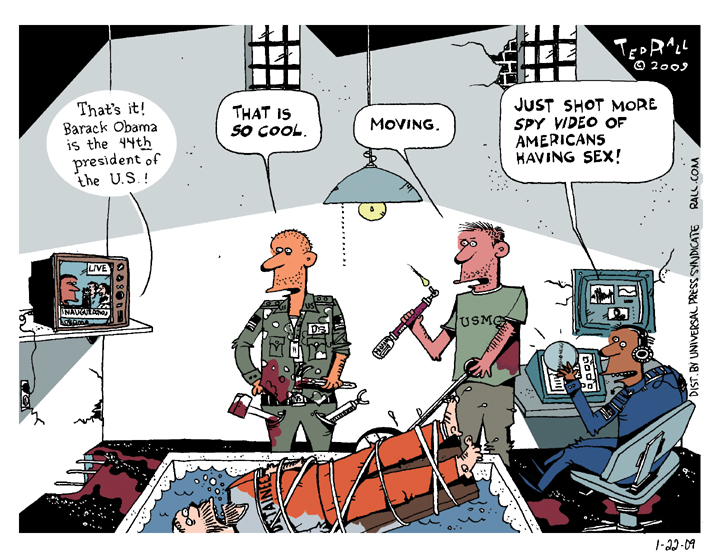

So much for change you can believe in: the torture continues at Gitmo and will continue at least another year. And nary a word about the NSA’s despicable warrantless wiretapping and espionage program against American citizens.

Unimpressed in Advance

Like all sane people, I am relieved that that worthless shit-for-brains is leaving office tomorrow. It wasn’t always certain, you know. After he all, he did steal the presidency in the first place.

But I am not likely to be thrilled by Obama, either. Tomorrow, we will no doubt hear an excellent speech, maybe even a great one. We will also read about some presidential executive orders, including one to close Gitmo, that will give cause for optimism to many Americans.

But it shouldn’t.

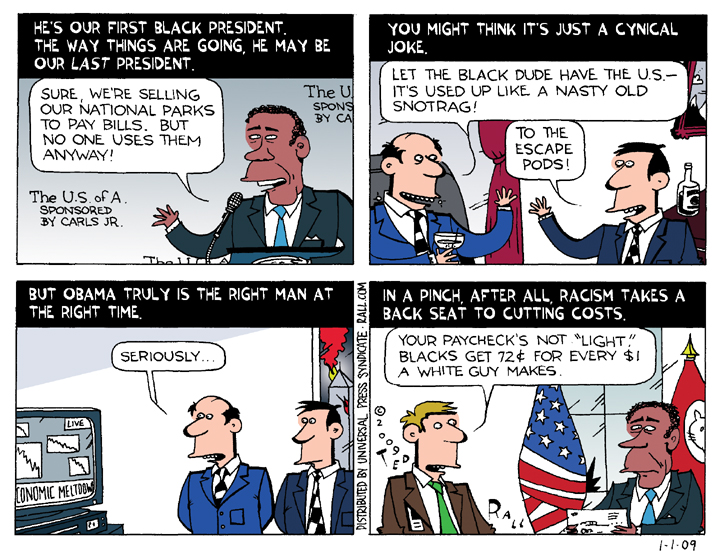

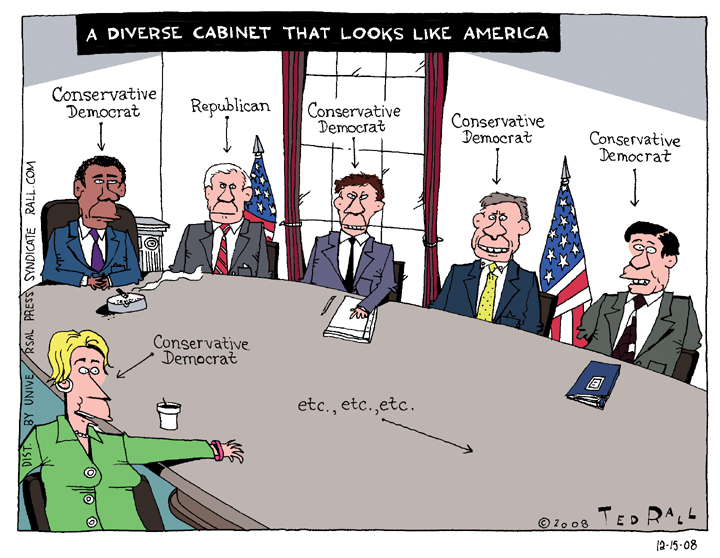

Pretty words are nice, but the facts belie them. Every indication is that Obama is a DINO–Democrat in name only. His cabinet, which doesn’t contain a single liberal, makes centrist Bill Clinton look like a Marxist in comparison. Conservatives and centrists are not going to be able to deliver the radical solutions needed to solve our many radical problems.

Obama’s economic program only promises to create 4 million jobs by 2011–when we will have lost about 29 million at current projections. By 2011, if Obama gets his way, we will be in a deep, deep Depression. We will be lucky if the country still exists in its present form if that happens.

The Gitmo closing is nice, but Obama doesn’t plan to prosecute those who ordered the torture and other war crimes that occurred there. Moreover, he doesn’t plan to release all the inmates. Gitmo could stay open another year or more. The CIA secret prisons could stay open. CIA torturers won’t be prosecuted. Neither will Bush and Cheney, who ordered it personally.

You get the idea.

Pretty words. Not much meat.

Don’t be taken in. Take it out–to the streets. Now, more than ever, is the time for intelligent Americans to speak out and be heard.

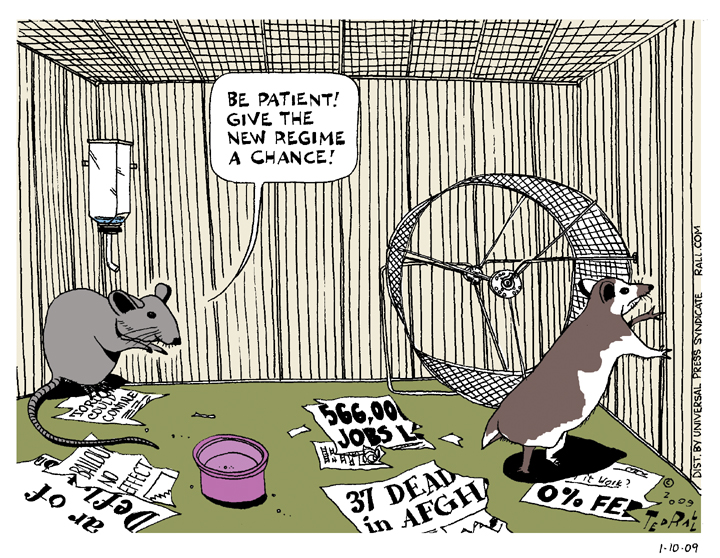

Give the New Regime a Chance

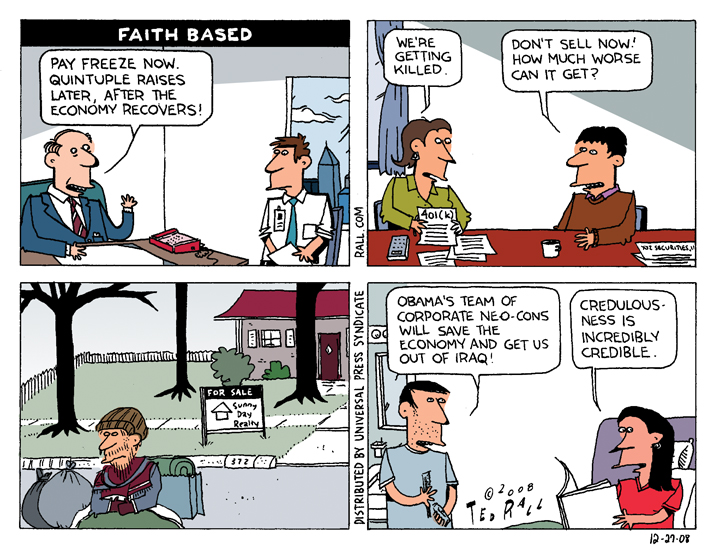

There’s no reason to be hopeful. Obama’s economic program is too little, too late. His cabinet is too moderate, too in-the-box to understand that he may well end up being the last president of the United States. There’s no dot-com-type event on the horizon that could rescue our overextended asses. And yet, despite everything, hope persists for the rats in the cage.

SYNDICATED COLUMN: Eat the Rich

Soak the Rich, Corporations

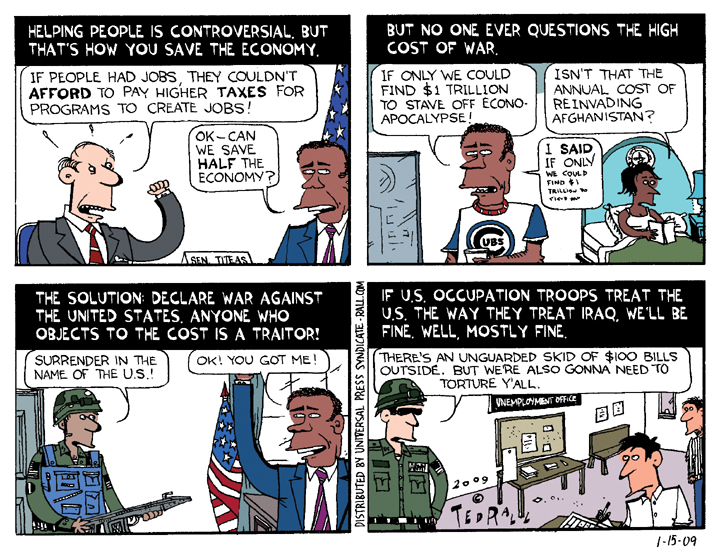

A moratorium on housing foreclosures and evictions is a good idea. So is making the tax code more progressive. Obama’s plan to build new public works is smart. But those are half-measures. Even if they don’t come out of Congress watered down and wankified, they’ll come too little and too late to kill the rapidly metastasizing disease that threatens to kill the U.S. economy: income inequality.

Employers are shedding jobs at a breathtaking rate: more than 560,000 per month. The rate of job losses could soon hit a million. People who still have jobs are being squeezed by pay cuts and freezes; even those who have yet to be affected are closing their wallets out of fear that they’ll be the next to get chopped. So consumer spending, which accounts for two-thirds of economic activity, is plunging. Moreover, millions of individuals and businesses have lost access to credit and thus the movement of capital that might have pulled us out of this tailspin.

“The key is that the consumer is in the worst condition since the Great Depression,” retail consultant Howard Davidowitz told NBC News. Boarded-up shops will abound. Experts expect 73,000 retail locations to close during the first few months of 2009. Between 20 and 40 percent of national retail chains will shut down. This isn’t a recession. It’s a depression, and it could destroy the country.

If broke consumers are the problem, shoveling money into their pockets is the way to get them spending again. Where do get it? The reason Willie Sutton robbed banks, he supposedly said, was because “that’s where the money is.” These days, the money is the hands of corporations and rich individuals.

(Warning: boring economic statistics and analysis follow. But stick with me. You could get a check!)

Tax returns give only a partial picture of a nation whose riches have been aggregated in the hands of a tiny elite. “The Internal Revenue Service,” reported The New York Times in 2007, “captures only about 70 percent of business and investment income, most of which flows to upper-income individuals, because not everybody accurately reports such figures.” So actual income inequality is bigger than IRS data indicates.

Even so, the IRS finds a huge pay gap between the very rich and the rest of us. “The wealthiest one percent of Americans earned 21.2 percent of all income in 2005,” the most recent year for which IRS data is available, according to a 2007 piece in The Wall Street Journal.

What if we played Karl Marx and left that one percent of the population (people who earn over $350,000 a year) with their fair share–one percent of national income? If we divided the rest of the loot equally, everyone else–99 percent–would get a 20.2 percent pay raise.

I don’t know about you, but I could use it. And because I’m a patriot, I pledge to fritter away half of my 20.2 percent windfall on wine, women and frivolous American-made consumer goods.

What would happen if we adopted the communist principle of total income equality? That would require closing the gap between median (the halfway mark of income distribution) income and average income. Due to wage inequality, the average worker earns 40 percent more than the median. Close the gap, and two-thirds of Americans get a raise. One-third gets a cut. But only a small group, the top five or ten percent, would feel significantly pinched. Most of the third wouldn’t lose much. And everyone would benefit from the increased economic activity that would result from equal income distribution.

Call it trickle-up economics.

Wouldn’t socialism remove people’s incentive to work hard? Though not a perfect economic model, the Soviet experience seems to disprove the idea that you can’t find good CEO help for under a million bucks a year. Soviet physicists, athletes, filmmakers, novelists, composers and other innovators led their fields, yet were rewarded with little more than a medal and a puff piece in Pravda. Mikhail Kalishnikov invented the AK-47, the world’s most popular firearm. He was never paid a dime, and never cared.

Here in the U.S., brilliant people become schoolteachers and priests. Salary isn’t the biggest motivation for most people.

Another thing to bear in mind is an aspect of wealth Americans don’t usually think about: assets. Eliminating income inequality wouldn’t address asset inequality. The rich, who’ve had years of high income with which to save and invest, and have inherited assets from parents and grandparents who did the same, would still be rich. A truly efficient attempt to put more money in the average person’s pocket would require redistribution of these accumulated assets.

If Willie Sutton were still around, however, he might find it easier to go after biggest 4000 U.S. corporations than its richest 40 million households. So let’s look at big business income.

After-tax 2007 profits for U.S. corporations totaled $1.8 trillion, up 10 percent since 2001. (Bear in mind: this figure doesn’t include CEO salaries, capital reinvestments, and the acquisition price of other corporations.) The effective average corporate tax rate in the U.S. is about 13 percent–one of the lowest in the industrialized world. If we were to double the effective tax rate to 26 percent, the U.S. would remain a tax haven compared to Germany and other major European countries.

Let’s say the IRS took that extra 13 percent corporate profits tax and cut a check to the American people. Why not? Without us, the U.S. consumer, these companies wouldn’t be in business. In 2007, every worker in the U.S. would have gotten a check for $12,000. That’s a lot of xBoxes, not to mention mortgage payments.

There’s plenty of cash left in the U.S. economy. Sooner or later, the tiny minority of corporations and rich individuals who are hoarding our nation’s wealth will be forced to share it with the rest of us. The question is when, and how.

COPYRIGHT 2009 TED RALL