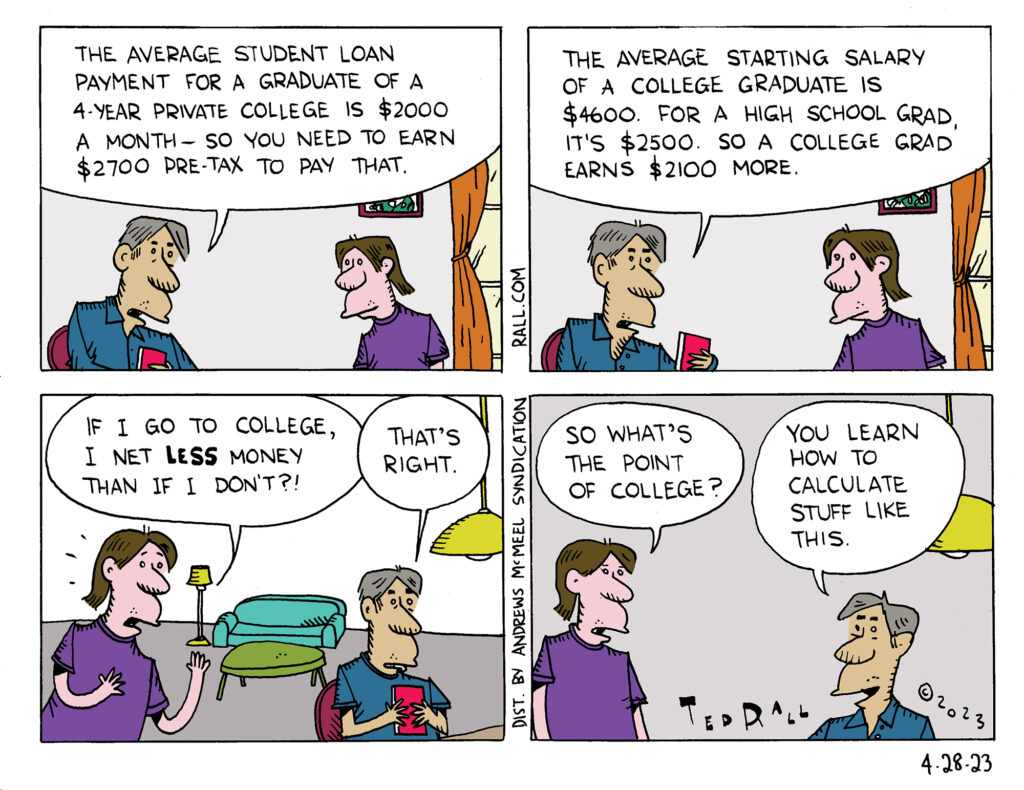

The “college premium”—the extra money you get from having a college degree compared to someone without one—has been eclipsed, more than eclipsed, by staggeringly high tuitions and resulting student loan burdens. There are still good reasons to go to college, but making more money probably isn’t one of them.

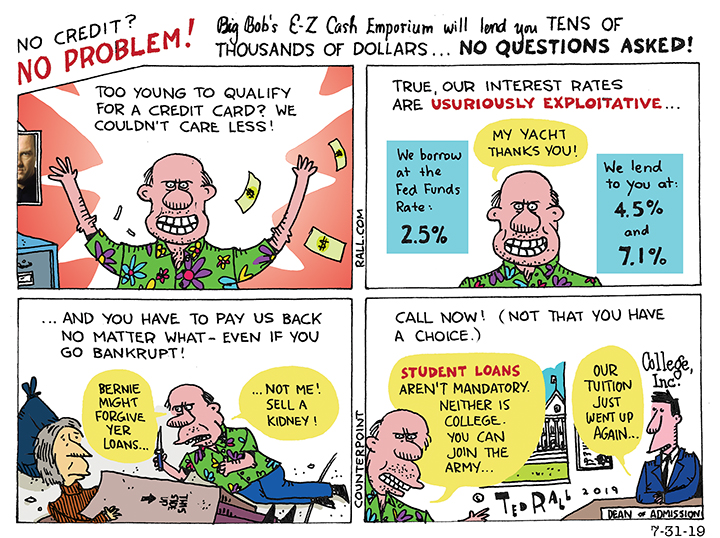

Student Loan Lenders Are Predatory

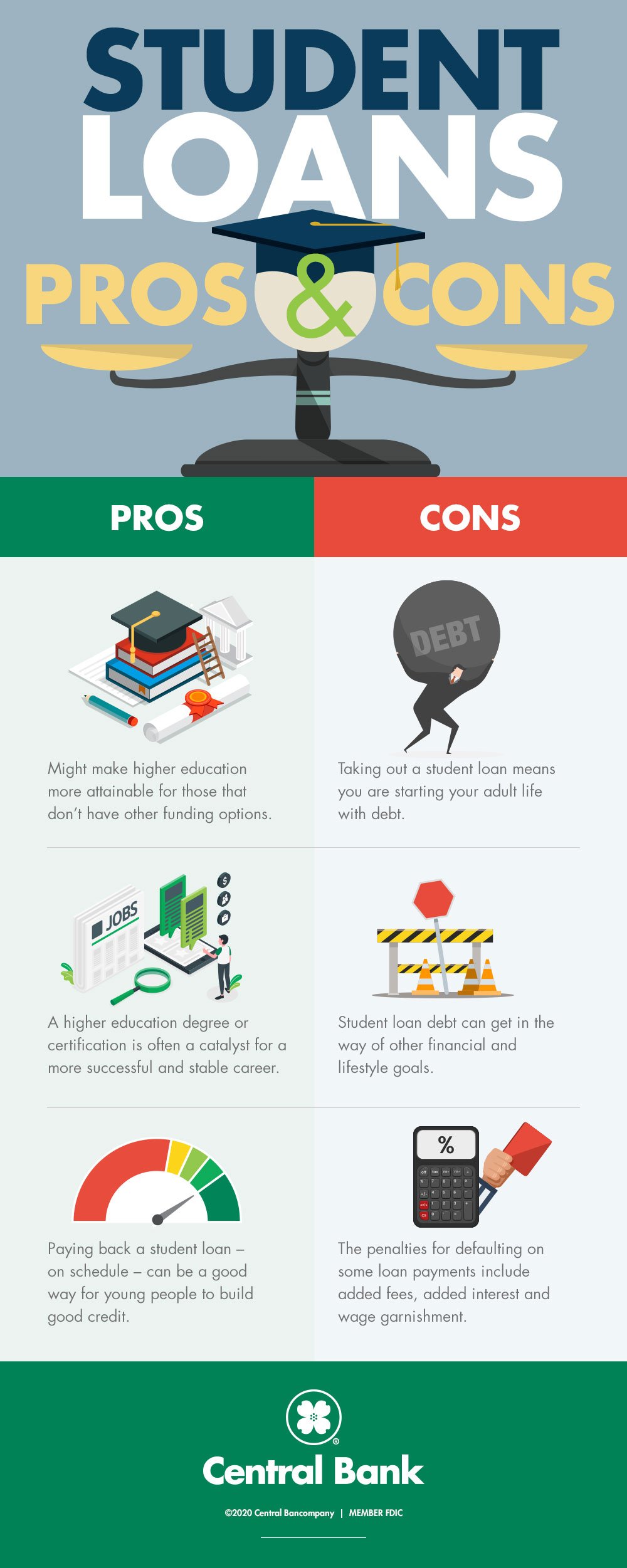

The student loan industry rakes in billions of dollars in profits on the backs of ignorant, impressionable teenagers who don’t know the first thing about finance and pay exorbitant interest rates. Then, when some of them have trouble repaying because they have trouble finding good jobs, the establishment smears them as irresponsible. Joe Biden was right to suspend student loan repayments due to COVID-19, but that’s temporary. Student loans shouldn’t exist at all, but until we go to all grants, it should be a zero-profit business.

Student Loans: A Silent Scandal No More

Student loans, long a non-issue that ruined countless lives, have finally become a political flashpoint in the conflict between progressive and moderate Democrats. Yielding to lefties’ pressure after Joe Manchin torpedoed Build Back Better, President Biden has extended Trump’s pandemic relief to 43 million federal borrowers by pausing payments another three months, to May 1.

The issue isn’t going away. 62% of Democratic and 57% of Republican voters aged 18 to 29 told a Harvard Institute of Politics poll that student loan debt is a major problem—a problem they think about when they pay their bills every month.

Left-leaning lawmakers want to go far beyond Biden’s stop-gap extension as well as his long-forgotten campaign promise to cancel $10,000 of debt per borrower. (The average ex-student owes $37,000 in federal loans.) Chuck Schumer, Elizabeth Warren and Ayanna Pressley propose to wipe out $50,000 each; Bernie Sanders and Alexandria Ocasio-Cortez want to forgive all $1.7 trillion.

A bill proposed by Republican Senator Marco Rubio would lower interest payments to zero, instead charging a one-time, non-compounding flat fee that student loan borrowers would pay over the term of their loan.

Our higher-education financing system is a scandal.

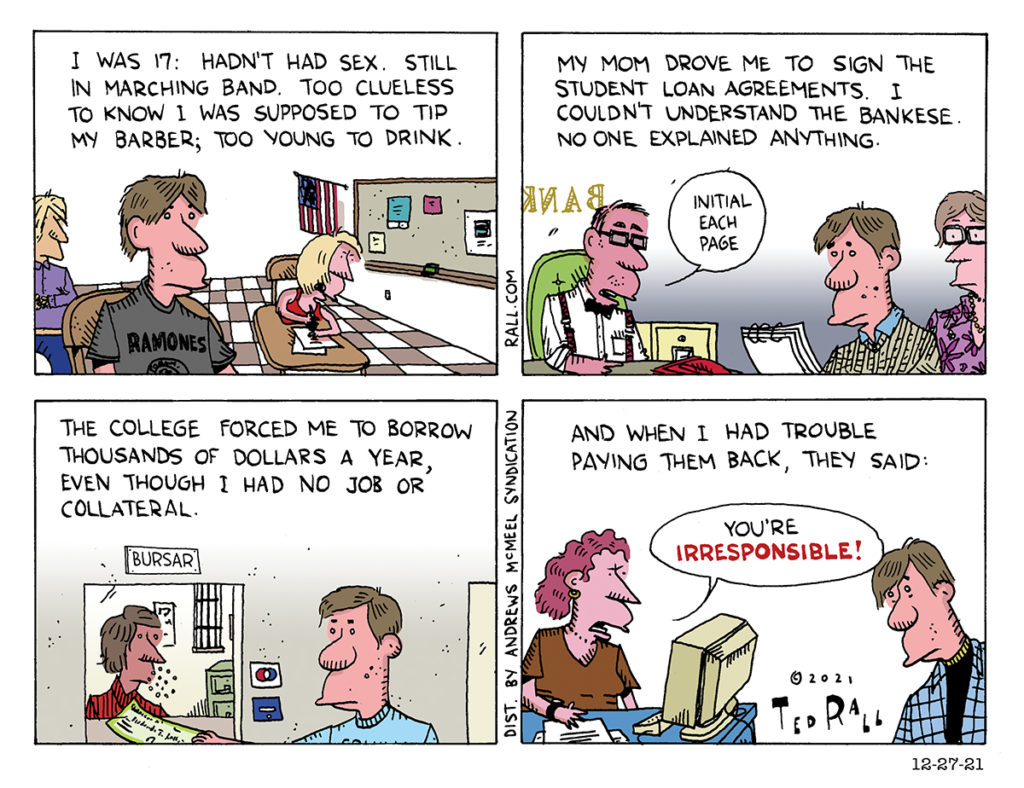

My grades and test scores were good enough to get into an Ivy League college. I was smart. But I was still a 17-year-old kid. In 1981 I didn’t know you were supposed to tip your barber, that your major field of study might have no bearing on your future career, or that Manhattan and Long Island were different places.

So signing a student loan agreement committing to repay thousands of dollars from a salary derived from some imaginary job in a mysterious future was a surreal experience.

I sat next to my mom in the lobby of the big bank building in downtown Dayton, clueless. All I knew was that I had to sign a sheaf of incomprehensible documents if I wanted to attend college. As my guidance counselor and teachers and parents had repeatedly warned, without a college degree I would be doomed to subsistence-level fast-food or manual labor—and factory jobs were getting hard to find.

Don’t forget to initial each page.

How much would I earn after graduation? What would be my monthly payment? How does compound interest work? Was 9% a reasonable rate? When would it begin to accrue? What if I became unemployed? I didn’t know and if the banker satisfactorily explained this stuff it didn’t stick to my hippocampus. I invisibly shrugged, hoping that I’d somehow muddle through.

I return to my state of mind 40 years ago whenever I hear someone deplore the ethics of the 15% of student loan borrowers who are in default at any given time. Is an obligation you don’t understand when you agree to it an obligation at all?

Honoring commitments is important. If you borrow money, you should pay it back. (I did.) But lenders have responsibilities too. As we saw during the subprime mortgage crisis of the late 2000s, the economy suffers when banks recklessly issue loans to borrowers who don’t understand the terms or won’t have enough income or collateral to repay—which is the case for most college loans.

Student loan lending is predicated on the assumption that graduates will be able to pay back what they owe, plus compound interest, out of the higher income they will earn compared to non-graduates. But 57% of student loan borrowers never graduate from college. Most borrowers, therefore, are naïve teenagers with bleak job prospects. Lending to them is as predatory as it gets.

Clemency proposals annoy people who already paid their loans, not to mention those who bypassed college rather than go into debt. Why should taxpayers foot the bill for others’ luxurious college education?

For one thing, post-secondary education is no longer optional. 65% of all job postings require a post-secondary education, according to a study by the Georgetown University Center on Education and the Workplace. As long as that’s the case, Americans will believe there’s a common economic interest in cranking out millions of freshly-minted graduates.

Canceling student loans across-the-board would have a low multiplier effect and thus do little to stimulate the economy. But there would still be advantages for everyone, not just borrowers.

Freeing a generation from debt slavery would provide flexibility and capital for new entrepreneurs and allow do-gooders to pursue work in helping professions with low wages. It would add liquidity to the nearly half of Millennials who report that their loan debts forced them to delay buying a first home by an average of seven years. You may not have gone to college yourself yet you may get to retire earlier because you’ll sell your home to a young couple at a higher price.

College expenses in the U.S. are too damn high, the most expensive system of higher education in the world after the U.K. on paper, but Britain’s are cheaper than ours when adjusted for grants and government-imposed price controls. When half of American borrowers continue to owe an average of $20,000 some 20 years after beginning as a freshman, reform is clearly called for.

One promising development is Secretary of Education Miguel Cardona’s promise to fix broken Bush-era student loan forgiveness programs for those who work in public service, education, healthcare and social work. Byzantine rules and application processes resulted in only 5,500 out of potentially 1 million qualified applicants getting their loans erased in part due to “miscommunication between the Department of Education and the loan servicers, as well as between the servicers and borrowers,” CNN reported about a 2018 General Accounting Office report. But that’s only a start.

Someday, hopefully, college will be free.

Until then, college loans need to be reined in. They’re a big business with no inherent limit upon growth. Colleges and universities have raised tuition and other fees faster than inflation because they know that a wide array of loan packages are available to students and parents. Lenders enjoy a fixed interest rate scheme that not only guarantees them a profit over their own borrowing rates, but also at low risk since it is virtually impossible to discharge student loans in bankruptcy.

These structural problems can be addressed by reducing lenders’ incentives to lend money willy-nilly and by reining in tuition costs. Congress should cap the maximum amount each student can borrow per year at $2500 for those attending community colleges and four-year public universities, and $5000 for those at private institutions. Bankruptcy courts should be given the option to discharge student loan debts. Any college or university that raises overall tuition, housing and other costs faster than inflation should not qualify for federally-subsidized loan payments from their students and ought to lose any federal contracts.

And if it’s really in the public interest for so many millions of young Americans to attend college and university, how does it make sense for educational financing to be a lucrative form of usury?

The federal government ought to take over the lending business from banks, with zero-profit interest fixed at the same rates it pays to holders of Treasury bonds. No one should get rich off the backs of 17-year-old kids seeking to better themselves through education.

(Ted Rall (Twitter: @tedrall), the political cartoonist, columnist and graphic novelist, is the author of a new graphic novel about a journalist gone bad, “The Stringer.” Order one today. You can support Ted’s hard-hitting political cartoons and columns and see his work first by sponsoring his work on Patreon.)

SYNDICATED COLUMN: No Man is Above the Law — Except on College Campuses

Freshman orientation, Columbia University, New York City, Fall 1981: Now as then, there were speeches. A blur of upperclassmen, professors and deans welcomed us, explained campus resources and laid out dos and donts. At one point, the topic of the campus drug policy came up. “You can do whatever you want in your dorm room,” we were told, “just make sure it’s OK with your roommate.” A ripple of surprise swept the audience. Several students asked for elaboration of this don’t-ask-don’t-tell policy on illegal narcotics, and were told that they’d heard correctly.

One of my friends, who grew pot plants in his window, proved the wisdom of that advice. My pal’s Born Again Christian roomie, not consulted about his grow house scheme, attacked him in what became a legendary fistfight out of a Western.

No one was arrested, though there was a stern talking-to courtesy of the R.A.

(Columbia has since changed this policy.)

The weird alternative universe of law on campus is in the headlines again due to Education Secretary Betsy DeVos’ announcement that the Trump Administration plans to rewrite Obama-era Title IX rules to give male students accused of rape on college campuses more rights to defend themselves.

Under a 2011 directive university administrators were advised that their institutions could lose federal education funding unless they reduce the evidentiary standard for finding a defendant student guilty of sexual misconduct from “beyond a reasonable doubt” (the same as in criminal courts, in which jurors are asked to be roughly 90% or more certain of guilt to convict) to the lower “based on the preponderance of the evidence” standard used in civil courts (50% or more).

Victims rights advocates say campus rape is an epidemic problem, that local police can’t be trusted to take rape charges seriously or prosecute them aggressively, and that the relatively friendly campus tribunals of administrators operating under the lower standard of proof mandated by Title IX are necessary to encourage victims to step forward.

Men counter that those accused of rape shouldn’t lose their rights when they step on a college campus, and that innocent defendants have been railroaded by kangaroo courts in which they’re not allowed to have a lawyer or, in some cases, to present their full defense.

DeVos referred to the bizarre case of a USC football player expelled for abusing his girlfriend even though she insists there was no abuse. This followed the news that the rape defendant in the notorious 2015 “mattress case” in which his alleged victim carried her mattress around campus and to her commencement ceremony had earned a measure of vindication earlier this year when the university paid him to settle his lawsuit and issued a statement declaring that, after years of being publicly rape-shamed in international media, he had done nothing wrong after all.

Like students at colleges and universities across the United States, I was stunned to learn that college campuses are sort of like Native American reservations: zones where the law applies theoretically but in practice is systematically ignored or enforced at significant variance to the way things go in the outside world.

The shooting of a motorist on a city street off campus by a University of Cincinnati police officer highlighted the fact that two out of three colleges have armed police forces — and that some of these campus cops are told they have the right to arrest, and even shoot, non-students in surrounding neighborhoods.

At least today’s colleges aren’t brazenly stealing land from public parks, as Columbia did in 1968 when it began construction on a gym in Manhattan’s Morningside Park. (The land grab sparked a riot and iconic student takeover of campus.)

The debunking of that big Rolling Stone piece about a supposed rape at UVA aside, it doesn’t take a statistician to grok that college campuses, with their witches’ brew of young people out on their own for the first time, minimal adult supervision and free-flowing booze set the stage for date rape as well as sexual encounters where consent appears ambiguous. The question is: should college administrators substitute for cops and district attorneys in the search for justice? Emily Yoffe’s Atlantic series on DeVos’ proposal strongly suggests no.

Yoffe portrays a system that encourages males to feel victimized by being considered guilty until proven innocent. “To ensure the safety of alleged victims of sexual assault,” she writes, “the federal government requires ‘interim measures’ —accommodations that administrators must offer the complainant before any finding of responsibility, including steps to ensure that she never has to encounter the accused… Common interim measures include moving the accused from his dormitory, limiting the places he can go on campus, forcing him to change classes, and barring him from activities. On small campuses, this can mean his life is completely circumscribed. Sometimes he is banned from campus altogether while awaiting the results of an investigation.” This is an injustice, and saying it’s necessary in order to protect victims doesn’t change that.

The New York Times recently published an op-ed that embodied the glib view of defendants’ rights au courant on college campuses. “Of course, being accused of sexual assault hurts,” wrote Nicole Bedera and Miriam Gleckman-Krut. “And there are things that we can and should do to help accused students — namely, providing them with psychological counsel.” Seriously? Men accused of rape face expulsion, felony charges (schools can refer cases to the police) and blackballing from other colleges if they apply. They need more than therapy.

It’s easy to see why colleges, and many parents of students, want to maintain their personal on-campus legal systems outside the bounds of adult law and order. 18-year-olds are legally adults but psychologically still kids, the thinking goes. Sending even serious matters like rape charges to the police can seem like a second brutalization of victims, and perhaps even unnecessarily harsh to the accused who, if innocent, may be able to assuage doubts with a simple explanation of their actions to friendly university staff members.

Though largely well-intentioned, and despite the fact that it is opposed by the despicable Donald Trump, this Title IX-based paternalism has no place in a society that purports to respect the concept of equal justice under the law. If there’s an alleged crime on a campus, students should call the cops.

The answer to nonresponsive police who disrespect victims isn’t to truncate defendants’ rights under a parallel facsimile of jurisprudence. The solution is to reform the police and the courts so that victims aren’t traumatized all over again. Let law enforcement do its job, and let educators do theirs.

(Ted Rall (Twitter: @tedrall) is author of “Trump: A Graphic Biography,” an examination of the life of the Republican presidential nominee in comics form. You can support Ted’s hard-hitting political cartoons and columns and see his work first by sponsoring his work on Patreon.)

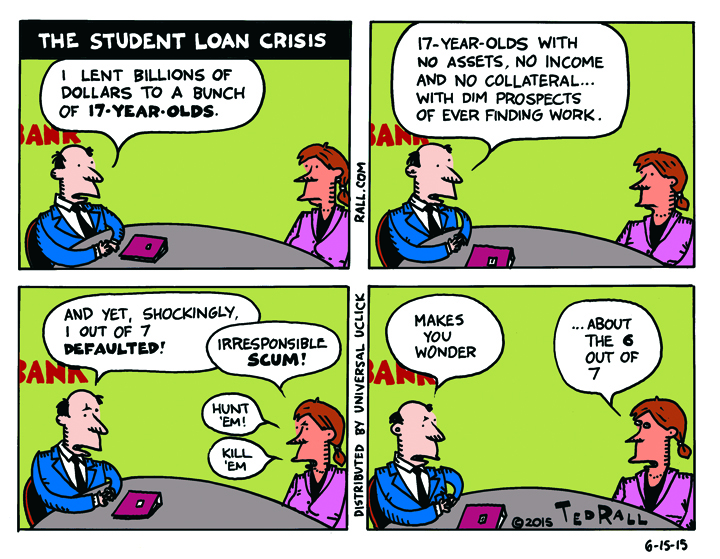

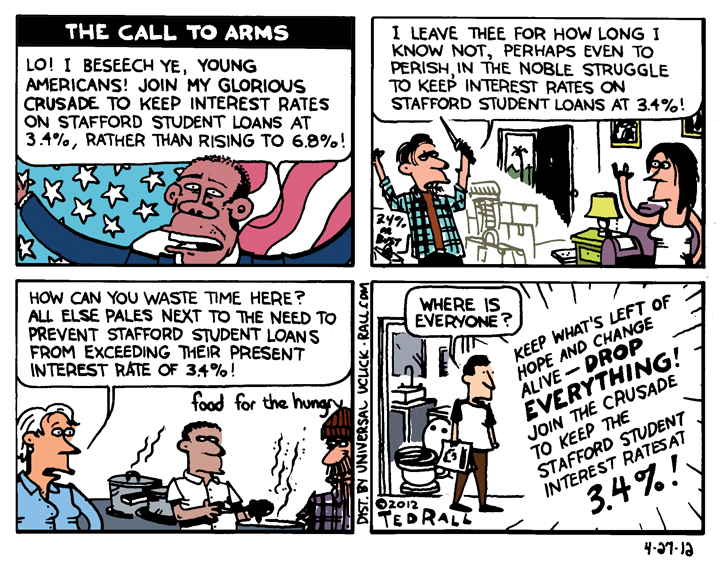

The Student Loan Crisis

Bankers issue student loans to 17-year-old kids. Who’s more irresponsible: the bankers who take a reckless risk? Or the 1 out of 7 impoverished students who default on their obligations?

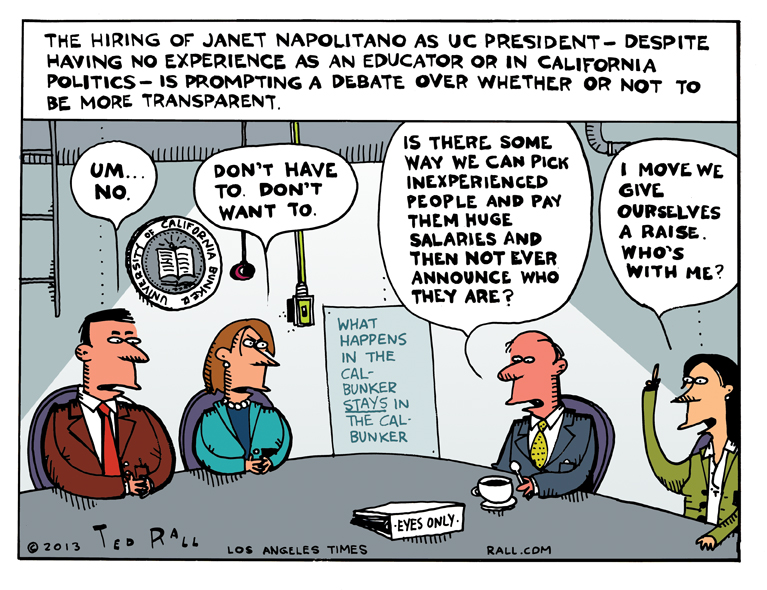

LOS ANGELES TIMES CARTOON: Cal Bunker

I draw cartoons for The Los Angeles Times about issues related to California and the Southland (metro Los Angeles).

This week: The hiring of former Homeland Security Secretary Janet Napolitano as president of the University of California prompts a debate over whether or not to be more transparent.

SYNDICATED COLUMN: Against Philanthropy

As Hurricane Victims Freeze, Billionaire Mayor Gives Away $1 Billion to Wealthy Med School

New York City Mayor Michael Bloomberg made headlines over the weekend with his announcement that he has donated $345 million to Johns Hopkins University. Added to his previous donations, the media baron has given his alma mater over $1 billion – the largest charitable contribution to an educational institution in US history.

Bloomberg received plaudits for his generosity by the usual media sycophants. Along with death and taxes, another thing you can count on is being told to be grateful when masters of the universe give away some of their loot (even if none of it goes to you.) As pundits fawned, thousands of New Yorkers – residents of Queens whose homes got damaged by superstorm Sandy – were shivering under blankets in heatless homes in 15° weather because restoring electricity and housing storm victims isn’t one of the mayor’s top priorities.

Disgusting.

This was a man, New Yorkers remember, who wanted the mayoralty so badly that he subverted the people’s will, bribing and bullying the City Council into overturning term limits passed by an overwhelming majority so that he could keep the job a third term.

No one should claim that he didn’t want responsibility for those poor cold slobs out in the Rockaways.

If there’s anything more nauseating than watching this rich pig bask in the glow of his philanthropy while the citizens he is tasked with caring for turn into popsicles, it’s the failure of anyone in the system – columnists, local TV anchor people, even Bloomberg’s political rivals – to call him out. For $345 million the mayor could have put his city’s storm victims up at the Four Seasons for years.

Bloomberg’s donation to one of the wealthiest universities on earth, with an endowment of $2.6 billion, serves to remind us that philanthropy is evil.

You could argue that generous rich people are better than cheap rich people. And if you like the way things are, with the gap between rich and poor at record levels and spreading – you’d be right. But most people are not happy with our winner-take-all economy.

No one deserves to be rich. And no one should be poor. Everyone who contributes to society, everyone who works to the best of their skills and abilities, deserves to earn the same salary. Of course, I realize that not everyone adheres to such basic Christian – er, communist – principles. (Anyone who denies that Jesus was a commie never cracked open a Bible.)

But most people – certainly most Americans – agree there’s a line. That too much is too much. People like Michael Bloomberg and Steve Jobs and Bill Gates may have worked hard and created products that consumers purchased in great numbers – but no one can work $25 billion hard (Bloomberg’s estimated net worth). There aren’t that many hours in the day; the human skull doesn’t contain enough synapses; no idea is worth that much.

One of the big problems with charitable giving is that it mitigates the injustice of inequality: sure, maybe it’s a little crazy that Bloomberg has 11 luxurious homes while people are starving to death and sleeping outside, but at least he’s generous. He’s giving it away. The implication, that the chasm between rich and poor isn’t that bad, is a lie. It’s also evil: If inequality isn’t that bad, it’s not important to talk about – much less fix.

“For many people, the generosity of these individuals who made so much money eliminates the problem that wealth poses, inequality poses, in the society,” says Robert Dalzell, author of “The Good Rich and What They Cost Us.” “We tend to conclude that such behavior is typical of the wealthy, and in fact it’s not…This whole notion of ‘the good rich’ I think reconciles us to levels of inequality in the society that in terms of our democratic ideology would otherwise be unacceptable.”

It’s better for society when rich people are unlikeable jerks like Mitt Romney. Knock over old ladies, stiff the waitress, talk with a pretentious fake British 19th-century accent, install a car elevator. Bad behavior by our elite oppressors hastens the revolution.

Bloomberg’s billion-dollar gift to a school that doesn’t need a penny illustrates the inherent absurdity of capitalism: aggregating so much wealth and power in the hands of a few individuals. It’s obscene and morally reprehensible to allow a disproportional share of resources to fall under the control of the arbitrary whims of a few quirky rich dudes.

Why should National Public Radio, which received a $200 million bequest by the widow of McDonald’s founder Ray Kroc, get all that cash while the Pacifica radio network – more avant-garde, better politics – teeters on the edge of bankruptcy? It’s nice that the Bill and Melinda Gates foundation fights AIDS in Africa, but who are Bill and Melinda Gates to decide that AIDS in Africa is worse than, say, diarrhea, which kills more people? It’s amusing to hear that the heir to a pharmaceutical fortune gave $100 million to an obscure poetry journal – but again, people are sleeping outside. Why not musicians? Or cartoonists?

People are dying because they can’t afford treatment by a doctor. People have been convicted of crimes they didn’t commit and executed because they couldn’t afford a competent lawyer to defend them.

If a government agency were allocating public funds based on the personal whims of its director, there would be a scandal. Under the veil of “philanthropy” billions of dollars that could help millions of people are being spent in a haphazard manner – and we’re supposed to applaud because it’s up to the “private sector”?

In an ideal world no one would have that kind of power. We’d be as equal as the Declaration of Independence declares us to be. We’d make decisions about who to help and what problems to try to fix collectively. The most unfortunate people and the worst problems would get helped first –long before Johns Hopkins.

Our world isn’t perfect. But it is our duty to do everything in our power to make that way. Toward that end, billionaires like Michael Bloomberg ought to have their assets confiscated and redistributed, whether through revolutionary political change or – for the time being – high taxes.

If we can’t pull off nationalization or truly progressive taxation, if we are too weak, too disorganized and too apathetic to form the political movements that will liberate us, the least we should do is to denounce “generous” acts of philanthropy like Michael Bloomberg’s for what they are: arbitrary and self-serving attempts to deflect us from hating the rich and the inequality they embody.

(Ted Rall’s website is tedrall.com. His book “After We Kill You, We Will Welcome You Back As Honored Guests: Unembedded in Afghanistan” will be released in November by Farrar, Straus & Giroux.)

COPYRIGHT 2013 TED RALL