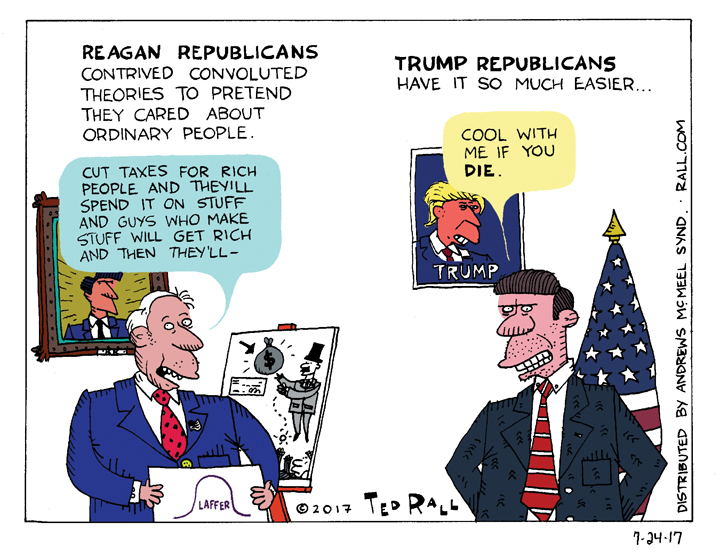

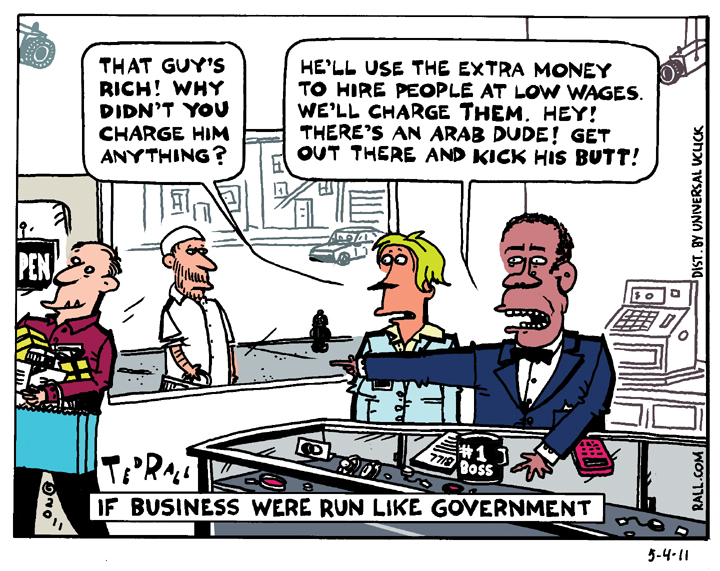

In the age of Reagan, Republicans had to pretend their policies were ultimately for the good of ordinary people. Now they don’t even bother to pretend.

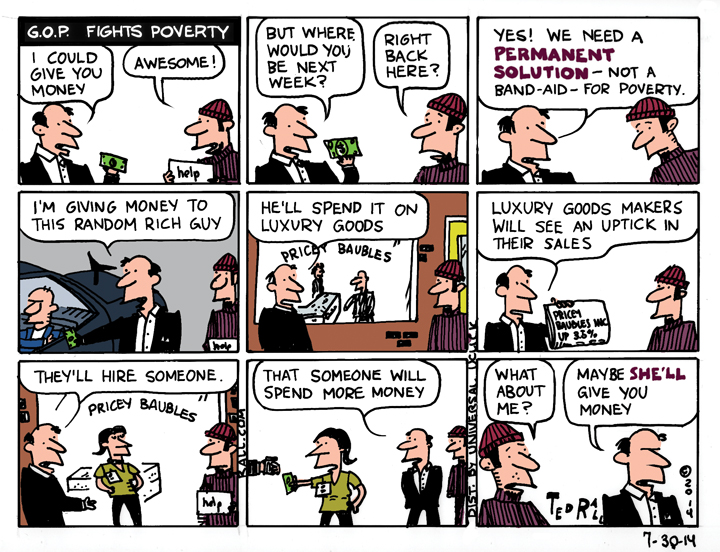

The GOP Finally Takes on Poverty

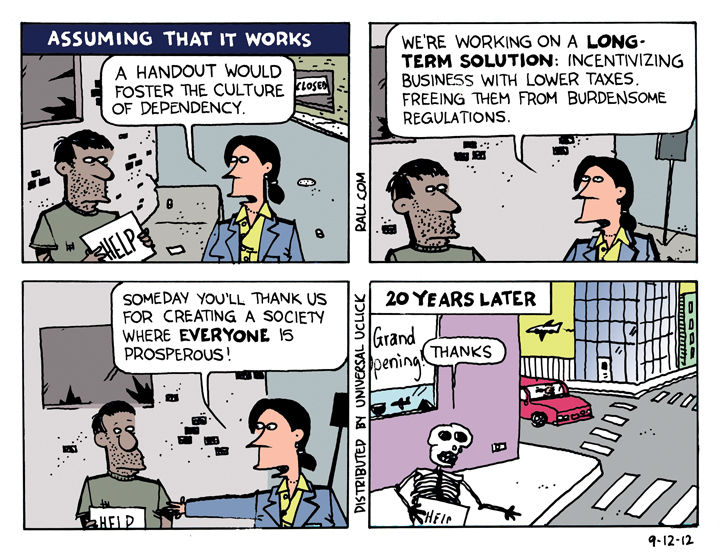

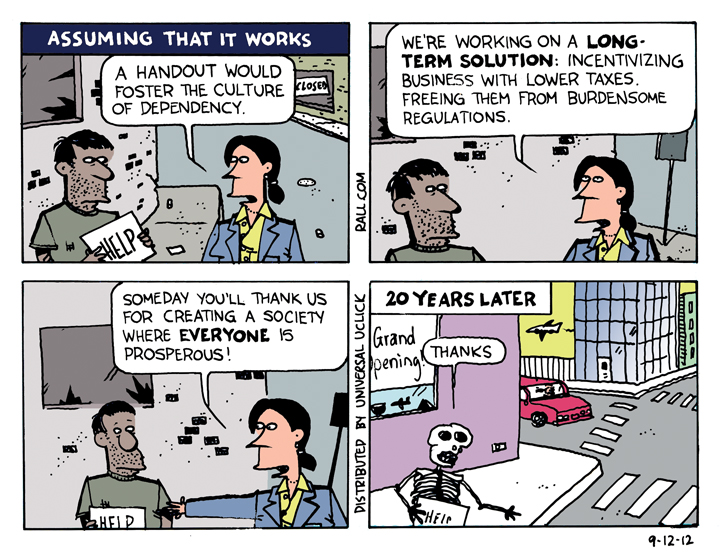

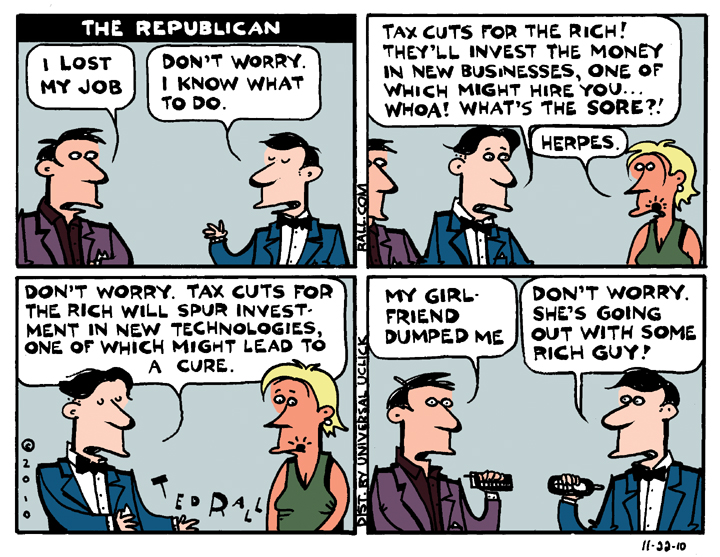

Republican Congressman and former vice presidential candidate Paul Ryan, infamous for budget proposals that denigrate and starve the downtrodden, has changed tack with an anti-poverty proposal that actually includes safety-net items like expanding the Earned Income Tax Credit. Still, the Republican Party remains in thrall to trickle-down economic theories that, if they worked, would take years to help poor people who need money now.

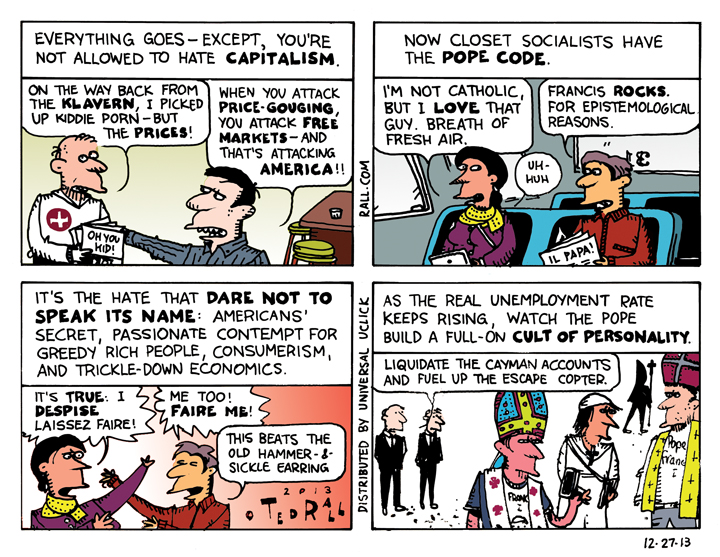

The Pope Code

65% of Americans say they agree with Pope Francis I’s critique of capitalism. But because we’re not allowed to publicly voice our opposition to capitalism, we resort to a sort of “dog whistle” — a “pope code” — in which we express our approval of the pope as an acceptable way to transmit our closet sympathies for socialism and communism.

SYNDICATED COLUMN: Men of Dishonor

A Congress of 21st Century Cynics Dodges 19th Century Rules

People are calling the recently adjourned 112th Congress “the most dysfunctional ever” and the least productive since the infamous “do-nothing Congress” of the 1940s. There’s lots of blame to go around, but one cause for congressional gridlock has gone unnoticed and unremarked upon: we no longer have a sense of honor.

Back in the late 18th and 19th centuries, when our bicameral legislature and its rules were conceived of by a bunch of land-owning white males, a gentleman’s word was his most precious asset. Integrity and the lack thereof were literally a matter of life and death; consider the matter of Alexander Hamilton and Aaron Burr. As Thomas Jefferson and his de facto wife Sally Hemings could attest, civility was far from guaranteed under this old system. It certainly could have worked better for Charles Sumner, the abolitionist Massachusetts senator who was nearly beaten to death by a proslavery colleague on the floor of the Senate in 1856. (He was avenging what he considered libelous rhetoric against his family.)

Though less-than-perfect, there was a lot to be said for a culture in which a person’s word was his bond, legalistic quibbling was scorned, and a legislator was expected to stake out and defend a principled position, even in the face of political and personal adversity.

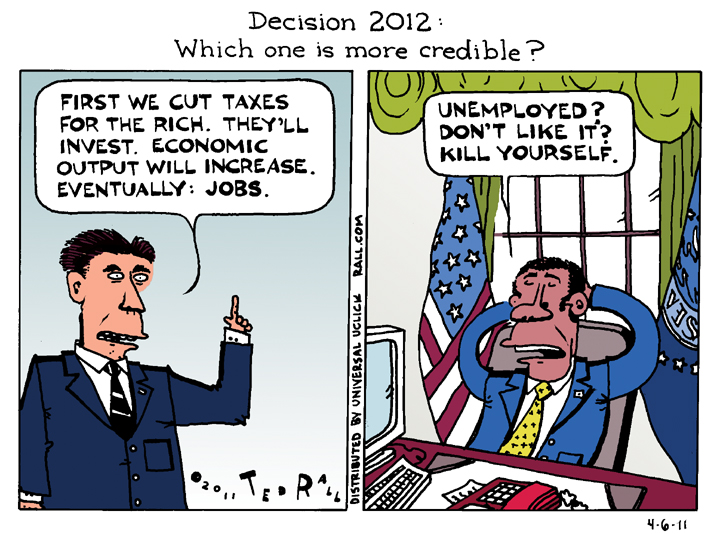

It’s hard to imagine the “fiscal cliff” showdown unfolding in the 1800s or even the first half of the 1900s for two simple reasons. First, the general fiscal health of the country would have come ahead of partisanship. Second, and more importantly, members of the two political parties would have stuck to the deal that they struck a decade earlier. When George W. Bush and his Republicans pushed for a set of income tax cuts that primarily benefited the wealthiest Americans in 2001, they argued the standard GOP trickle-down economics talking point that the tax cuts would pay for themselves by stimulating the economy so much that revenues into government coffers would more than make up for the cost. In order to get enough Democratic support for passage, the Republicans agreed to a five-year time period, after which taxes would revert to their Bill Clinton-era levels.

By 2006 there was still no evidence to show that the tax cuts had stimulated the economy. In fact, by many measures, things were worse. The housing bubble was beginning to burst; unemployment and underemployment had increased. If this had been the 19th century, Republican legislators would have acknowledged that their experiment had failed and that would have been that. A gentleman didn’t run away from the facts or his mistakes.

Voters seemed to agree. Unhappy with the invasion of Iraq as well as the state of the economy, Americans returned Democrats to control of Congress in 2006. Republicans had a pretty good idea—the polls were damning—that their unpopular policies were driving them toward a decisive defeat in the midterm elections. For men and women of honor, this would have been a time to reassess and back off.

Nevertheless the GOP jammed through an extension of the 2001 Bush tax cuts for the wealthy months before the midterm election. No honor there.

Here we are nearly 12 years later, and the verdict is in: the Bush tax cuts failed miserably. No doubt about it, it’s absolutely ridiculous that President Obama and the Democrats agreed to extend them for all but the richest one-half of one percent of American income earners. But the debate should never have gotten this far in the first place. Had the Republicans who proposed it in the first place possessed an iota of good old-fashioned 19th-century honor and integrity, this misbegotten legislative abortion would have died in 2006.

Robert’s Rules of Order and other quaint traditions of parliamentary procedure don’t translate to a quibbling little time like ours, when White House lawyers torture widely understood words like “torture” and “soldier” or claim that a US military base in Cuba is in no man’s land, neither in Cuba nor under US control, and that members of both major political parties say anything in order to get their way. Consider, for example, the current push to reform the filibuster, in order to clear the logjam on judicial nominations and other business that used to be considered routine.

The Senate, the only house of Congress that permits a filibuster, draws upon a tradition of principled minority protest that goes back to Cato in ancient Rome. Until the 1970s, filibusters were a rarity, averaging one a year. Senators viewed them as a bit of a nuclear option and only considered deploying a one-man block on debate of a bill a few times during a long political career, to take a stand on an issue where he felt it mattered most. Now the filibuster is not only a daily routine but gets deployed in an automated way so that the Senate has effectively become a body in which nothing gets done without a 60% vote in favor.

Everyone in the Senate understood what filibusters were for. No one abused them. It was a matter of honor.

But honor is too much to ask when even the most basic of all political considerations—ideology and party affiliation—bend like a reed in the winds of change.

Last week the Republican governor of New Jersey and a Republican congressman from Long Island, New York were so incensed by their party’s refusal to approve disaster relief funds for their states after hurricane Sandy that they went public with disparaging remarks about the Republican leadership in Congress. Fair enough. Standing up for your constituents against rank parochial self-interest is what integrity is all about.

On the other hand, the immediate willingness of some so-called liberal and progressive Democrats to welcome Chris Christie—a Tea Party favorite—and Peter King—a notorious nativist and anti-Muslim bigot—into their party’s ranks indicates a willingness to overlook basic principles that would have startled most self-described gentlemen of a century or two ago, much less those who’d entered public service. Back then, of course, the American political party system wasn’t as settled as it is today, so there were mass changes of party affiliation as parties appeared, metastasized and vanished. Still, it wasn’t acceptable behavior to change parties over a minor spat like the hurricane aid or for a party to accept members who didn’t adhere to its principles.

It’s almost enough to make you wish for a duel.

(Ted Rall is the author of “The Book of Obama: How We Went From Hope and Change to the Age of Revolt.” His website is tedrall.com.)

COPYRIGHT 2013 TED RALL

SYNDICATED COLUMN: The Phony Budget Crisis

Forget Austerity. Tax the Rich.

Everywhere you look, from the federal government to the states to your hometown, budget crises abound. Services are being slashed. Politicians and pundits from both parties tell us that the good times are over, that we’ve got to start living within our means.

It’s a lie.

Two case studies have made news lately: California, where new/old governor Jerry Brown is trying to close a $25 billion shortfall with a combination of draconian cuts in public services and a series of regressive tax increases, and Wisconsin, where right-winger Scott Walker says getting rid of unions would eliminate the state’s $137 million deficit.

Never mind the economists, most of whom say an economic death spiral is exactly the worst possible time for government to cut spending. Pro-austerity propaganda has won the day with the American public. A new Rasmussen poll funds that 58 percent of likely voters would approve of a shutdown until Democrats and Republicans can agree on what spending to cut.

The budget “crisis” is a phony construction, the result of right-wing “starve the beast” ideology. There is plenty of money out there—but the pols don’t want it.

There is no need to lay off a single teacher, close a single library for an extra hour, or raise a single fee by one red cent.

Every government can not only balance its budget, but wind up with a surplus.

The solution is simple: tax the rich.

Over the last 50 years tax rates for the bottom 80 percent of wage earners have remained almost static. Meanwhile the rich have received tax cut after tax cut after tax cut. For example, the rate paid by the top 0.01 percent—people who currently get more than $6.5 million a year—fell by half (from 70 to 35 percent).

Times are tough. Someone has to pay. Why not start with those who can most afford it?

Europe has the world’s best food, its best healthcare system and its best vacation policy. It also has one of the fairest ways to generate revenue for government: a wealth tax. In Norway, for example, you pay one percent of your net worth in addition to income tax.

What if we imposed a Norwegian-style wealth tax on the top one percent of U.S. households? We’re not talking upper middle class here: the poorest among them is worth a mere $8.3 million. This top one percent owns 35 percent of all wealth in the United States.

“Such a wealth tax…would raise $191.1 billion each year (one percent of $19.1 trillion), a significant attack on the deficit,” Leon Friedman writes in The Nation. “If we extended the tax to the top 5 percent, we could raise $338.5 billion a year (one percent of 62 percent of $54.6 trillion).”

But that’s just the beginning. Wealthy individuals are nothing next to America’s money-sucking corporations.

Business shills whine that America’s corporate tax rate—35 percent—is one of the world’s highest. But that’s pure theory. Our real corporate rate—the rate companies actually pay after taking advantages of loopholes and deductions—is among the world’s lowest. According to The New York Times, Boeing paid a total tax rate of 4.5 percent over the last five years. (This includes federal, state, local and foreign taxes.) Yahoo paid seven percent. GE paid 14.3 percent. Southwest Airlines paid 6.3 percent. “GE is so good at avoiding taxes that some people consider its tax department to be the best in the world, even better than any law firm’s,” reports the Times‘ David Leonhardt. “One common strategy is maximizing the amount of profit that is officially earned in countries with low tax rates.”

America’s low effective corporate tax rates have left big business swimming in cash while the country goes bust. As of March 2010 non-financial corporations in the U.S. had $26.2 trillion in assets. Seven percent of that was in cash.

The national debt is $14.1 trillion.

Which is a lot. And, you see, entirely by choice.

(Ted Rall is the author of “The Anti-American Manifesto.” His website is tedrall.com.)

COPYRIGHT 2011 TED RALL