Southern California has always had one of the priciest real estate markets in the United States, but in recent years the gap between what people can afford to pay for rent or mortgage and median housing prices has opened to a gaping chasm.

Tim Logan of the Times reports about new data that reflects just how bad things have gotten for most Southlanders:

Nearly half of all working-age adults in Los Angeles and Orange counties live in a home with another adult who is not their spouse — a higher percentage than any other big city in the country, according a new report by real estate website Zillow. In second place: the Inland Empire.

Economists at Zillow crunched U.S. census numbers and found that 47.9% of adults in metro L.A. lived in “doubled-up” households in 2012, a number that has grown rapidly — up from 41.2% in 2000 — as the recession and yo-yo-ing housing market have pushed more people to share apartments.

“You’ve got a lot of households that are blending together,” said Zillow economist Skylar Olsen. “They’re doing that to make housing more affordable.”

That’s especially true in Southern California, where relatively high costs and relatively low wages combine to create what is, by some measures, the least affordable housing market in the country, especially for renters.

One has to wonder: how is this sustainable? Although there’s been some improvement in the economy, unemployment, especially long-term, remains stubbornly high. Wages remain stagnant. You can’t squeeze blood out of a stone. Won’t people just move away to somewhere more affordable?

Maybe eventually. For the time being, the pull of family ties, whatever work they currently hasveand just plain inertia is keeping hundreds of thousands of people stuck in houses and apartments that they can’t really afford. Until things turn around, maybe, someday, who knows when, they are doubling up and tripling up with friends, lovers and random people they find on Craigslist. As someone who has from time to time been forced to participate in the so-called “sharing economy” to make ends meet, I have nothing but sympathy for this situation.

Having a roommate you don’t want, simply for economic reasons, violates your privacy and sense of personal calm at least as much as secret government surveillance programs that intercept your email. This goes double if, like me, you are an introvert.

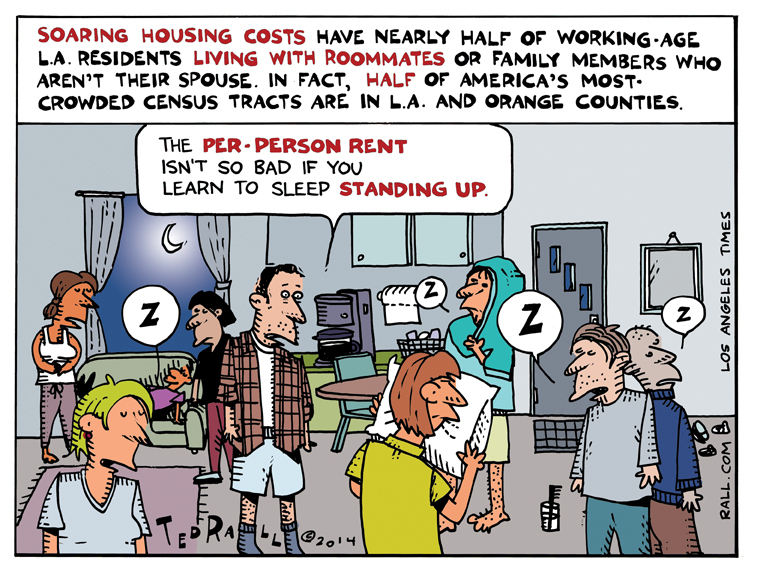

For this week’s cartoon, however, I do appreciate the fact that this predicament makes for a fun sight gag. If I had the ability to add sound here, imagine all the characters either snoring or growling ominously like zombies.

6 Comments.

Solution: Work different shifts so that one person (or couple) works 8:00am to 4:00pm; another works 4:00pm to 12:00 midnight; a third,12:00 midnight to 8:00am — thus, of six residents, there are at most two people in the apartment/house at the same time! Fun, huh? 😀

Just like life on a submarine.

Notice the language?

“You’ve got a lot of households that are blending together,” said Zillow economist Skylar Olsen. “They’re doing that to make housing more affordable.”

“Blending” “affordable” she makes it sound almost delightful, doesn’t she? Gotta be positive, gotta stay upbeat. No one says negative things anymore because that gets you a talking to.

Imagine if someone said: “A lot of people are stuck having to share their apartments. It’s awful if you aren’t into living with others. Rents have kept going up but salaries haven’t. People are spending almost all their income on housing. People are even spending money they should be putting toward retirement or buying a home into just keeping a half or a third of an apartment.”

Good eye.

I read some Federal Reserve Bank brainstorm paper on the housing market once that was pretty interesting. Realizing what we know about earning among the people who should be buying, how does the buying continue?

The answer is baby boomers; the last generation who had the ability earn enough to buy houses. 9/10 times when you ask your friends how they afforded to buy in LA, the answer is that their boomer parents helped. When looking for well-priced houses, these artificially flush youngsters show up to open houses to find themselves lost in a sea of grey haired heads dreaming of endless rental-funded vacations. The boomers take the best homes in the best neighborhoods, leaving young families the scraps.

Parental Keynesiansim doesn’t come to the rescue of everyone. Most parents have better plans for their money than helping their deadbeat kids slouch into the middle class. Still others lost their ass in one of the last two bubbles.

Either way, the boomer life raft can’t last forever. As the report said, sometime in the next 20 years, they’re all gonna keel over, and so then so will the housing market. And if you think that falling house prices will finally make them affordable, realize that hedge funds are already poised with automated buying systems to snatch these properties up thus making all people renters for the rest of time.

Millennials will have an app to help them rent a new place every day, and will pity people who actually had to own homes once upon a time, just like they will pity people who had jobs. And while you think I may have veered into jest, consider that the supply of superfluous working-age humans is at an all time high and will in all likelihood increase at an accelerated pace.

Such is life in the greatest Representative Plutocracy on earth.

The next step down people living in shipping containers and old RV’s behind their jobs.

Then container roommates and shanty towns, once the minimum wage is gone

Once are wages are low enough the flood of H1 visa will slow but it won’t end because fewer and fewer Americans will be able to afford college. Free trade is not free but the people it hurts are ignored or ridiculed.

From a vet the slept at rest stop for a year to go to class