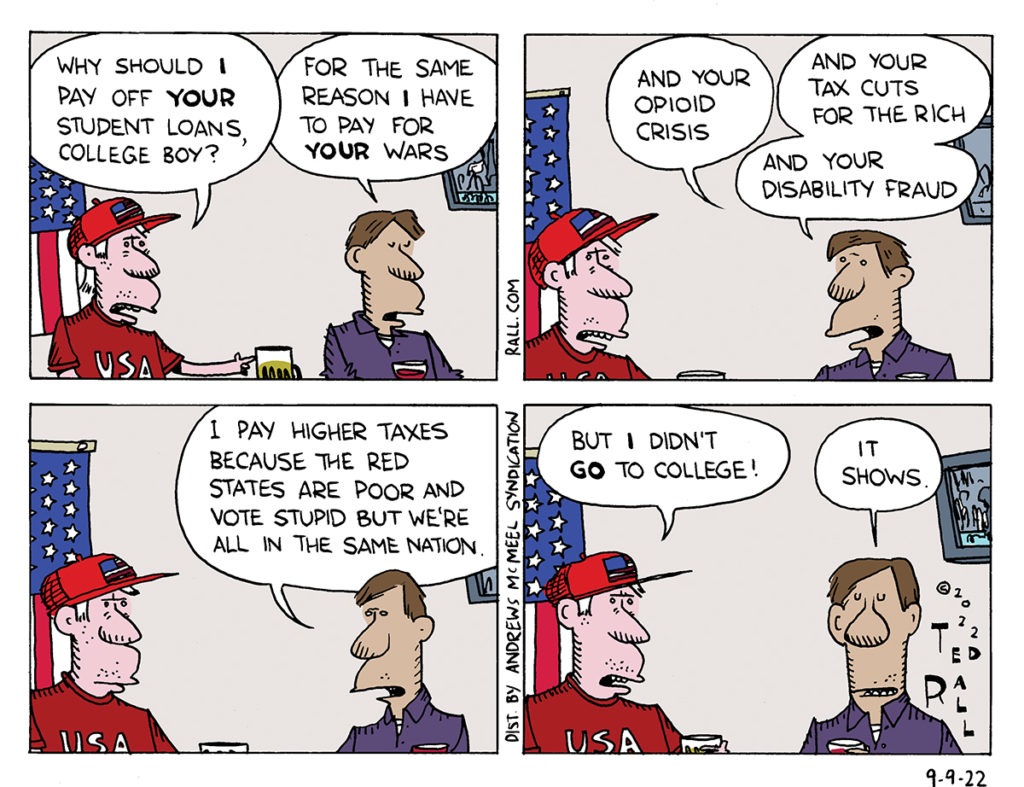

The most effective Republican talking point against Joe Biden’s attempt to forgive outstanding student loans is that people who didn’t go to college shouldn’t have to pay for those who did. But in a country as big as the United States, everyone inevitably has to pay for other people’s choices and politics.

SYNDICATED COLUMN: Men of Dishonor

A Congress of 21st Century Cynics Dodges 19th Century Rules

People are calling the recently adjourned 112th Congress “the most dysfunctional ever” and the least productive since the infamous “do-nothing Congress” of the 1940s. There’s lots of blame to go around, but one cause for congressional gridlock has gone unnoticed and unremarked upon: we no longer have a sense of honor.

Back in the late 18th and 19th centuries, when our bicameral legislature and its rules were conceived of by a bunch of land-owning white males, a gentleman’s word was his most precious asset. Integrity and the lack thereof were literally a matter of life and death; consider the matter of Alexander Hamilton and Aaron Burr. As Thomas Jefferson and his de facto wife Sally Hemings could attest, civility was far from guaranteed under this old system. It certainly could have worked better for Charles Sumner, the abolitionist Massachusetts senator who was nearly beaten to death by a proslavery colleague on the floor of the Senate in 1856. (He was avenging what he considered libelous rhetoric against his family.)

Though less-than-perfect, there was a lot to be said for a culture in which a person’s word was his bond, legalistic quibbling was scorned, and a legislator was expected to stake out and defend a principled position, even in the face of political and personal adversity.

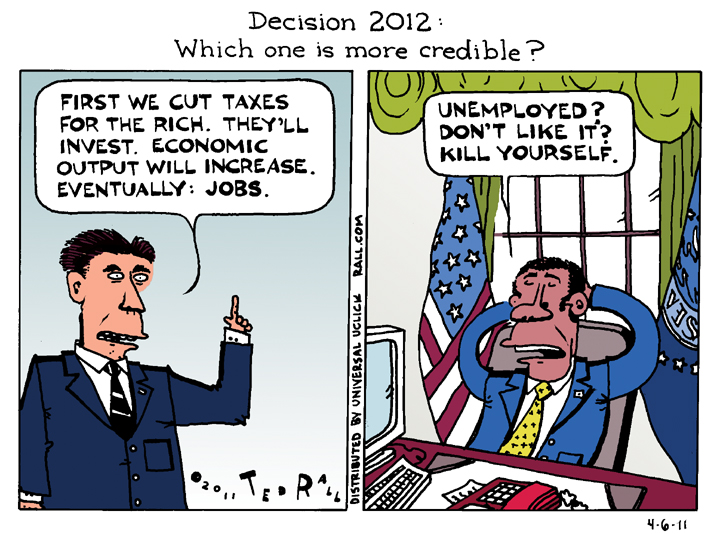

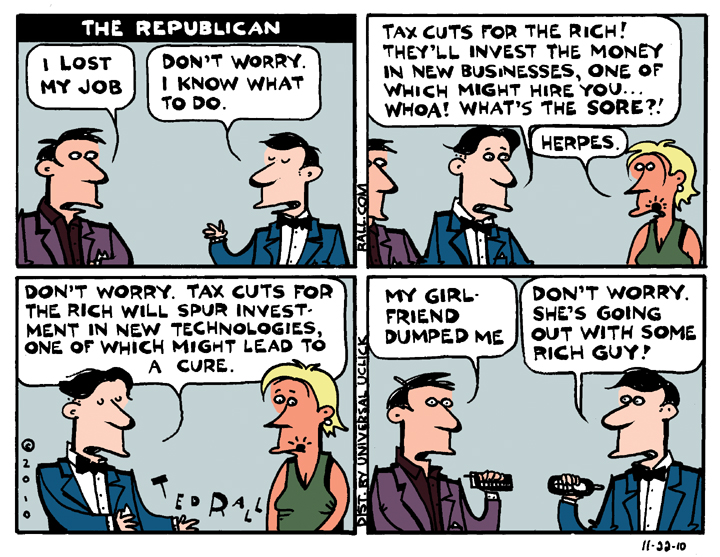

It’s hard to imagine the “fiscal cliff” showdown unfolding in the 1800s or even the first half of the 1900s for two simple reasons. First, the general fiscal health of the country would have come ahead of partisanship. Second, and more importantly, members of the two political parties would have stuck to the deal that they struck a decade earlier. When George W. Bush and his Republicans pushed for a set of income tax cuts that primarily benefited the wealthiest Americans in 2001, they argued the standard GOP trickle-down economics talking point that the tax cuts would pay for themselves by stimulating the economy so much that revenues into government coffers would more than make up for the cost. In order to get enough Democratic support for passage, the Republicans agreed to a five-year time period, after which taxes would revert to their Bill Clinton-era levels.

By 2006 there was still no evidence to show that the tax cuts had stimulated the economy. In fact, by many measures, things were worse. The housing bubble was beginning to burst; unemployment and underemployment had increased. If this had been the 19th century, Republican legislators would have acknowledged that their experiment had failed and that would have been that. A gentleman didn’t run away from the facts or his mistakes.

Voters seemed to agree. Unhappy with the invasion of Iraq as well as the state of the economy, Americans returned Democrats to control of Congress in 2006. Republicans had a pretty good idea—the polls were damning—that their unpopular policies were driving them toward a decisive defeat in the midterm elections. For men and women of honor, this would have been a time to reassess and back off.

Nevertheless the GOP jammed through an extension of the 2001 Bush tax cuts for the wealthy months before the midterm election. No honor there.

Here we are nearly 12 years later, and the verdict is in: the Bush tax cuts failed miserably. No doubt about it, it’s absolutely ridiculous that President Obama and the Democrats agreed to extend them for all but the richest one-half of one percent of American income earners. But the debate should never have gotten this far in the first place. Had the Republicans who proposed it in the first place possessed an iota of good old-fashioned 19th-century honor and integrity, this misbegotten legislative abortion would have died in 2006.

Robert’s Rules of Order and other quaint traditions of parliamentary procedure don’t translate to a quibbling little time like ours, when White House lawyers torture widely understood words like “torture” and “soldier” or claim that a US military base in Cuba is in no man’s land, neither in Cuba nor under US control, and that members of both major political parties say anything in order to get their way. Consider, for example, the current push to reform the filibuster, in order to clear the logjam on judicial nominations and other business that used to be considered routine.

The Senate, the only house of Congress that permits a filibuster, draws upon a tradition of principled minority protest that goes back to Cato in ancient Rome. Until the 1970s, filibusters were a rarity, averaging one a year. Senators viewed them as a bit of a nuclear option and only considered deploying a one-man block on debate of a bill a few times during a long political career, to take a stand on an issue where he felt it mattered most. Now the filibuster is not only a daily routine but gets deployed in an automated way so that the Senate has effectively become a body in which nothing gets done without a 60% vote in favor.

Everyone in the Senate understood what filibusters were for. No one abused them. It was a matter of honor.

But honor is too much to ask when even the most basic of all political considerations—ideology and party affiliation—bend like a reed in the winds of change.

Last week the Republican governor of New Jersey and a Republican congressman from Long Island, New York were so incensed by their party’s refusal to approve disaster relief funds for their states after hurricane Sandy that they went public with disparaging remarks about the Republican leadership in Congress. Fair enough. Standing up for your constituents against rank parochial self-interest is what integrity is all about.

On the other hand, the immediate willingness of some so-called liberal and progressive Democrats to welcome Chris Christie—a Tea Party favorite—and Peter King—a notorious nativist and anti-Muslim bigot—into their party’s ranks indicates a willingness to overlook basic principles that would have startled most self-described gentlemen of a century or two ago, much less those who’d entered public service. Back then, of course, the American political party system wasn’t as settled as it is today, so there were mass changes of party affiliation as parties appeared, metastasized and vanished. Still, it wasn’t acceptable behavior to change parties over a minor spat like the hurricane aid or for a party to accept members who didn’t adhere to its principles.

It’s almost enough to make you wish for a duel.

(Ted Rall is the author of “The Book of Obama: How We Went From Hope and Change to the Age of Revolt.” His website is tedrall.com.)

COPYRIGHT 2013 TED RALL

SYNDICATED COLUMN: Want More Wars? Raise Taxes on the Rich

Tax Fairness Won’t Reduce Inequality

Reacting to and attempting to co-opt the Occupy Wall Street movement, President Obama used his 2012 State of the Union address to discuss what he now calls “the defining issue of our time”—the growing gap between rich and poor.

“We can either settle for a country where a shrinking number of people do really well, while a growing number of Americans barely get by,” Obama said. “Or we can restore an economy where everyone gets a fair shot, everyone does their fair share, and everyone plays by the same set of rules.”

No doubt, the long-term trend toward income inequality is a major flaw of the capitalist system. From 1980 to 2005 more than 80 percent in the gain in Americans’ incomes went to the top one percent. This staggering disparity between the haves and have-nots has created a permanent underclass of underemployed, undereducated and alienated people who often turn to crime for survival and social status. Aggregation of wealth into fewer hands has shrunk the size of the U.S. market for consumer goods, prolonging and deepening the depression.

How can we make the system fairer?

Liberals are calling for a more progressive income tax: i.e., raise taxes on the rich. Obama says he’d like to slap a minimum federal income tax of 30 percent on individuals earning more than $1 million a year.

Soaking the rich would obviously be fair. GOP frontrunner/corporate layoff sleazebag Mitt Romney earned $59,500 a day in 2010—and paid half the effective tax rate (13.9 percent) of that paid by a family of four earning $59,500 a year.

Fair, sure. But would it work? Would increasing taxes on the wealthy do much to close the gap between rich and poor—to level the economic playing field?

Probably not.

From FDR through Jimmy Carter it was an article of faith among liberals that higher taxes on the rich would result in lower taxes on the poor and working class. This was because the Republican Party consistently pushed for a balanced budget. Tax income was tied to expenditures, which were more or less fixed—and thus a zero-sum game.

That period from 1933 to 1980 was also the era of the New Deal, Fair Deal and Great Society social and anti-poverty programs, such as Social Security, the G.I. Bill, college grants and welfare. These government handouts helped mitigate hard times, gave life-changing educational opportunities that allowed class mobility, closing the gap between despair and hope for tens of millions of Americans. As the list of social programs grew, so did the tax rate—mostly on the rich. The practical effect was to redistribute income from top to bottom.

Democrats think it still works that way. It doesn’t.

The political landscape has shifted dramatically under Reagan, Clinton and the two Bushes. Budget cuts slashed spending on student financial aid, food stamps, Medicaid, school lunch programs, veterans hospitals, aid to single mothers. The social safety net is shredded. Most federal tax dollars flow directly into the Pentagon and defense contractors such as Halliburton.

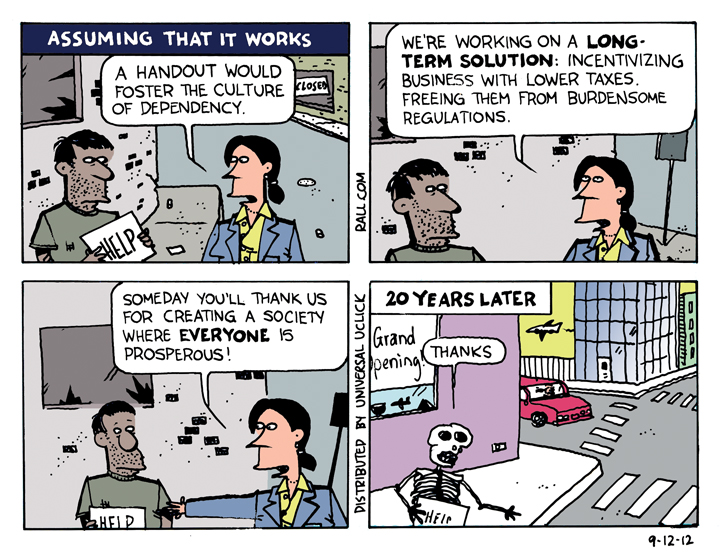

As the economy continues to tank, there’s only one category to cut: social programs. “Eugene Steuerle worked on tax and budget issues in the Reagan Treasury Department and is now with the Urban Institute,” NPR reported a year ago. “He says one reason no one talks about preserving the social safety net today is that lawmakers have given themselves little choice but to cut it. They’ve taken taxes and entitlements, such as Social Security and Medicare, off the budget-cutting table, so there’s not much left.”

Meanwhile, effective tax rates on the wealthy have been greatly reduced. Which isn’t fair—but not in the way you might think.

Taxes on middle-class families are at their lowest level in 50 years, according to the Center on Budget and Policy Priorities, a liberal thinktank.

What’s going on?

On the revenue side of the budget equation, the poor and middle-class have received tiny tax cuts. The rich and super rich have gotten huge tax cuts. Everyone is paying less.

On the expense side, social programs have been pretty much destroyed. If you grow up poor there’s no way to attend college without going into debt. If you lose your job you’ll get 99 weeks of tiny, taxable (thanks to Reagan) unemployment checks before burning through your savings and winding up on the street.

Military spending, on the other hand, has soared, accounting for 54 percent of federal spending.

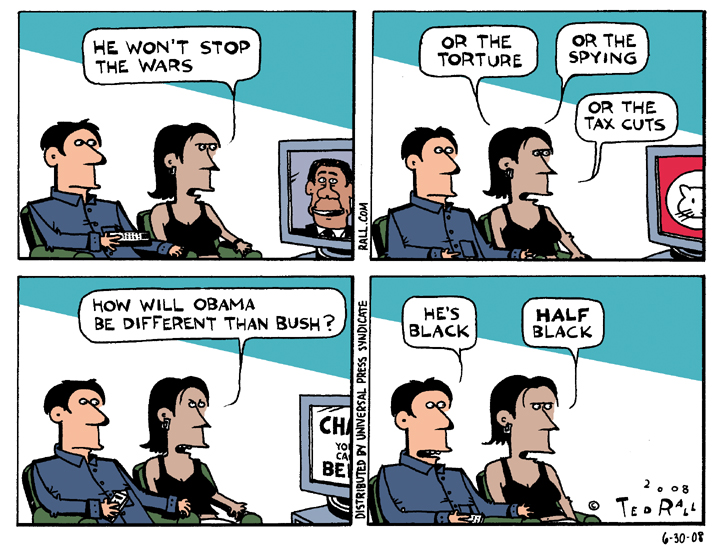

In short, we’re running up massive deficits in order to finance wars in Afghanistan, Iraq, and so on, and so rich job-killers can pay the lowest tax rates in the developed world.

I’m all for higher taxes on the rich. I’m for abolishing the right to be wealthy.

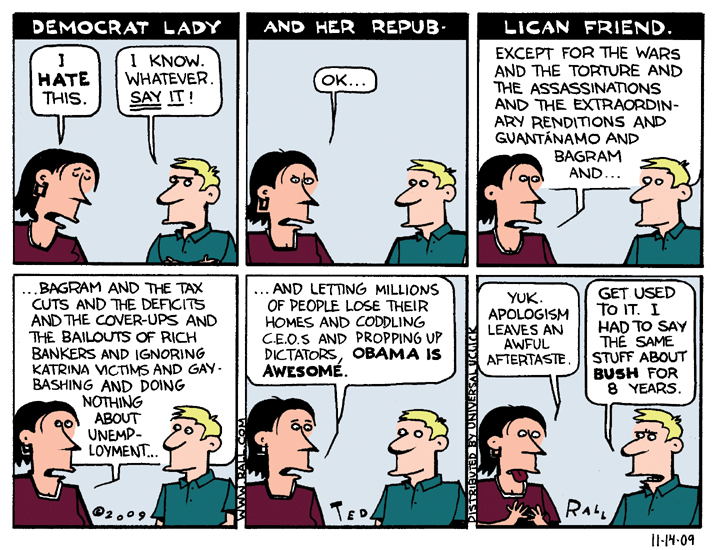

But liberals who think progressive taxation will mitigate or reverse income inequality are trapped in the 1960s, fighting the last (budget) war in a reality that no longer exists. The U.S. government’s top priority is invading Muslim countries and bombing their citizens. Without big social programs, invading Muslim countries and bombing their citizens is exactly where every extra taxdollar collected from the likes of Mitt Romney would go.

The only way progressive taxation can address income inequality is if higher taxes on the rich are coupled with an array of new anti-poverty and other social programs designed to put money and new job skills directly into the pockets of the 99 percent of Americans who have seen no improvement in their lives since 1980.

You have to rebuild the safety net. Otherwise higher taxes will swirl down the Pentagon’s $800 toilets.

If you’re serious about inequality, income redistribution through the tax system is only a start. Whether through stronger unions or worker advocacy through federal agencies, government must require higher minimum wages. It should set a maximum wage, too. A nation that allows its richest citizen to earn ten times more than its poorest would still be horribly unfair—yet it would be a big improvement over today. Shipping jobs overseas must be banned. Most free trade agreements should be torn up. Companies must no longer be allowed to layoff employees before eliminating salaries and benefits for their top-paid managers—CEOs, etc.

And a layoff should mean just that—a layoff. First fired should be first rehired—at equal or greater pay—if and when business improves.

Once a battery of spending programs targeted to the 99 percent is in place—permanent unemployment benefits, subsidized public housing, full college grants, etc.—the tax code ought to be radically revamped. For example, nothing gives the lie to the myth of America as a land of equal opportunity than inheritance. Aristocratic societies pass wealth and status from generation to generation. In a democracy, no one has the right to be born into wealth.

Because everyone deserves an equal chance, the national inheritance tax should be 100 percent. While we’re at it, why should people who inherited wealth but have low incomes get off scot-free? Slap the bastards with a European-style tax on wealth as well as the appearance of wealth.

Now you’re probably laughing. Even Obama’s lame call for taxing the rich—so the U.S. can buy more drone planes—stands no chance of passing the Republican Congress. They’re empty words meant for election-year consumption. Taking income inequality seriously? That’s so off the table it isn’t even funny.

Which is why we shouldn’t be looking to corporate machine politicians like Obama for answers.

(Ted Rall is the author of “The Anti-American Manifesto.” His website is tedrall.com.)

COPYRIGHT 2012 TED RALL