Live at 10 am Eastern/9 am Central time, and Streaming 24-7 Thereafter:

The Trump administration has sparked controversy with aggressive moves to reshape the federal government and military. Budget director Russell Vought ordered federal agencies to plan mass layoffs, targeting thousands of workers at agencies like the IRS, FEMA, and Social Security Administration, aligning with Trump and Elon Musk. Over 20,000 federal employees have been fired, prompting lawsuits from unions and outrage from affected workers. Now a federal judge has ruled that all of those firings were illegal and must be reversed.

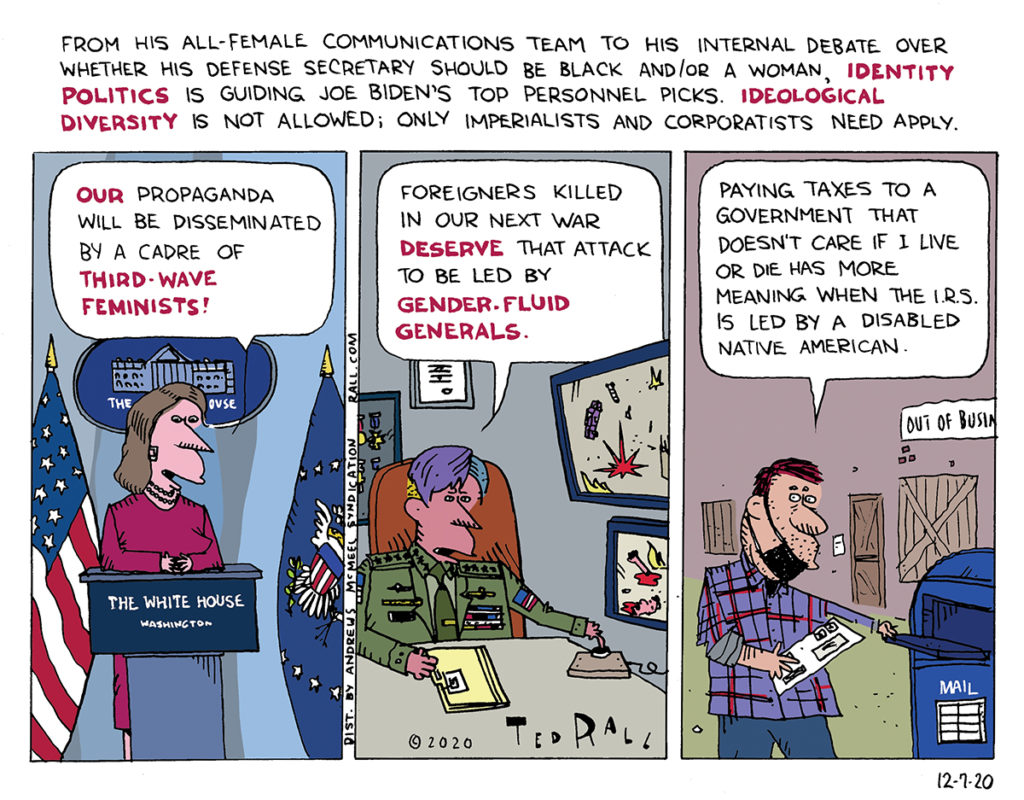

Simultaneously, Trump executed a dramatic Pentagon purge, firing Joint Chiefs Chairman Gen. C.Q. Brown and five other top officers, aiming to make military leadership loyal to him, and plans to expel transgender soldiers, airmen and sailors. Critics, including lawmakers, warn this politicizes the military, with some alleging a rejection of “woke” policies. Courts are blocking other initiatives like changes to birthright citizenship. Public and political backlash is growing, with protests across the country, yet Trump presses forward, framing the chaos as a drive to achieve efficiency.

As the rapid, polarizing overhaul continues to unfold, “The TMI Show” hosts Ted Rall and Manila Chan predict the road ahead for the mayhem in Trumpworld. Will the deep state strike back?