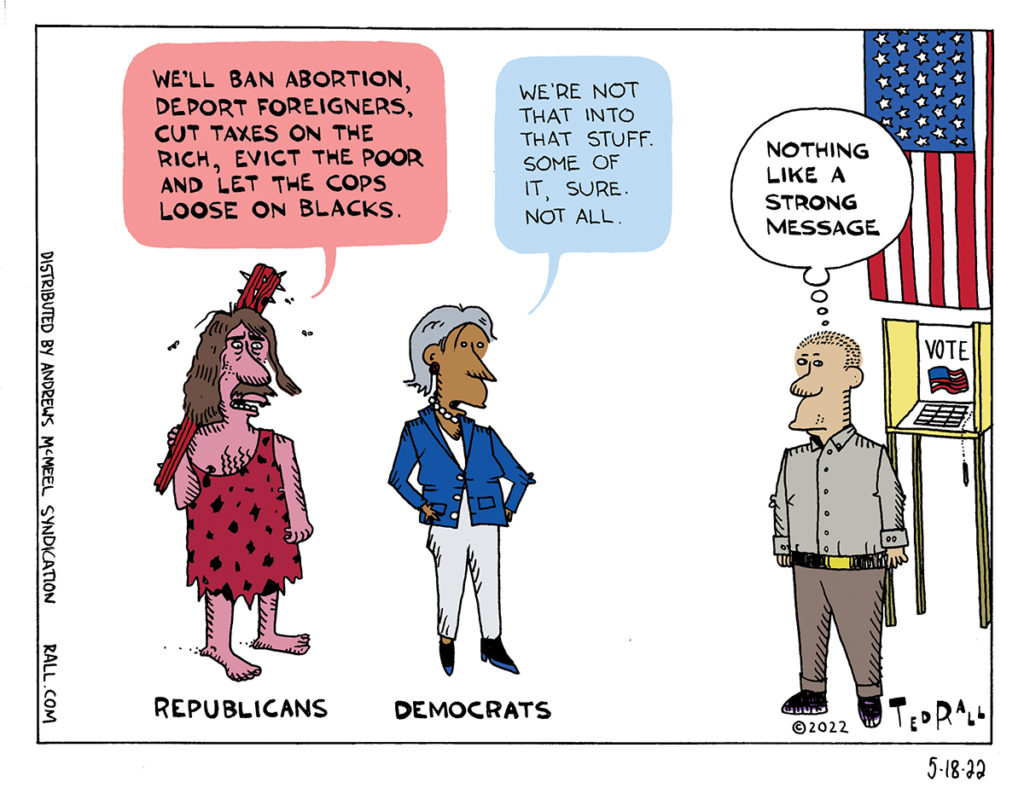

Nothing like a Strong Message for the Midterms

Voters will be going to the polls for the midterm elections six months from now. Democratic politicians know that they face an uphill climb and are likely to lose both the House of Representatives and the Senate. Yet the party hasn’t managed to coalesce behind a clear message beyond not being Republicans.

SYNDICATED COLUMN: Want More Wars? Raise Taxes on the Rich

Tax Fairness Won’t Reduce Inequality

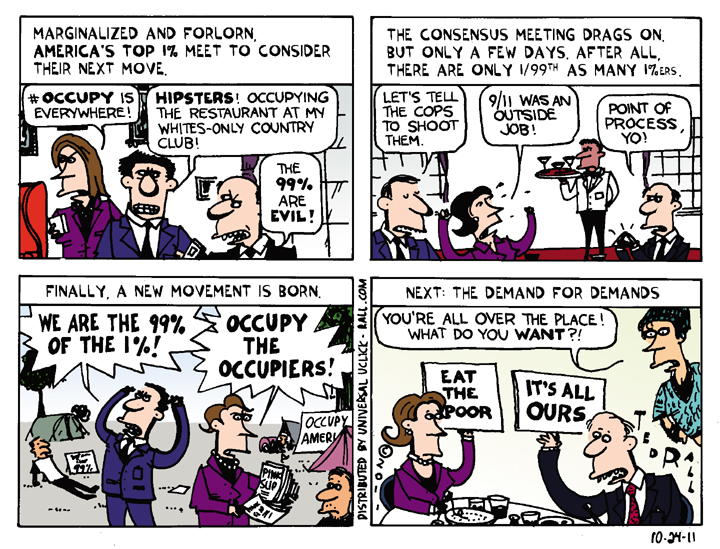

Reacting to and attempting to co-opt the Occupy Wall Street movement, President Obama used his 2012 State of the Union address to discuss what he now calls “the defining issue of our time”—the growing gap between rich and poor.

“We can either settle for a country where a shrinking number of people do really well, while a growing number of Americans barely get by,” Obama said. “Or we can restore an economy where everyone gets a fair shot, everyone does their fair share, and everyone plays by the same set of rules.”

No doubt, the long-term trend toward income inequality is a major flaw of the capitalist system. From 1980 to 2005 more than 80 percent in the gain in Americans’ incomes went to the top one percent. This staggering disparity between the haves and have-nots has created a permanent underclass of underemployed, undereducated and alienated people who often turn to crime for survival and social status. Aggregation of wealth into fewer hands has shrunk the size of the U.S. market for consumer goods, prolonging and deepening the depression.

How can we make the system fairer?

Liberals are calling for a more progressive income tax: i.e., raise taxes on the rich. Obama says he’d like to slap a minimum federal income tax of 30 percent on individuals earning more than $1 million a year.

Soaking the rich would obviously be fair. GOP frontrunner/corporate layoff sleazebag Mitt Romney earned $59,500 a day in 2010—and paid half the effective tax rate (13.9 percent) of that paid by a family of four earning $59,500 a year.

Fair, sure. But would it work? Would increasing taxes on the wealthy do much to close the gap between rich and poor—to level the economic playing field?

Probably not.

From FDR through Jimmy Carter it was an article of faith among liberals that higher taxes on the rich would result in lower taxes on the poor and working class. This was because the Republican Party consistently pushed for a balanced budget. Tax income was tied to expenditures, which were more or less fixed—and thus a zero-sum game.

That period from 1933 to 1980 was also the era of the New Deal, Fair Deal and Great Society social and anti-poverty programs, such as Social Security, the G.I. Bill, college grants and welfare. These government handouts helped mitigate hard times, gave life-changing educational opportunities that allowed class mobility, closing the gap between despair and hope for tens of millions of Americans. As the list of social programs grew, so did the tax rate—mostly on the rich. The practical effect was to redistribute income from top to bottom.

Democrats think it still works that way. It doesn’t.

The political landscape has shifted dramatically under Reagan, Clinton and the two Bushes. Budget cuts slashed spending on student financial aid, food stamps, Medicaid, school lunch programs, veterans hospitals, aid to single mothers. The social safety net is shredded. Most federal tax dollars flow directly into the Pentagon and defense contractors such as Halliburton.

As the economy continues to tank, there’s only one category to cut: social programs. “Eugene Steuerle worked on tax and budget issues in the Reagan Treasury Department and is now with the Urban Institute,” NPR reported a year ago. “He says one reason no one talks about preserving the social safety net today is that lawmakers have given themselves little choice but to cut it. They’ve taken taxes and entitlements, such as Social Security and Medicare, off the budget-cutting table, so there’s not much left.”

Meanwhile, effective tax rates on the wealthy have been greatly reduced. Which isn’t fair—but not in the way you might think.

Taxes on middle-class families are at their lowest level in 50 years, according to the Center on Budget and Policy Priorities, a liberal thinktank.

What’s going on?

On the revenue side of the budget equation, the poor and middle-class have received tiny tax cuts. The rich and super rich have gotten huge tax cuts. Everyone is paying less.

On the expense side, social programs have been pretty much destroyed. If you grow up poor there’s no way to attend college without going into debt. If you lose your job you’ll get 99 weeks of tiny, taxable (thanks to Reagan) unemployment checks before burning through your savings and winding up on the street.

Military spending, on the other hand, has soared, accounting for 54 percent of federal spending.

In short, we’re running up massive deficits in order to finance wars in Afghanistan, Iraq, and so on, and so rich job-killers can pay the lowest tax rates in the developed world.

I’m all for higher taxes on the rich. I’m for abolishing the right to be wealthy.

But liberals who think progressive taxation will mitigate or reverse income inequality are trapped in the 1960s, fighting the last (budget) war in a reality that no longer exists. The U.S. government’s top priority is invading Muslim countries and bombing their citizens. Without big social programs, invading Muslim countries and bombing their citizens is exactly where every extra taxdollar collected from the likes of Mitt Romney would go.

The only way progressive taxation can address income inequality is if higher taxes on the rich are coupled with an array of new anti-poverty and other social programs designed to put money and new job skills directly into the pockets of the 99 percent of Americans who have seen no improvement in their lives since 1980.

You have to rebuild the safety net. Otherwise higher taxes will swirl down the Pentagon’s $800 toilets.

If you’re serious about inequality, income redistribution through the tax system is only a start. Whether through stronger unions or worker advocacy through federal agencies, government must require higher minimum wages. It should set a maximum wage, too. A nation that allows its richest citizen to earn ten times more than its poorest would still be horribly unfair—yet it would be a big improvement over today. Shipping jobs overseas must be banned. Most free trade agreements should be torn up. Companies must no longer be allowed to layoff employees before eliminating salaries and benefits for their top-paid managers—CEOs, etc.

And a layoff should mean just that—a layoff. First fired should be first rehired—at equal or greater pay—if and when business improves.

Once a battery of spending programs targeted to the 99 percent is in place—permanent unemployment benefits, subsidized public housing, full college grants, etc.—the tax code ought to be radically revamped. For example, nothing gives the lie to the myth of America as a land of equal opportunity than inheritance. Aristocratic societies pass wealth and status from generation to generation. In a democracy, no one has the right to be born into wealth.

Because everyone deserves an equal chance, the national inheritance tax should be 100 percent. While we’re at it, why should people who inherited wealth but have low incomes get off scot-free? Slap the bastards with a European-style tax on wealth as well as the appearance of wealth.

Now you’re probably laughing. Even Obama’s lame call for taxing the rich—so the U.S. can buy more drone planes—stands no chance of passing the Republican Congress. They’re empty words meant for election-year consumption. Taking income inequality seriously? That’s so off the table it isn’t even funny.

Which is why we shouldn’t be looking to corporate machine politicians like Obama for answers.

(Ted Rall is the author of “The Anti-American Manifesto.” His website is tedrall.com.)

COPYRIGHT 2012 TED RALL

SYNDICATED COLUMN: The Phony Budget Crisis

Forget Austerity. Tax the Rich.

Everywhere you look, from the federal government to the states to your hometown, budget crises abound. Services are being slashed. Politicians and pundits from both parties tell us that the good times are over, that we’ve got to start living within our means.

It’s a lie.

Two case studies have made news lately: California, where new/old governor Jerry Brown is trying to close a $25 billion shortfall with a combination of draconian cuts in public services and a series of regressive tax increases, and Wisconsin, where right-winger Scott Walker says getting rid of unions would eliminate the state’s $137 million deficit.

Never mind the economists, most of whom say an economic death spiral is exactly the worst possible time for government to cut spending. Pro-austerity propaganda has won the day with the American public. A new Rasmussen poll funds that 58 percent of likely voters would approve of a shutdown until Democrats and Republicans can agree on what spending to cut.

The budget “crisis” is a phony construction, the result of right-wing “starve the beast” ideology. There is plenty of money out there—but the pols don’t want it.

There is no need to lay off a single teacher, close a single library for an extra hour, or raise a single fee by one red cent.

Every government can not only balance its budget, but wind up with a surplus.

The solution is simple: tax the rich.

Over the last 50 years tax rates for the bottom 80 percent of wage earners have remained almost static. Meanwhile the rich have received tax cut after tax cut after tax cut. For example, the rate paid by the top 0.01 percent—people who currently get more than $6.5 million a year—fell by half (from 70 to 35 percent).

Times are tough. Someone has to pay. Why not start with those who can most afford it?

Europe has the world’s best food, its best healthcare system and its best vacation policy. It also has one of the fairest ways to generate revenue for government: a wealth tax. In Norway, for example, you pay one percent of your net worth in addition to income tax.

What if we imposed a Norwegian-style wealth tax on the top one percent of U.S. households? We’re not talking upper middle class here: the poorest among them is worth a mere $8.3 million. This top one percent owns 35 percent of all wealth in the United States.

“Such a wealth tax…would raise $191.1 billion each year (one percent of $19.1 trillion), a significant attack on the deficit,” Leon Friedman writes in The Nation. “If we extended the tax to the top 5 percent, we could raise $338.5 billion a year (one percent of 62 percent of $54.6 trillion).”

But that’s just the beginning. Wealthy individuals are nothing next to America’s money-sucking corporations.

Business shills whine that America’s corporate tax rate—35 percent—is one of the world’s highest. But that’s pure theory. Our real corporate rate—the rate companies actually pay after taking advantages of loopholes and deductions—is among the world’s lowest. According to The New York Times, Boeing paid a total tax rate of 4.5 percent over the last five years. (This includes federal, state, local and foreign taxes.) Yahoo paid seven percent. GE paid 14.3 percent. Southwest Airlines paid 6.3 percent. “GE is so good at avoiding taxes that some people consider its tax department to be the best in the world, even better than any law firm’s,” reports the Times‘ David Leonhardt. “One common strategy is maximizing the amount of profit that is officially earned in countries with low tax rates.”

America’s low effective corporate tax rates have left big business swimming in cash while the country goes bust. As of March 2010 non-financial corporations in the U.S. had $26.2 trillion in assets. Seven percent of that was in cash.

The national debt is $14.1 trillion.

Which is a lot. And, you see, entirely by choice.

(Ted Rall is the author of “The Anti-American Manifesto.” His website is tedrall.com.)

COPYRIGHT 2011 TED RALL

SYNDICATED COLUMN: Hope and Change? Not for Americans

Turmoil from Mideast to Midwest

If irony were money we’d be rich.

“You’ve got to get out ahead of change,” President Obama lectured a week ago. “You can’t be behind the curve.” He was, of course, referring to the Middle East. During the last few weeks there has been a new popular uprising every few days: Tunisia, Egypt, Yemen, Jordan, Bahrain, Libya.

And now, Wisconsin.

In Madison, where a new Republican governor wants to gut the rights of state workers to form unions and negotiate for higher wages, tens of thousands of protesters have filled the streets and sat in the State Capitol for days. “It’s like Cairo has moved to Madison these days,” said Congressman Paul Ryan (R-WI).

Revolutionary foment is on the march around the globe, but Mr. Hopey Changey is nowhere to be found now that it’s here in the U.S. Whatever happened to “get ahead of change?” What’s good for the Hosni isn’t good for the Barry.

Deploying his customary technocratic aloofness in the service of the usual screw-the-workers narrative, President Obama sided with the union-busters: “Everybody has to make some adjustments to the new fiscal realities,” he scolds.

“Everybody,” naturally, does not include ultrarich dudes like our multi-millionaire president. Obama, who declared a whopping $5.5 million in annual income for 2009 (the last year available), has neither reduced his salary nor donated a penny of his $7.7 million fortune to the Treasury to help adjust to those “new fiscal realities.”

Hard times, doncha know, are for the little people. “We had to [my italics] impose a freeze on pay increases for federal workers in the next two years as part of my overall budget freeze,” said Obama. “I think those kinds of adjustments are the right thing to do [in Wisconsin].”

“Had to.” Interesting pair of words. They imply that there was no other choice. What a brazen lie.

Three more words: Tax. The. Rich. Rich people and corporations are making out like bandits. If they paid their fair share, there’d be no need to cut budgets.

“Adjustments.” How bloodless. For normal people, Herr President, losing two percent of one’s pay is not a mere adjustment. It hurts.

Obama’s grandstanding had-to freeze on federal pay will save $5 billion over two years. Which is nothing. That’s what the Pentagon chucks down the Iraq and Afghanistan ratholes in a single week.

The federal deficit is $14 trillion. That’s $14,000 billion. Obama’s federal pay freeze, which amounts to a piddling four hundredths of one percent, is empty symbolism.

As the striking members of the PATCO air traffic controllers union learned in 1981, higher wages and working conditions are for foreigners, not Americans. Ronald Reagan had nothing but praise for Solidarity in Poland (declaring that “the right to belong to a free trade union” was “one of the most elemental human rights”).

At the same time he was defending Polish workers Reagan fired all of America’s 11,345 striking air traffic controllers and ordered their union decertified.

All political systems are built on contradictions that eventually lead to their downfall. The U.S. relies on a whopping chasm between soaring rhetoric (freedom, democracy, individual rights) and brutish reality (preemptive war, supporting dictators, torture, spying on citizens)—a gap that is so wide and so glaring that it is amazing anyone ever takes the propaganda seriously.

A recent report in The New York Times slathers on a rich quadruple serving of syrupy irony. The Obama Administration asked the CIA to prepare a secret memo about the revolutions in the Middle East, specifically analyzing “how to balance American strategic interests and the desire to avert broader instability against the democratic demands of the protesters.”

What, exactly, are those “strategic interests”? Business. Dictators cut sweetheart deals with big corporations that donate to the Democratic and the Republican parties.

Democracy—real democracy, the kind people are fighting for in Bahrain and Madison, is incompatible with free-market capitalism.

Which is what union members in Wisconsin, as well as those of us who don’t belong to unions but understand that we would be working 100-hour weeks in death-trap factories without them, see clearly. The American Dream is just that— a dream. And it’s not for Americans.

Obama’s statement about the Arab autarchies is astonishingly tone deaf to realities here at home. “I think that the thing that will actually achieve stability in that region is if young people, if ordinary folks, end up feeling that there are pathways for them to feed their families, get a decent job, get an education, aspire to a better life,” he said. “And the more steps these governments are taking to provide these avenues for mobility and opportunity, the more stable these countries are.”

Well, yes.

According to a recent Bloomberg National poll, most American adults believe that their children will have worse lives than they do.

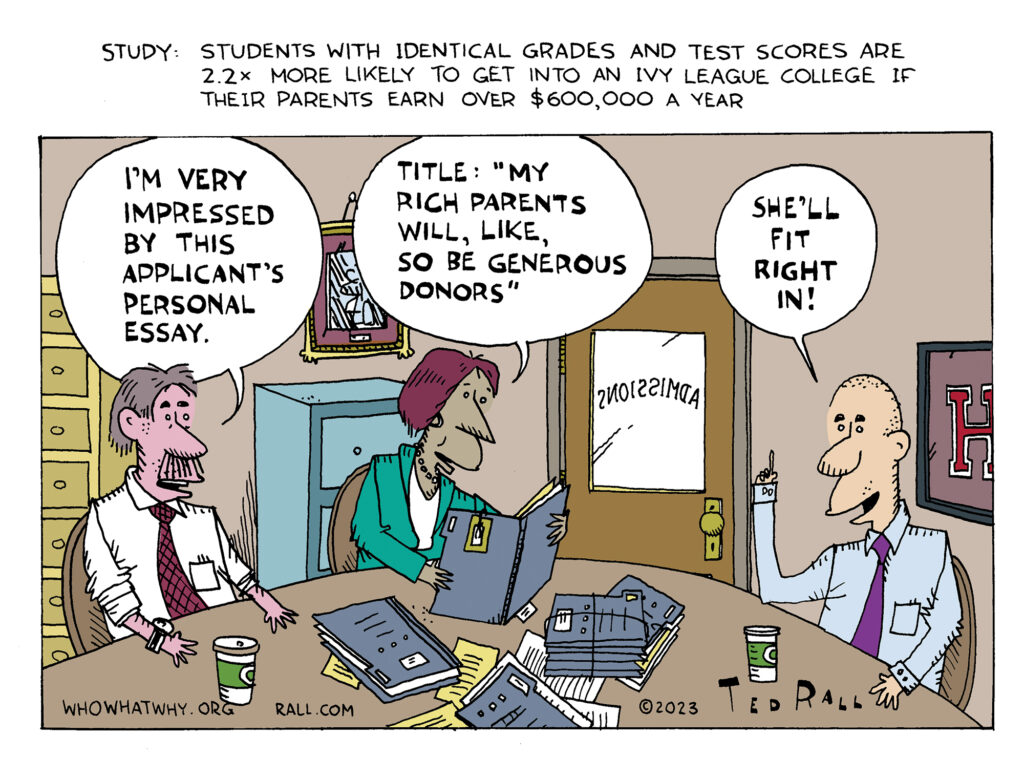

That’s true even about those who have all the so-called advantages.

At this writing the unemployment rate for recent college graduates is 80.3 percent.

How will they pay their loans?

The rate is even higher for other young adults.

In a way, the unemployed and underemployed should thank Obama and the plutocrats he helps protect. The ruling classes’ shortsighted refusal to give up some of the loot they’ve stolen will soon bring about the real changes Americans require and deserve.

(Ted Rall is the author of “The Anti-American Manifesto.” His website is tedrall.com.)

COPYRIGHT 2011 TED RALL

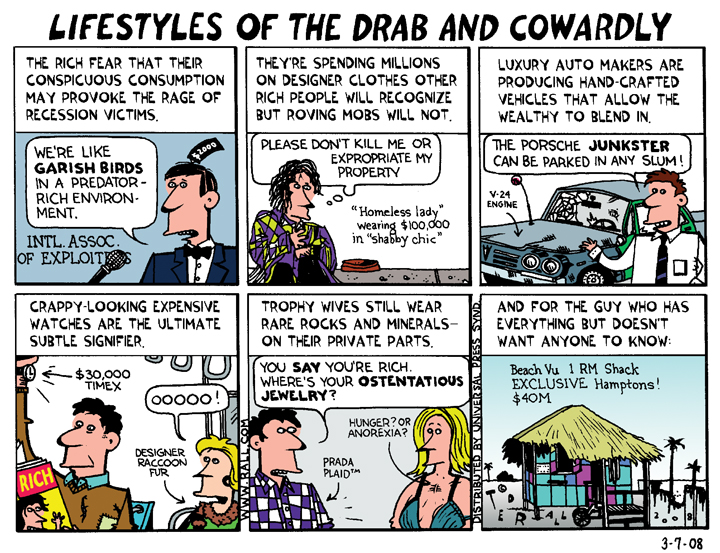

Lifestyles of the Drab and Cowardly

Inspired by a heinous article in The New York Times, this cartoon deals with recession-friendly luxury wear for rich assholes. They want other rich people to recognize them–but they don’t want us to catch them in the streets.

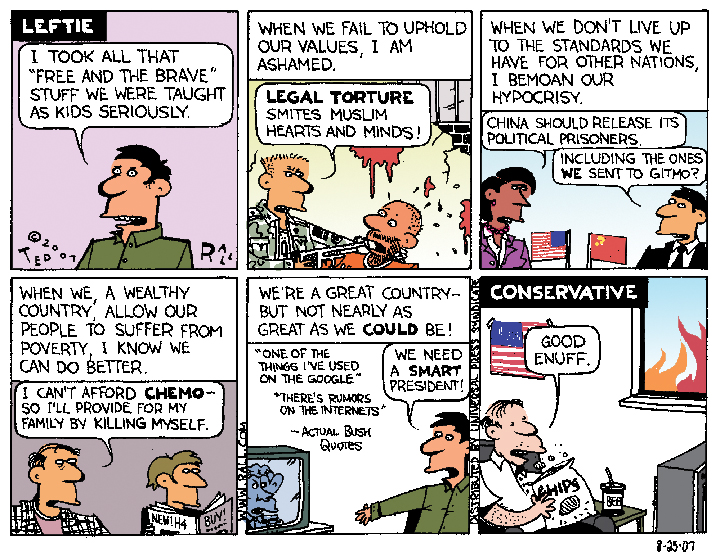

Left v. Right

This one resulted from a few conversations I’ve had lately with conservative friends. There are other differences between lefties and righties, of course, but one of those we’ve neglected is this one. Many Republicans wonder, given all the things America does right, why we whine so much about what it does wrong. We, of course, wonder why conservatives don’t want to make our country even better.