On this episode of The Final Countdown, hosts Angie Wong and Ted Rall discuss a wide array of topics including the debate over free speech amid the widespread campus protests against the war in Gaza.

On this episode of The Final Countdown, hosts Angie Wong and Ted Rall discuss a wide array of topics including the debate over free speech amid the widespread campus protests against the war in Gaza.

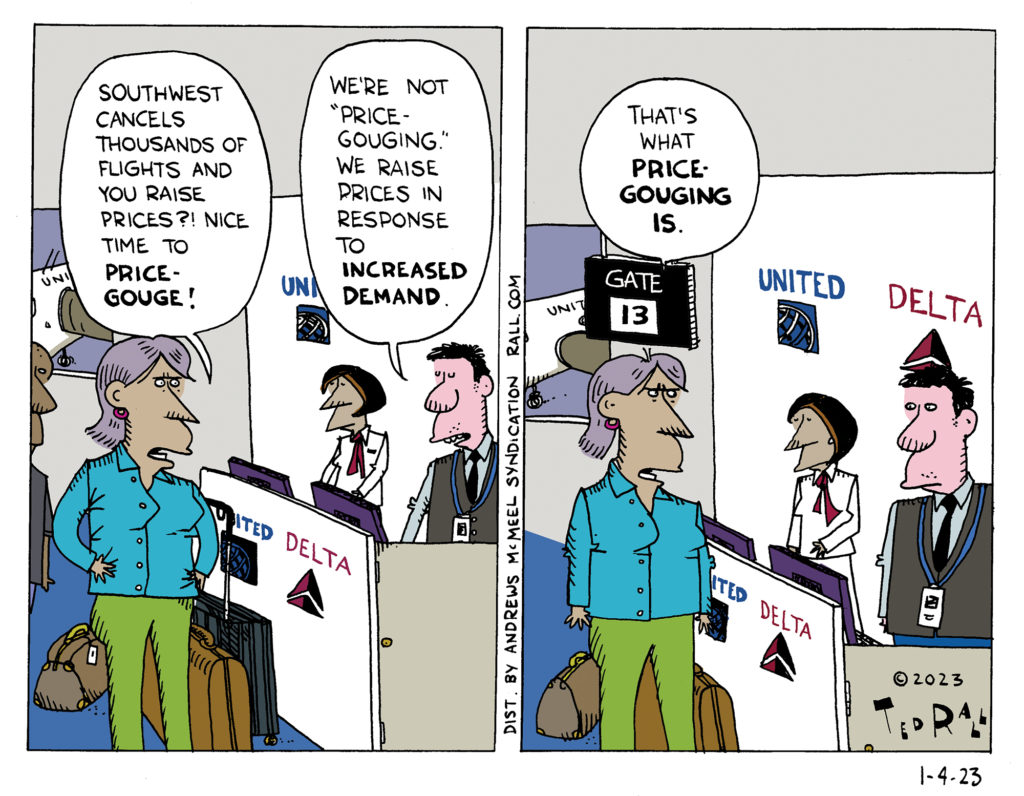

DMZ America #81: Southwest Airlines, Mark Santos and Section 42

What’s to blame for mass cancellations and dysfunction at the formerly beloved Southwest Airlines? Long Island has a new Congressman-elect, Mark Santos. But nothing he told us about himself seems to be true. Ironically, his lies make him look worse than the reality of his hardscrabble upbringing. Supreme Court is allowing Section 42 to remain in place, trapping tens of thousands of asylum seekers at the Mexico border. Surely there’s a better way. Editorial cartoonists Scott Stantis and Ted Rall break it down for you.

SYNDICATED COLUMN: The Phony Budget Crisis

Forget Austerity. Tax the Rich.

Everywhere you look, from the federal government to the states to your hometown, budget crises abound. Services are being slashed. Politicians and pundits from both parties tell us that the good times are over, that we’ve got to start living within our means.

It’s a lie.

Two case studies have made news lately: California, where new/old governor Jerry Brown is trying to close a $25 billion shortfall with a combination of draconian cuts in public services and a series of regressive tax increases, and Wisconsin, where right-winger Scott Walker says getting rid of unions would eliminate the state’s $137 million deficit.

Never mind the economists, most of whom say an economic death spiral is exactly the worst possible time for government to cut spending. Pro-austerity propaganda has won the day with the American public. A new Rasmussen poll funds that 58 percent of likely voters would approve of a shutdown until Democrats and Republicans can agree on what spending to cut.

The budget “crisis” is a phony construction, the result of right-wing “starve the beast” ideology. There is plenty of money out there—but the pols don’t want it.

There is no need to lay off a single teacher, close a single library for an extra hour, or raise a single fee by one red cent.

Every government can not only balance its budget, but wind up with a surplus.

The solution is simple: tax the rich.

Over the last 50 years tax rates for the bottom 80 percent of wage earners have remained almost static. Meanwhile the rich have received tax cut after tax cut after tax cut. For example, the rate paid by the top 0.01 percent—people who currently get more than $6.5 million a year—fell by half (from 70 to 35 percent).

Times are tough. Someone has to pay. Why not start with those who can most afford it?

Europe has the world’s best food, its best healthcare system and its best vacation policy. It also has one of the fairest ways to generate revenue for government: a wealth tax. In Norway, for example, you pay one percent of your net worth in addition to income tax.

What if we imposed a Norwegian-style wealth tax on the top one percent of U.S. households? We’re not talking upper middle class here: the poorest among them is worth a mere $8.3 million. This top one percent owns 35 percent of all wealth in the United States.

“Such a wealth tax…would raise $191.1 billion each year (one percent of $19.1 trillion), a significant attack on the deficit,” Leon Friedman writes in The Nation. “If we extended the tax to the top 5 percent, we could raise $338.5 billion a year (one percent of 62 percent of $54.6 trillion).”

But that’s just the beginning. Wealthy individuals are nothing next to America’s money-sucking corporations.

Business shills whine that America’s corporate tax rate—35 percent—is one of the world’s highest. But that’s pure theory. Our real corporate rate—the rate companies actually pay after taking advantages of loopholes and deductions—is among the world’s lowest. According to The New York Times, Boeing paid a total tax rate of 4.5 percent over the last five years. (This includes federal, state, local and foreign taxes.) Yahoo paid seven percent. GE paid 14.3 percent. Southwest Airlines paid 6.3 percent. “GE is so good at avoiding taxes that some people consider its tax department to be the best in the world, even better than any law firm’s,” reports the Times‘ David Leonhardt. “One common strategy is maximizing the amount of profit that is officially earned in countries with low tax rates.”

America’s low effective corporate tax rates have left big business swimming in cash while the country goes bust. As of March 2010 non-financial corporations in the U.S. had $26.2 trillion in assets. Seven percent of that was in cash.

The national debt is $14.1 trillion.

Which is a lot. And, you see, entirely by choice.

(Ted Rall is the author of “The Anti-American Manifesto.” His website is tedrall.com.)

COPYRIGHT 2011 TED RALL