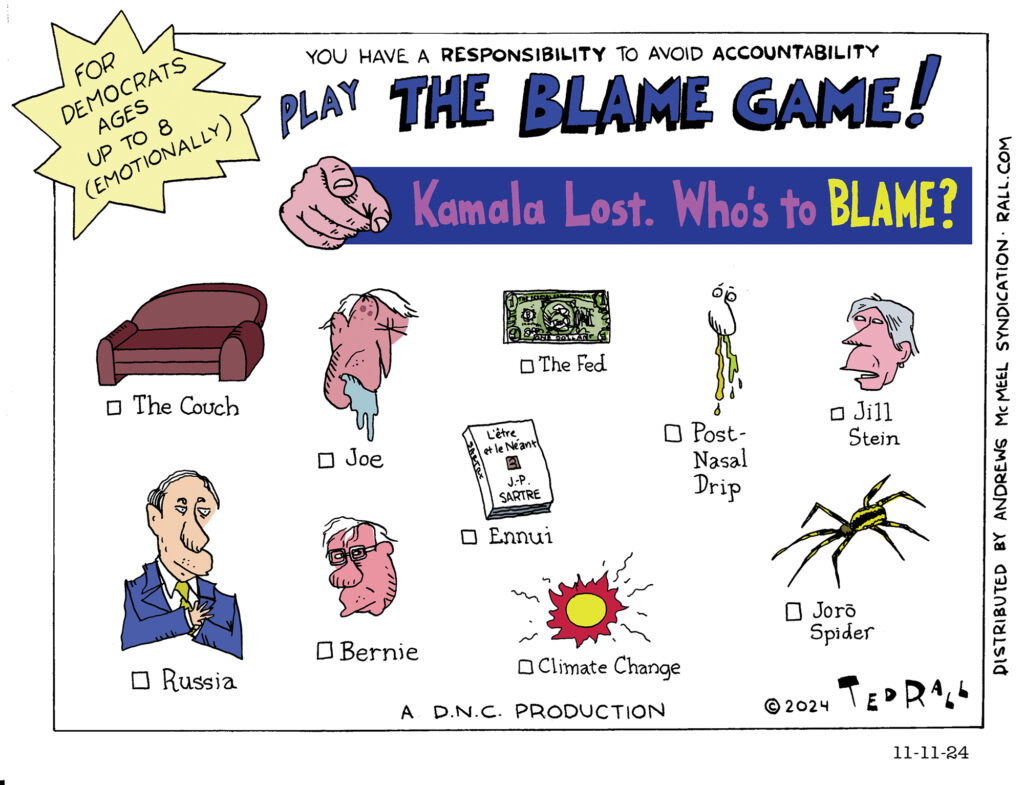

Defeat is an orphan. But defeated Democrats, themselves responsible for losing an election to Donald Trump that should have been easy to win, are flailing about trying to pin the blame on everyone but themselves.

DMZ America Podcast #164: Pager Rager, Dogging Cats, Half the Point

Political cartoonists and analysts Ted Rall (on the Left) and Scott Stantis (on the Right) take on the week in politics.

First up, Israel’s Mossad launches a fearsome attack against Hezbollah by blowing up their pagers and walkie-talkies throughout Lebanon, injuring thousands of people and killing at least a dozen. Does this impressive act of international terrorism cross a red line for supporters of Israel against Gaza? What happens next in the Middle East?

Springfield, Ohio has made headlines, most of them probably false, about the allegation that Haitian migrants have been chowing down on the locals’ cats and dogs. Ted relates what he heard from relatives who live in Springfield and Scott and Ted dissect Trump’s ability to touch upon big truths even while lying like the day is long.

Finally, the Federal Reserve Bank has decided to cut short-term interest rates by 0.5%. How much will juicing the economy help Kamala Harris’ campaign?

Watch the Video version: here. (Will be live 9/18/24 8:00 Eastern time)

DMZ America Podcast #68: Neofascism in Italy. Is the Fed destroying the economy for the rich? Snowden granted Russian citizenship

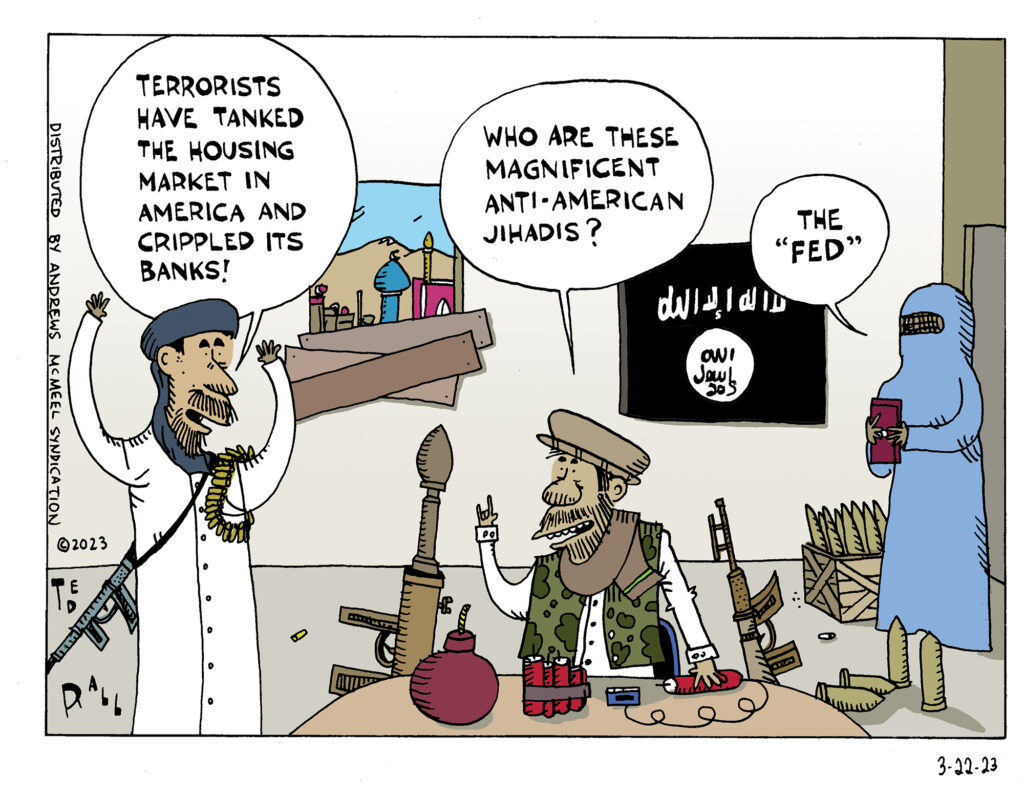

Ted Rall, coming at things from the Left and Scott Stantis, coming from the Right, tackle the major issues of the day. First off, Italy elects Giorgia Meloni, head of the Brothers of Italy, a political party founded by neo-fascists which begs the question: is the whole world going totalitarian or what? Next, Scott and Ted discuss the Fed and its passion for bringing back the ’70’s and all the economic pain that comes with it. Lastly, breaking news as Edward Snowden, ( Ted wrote his biography), is granted Russian citizenship by Vladimir Putin. Is this just the Russian system working or is it Putin thumbing his nose at America? All of this and more on the best podcast in the world!

Why Business Wants a Recession

Give Jerome Powell credit for candor: the Fed chairman admits that his policy of increasing interest rates to fight inflation might push the economy into a recession. “No one knows whether this process will lead to a recession or, if so, how significant that recession would be,” he recently told reporters.

If it does, one sector won’t be entirely displeased: employers.

According to the Deloitte accounting firm, a typical Fortune 500 company spends $1 to $2 billion a year on payroll, averaging between 50% and 60% of total spending. Controlling labor costs, unsurprisingly, is a top priority for employers.

In the boom-bust cycle of labor-management negotiations, the post-pandemic Great Resignation has triggered a labor shortage, a phenomenon we rarely witness and tends to fizzle out fast. Workers are quitting and retiring early, tanking the labor force participation rate. Those who remain enjoy the upper hand at interviews that feel like the job prospect is sizing up the company rather than the other way around. Labor shortages are driving up salaries, shortening hours, prompting signing bonuses and forcing bosses to accommodate people who prefer to work at home. Just 8% of office workers in Manhattan are back in the office a full five days a week.

The most recent data published, for June, finds that wages and salaries soared 16.8% on an annualized basis as benefit costs went up 14.4%.

Workers, angry and resentful after decades of frozen real wages and merciless downsizing, are becoming demanding. This reversal of a power dynamic in which workers were supplicants and bosses called the shots has also strengthened labor unions that had been losing membership for years.

This, some CFOs may be thinking, calls for a recession.

Company profit margins are at a 70-year record high, up 25% each of the last two years as the result of raising prices during the pandemic. Which means that, even allowing for an 8% inflation rate, a generic S&P 500 corporation should easily be able to ride out the average 26% earnings decline suffered in the most recent typical recessions that took place in 1990, 2000 and 2020. (A bigger crisis like the 2008-09 Great Recession, which reduced earnings by 57%, is another matter.)

No corporate officer would voluntarily reduce earnings. Or would they, in order to get something more valuable: regaining leverage over labor?

Traditional conservative allies of big business are openly arguing in favor of higher unemployment. “The recent drop in work and labor force participation—particularly among young workers—is troubling [my emphasis],” writes Sarah Greszler in a white paper for the Heritage Foundation, the right-wing think tank. “Job openings, at 11.3 million, remain near record highs, and record percentages of employers report unfilled positions and compensation increases.”

Greszler summarizes: “Continued low levels of employment [sic] will reduce the rate of economic growth, reduce real incomes and output, result in greater dependence on government social programs, require higher levels of taxation, and exacerbate the U.S.’s already precarious fiscal situation.”

Workers, of course, feel like they can finally breathe. High demand for labor means that they can quit positions where they feel unappreciated and/or undercompensated, pack up and move to another state and create a healthier balance between their family and work lives. The current situation is anything but “troubling.”

Executives at employers like Apple, Tesla and Uber have had enough of workers calling the shots. They’re demanding that people get back to work — at the office — or find another job. “A quickly shifting employer-employee dynamic could give companies the ammunition to take a harder line against the full-time work-at-home arrangements that many employees have pushed for, according to corporate policies experts. In fact, they say more companies are likely to start pressing staffers to come back to the office — at least a few days a week,” reports CNBC. “The hybrid workforce is not going to go away, but the situation where employees refuse to come to the workplace at all is not likely to hold,” Johnny C. Taylor Jr. of the Society for Human Resource Management tells the network.

Perhaps no one has told CEOs that at-home work empowers them too. Rather than hiring security goons to escort laid-off workers past their terrorized colleagues, companies can memory-hole the condemned by deactivating their remote-access passwords. Who’ll notice one less square on the Zoom screen?

I’m not subscribing to a dark Marxist suspicion that CEOs, the Fed and other powers-that-be are conspiring to slam the brakes on an economy that would otherwise be coming in for a soft landing as pent-up consumer demand from the pandemic naturally ebbs, in order to return their recently empowered employees to their rightful status as wage slaves. Powell and his fellow governors are doing what comes naturally to government, treating a disease based on a diagnosis that is close to a year out of date and, reasonably, including wage increases as part of their calculus of what constitutes a major driver of the inflation rate.

Business, however, does see what’s coming. If the captains of industry aren’t worried enough to be calling their pet politicians to demand an end to interest-rate hikes, one reason might be that they see a silver lining to the next recession.

(Ted Rall (Twitter: @tedrall), the political cartoonist, columnist and graphic novelist, co-hosts the left-vs-right DMZ America podcast with fellow cartoonist Scott Stantis. You can support Ted’s hard-hitting political cartoons and columns and see his work first by sponsoring his work on Patreon.)

What’s Worse Than Inflation? Fighting Inflation.

Inflation is a cancer. It eats away at savings and consumer confidence. But the tools the United States government uses to fight inflation are often worse—they’re a form of chemotherapy that’s even more likely to kill the economy than the underlying disease. When your car is careening down a hill, slamming on the brakes is an inexperienced driver’s first instinct. But it’s the last thing you should do. Unfortunately, the history of inflation-fighting indicates that monetary policymakers seem to prefer crashes to soft landings.

Fueled in large part by massive deficit spending as the Pentagon tried to bomb its way to victory in the unwinnable Vietnam war, inflation ran rampant from the latter part of the presidency of Richard Nixon through that of his successor Gerald Ford, and infamously contributed to the destruction of Jimmy Carter’s reelection chances.

Inflation encourages consumer spending because, if you put off a purchase, it will cost more later. Enter Paul Volcker, appointed to the chairmanship of the Federal Reserve Bank in 1979. Determined to radically reduce spending and wages, he applied the anti-stimulus of sky-high Fed interest rates that peaked out at nearly 20% in 1981, Reagan’s first year in office. The result was two back-to-back recessions, which saw unemployment soar even higher than during the Great Recession of 2008-11.

Inflation was dead for the foreseeable future. With the benefit of hindsight, however, the cost of taming inflation was too damn high.

Reagan’s supply-side policies, which centered around tax cuts for large corporations and wealthy individuals coupled with austerity for everyone else, combined with Volcker’s hard line on inflation to create an anemic mid-1980s recovery before the 1987 stock market crash marked the start of yet another Republican bust.

It is, of course, impossible to brush away the cynical conclusion that crushing workers and their economic power was and remains a feature of the capitalist system and its stewards in government and finance. Reagan and his merciless smashing of the air traffic controllers union—leading to years of union-busting—coincided neatly with those 30+ years of non-existent raises, as well as private-sector union membership falling off a cliff. Throughout the 1950s, 1960s and 1970s, there were between 200 and 400 major strikes by labor unions each year. When Reagan left office in 1988, there were 40. There were just seven in 2017.

Unsurprisingly, taking away power from workers and giving it to bosses made things worse for workers. The Reagan years radically widened the income gap between low- and high-income earners for the following three decades—even though the average American worker was increasingly efficient and productive year after year. Between 1979 and 2019, productivity increased 60% while wages only went up 16%. Windfall profits went to shareholders and owners.

Ironically, wage stagnation came to its merciful, all-too-brief conclusion in 2020, when people weren’t working at all. Between March and June of that year, when many furloughed workers were sitting at home during the COVID-19 pandemic lockdown, government stimulus checks caused real wages to increase relative to inflation. Increased savings allowed employees to quit in droves in the so-called Great Resignation; labor unions chalked up some impressive victories as emboldened wage slaves stood up for themselves.

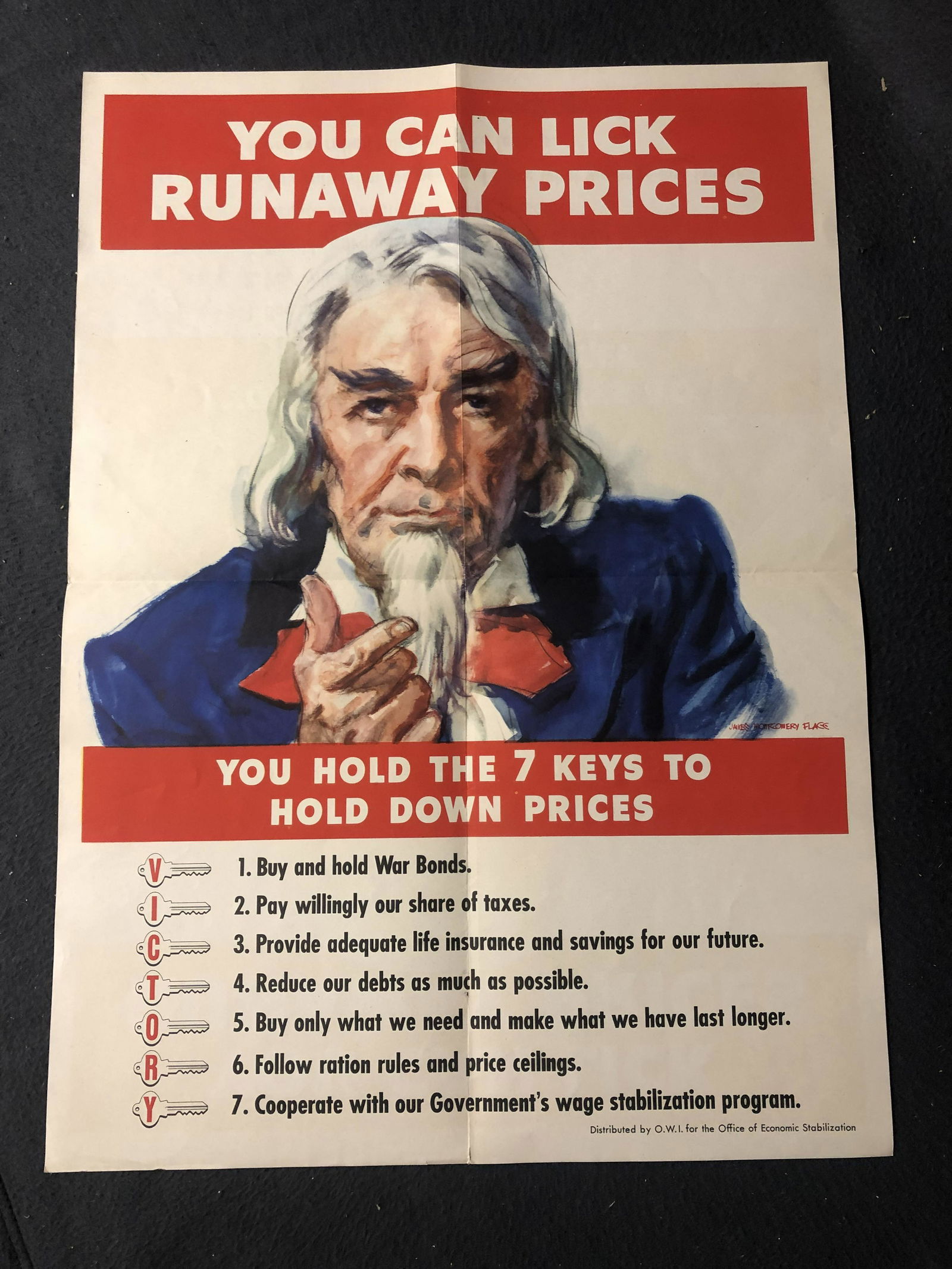

The worst inflation crisis of the past century was sparked by the end of World War II-era price controls on a wide array of rationed commodities and a surge in pent-up demand. (The latter is, at a smaller scale, the main force behind inflation today.) In 1947, the inflation rate rose to 20%. What’s interesting is what the Fed did not do in response: raise interest rates. It couldn’t. It didn’t have that power then.

Instead, fiscal policy makers refused to extend additional credit to the big banks — which had contributed to inflation — and waited for consumers to satisfy their pent-up demand. This they did by 1948. With no one to slam on the brakes, there was a quick, mild recession in 1949 followed by an impressive period of economic expansion in the 1950s. This episode from the Truman era strongly suggests that current Fed policy of raising short-term interest rates is a mistake. The only solution to pent-up demand is no solution at all. Just sit back and wait.

(Ted Rall (Twitter: @tedrall), the political cartoonist, columnist and graphic novelist, co-hosts the left-vs-right DMZ America podcast with fellow cartoonist Scott Stantis. You can support Ted’s hard-hitting political cartoons and columns and see his work first by sponsoring his work on Patreon.)

SYNDICATED COLUMN: Investigating the Investigators

IRS Targeting is a Scandal, CIA Targeting is Business as Usual

“We’re fighting for you!” That’s what the Democratic Party tells Democratic voters and what the Republican Party tells Republicans. But even their “battles” reveal how similar the two parties really are.

Case study: what gets investigated.

Less than a week after the news broke that the IRS engaged in ideological profiling in 2011 and 2012 — targeting Tea Party-related non-profits for checks into whether they were violating the terms of their tax-exempt status by spending donor money on political ads — top Democrats joined their GOP counterparts to demand a Congressional investigation. That’s lightening quick for government work — and yet not fast for some. Senator Marco Rubio (R-Florida, ’16 prez prospect) called for Acting IRS Commissioner Steven Miller to resign immediately. President Obama called the IRS’ actions “outrageous” and “contrary to our traditions.” The IRS has already apologized.

This all goes to show that the federal government can turn on a dime when it wants to do something. It’s a matter of priorities. Millions of Americans whose homes were stolen by banks in illegal foreclosures waited five years for $600 settlement checks that bounced; the Fed gave the executives of those banks $7.77 trillion in a matter of days, no questions asked.

So it goes with what gets investigated.

Thrown under the bus in a matter of days, the IRS is already getting ground to mincemeat. Meanwhile, a spectacular panorama of Bush-era abuses have yet to draw the attention of a single Congressional subcommittee.

The 2000 stolen presidential election fiasco? Still no investigation — even though retired Supreme Court Justice Sandra Day O’Connor, the swing vote in the 5-4 decision in Bush v. Gore, now agrees with constitutional lawyers who say the high court had no jurisdiction in the case and thus shouldn’t have heard it.

There still hasn’t been an independent investigation of 9/11.

No one has ever been questioned, much less held accountable, for the invasion of Afghanistan (ostensibly to catch Osama bin Laden, though he was already in Pakistan), the installation by the U.S. of the unpopular Hamid Karzai as a U.S. puppet, huge cash bribes paid to Karzai by Bush and now Obama, or the lies — an impeachable offense — about Saddam’s WMDs used to con the public into war against Iraq.

People outraged by Bush’s torture program, secret prisons, extraordinary rendition and indefinite detention of innocent people, including children, at post-9/11 gulags at places like Guantánamo, the “salt pit” at Bagram and the Indian Ocean island of Diego Garcia — even on prison ships on the high seas — hoped that President Obama would make good on his campaign promises to investigate these horrific crimes against international law, U.S. law and common decency. Instead, he obstructed justice — another impeachable offense — issuing a directive to his Justice Department and other law enforcement agencies to ignore them. “We need to look forward as opposed to looking backwards,” he told a TV interviewer on January 12, 2009, eight days before taking office.

“At the CIA, you’ve got extraordinarily talented people who are working very hard to keep Americans safe,” he said. “I don’t want them to suddenly feel like they’ve got spend their all their time looking over their shoulders.”

Yes. God forbid our heroic torturers should face any questions about jamming forced enemas up prisoners’ butts. Sorry: I meant our extraordinarily talented torturers.

And, now a flashback to April 14, 2008 — a mere nine months earlier. Candidate Obama told The Philadelphia Inquirer: “If I found out that there were high officials who knowingly, consciously broke existing laws, engaged in cover-ups of those crimes with knowledge forefront, then I think a basic principle of our Constitution is nobody above the law.”

Except the CIA. And the military. And Donald Rumsfeld and Condi Rice and Dick Cheney and John Yoo and, of course, George W. Bush, who explicitly authorized the torture and other high crimes, and is now an elder statesman with his own library and everything.

To recap:

Both parties think it’s bad bad bad for the IRS to target right-wing pseudo-nonprofits for audits.

Both parties think it’s perfectly fine A-OK doubleplusgood to target the buttholes of random Muslims you kidnapped from Afghanistan or Yemen or wherever.

What the IRS did was, of course, wrong. But I’d rather be audited than butt-raped. Butt-raping, especially butt-raping that occurs before illegal auditing, should be investigating before illegal auditing.

Both parties also agree that if there’s ever been something that doesn’t need investigating by anyone, ever, it’s drones. Yes, a whopping 1.8% of Congress recently held an “unofficial hearing” (toothless PR stunt) and politely requested that Obama provide “further clarification of the legal justifications behind drone strikes.”

But no one —not even Vermont’s token “socialist” Bernie Sanders — has called for an investigation into a drone war that ridiculously remains “classified,” a secret to everyone but the dead, the maimed and their survivors. Senator Rand Paul (R-Kentucky, ’16 prez prospect)’s filibuster merely demanded whether Obama planned to drone any U.S. citizens on U.S. soil. (Since he has already droned U.S. citizens on foreign soil, we know the answer to that.)

I’m not Suze Orman, but please let me help you save a few bucks. Whether you’re a Democrat or a Republican, the next time you get a campaign mailer asking you to support them because they’re “fighting hard for you,” chuck that sucker into the recycler. The truth is, the two major parties are on the same page on just about everything.

They’re not fighting for you.

They’re fighting for themselves.

(Ted Rall’s website is tedrall.com. His book “After We Kill You, We Will Welcome You Back As Honored Guests: Unembedded in Afghanistan” will be released in November by Farrar, Straus & Giroux.)

COPYRIGHT 2013 TED RALL

SYNDICATED COLUMN: Lose Your House, Collect $300

Why Aren’t Rioters Burning Down the Banks?

One in ten Americans take such antidepressants as Prozac and Paxil. Among those in their 40s and 50s, it’s 23%. Maybe that’s why we’re so passive.

Like the blissed-out soma-sucking drones of Huxley’s “Brave New World,” we must be too drugged to feel, much less express, rage. How else to explain that furious mobs haven’t burned the banks to the ground?

Last week, as the media ginned up empty speculation about Hillary Clinton’s presidential prospects, and wallowed in nuclear cognitive dissonance — Iran, which doesn’t have nukes and says it doesn’t want them, is repeatedly called a grave threat worth going to war over, while North Korea, which does have them and won’t stop threatening to turn the West Coast of the U.S. into a “sea of fire,” is dismissed as empty bluster, nothing to worry about — the Office of the Comptroller of the Currency and the Federal Reserve released the details of the settlement between the Obama Administration and the big banks over the illegal foreclosure scandal.

Citibank, JPMorgan Chase, Bank of America, Wells Fargo and other major home mortgage lenders foreclosed upon and evicted millions of homeowners between the start of the housing collapse in 2007 and 2011. Millions of families became homeless, including 2.3 million children. The vast majority of these Americans are still struggling; many fell into poverty from which they will never escape.

Disgusting, amazing, yet true: the banks had no legal right to evict these people. In many cases, the banks didn’t have basic paperwork, like the original deed to the house. They resorted to “robo-signing” boiler room operations to churn out falsified and forged eviction papers. In others cases, people could have kept their homes if they’d been allowed to refinance — their right under federal law — but the banks illegally refused, giving them the runaround, repeatedly asking for the same paperwork they’d already sent in. Soldiers fighting in Afghanistan and Iraq, protected from foreclosure under U.S. law, came home to find their homes resold at auction. In other cases, banks even repossessed homes where the homeowner had never missed a mortgage payment.

The foreclosure scandal helped spark the Occupy Wall Street movement.

Promising justice and compensation for the victims, President Obama’s Justice Department joined lawsuits filed by the attorneys general of several states.

Last year, Obama announced that the government had concluded a “landmark settlement” with the banks that would “deliver some measure of justice for those families that have been victims of their abusive practices.” The Politico newspaper called the $26 billion deal “a big win for the White House.” $26 billion. Sounds impressive, right?

So…the envelope, please.

How much will the banks have to pay? What will people whose homes were stolen — there is no other word — receive? Now we know the details.

Remember what we’re talking about. Your house is your biggest asset. You own tens of thousands, in some cases hundreds of thousands of dollars in equity. One morning the sheriff comes. He throws you and your family out on the street. Your possessions are dumped on the lawn. You have nowhere to go. Your kids are crying. If you were struggling before, now you’re completely screwed. And the bank that did it had no legal basis whatsoever to do what they did.

They took your house, sold it, and pocketed the profits.

What would happen to you if you walked into Tiffany’s and stole a $200,000 necklace?

The details:

- Even though they qualified for federal loan modifications, the banks seized 1.1 million homes, making 1.1 million families homeless after they were approved for refinancing. Since the average foreclosed home was worth $191,000, the banks stole $210 billion in homes. Under the “landmark settlement,” these wrongfully evicted Americans will receive $300 or $500 each, the value of a modest night out at a nice restaurant in Manhattan (two tenths of one percent of their loss).

- 900,000 borrowers who were entitled under Obama’s Make Home Affordable program to refinancing were denied help and lost their homes. They get $300 or $600.

- 420,000 homeowners who lost their homes while the banks intentionally dithered and “lost” their paperwork get $400 or $800.

- 28,000 families who were entitled to protection against foreclosure under federal bankruptcy law, but got thrown out of their homes anyway, get $3,750 to $62,500.

- 1,100 soldiers entitled to protection against foreclosure because of their military status get $125,000.

- 53 families who weren’t late on their mortgages, never missed a payment, but got thrown out anyway, get $125,000.

So we’ve got more than 2.4 million families — that’s 5 million people — whose homes got bogarted by scumbag banksters. They’re getting a thousand bucks each on average. A thousand bucks for a two hundred thousand dollar theft! Not to mention the heartbreak and stress they suffered.

Why aren’t those five million people stringing up bank execs from telephone poles? It’s gotta be the Paxil.

But what really gets me is the 53 families who are getting $125,000 payouts for losing homes they were 100% up to date on.

Even if you’re a heartless right-winger, you’ve got to have a problem with a bank taking your house when you never missed a payment. Sorry, but these are multinational, multibillion dollar banks. They should pay these families tens of millions of dollars each.

Those 53 families should own Citibank, JPMorgan Chase, Bank of America and Wells Fargo.

Some perspective:

Citigroup CEO Vikram Pandit received $260 million in pay between 2007 and 2012, the height of the foreclosure scandal.

In 2011 alone, JPMorgan Chase CEO Jamie Dimon was given $23 million. In 2012, the company’s board of directors “punished” him for a $6 billion loss in derivatives trading by paying him “merely” $18.7 million.

In 2012 alone, Bank of America paid CEO Brian Moynihan $12 million; Wells Fargo paid $23 million to CEO John Stumpf.

Not bad for some of the worst criminals in history.

That’s how things work in the United States: the criminals get the big payouts. The people whose lives they destroy get $300.

(Ted Rall’s website is tedrall.com. His book “After We Kill You, We Will Welcome You Back As Honored Guests: Unembedded in Afghanistan” will be released in November by Farrar, Straus & Giroux.)

COPYRIGHT 2013 TED RALL

SYNDICATED COLUMN: The Mayors of Brokesville

To Be Young, Technodouchey and Shilly at SXSW

It’s not like I didn’t know what I was getting into.

This was my second year at South by Southwest, the Austin music festival that has morphed into a trilateral Comic Con of the tattered remnants of the music industry, the on-the-ropes independent film sector, and a New Third Thing, the tantalizingly monetizable-for-a-few culturo-fiscal tsunami that left the first two that way, which SXSW hath dubbed Interactive.

Which is, of course, the Internet. Or more exactly, the hapless wretches who want to make money from it because, this being 2013, what else are they going to do – build real stuff and sell it? They seek to profit directly, by coming up with an awesome app like Foursquare which, as every article about this topic is required by law to mention, launched at SXSW in 2009 (and which said articles are never allowed to say, is pretty boring and useless and lame and, anyway, isn’t it kind of sad to have to point back four years to find a Big SXSW Launch?). Either that, or indirectly – by sucking dry a gullible VC (venture capitalist).

In case you’re wondering what goes on SXSW and why you should care, here’s what (why comes later; feel free to skip ahead, I would if I didn’t have to write this):

It’s a bunch of incredibly douchey – you think you know douche? you think you’ve met douches? oh, no, not like these douches you don’t – 25-to-37-year-old wannabentrepreneurs trying to market Webby things, 99% of which are apps for smartphones. And 99% of those 99% of those apps are redundant.

Redundant as in: “You can find restaurants in your area and review them. You can talk to other patrons about them in our online community.”

“Like Yelp?”

“Yeah, well, yes, but…”

“Like Yelp?”

Sad confused face.

I told you they were douches.

Speaking of which:

So during SXSW 2012 I wandered down to the lobby of my hotel to get coffee. Some douches were ambling zombie-aimlessly around, heads cocked in the familiar 20°-forward-head-tilt-toward-iPhone position. Other douches were clustered on the floor, deeply engaged in a random hackathon that accomplished little more than stressing the Hilton’s already technorati-overburned wi-fi network. But that still left other douches to notice that I wasn’t wearing shoes.

“Dude,” a tall male douche, about 32 years old, smiled at me. And pointed at my feet.

“What?” I asked, grouchily. Which was appropriate, considering that he was standing between me and the coffee line. Which was long. Shilling redundant apps requires caffeine as well as gall.

“No shoes,” he replied. “What are you promoting?” He actually seemed interested in my answer to his question.

Another douche, apparently the first douche’s comrade, joined us. “Hey, that’s great!” the second douche chimed in. “Are you repping a foot app? A shoe app? What is it? I gotta know! Hey guys” – he motioned toward a small douche-flock – “check it out!”

They were visibly, crushed-like-kids-who-got-lame-presents-on-Christmas-morn disappointed by my explanation, which was boring and simple: I didn’t feel like putting on shoes since I was just going back upstairs to my room. They thought I was lying.

“No one just doesn’t wear shoes,” the first douche accused. “You are promoting something.” Because, you know, the way you promote a product is by refusing to admit it.

To paraphrase Bruce Springsteen and Dave Edmunds, from big dumb things small dumb things one day come. So what came out of tens of thousands of douches dropping millions of dollars into Austin’s tourism industry?

“The breakout star of [the 2012] SXSW was Highlight, a location-aware app that alerts you when people you know are nearby, and attempts to introduce you to people you might want to know,” the Austin Business Journal reported. “Highlight dominated the buzz at the conference and was crowned the winner early on. However, it struggled to expand afterward because it was a battery hog, and it didn’t work as well outside of SXSW’s target-rich environment, where everyone was using it.” Which is why you’ve never heard of it.

So anyway, this year was more of the same. It was depressing and maddening. Except, without anything as thrilling as Highlight. It was also enlightening. Because SXSW is a metaphor for what’s going on in the American economy.

Like most U.S. businesses, SXSW attendees wanted to sell stuff. The problem was, no one wanted to buy, or hire, or invest.

So no one was selling or getting hired or invested in.

If the balance in Austin at SXSW and in the U.S. (and for that matter internationally) were less extreme – if, in Marxist terms, the oversupply of production merely exceeded rather than dwarfed consumer demand – you’d merely have downward pressure on wages and prices. Which, in fact, we’ve seen since the end of the Vietnam War. And isn’t good.

As things stand, the demand side – companies that want to hire people, which increases the number of goods and services consumers want to buy – is virtually nonexistent. And that’s catastrophic. The U.S. economy added 177,000 jobs in January, 237,000 in February, and 158,000 in March. Moody’s Analytics chief economist Mark Zandi estimates that overall growth is running at about 175,000 a month. Since the U.S. needs to add 180,000 jobs per month just to keep up with population growth, the U.S. in “recovery” is losing 5,000 jobs a month. “If that’s the case, underlying job growth is not changed appreciably,” Zandi says dryly.

Sassy ex-Reagan budget chief David Stockman – say what you will about his blame-the-Fed politics, he’s the most thrilling economist-writer ever – says America is doomed because of failed government intervention. “The United States is broke — fiscally, morally, intellectually — and the Fed has incited a global currency war (Japan just signed up, the Brazilians and Chinese are angry, and the German-dominated euro zone is crumbling) that will soon overwhelm it. When the latest [Wall Street] bubble pops, there will be nothing to stop the collapse.”

Stockman is probably wrong about the why – more old-fashioned socialist state control would have avoided or at least mitigated this mess by redistributing wealth, thus stimulating consumer demand – but right about the what. When you’ve got a marketplace full of would-be sellers but no one who wants to buy, you’ve got no market at all.

All that’s left is a bunch of douchebags looking at your feet.

(Ted Rall’s website is tedrall.com. His book “After We Kill You, We Will Welcome You Back As Honored Guests: Unembedded in Afghanistan” will be released in November by Farrar, Straus & Giroux.)

COPYRIGHT 2013 TED RALL