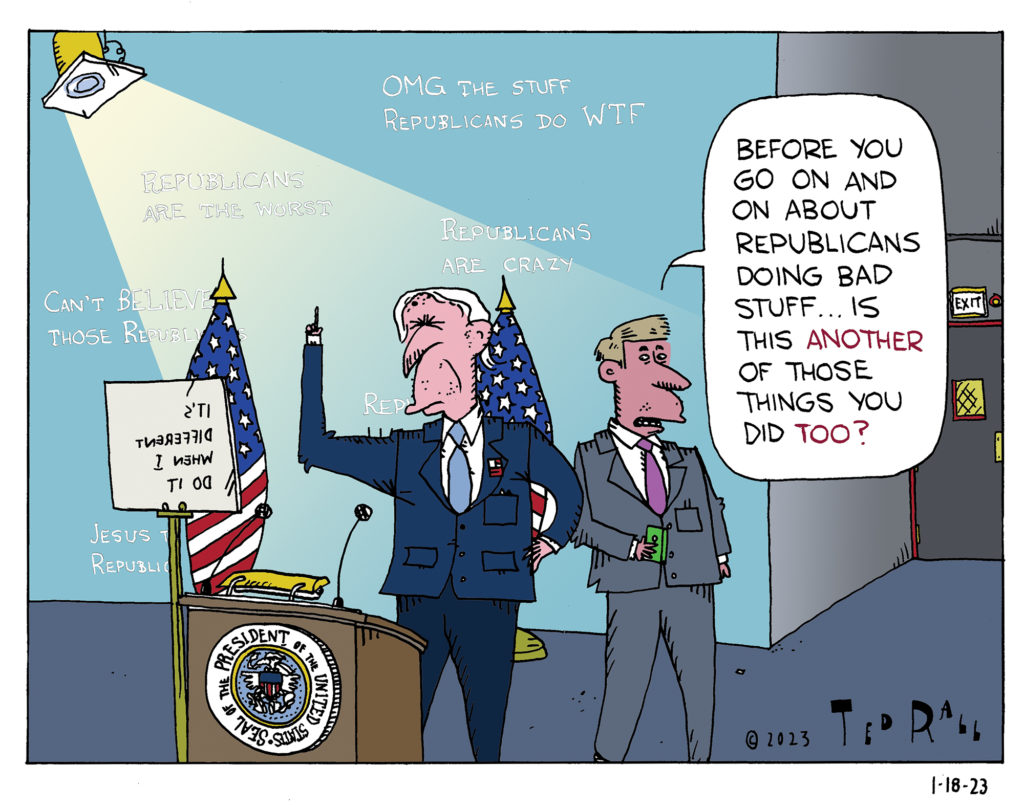

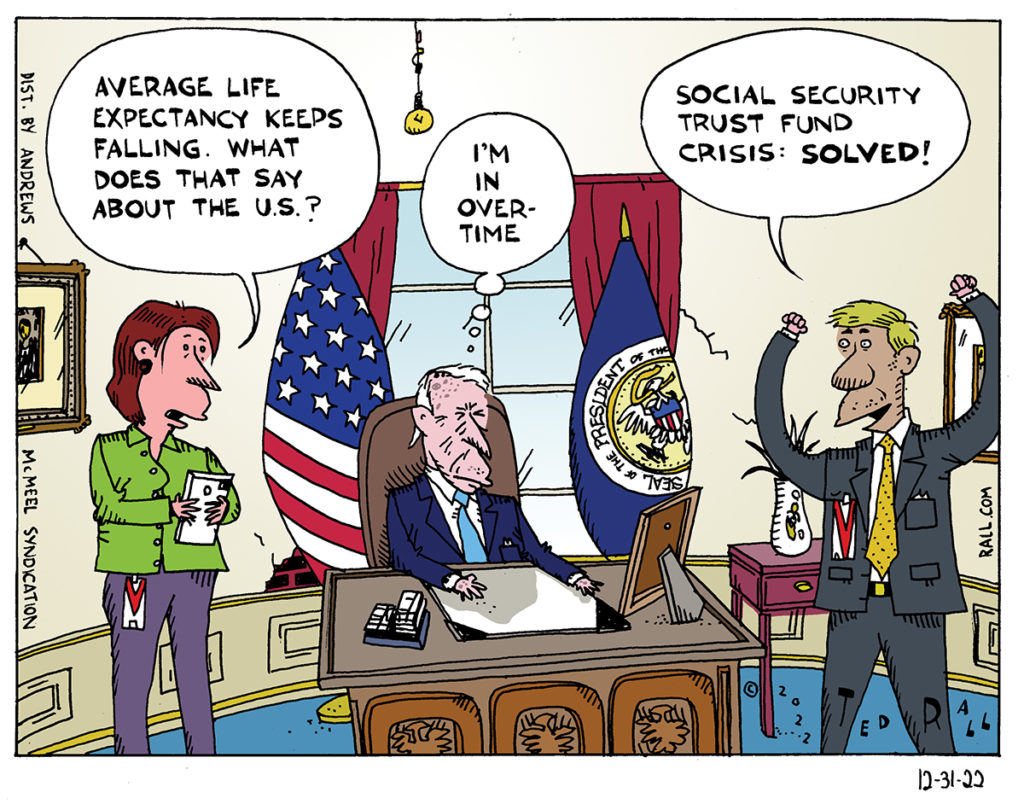

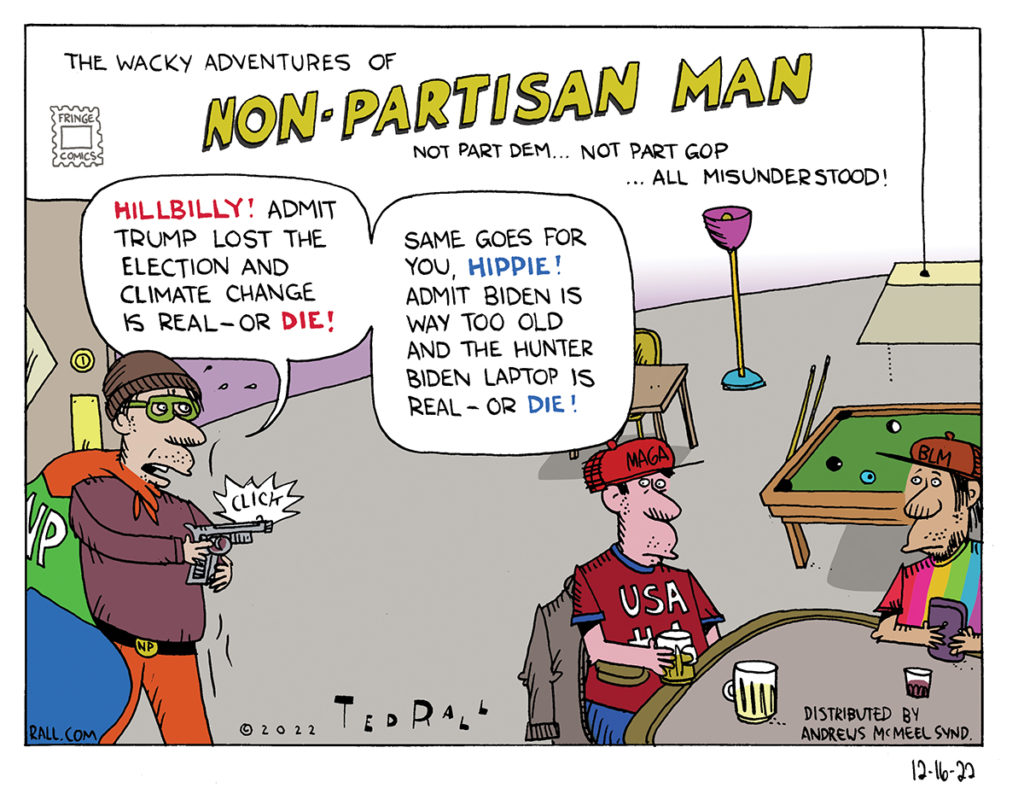

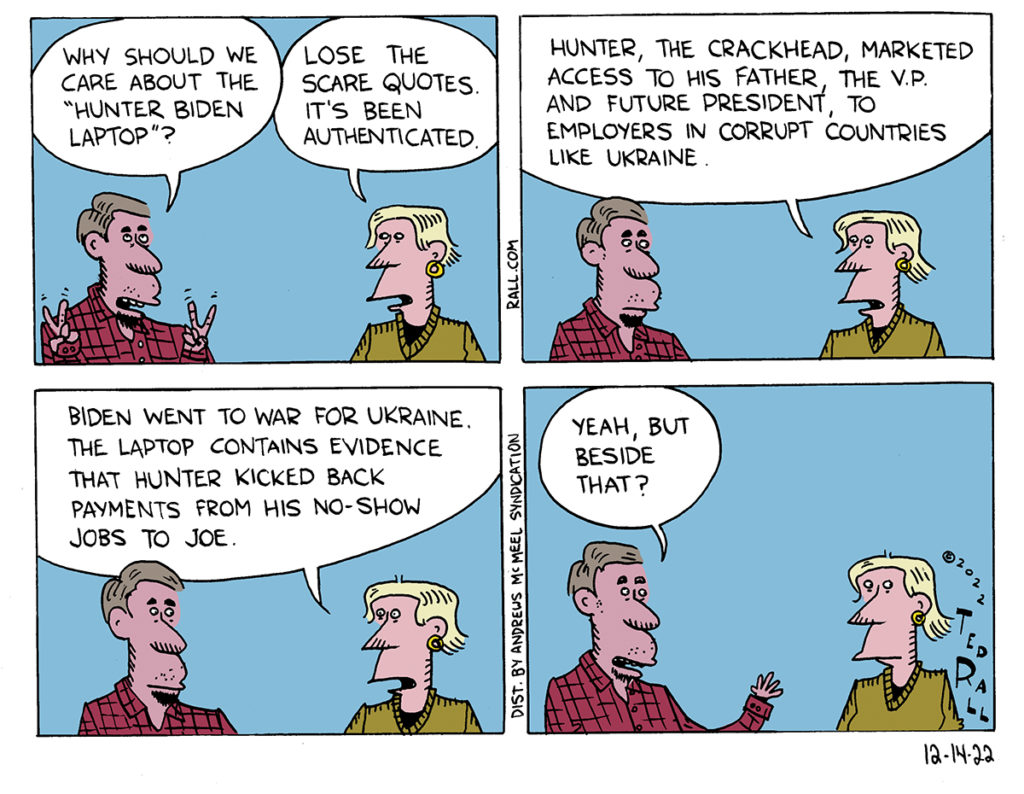

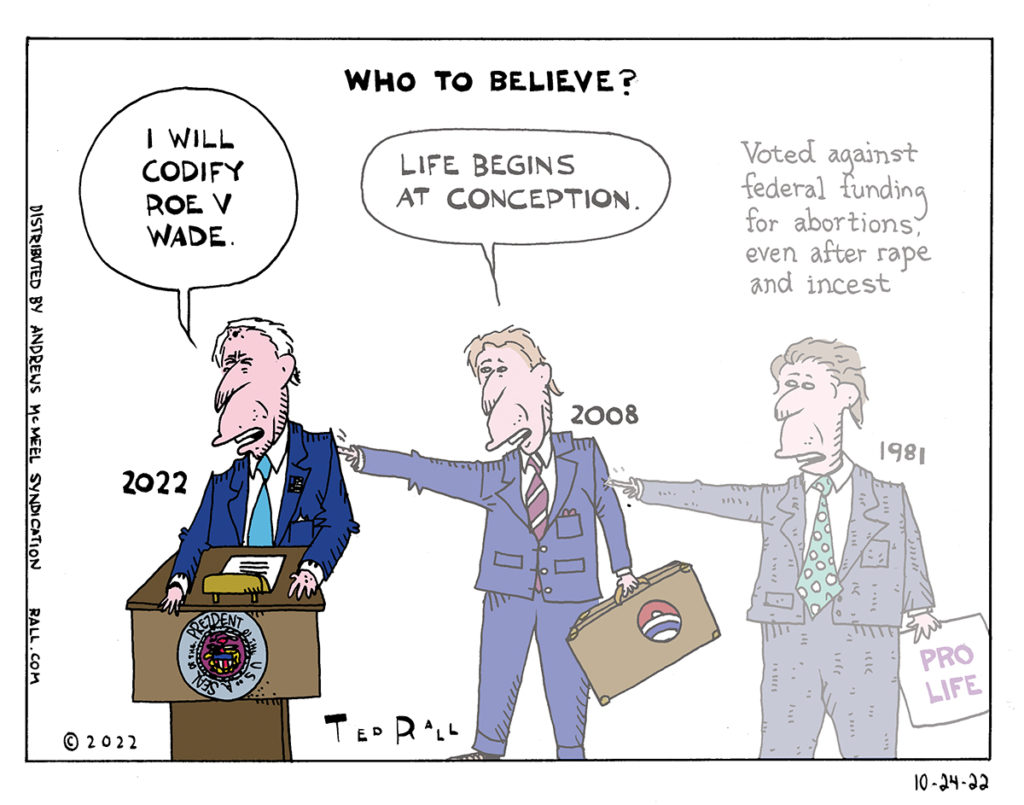

Editorial cartoonists Ted Rall (from the Left) and Scott Stantis (from the Right) break down another interesting week in news and current events. Former Vice President Mike Pence, it turns out, also had classified documents left over from his time in office. Is it time to admit that (a) everyone has classified documents and (b) way too much stuff is overclassified and we should just stop caring about this? Now Ukraine wants tanks. But it turns out many of President Zelensky’s top officials were corrupt, so he fired them. Should the U.S. establish a war aim to define what victory looks like? If so, what should it be? Angry parents, including some liberal Democrats, say schools should tell them if their kids are identifying as a different gender in the classroom. Do parents have a right to know that their boy is really a girl? Finally, downtowns are dying as a result of workers no longer going into the office. Why do Americans hate commuting so much?