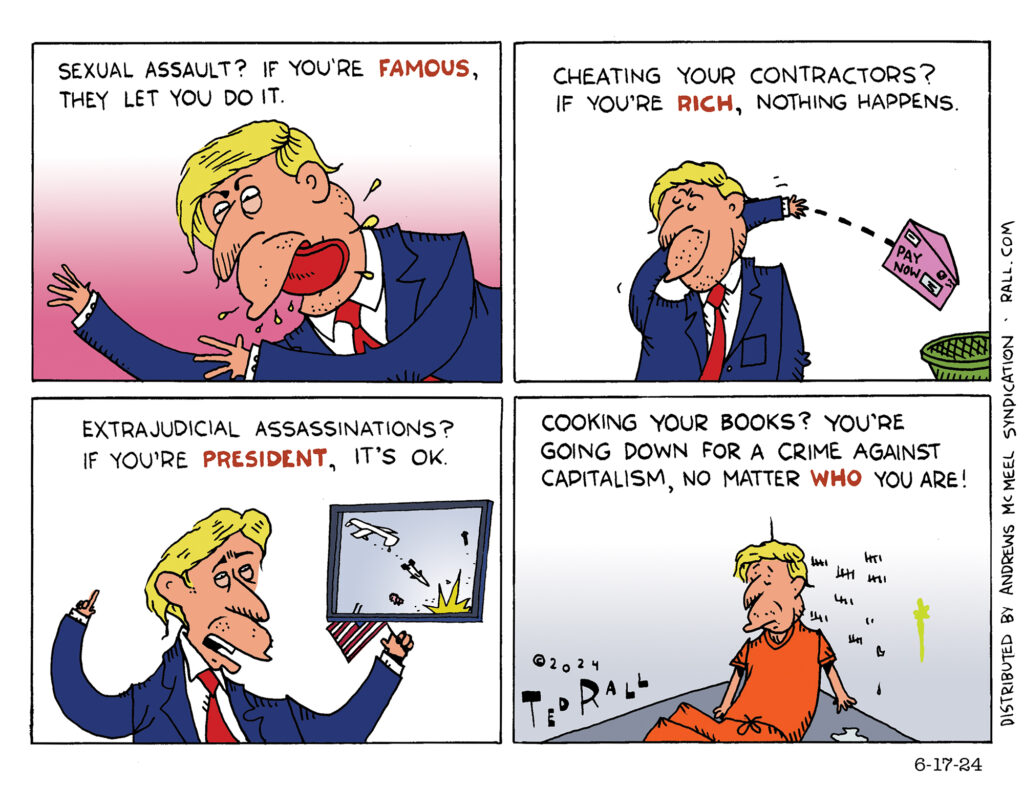

Donald Trump committed countless crimes without being held accountable. So it’s a weird reflection of our societal priorities that the one offense for which he is being held accountable is a relatively trivial paperwork charge.

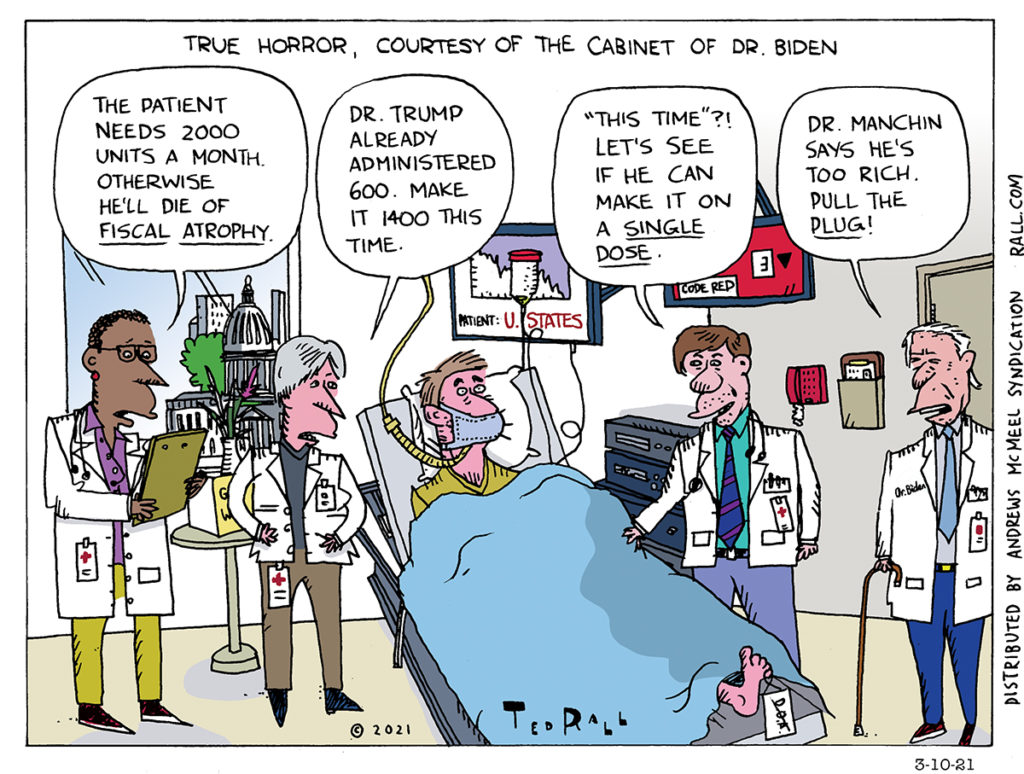

True Horror, Courtesy of the Cabinet of Dr. Biden

Bernie Sanders proposed a monthly stimulus of $2000, hardly a king’s ransom when you consider that tens of millions of people have lost their jobs entirely. Instead, Joe Biden promised $2000, one time, and then reduced it to $1400 after taking into account $600 paid out by Donald Trump toward the end of his term. Now he’s caving in to moderate Democrats like Joe Manchin of West Virginia and subjecting the payments to increased means testing. The patient, the American economy, is dying. But there’s no sense of urgency whatsoever on the part of the White House or the US Congress.

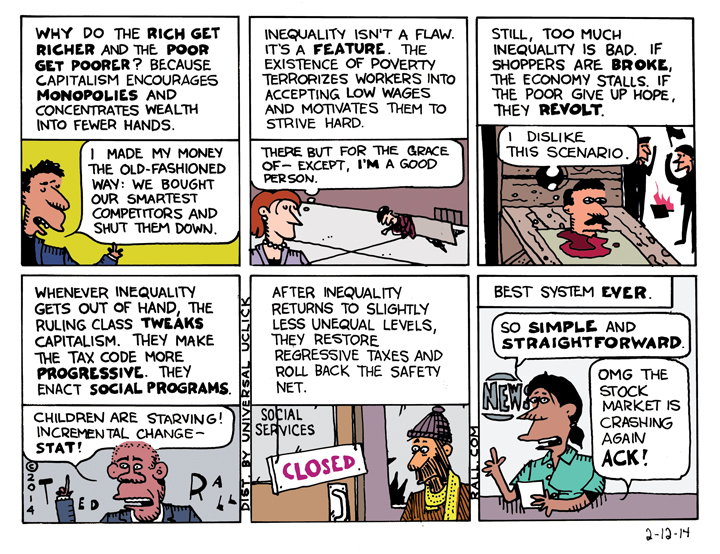

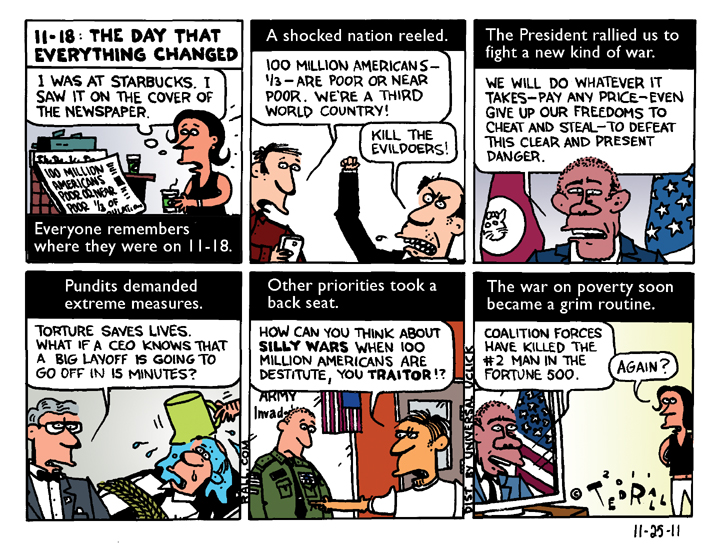

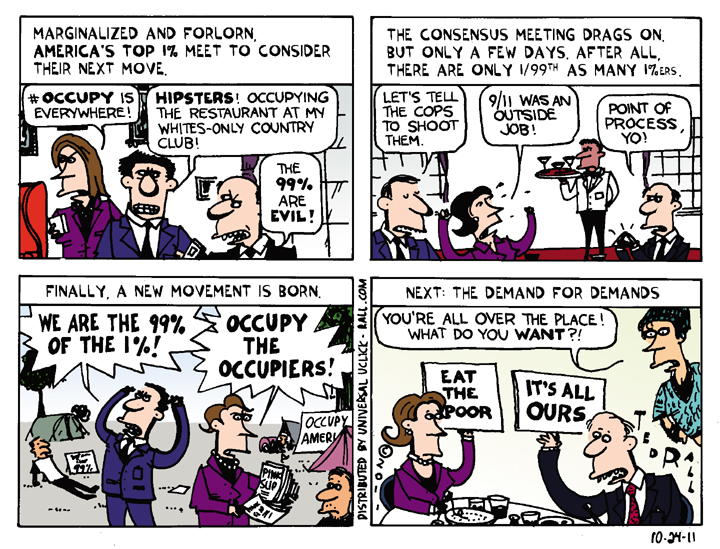

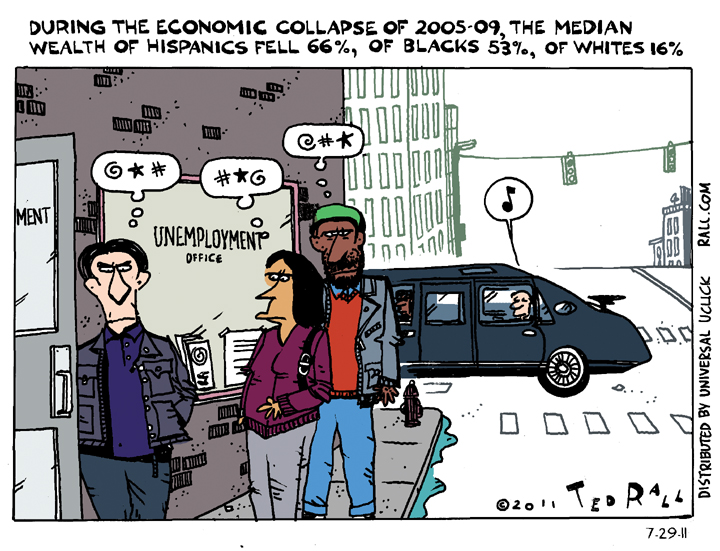

How Capitalism Deals with Inequality

President Obama and the Democrats have finally decided, five years after his election, to begin talking about the issue of income inequality, which has been increasing since the early 1970s. But their rhetoric makes it sound like inequality is a weird byproduct of capitalism when, in fact, it is a key feature of an economic system that relies on poverty and exploitation. This is the best system ever conceived?

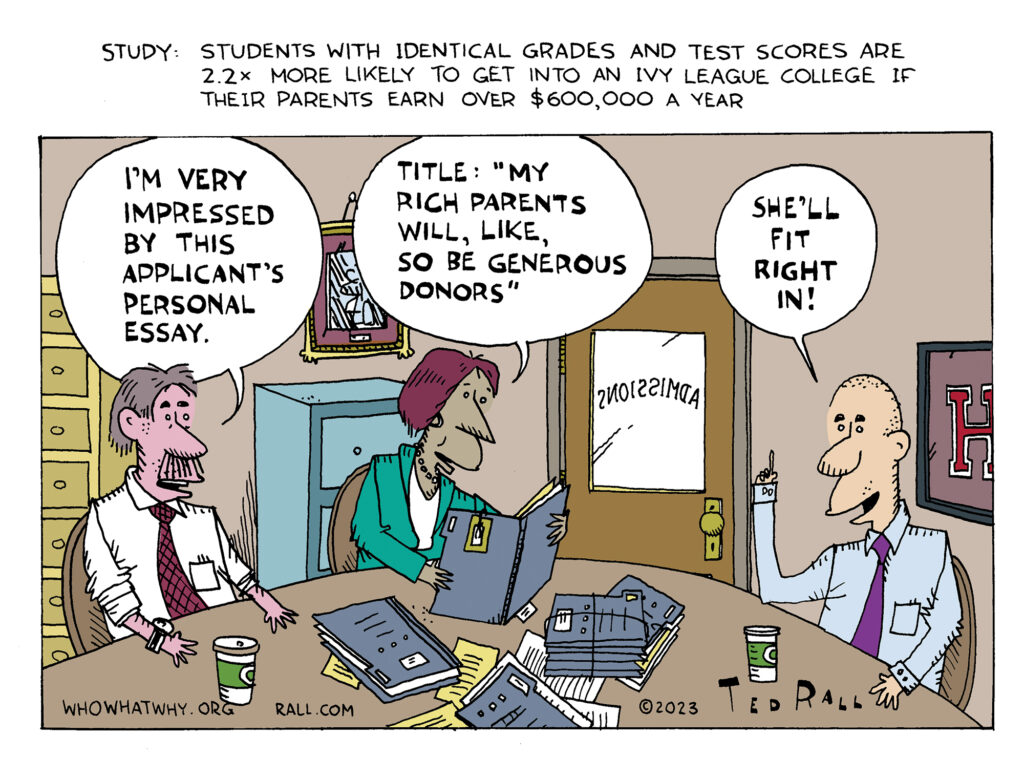

SYNDICATED COLUMN: Our Politicians Need an Education

Why Both Democrats and Republicans Miss the Big Picture

Public education is mirroring American society overall: a tiny island of haves surrounded by a vast ocean of have-nots.

For worried parents and students, the good news is that spending on public education has become a campaign issue. Mitt Romney is pushing a warmed-over version of the old GOP school voucher scheme, “school choice.” The trouble with vouchers, experts say (and common sense supports), is that allowing parents to vote with their feet by withdrawing their kids from “failing schools” deprives cash-starved schools of more funds, leading to a death cycle—a “winner takes all” sweepstakes that widens the gap between the best and worst schools. Critics—liberals and libertarians—also dislike vouchers because they allow the transfer of public tax dollars into the coffers of private schools, many of which have religious, non-secular curricula unaccountable to regulators.

Romney recently attacked President Obama: “He says we need more firemen, more policemen, more teachers. Did he not get the message of [the failed recall of the union-busting governor of] Wisconsin?”

“I would suggest [Romney is] living on a different planet if he thinks that’s a prescription for a better planet,” shot back Obama strategist David Axelrod.

Both parties are missing the mark, the Republicans more than the Democrats. Republicans want to gut public schools by slashing budgets that will lead to bigger class sizes, which will reduce the individual attention dedicated to teaching each student. Democrats rightly oppose educational austerity, but are running a lame defense rather than aggressively promoting positive ideas to improve the system. Both parties are too interested in weakening unions and grading teacher performance with endless tests, and not enough in raising salaries so teaching attracts the brightest college graduates. Not even the Democrats are calling for big spending increases on education.

Is the system really in crisis? Yes, said respondents to a 2011 Gallup-Phi Delta Kappa poll, which found that only 22 percent approved of the state of public education in the U.S. The number one problem? Not enough funding, say voters.

Millions of parents whose opinion of their local public system is so dim that they spend tens of thousands of dollars a year on private school tuition and—in competitive cities like New York City, force their kids to endure a grueling application process.

According to one of the world’s leading experts on comparing public school systems, Andreas Schleicher of the Organization for Economic Cooperation and Development, the U.S. is falling rapidly behind other countries. In Canada, he told a 2010 Congressional inquiry, an average 15-year-old ahead is a full year ahead his or her American counterpart. The U.S. high-school completion rate is ranked 25th out of the 30 OECD countries.

The elephant in the room, the idea neither party is willing to consider, is to replace localized control of education—funding, administration and curricula—with centralized federal control, as is common in Europe and around the world.

“America’s system of standards, curriculums and testing controlled by states and local districts with a heavy overlay of federal rules is a ‘quite unique’ mix of decentralization and central control,” The New York Times paraphrased Schleicher’s testimony. “More successful nations, he said, maintain central control over standards and curriculum, but give local schools more freedom from regulation, he said.”

Why run public schools out of Washington? The advantages are obvious. When schools in rich districts get the same resource allocation per student as those in poor ones, influential voters among the upper and middle classes tend to push for increased spending of education. Centralized control also eliminates embarrassing situations like when the Kansas School Board eliminated teaching evolution in its schools, effectively reducing standards.

A streamlined curriculum creates smarter students. It’s easier for Americans, who live in a highly mobile society, to transfer their children midyear from school to school, when a school in Peoria teaches the same math lesson the same week as one in Honolulu. Many students, especially among the working poor, suffer lower grades due to transiency.

Of course, true education reform would need to abolish the ability of wealthier parents to opt out of the public school system. That means banning private education and the “separate but equal” class segregation we see today, particularly in big cities, and integrating the 5.3 million kids (just under 10 percent of the total) in private primary and secondary schools into their local public systems. Decades after forced bussing, many students attend schools as racially separated as those of the Jim Crow era. The New York Times found that 650 out of New York’s 1700 public schools have student bodies composed at least 70 percent of one race—this in a city with extremely diverse demographics.

If we’re to live in a true democracy, all of our kids have to attend the same schools.

(Ted Rall’s new book is “The Book of Obama: How We Went From Hope and Change to the Age of Revolt.” His website is tedrall.com. This column originally appeared at MSNBC.com)

(C) 2012 TED RALL, ALL RIGHTS RESERVED.

SYNDICATED COLUMN: The Phony Budget Crisis

Forget Austerity. Tax the Rich.

Everywhere you look, from the federal government to the states to your hometown, budget crises abound. Services are being slashed. Politicians and pundits from both parties tell us that the good times are over, that we’ve got to start living within our means.

It’s a lie.

Two case studies have made news lately: California, where new/old governor Jerry Brown is trying to close a $25 billion shortfall with a combination of draconian cuts in public services and a series of regressive tax increases, and Wisconsin, where right-winger Scott Walker says getting rid of unions would eliminate the state’s $137 million deficit.

Never mind the economists, most of whom say an economic death spiral is exactly the worst possible time for government to cut spending. Pro-austerity propaganda has won the day with the American public. A new Rasmussen poll funds that 58 percent of likely voters would approve of a shutdown until Democrats and Republicans can agree on what spending to cut.

The budget “crisis” is a phony construction, the result of right-wing “starve the beast” ideology. There is plenty of money out there—but the pols don’t want it.

There is no need to lay off a single teacher, close a single library for an extra hour, or raise a single fee by one red cent.

Every government can not only balance its budget, but wind up with a surplus.

The solution is simple: tax the rich.

Over the last 50 years tax rates for the bottom 80 percent of wage earners have remained almost static. Meanwhile the rich have received tax cut after tax cut after tax cut. For example, the rate paid by the top 0.01 percent—people who currently get more than $6.5 million a year—fell by half (from 70 to 35 percent).

Times are tough. Someone has to pay. Why not start with those who can most afford it?

Europe has the world’s best food, its best healthcare system and its best vacation policy. It also has one of the fairest ways to generate revenue for government: a wealth tax. In Norway, for example, you pay one percent of your net worth in addition to income tax.

What if we imposed a Norwegian-style wealth tax on the top one percent of U.S. households? We’re not talking upper middle class here: the poorest among them is worth a mere $8.3 million. This top one percent owns 35 percent of all wealth in the United States.

“Such a wealth tax…would raise $191.1 billion each year (one percent of $19.1 trillion), a significant attack on the deficit,” Leon Friedman writes in The Nation. “If we extended the tax to the top 5 percent, we could raise $338.5 billion a year (one percent of 62 percent of $54.6 trillion).”

But that’s just the beginning. Wealthy individuals are nothing next to America’s money-sucking corporations.

Business shills whine that America’s corporate tax rate—35 percent—is one of the world’s highest. But that’s pure theory. Our real corporate rate—the rate companies actually pay after taking advantages of loopholes and deductions—is among the world’s lowest. According to The New York Times, Boeing paid a total tax rate of 4.5 percent over the last five years. (This includes federal, state, local and foreign taxes.) Yahoo paid seven percent. GE paid 14.3 percent. Southwest Airlines paid 6.3 percent. “GE is so good at avoiding taxes that some people consider its tax department to be the best in the world, even better than any law firm’s,” reports the Times‘ David Leonhardt. “One common strategy is maximizing the amount of profit that is officially earned in countries with low tax rates.”

America’s low effective corporate tax rates have left big business swimming in cash while the country goes bust. As of March 2010 non-financial corporations in the U.S. had $26.2 trillion in assets. Seven percent of that was in cash.

The national debt is $14.1 trillion.

Which is a lot. And, you see, entirely by choice.

(Ted Rall is the author of “The Anti-American Manifesto.” His website is tedrall.com.)

COPYRIGHT 2011 TED RALL