Originally published by The Kernel/The Daily Dot:

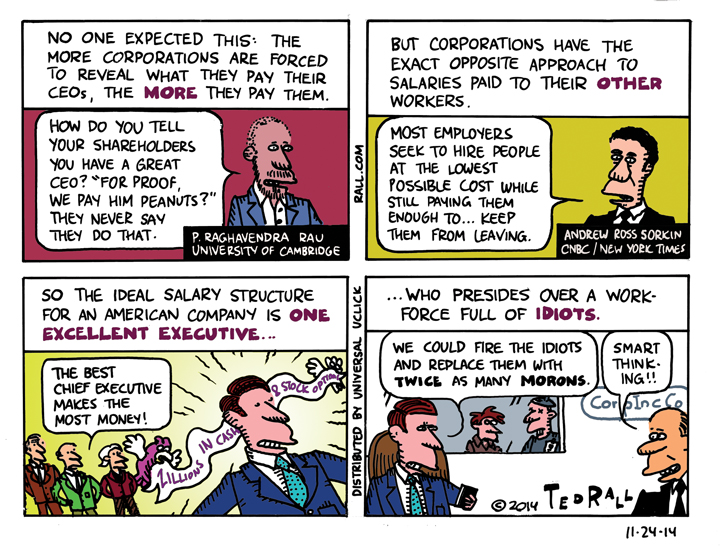

LOS ANGELES TIMES CARTOON: Roommates from Hell

Southern California has always had one of the priciest real estate markets in the United States, but in recent years the gap between what people can afford to pay for rent or mortgage and median housing prices has opened to a gaping chasm.

Tim Logan of the Times reports about new data that reflects just how bad things have gotten for most Southlanders:

Nearly half of all working-age adults in Los Angeles and Orange counties live in a home with another adult who is not their spouse — a higher percentage than any other big city in the country, according a new report by real estate website Zillow. In second place: the Inland Empire.

Economists at Zillow crunched U.S. census numbers and found that 47.9% of adults in metro L.A. lived in “doubled-up” households in 2012, a number that has grown rapidly — up from 41.2% in 2000 — as the recession and yo-yo-ing housing market have pushed more people to share apartments.

“You’ve got a lot of households that are blending together,” said Zillow economist Skylar Olsen. “They’re doing that to make housing more affordable.”

That’s especially true in Southern California, where relatively high costs and relatively low wages combine to create what is, by some measures, the least affordable housing market in the country, especially for renters.

One has to wonder: how is this sustainable? Although there’s been some improvement in the economy, unemployment, especially long-term, remains stubbornly high. Wages remain stagnant. You can’t squeeze blood out of a stone. Won’t people just move away to somewhere more affordable?

Maybe eventually. For the time being, the pull of family ties, whatever work they currently hasveand just plain inertia is keeping hundreds of thousands of people stuck in houses and apartments that they can’t really afford. Until things turn around, maybe, someday, who knows when, they are doubling up and tripling up with friends, lovers and random people they find on Craigslist. As someone who has from time to time been forced to participate in the so-called “sharing economy” to make ends meet, I have nothing but sympathy for this situation.

Having a roommate you don’t want, simply for economic reasons, violates your privacy and sense of personal calm at least as much as secret government surveillance programs that intercept your email. This goes double if, like me, you are an introvert.

For this week’s cartoon, however, I do appreciate the fact that this predicament makes for a fun sight gag. If I had the ability to add sound here, imagine all the characters either snoring or growling ominously like zombies.

SYNDICATED COLUMN: You Know Your Country Sucks When You Look Wistfully Back at Stalin

You can tell a lot about the state of a country by comparing the state of its public and private infrastructure.

Take a look, if you can sneak past the gated community guard shack and peek through the privets without getting tackled by a rented goon, at the homes of the wealthy. Note the manicured lawns of the one percenters, fertilized the months recommended by experts depending on climactic zone, painstakingly controlled for weeds, irrigation calibrated by volume, on timers. Check out the garden: lines of shrubs that run a hundred bucks each, red-dyed mulch hiding the dirty brown dirt and tamping down unwanted dandelions before they get a chance to sprout. The driveway is flat, smooth, free of cracks. Stucco walls, if you live out West, are similarly crack-free; if you’re east of the Mississippi, bricks are framed by perfect pointing. Every detail, from the brass numbers on the mailbox to the baseboards to the perfect absence of cobwebs in high ceiling corners, reflects thorough, routine, frequent maintenance and repairs by a retinue of professional service providers.

Tasteful. New. Kept up.

Bear in mind: all this perfectly-maintained stuff houses a single family. At most, we’re talking two parents, four kids and a nanny or two. Certainly fewer than 10 people.

Now look at our public infrastructure.

Drive on a public highway in any major city: New York, Chicago, Los Angeles. It’s a disaster. Potholes so big you worry about breaking an axle. (And you should. In New York State, for example, a recent study estimated that bad roads and bridges cost motorists $20.3 billion in repairs annually.) Cracked concrete and asphalt everywhere. Missing guardrails, stolen signs, and everywhere you turn, garbage. Graffiti and vandalism take a toll but mostly it’s all just old. Old, rusted, worn out, years of “deferred maintenance” — i.e., none at all. Yeah, people throw crap out their car windows — but municipal governments don’t clean it up for days, weeks months at a time.

Connecting two of NYC’s biggest boroughs, the Brooklyn-Queens Expressway is used daily by 160,000 vehicles. It is hideous. It is narrow. It is literally falling apart. Constantly. “With its multitude of trucks and dangerous on-ramps, the BQE is a den of congestion at virtually all hours of the day,” The New York Times reported in 2012. “But one factor has condemned this antiquated 16.8-mile stretch of highway to a place of longstanding infamy in the New York metropolitan area, if not all of urban America: construction that never seems to end. As Gerry Michalowski, a truck driver who has traveled the BQE since 1978, put it, ‘It was under construction then, and it’s still under construction now.'”

Think again about that house I described at the beginning of this column.

It’s used by half a dozen people a year.

The BQE is used by 58 million vehicles a year.

If you don’t think there’s something wrong with this, if you defend the “right” of the wealthy to aggregate more and more until the point when they own everything including our bodies and souls, consider this: rich people have to drive on those roads too. By definition, 580,000 of those BQE users are one percenters.

America isn’t broke, but most Americans are. The reason is simple: too few people have too much of our national wealth. The pauperizing of our common property — the deliberate starving of public funding for roads, bridges, parks, schools, public hospitals, even hospitals charged with caring for veterans of America’s oil wars — reflects the economic and political system’s ass-backward priorities. It’s immoral. Because any society that spends more resources to maintain and upgrade private homes than public works is crazy stupid.

And it hurts the economy.

The American Society of Civil Engineers estimates that the United States needs to spend $3.6 trillion over the next six years to replace and repair the nation’s decaying dams, upgrade its parks and outdated schools, rusting water mains, and our crumbling airports, train and bus terminals, roads and bridges — many of which have deteriorated to Third World standards. (Although, to be fair to the Third World, I’ve seen U.S.-funded roads in Afghanistan in better shape than some in L.A.) The ASCE gives the U.S. a D+ on infrastructure.

The World Economic Forum ranks the U.S. 25th in the world in infrastructure, behind Oman, Saudi Arabia and Barbados.

It doesn’t have to be this way.

Josef Stalin, of all people, showed how infrastructure could be prioritized over private property. The dictator approved every extravagance — and why not? Obama signs off on every luxury the military can dream up.

Determined that his new Moscow Metro be a “palace of the people” for the Soviet capital’s subway commuters, Stalin ordered that no expense be spared to create a system that was not only fast and efficient, but beautiful. “In stark contrast to the gray city above,” The Times wrote as late as 1988, “the bustling, graffiti-less Metro is a subterranean sanctuary adorned with crystal chandeliers, marble floors and skillfully crafted mosaics and frescoes fit for a czar’s palace.” With good reason: first Stalin had chandeliers ripped out of the czar’s old palaces and moved underground; for future stations he had even more stunning ones designed from scratch using radically innovative techniques.

The Moscow Metro remains a showcase of what socialism could do at its best: prioritize the people and thus improve their daily lives.

Then there’s us.

Earlier this week President “Obama appeared at the I-495 bridge over the Christina River in Wilmington, Del., a span that has been closed since June, when engineers discovered that four of its columns were leaning to one side. That has created a traffic nightmare for the 90,000 vehicles that travel the major East Coast highway every day.”

The President went to Delaware to “announce new initiatives to encourage private-sector investment in the nation’s infrastructure, including the creation of a ‘one-stop shop’ at the Department of Transportation to forge partnerships between state and local governments, and public and private developers and investors.” In other words: the usual too little, too late, and even that probably won’t happen.

You know you’re in trouble when you look up to Stalin.

(Ted Rall, syndicated writer and cartoonist, is the author of “After We Kill You, We Will Welcome You Back As Honored Guests: Unembedded in Afghanistan,” out Sept. 2. Subscribe to Ted Rall at Beacon.)

COPYRIGHT 2014 TED RALL, DISTRIBUTED BY CREATORS.COM

SYNDICATED COLUMN: Smart Young People Who Snub Politics Are Smart

Smart Young People Reject Public Service — Because They’re Smart.

America’s best and brightest don’t go into politics.

(By which we mean mainstream two-party corporate politics. Democrats, Republicans, Washington. Politics as activism, as the ongoing debate over how we should live our lives, remains of great interest to young people.)

Mediocrity among the members of the political class is often cited as a reason for government’s ineptitude, its inability/unwillingness to address the great problems we face today: climate change, soaring income inequality, the Third Worldification of America. If we had smarter, more charismatic politicians, the reasoning goes, we’d get smarter, more effective problem-solving.

Forget it. The word from the trenches of academia is that that’s not going to change. Millennials just aren’t interested.

A national survey of 4200 high school and college students conducted last year found that only 11% might consider running for political office. Most young people say they want nothing to do with a career in government.

We don’t know how that number compares to the past. As Fareed Zakaria points out, “Americans have always been suspicious of government. Talented young people don’t dream of becoming great bureaucrats.”

Still, like other mainstream media types, Zakaria thinks disinterest in public service has increased. “The New Deal and World War II might have changed that for a while, but over the past 30 years, anti-government attitudes have risen substantially,” he says.

Young people think politicians can’t/don’t make much of a positive impact in people’s lives. In a poll of 18- to 29-year-olds, Harvard’s Institute of Politics found a 5% increase, to a third, in the portion of young adults who believe that “political involvement rarely has any tangible results.” When asked about the statement “politics today are no longer able to meet the challenges our country is facing,” 47% agree and 16% disagree.

I was thinking about this a few weeks ago while researching a column about the possible presidential candidacy of Hillary Rodham Clinton in 2016. First lady, senator, secretary of state — Clinton is one of the most successful political figures of our time. Yet what has she actually accomplished? How has she changed the life of the average American? Where is the big feather in her foreign policy cap? She’s been busy, but she hasn’t done anything historical — and the same could be said of almost all her peers.

Future coulda-been bests and brightests are paying attention to Washingtonian disfunction. “How deep is the disengagement?” Ron Fournier asked in The Atlantic. “I spent two days at Harvard, and couldn’t find a single student whose career goal is Washington or elective office. One wouldn’t expect to hear this at the Kennedy School of Government.“

Which prompts two questions:

Why are the young eschewing politics?

Can we do anything to make a career in politics/government more appealing?

Zakaria offers a “why”: “The ever-increasing obstacles — disclosure forms, conflict-of-interest concerns, political vetting — dissuade and knock out good candidates.”

I disagree. Getting exposed for financial or other improprieties is a concern for some political prospects in their 50s or 60s. But the most that your average 21-year-old college senior has to worry about getting outted over is drug use, and if current trends continue, no one is going to care about that in a few years. After all, George W. Bush and President Obama both used cocaine.

Not long ago I was approached by an Important Democratic Party Official about running for Congress. After he saw a talk I gave to a group of high school students, he pronounced himself so impressed that wouldn’t stop calling me. The party needs you, he said. So does your country.

Heady words. And I’m at least as egotistical as the next bear. So I looked into it.

I wasn’t concerned about personal disclosures. I’d be running as far to the left as you can in today’s Democratic Party; my district is very liberal on social issues. Whatever came out wasn’t bound to hurt my prospects. Anyway, I have a theory about political strategy: your opponents can’t use your deeds against you. They can exploit your denial of those deeds. Candidates who reveal their own skeletons find the electorate much more forgiving than when they’re uncovered by their opponent’s “opposition research” team.

Money would have been a major issue. You need at least $1 million to fund a Congressional campaign. It’s easiest if you have it yourself, and if you have rich friends willing to bankroll you. I don’t.

This is a grim system we have. “Wealthy candidates who try to buy office with their own money tend to lose, but in order to set up a campaign, you have to know a lot of wealthy people and wealthy special interests — and that’s something that most of us are not privy to,” Craig Holman, government affairs lobbyist for Public Citizen, told CBS News.

I might have been able to sell out to local business interests in exchange for favor chits to be cashed in later. But then, why run in the first place? For me, the point of running for Congress is to have a chance to change things for the better.

Washington has plenty of you-scratch-my-back-I’ll-scratch-yours corruption as it is. (I’m talking to you, Former Treasury Secretary/Warburg Pincus President Timothy Geithner.) They don’t need more from me.

The money thing is pretty much insurmountable.

Even presupposing a dramatic upturn in my finances (Powerball win? Selling a kidney to a desperate Internet billionaire? Kickstarter?), there’s the question of what I could accomplish in Congress. This is assuming, of course, that I win. Half of candidates lose, with nothing to show for their million-plus bucks.

Like the kids at Harvard, I can’t think of a single Congressman or, for that matter, Senator, who has managed to achieve much for the working class, or the environment, or anything big, since, well — my entire life. And I’m 50. As a political junkie, I would have heard of something.

Senator Ted Kennedy was one of my political heroes. I worked for two of his presidential campaigns. But let’s be honest. What was his greatest political accomplishment? Probably the State Children’s Health Insurance Program. A nice piece of law to be sure, but a small-bore one — and hardly worth spending decades of your life sitting through endless boring meetings.

And that’s what you do in Congress. You sit on your ass waiting for a chance to talk to people who are waiting for you to shut up so they can talk.

To an empty chamber.

Perhaps I should amend this: politics makes sense for right-wingers.

Republicans have radically transformed American society in recent years: legalized torture, extraordinary rendition, Guantánamo concentration camp, preemptive warfare, the doctrine of the unitary executive, sweeping tax cuts for the ultrarich and yes, even Obamacare — that one was dreamed up by the right-wing Heritage Foundation.

Liberals and progressives, on the other hand…there’s not much for us in the world of mainstream politics.

If we want leftie — most young people are — bright young things to enter public service, public service is going to have to change first. Obviously, that doesn’t seem likely. So if you’re a smart, energetic young person who wants to change the world, there’s still a place to do that.

Not in Congress.

In the streets.

(Ted Rall’s website is rall.com. Go there to join the Ted Rall Subscription Service and receive all of Ted’s cartoons and columns by email.)

COPYRIGHT 2013 TED RALL

SYNDICATED COLUMN: Get Pissed Off and Break Things

Why Are Americans So Passive?

There’s a reason “Keep Calm and Carry On” is everywhere. When people lose everything — their economic aspirations, their freedom, their privacy — when there’s nothing they can do to restore what they’ve lost — all they have left is dignity.

Remember Saddam? Seconds before he was hanged, disheveled and disrespected, the deposed dictator held his head high, his eyes blazing with contempt as he spat sarcastic insults at his executioners. He “faced death like a lion,” said his supposed body double, Latif Yahia, and no one could argue. He left this life with the one thing he could control intact.

Dignity. That’s what “Keep Calm and Carry On” is all about. That’s what we think of when we think of the Battle of Britain. As German bombs rained down, the English went about their business. Like the iconic photo of the milkman tiptoeing over rubble. Like the bomb-damaged stores whose shopkeepers posted signs that read “We are still open — more open than usual.”

Man, that is so not us.

You’ve seen the T-shirts, with their clean Gill Sans-esque lettering and iconic crown. There are mugs, postcards and posters. Of course. It’s a reproduction of a propaganda poster from World War II, an (unsuccessful, because it wasn’t distributed) attempt by the British government to steel jittery citizens during the Blitz.

“Keep Calm and Carry On” merch dates to 2000 but really took off after 9/11; the popularity of the image, the stoicism of its call to stiffen upper lips everywhere, and numerous parodies (“Stay Alive and Kill Zombies”) has generated millions of dollars of profits, inevitably sparking lawsuits and inspiring a song by John Nolan.

Why is a meme originally prepared for a possible German invasion of the UK (which is why it wasn’t released) popular now? Zizi Papacharissi, communications professor at the University of Illinois at Chicago, points to the crappy economy. “We are undergoing a profound and fairly global economic crisis, so it is natural to revisit the saying: Keep calm and carry on. It reminds us of courage shown back then, and how courage shown helped people pluck through a crisis.”

It’s also a reaction to terrorism — or more accurately a reaction to the initial reaction to the 9/11 terrorist attacks: hysteria, jingoism, multiple wars of choice, all doomed. More than any other factor, Obama owed his 2008 victory to his (Maureen Dowd called him) Vulcan personality: cool, implacable, possibly non-sentient, the anti-Dubya.

What wouldn’t we give for a 2001 do-over? No invasions, no Patriot Act, no Gitmo, no “extraordinary renditions,” no New York Times op-ed pieces arguing in favor of “enhanced interrogation techniques.” Treat 9/11 like a crime, let the FBI go after the perps. Reach out to Muslims, reconsider our carte blanche to Israel, and most of all: go slow. Don’t freak out.

Perspective: 3,000 deaths is awful. 9/11 was shocking. We killed 2 million Vietnamese people, yet they’re going strong. With a minimum of whining.

And yet…

Sometimes you need some perspective to your perspective.

There are times when it’s appropriate to freak out. When, in fact, it’s downright weird and unhealthy and wrong not to flip your lid. For example, when you get diagnosed with a terrible disease. When someone you love dies.

There are also times when big-picture, impersonal stuff, including politics and the economy, ought to make you crazy with rage or grief or…something. Not nothing. Not just keeping calm and carrying on.

Keeping calm and carrying on was an appropriate response to the Blitz. Short of moving away from the targeted area, there’s nothing you can do about bombs. Living or dying is a matter of happenstance. Keeping calm might help you make smart decisions. Panic is usually more dangerous than self-control.

The same is true of terrorism. Terrorists will kill you, or not — probably not. You can’t fix your fate.

But that is decidedly not true about the economy. Not when what is wrong with the economy is not something no one can control — a giant meteor, bad weather, panic in the markets — but something that most assuredly can and indeed should be, like the systemic transfer of wealth from the poor and middle-class to the rich that has characterized the class divide in Western nations since the 1970s. The appropriate, intelligent and self-preserving response to mass theft is rage, demands for action, and decisive punishment of political and economic leaders who refuse to change things.

As one revelation about the National Security Agency’s spying follows another, the “Keep Calm and Carry On” meme seems less like an appeal to dignity and calm reserve than the much older, classic response of the power elite to their oppressed subjects: Shut the Fuck Up.

(Ted Rall’s website is tedrall.com. His book “After We Kill You, We Will Welcome You Back As Honored Guests: Unembedded in Afghanistan” will be released in March 2014 by Farrar, Straus & Giroux.)

COPYRIGHT 2013 TED RALL

SYNDICATED COLUMN: Want More Wars? Raise Taxes on the Rich

Tax Fairness Won’t Reduce Inequality

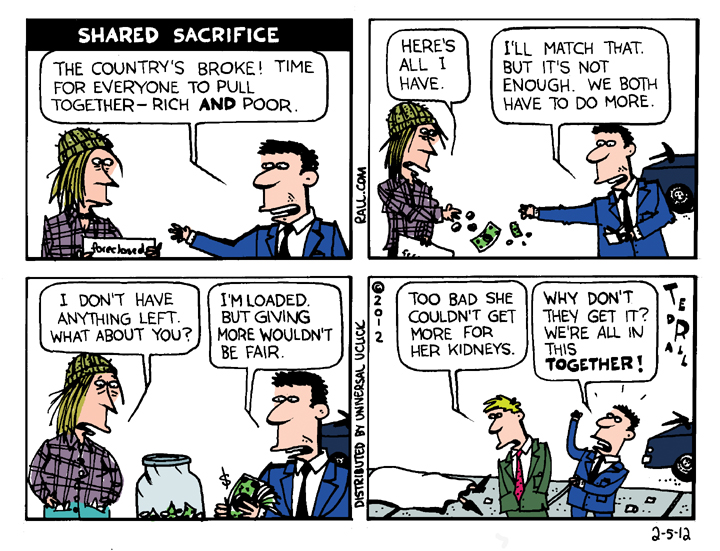

Reacting to and attempting to co-opt the Occupy Wall Street movement, President Obama used his 2012 State of the Union address to discuss what he now calls “the defining issue of our time”—the growing gap between rich and poor.

“We can either settle for a country where a shrinking number of people do really well, while a growing number of Americans barely get by,” Obama said. “Or we can restore an economy where everyone gets a fair shot, everyone does their fair share, and everyone plays by the same set of rules.”

No doubt, the long-term trend toward income inequality is a major flaw of the capitalist system. From 1980 to 2005 more than 80 percent in the gain in Americans’ incomes went to the top one percent. This staggering disparity between the haves and have-nots has created a permanent underclass of underemployed, undereducated and alienated people who often turn to crime for survival and social status. Aggregation of wealth into fewer hands has shrunk the size of the U.S. market for consumer goods, prolonging and deepening the depression.

How can we make the system fairer?

Liberals are calling for a more progressive income tax: i.e., raise taxes on the rich. Obama says he’d like to slap a minimum federal income tax of 30 percent on individuals earning more than $1 million a year.

Soaking the rich would obviously be fair. GOP frontrunner/corporate layoff sleazebag Mitt Romney earned $59,500 a day in 2010—and paid half the effective tax rate (13.9 percent) of that paid by a family of four earning $59,500 a year.

Fair, sure. But would it work? Would increasing taxes on the wealthy do much to close the gap between rich and poor—to level the economic playing field?

Probably not.

From FDR through Jimmy Carter it was an article of faith among liberals that higher taxes on the rich would result in lower taxes on the poor and working class. This was because the Republican Party consistently pushed for a balanced budget. Tax income was tied to expenditures, which were more or less fixed—and thus a zero-sum game.

That period from 1933 to 1980 was also the era of the New Deal, Fair Deal and Great Society social and anti-poverty programs, such as Social Security, the G.I. Bill, college grants and welfare. These government handouts helped mitigate hard times, gave life-changing educational opportunities that allowed class mobility, closing the gap between despair and hope for tens of millions of Americans. As the list of social programs grew, so did the tax rate—mostly on the rich. The practical effect was to redistribute income from top to bottom.

Democrats think it still works that way. It doesn’t.

The political landscape has shifted dramatically under Reagan, Clinton and the two Bushes. Budget cuts slashed spending on student financial aid, food stamps, Medicaid, school lunch programs, veterans hospitals, aid to single mothers. The social safety net is shredded. Most federal tax dollars flow directly into the Pentagon and defense contractors such as Halliburton.

As the economy continues to tank, there’s only one category to cut: social programs. “Eugene Steuerle worked on tax and budget issues in the Reagan Treasury Department and is now with the Urban Institute,” NPR reported a year ago. “He says one reason no one talks about preserving the social safety net today is that lawmakers have given themselves little choice but to cut it. They’ve taken taxes and entitlements, such as Social Security and Medicare, off the budget-cutting table, so there’s not much left.”

Meanwhile, effective tax rates on the wealthy have been greatly reduced. Which isn’t fair—but not in the way you might think.

Taxes on middle-class families are at their lowest level in 50 years, according to the Center on Budget and Policy Priorities, a liberal thinktank.

What’s going on?

On the revenue side of the budget equation, the poor and middle-class have received tiny tax cuts. The rich and super rich have gotten huge tax cuts. Everyone is paying less.

On the expense side, social programs have been pretty much destroyed. If you grow up poor there’s no way to attend college without going into debt. If you lose your job you’ll get 99 weeks of tiny, taxable (thanks to Reagan) unemployment checks before burning through your savings and winding up on the street.

Military spending, on the other hand, has soared, accounting for 54 percent of federal spending.

In short, we’re running up massive deficits in order to finance wars in Afghanistan, Iraq, and so on, and so rich job-killers can pay the lowest tax rates in the developed world.

I’m all for higher taxes on the rich. I’m for abolishing the right to be wealthy.

But liberals who think progressive taxation will mitigate or reverse income inequality are trapped in the 1960s, fighting the last (budget) war in a reality that no longer exists. The U.S. government’s top priority is invading Muslim countries and bombing their citizens. Without big social programs, invading Muslim countries and bombing their citizens is exactly where every extra taxdollar collected from the likes of Mitt Romney would go.

The only way progressive taxation can address income inequality is if higher taxes on the rich are coupled with an array of new anti-poverty and other social programs designed to put money and new job skills directly into the pockets of the 99 percent of Americans who have seen no improvement in their lives since 1980.

You have to rebuild the safety net. Otherwise higher taxes will swirl down the Pentagon’s $800 toilets.

If you’re serious about inequality, income redistribution through the tax system is only a start. Whether through stronger unions or worker advocacy through federal agencies, government must require higher minimum wages. It should set a maximum wage, too. A nation that allows its richest citizen to earn ten times more than its poorest would still be horribly unfair—yet it would be a big improvement over today. Shipping jobs overseas must be banned. Most free trade agreements should be torn up. Companies must no longer be allowed to layoff employees before eliminating salaries and benefits for their top-paid managers—CEOs, etc.

And a layoff should mean just that—a layoff. First fired should be first rehired—at equal or greater pay—if and when business improves.

Once a battery of spending programs targeted to the 99 percent is in place—permanent unemployment benefits, subsidized public housing, full college grants, etc.—the tax code ought to be radically revamped. For example, nothing gives the lie to the myth of America as a land of equal opportunity than inheritance. Aristocratic societies pass wealth and status from generation to generation. In a democracy, no one has the right to be born into wealth.

Because everyone deserves an equal chance, the national inheritance tax should be 100 percent. While we’re at it, why should people who inherited wealth but have low incomes get off scot-free? Slap the bastards with a European-style tax on wealth as well as the appearance of wealth.

Now you’re probably laughing. Even Obama’s lame call for taxing the rich—so the U.S. can buy more drone planes—stands no chance of passing the Republican Congress. They’re empty words meant for election-year consumption. Taking income inequality seriously? That’s so off the table it isn’t even funny.

Which is why we shouldn’t be looking to corporate machine politicians like Obama for answers.

(Ted Rall is the author of “The Anti-American Manifesto.” His website is tedrall.com.)

COPYRIGHT 2012 TED RALL