Donald Trump, who takes office in a matter of days, defeated Kamala Harris in large part because of voter dissatisfaction over the economy. But what will his economy look like?

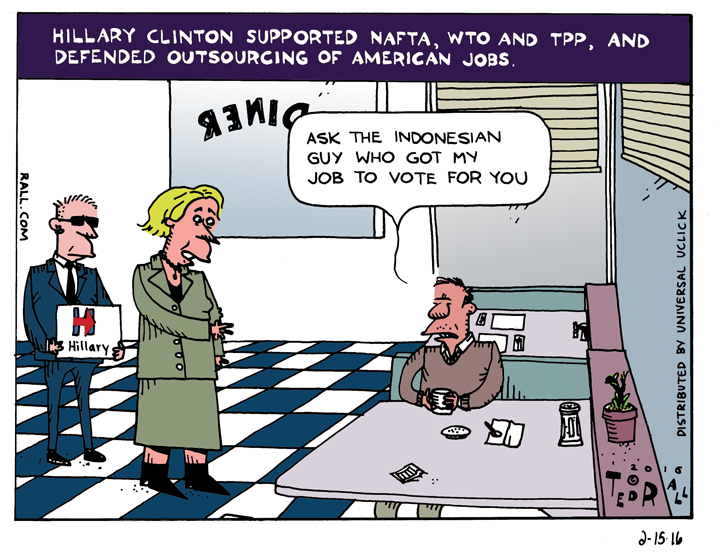

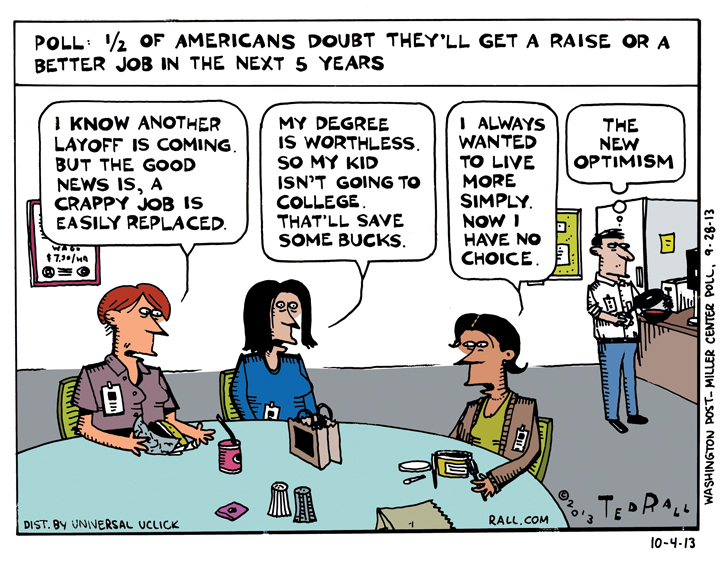

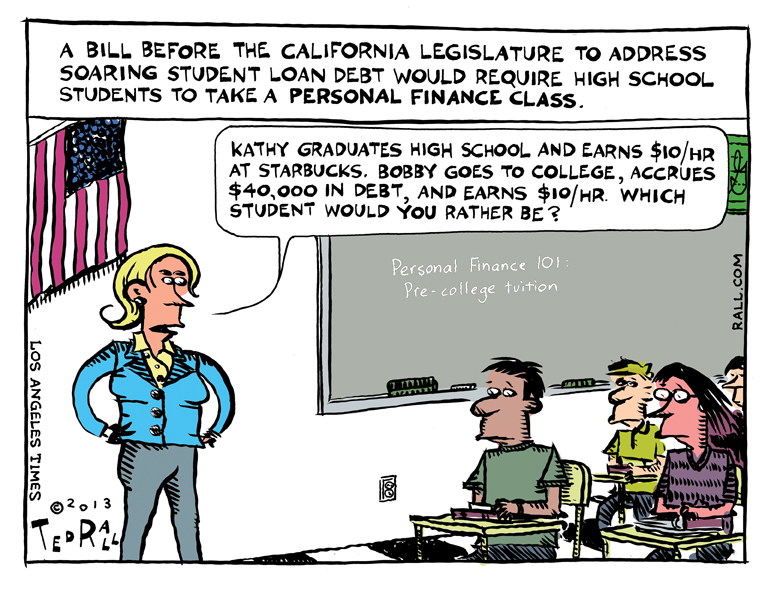

In many ways, this is a tale of two economies. The stock market, tech and the wealthy are doing better than ever. The working class and manufacturing are struggling. Can Trump reconcile his populist and billionaire bases? Can he keep inflation under control? Might he consider expanding the social safety net, especially for healthcare, or increase the minimum wage? What will he do as A.I. continues to kill jobs?

“The TMI Show” tries to predict the state of the US economy in the coming year. Co-hosts Ted Rall and Manila Chan is joined by Aquiles Larrea, CEO and Founder of Larrea Wealth Management.