SYNDICATED COLUMN: The Banksters Strike Again

Chase Bank and Obama’s “Make Home Affordable” Scam

SOMEWHERE IN AFGHANISTAN—It isn’t surprising, what with the world falling apart and all, that the world scarcely noticed that I lost my job as an editor in April 2009. Why should it? I was one of millions of Americans who lost their job that month.

But it mattered to me.

It wasn’t all bad. No more early morning commutes. And no more Lisa. Lisa was my boss. My mean boss. My mean and crazy boss. In the long run, I stand to save thousands of dollars on therapy.

In the meantime, however, one visit with HR cost more than half my annual income. (My ex-employer, the Scripps media conglomerate, offered just four weeks severance pay—if I agreed not to work as a journalist for the rest of my life. Needless to say, I refused.) Just like that, I was broke.

The bills, of course, kept coming. Including my home mortgage. Unlike many people, I was conservative. When I bought, in 2004, I put down more than 50 percent of the purchase price. Refusing an adjustable-rate mortgage, I took out a vanilla 30-year fixed-rate mortgage from Chase Home Finance LLC.

My monthly nut, a combined payment of $2200 for the loan plus local property tax, didn’t seem so bad in ’04. But property taxes went up. Now I’m shelling out over $2700—on half the income. I’m still making my payments on time, but only by borrowing from a home equity line of credit.

I’m not in foreclosure. But it’s easy to see how, if this keeps up, I will be. The credit line isn’t limitless. The more I borrow, the higher my payments on that. My cash flow is a disaster.

So I asked Chase for help.

Responding to political pressure to cut distressed homeowners a break, the big banks who destroyed global capitalism in 2008—including Chase—agreed to the Obama Administration’s request to create a program to assist distressed homeowners. The result was “Make Home Affordable.” (Nice name.)

From Chase’s website: “No matter what your individual situation is, you may have options. Whether your want to stay in your home or sell it, we may be able to help.”

Key word: “May.” Translation: “May” = “Won’t.”

As I can now attest from personal experience, “Make Home Affordable” is a scam. MHA is cited by bank ads as evidence that they get it, that their “greed is good” days are over, that we don’t need to nationalize the sons of bitches and ship them off to reeducation labor camps.

In reality, it exists solely to give banks like Chase political cover. They deliberately give homeowners the runaround, dragging out the process so they can foreclose. As of the end of 2009, only four percent of applicants received any help. By June 2010 the vast majority of that “lucky” four percent had lost their homes anyway—because the amount of relief they got was too small.

I was a banker in the ’80s. I often travel to the former USSR, where sloppy paperwork gives the police the right to rob you blind. So I know how to navigate bureaucracy. I’m careful. Thorough. When, among other things—many, many other things—Chase asked me for copies of my bank statements, I knew to send the blank pages too.

I explained my situation to an officer at my local Chase branch. “As someone who recently lost a job and thus a substantial portion of your income,” she said, “you clearly qualify for Make Home Affordable. But you have to keep making your payments on time. Don’t fall behind or you’ll be disqualified.”

Chase Home Finance’s lists qualifications for MHA; I easily fulfilled them. I was excited. To make sure I didn’t become the ten millionth American to lose his house since 2008, Chase would work to reduce my monthly payment. First, they would lengthen the repayment period. If that wasn’t enough help, they’d cut my interest rate. They might even reduce the principal.

I carefully filled out the forms. I copied all the financial records they demanded. I mailed them off to a brand-new loan center in Colorado that, Chase promised, had been set up to expedite the processing of HFA applications. The package was more than 100 pages thick.

That was in January.

About a month later, Chase sent me a letter asking for the same exact documents I had already sent them. I was perplexed. The application was in the same package as the supporting papers. How could they know I wanted to apply for HFA, yet not have that stuff? They also asked for another bank statement—for the month that had passed between their receipt of my application and the date of their letter.

They did it over and over. They’d confirm receipt of an item, then demand it again. They asked for one particular month’s bank record three times—after telling me that they’d gotten it twice.

Want a good laugh? Try navigating Chase’s phone tree. It’s at (866) 550-5705.

I called in March. Happy day! After submitting 318 pages of records, most of them redundant, my application was finally complete. An Actual Living Human would be in touch shortly to tell me whether I’d been approved and, if so, how much of a break I’d get. I also got a letter. Application complete! Application complete! What were all those pissed-off Chase Home Finance customers on the Internet whining about? All you had to do was be thorough. And persistent.

Alas, April brought more melancholia. Another letter: my application still wasn’t complete again. Why hadn’t I sent in the same documents I’d already sent in four times and had confirmed three times? And what about the bank statement that arrived between March and April?

I sent in the stuff along with a pissy cover note threatening to contact my Congressman if they didn’t shape up.

So what happened? Democracy works! One week later, on May 18th, I received a rejection letter. The Reason: I had not suffered any loss of income.

“If it is determined that you are not eligible for a Home Affordable Modification,” their website assures, “we’ll evaluate you for other workout options to keep you in your home or advise you of other foreclosure alternatives.” Never heard from them.

As a former banker, I wondered: How could they say that I hadn’t taken a hit? Then it came to me. Chase only asks for records that show income: W-2s, pay stubs, income statements, bank statements. They don’t look at your debt: credit cards, home equity lines of credit, other mortgages. Like most people whose income drops, my debts went up as I struggled to pay my bills. Indeed, I offered to send that stuff. They refused it!

At this time I would like to express my unvarnished admiration for the ruthless cynicism that led the executives at Chase Home Finance to conceive of a fake lending branch entirely dedicated to increasing foreclosures, improving their public image, and driving distressed homeowners crazy.

“The foreclosure-prevention program has had minimal impact,” says John Taylor, chief executive of the National Community Reinvestment Coalition. “It’s sad that they didn’t put the same amount of resources into helping families avoid foreclosure as they did helping banks.”

I would also like to volunteer for the firing squad if and when these scumbags get what they deserve.

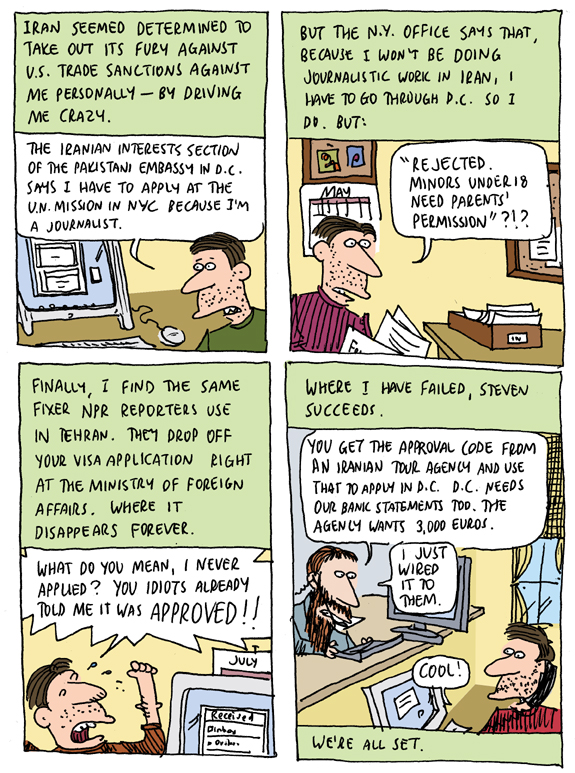

(Ted Rall is in Afghanistan to cover the war and research a book. He is the author of “The Anti-American Manifesto,” which will be published in September by Seven Stories Press. His website is tedrall.com.)

COPYRIGHT 2010 TED RALL

Greetings from Mazar-i-Sharif

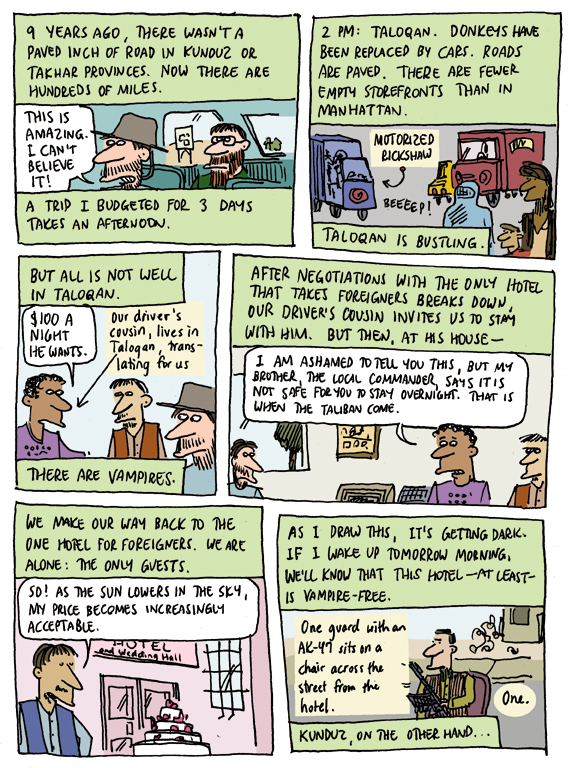

Matt Bors, Steven Cloud and I have just arrived in Mazar-i-Sharif, the fourth largest city in Afghanistan, the gateway to Uzbekistan, and about the hottest and dustiest place on earth. Don’t believe the Internet: It says it’s 81 here. More like 111.

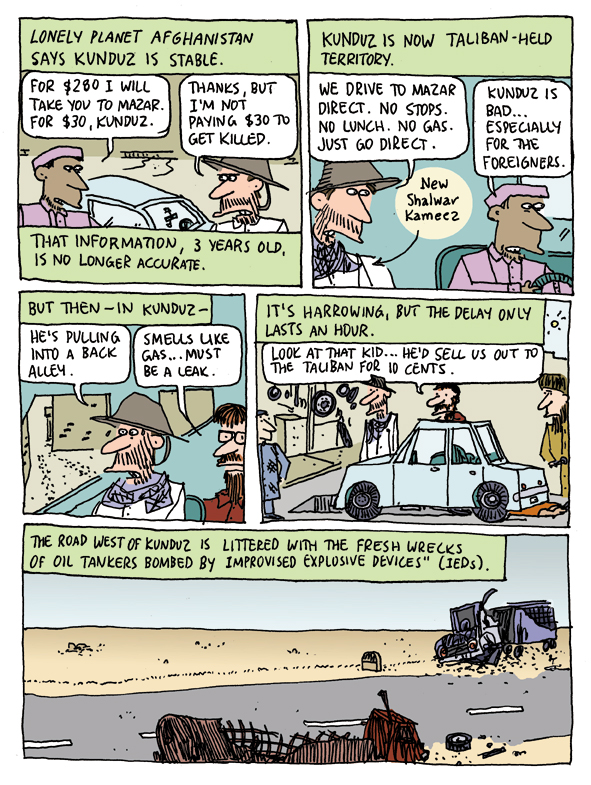

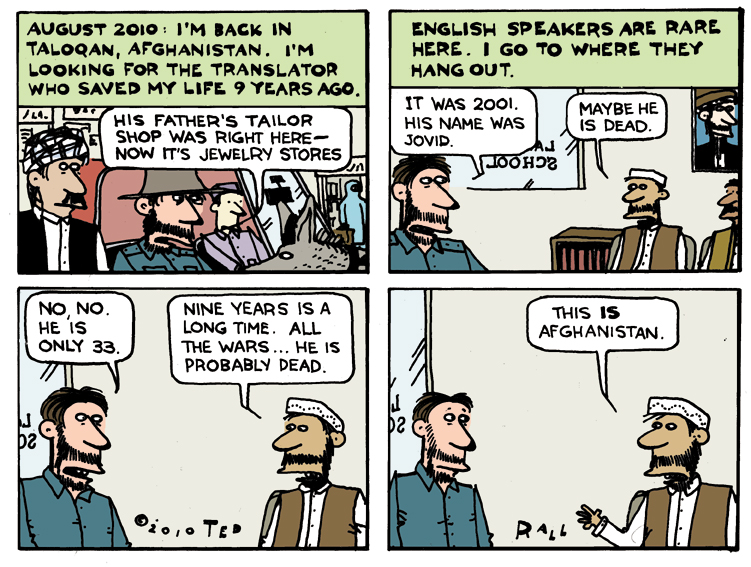

It was a brutal drive from Taloqan, where we spent two nights looking for my 2001 fixer Jovid. (Follow my daily cartoon blog to find out whether or not we were successful. It was much, much worse in 2001, before road-paving, though. Yes, most major roads in Kunduz and Takhar provinces are now paved. This might have made a favorable impression on Afghans prior to 2003, but now it appears to be too late. Everyone knows the Taliban will soon be back in charge.

Women are still in burqas, same as it ever was. Business is booming, but poverty remains widespread. And American troops are still acting like assholes: buzzing through town at high speeds, terrorizing the Afghans they’re supposedly there to help.

We plan to enjoy a few days of R&R before heading west toward Maimana. Mazar has some major architectural treasures we plan to start seeing tomorrow morning.