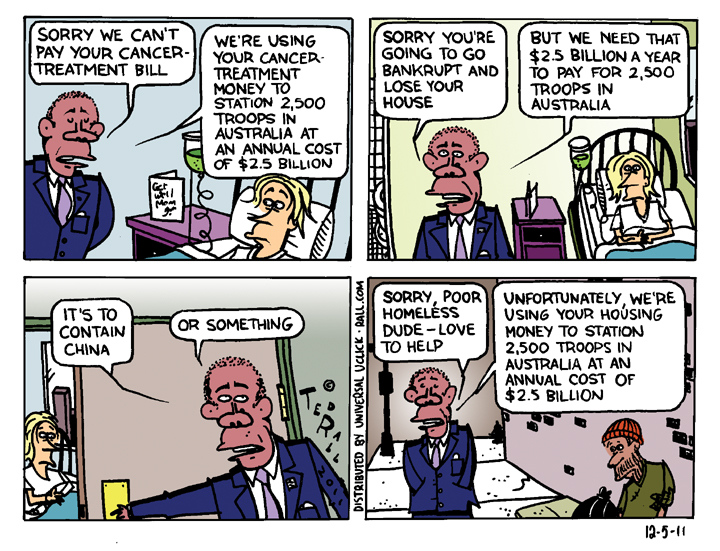

Obama announced that the U.S. will station 2,500 U.S. troops in northern Australia.

SYNDICATED COLUMN: 7-7-7

Jobless? Face It: Obama’s Not That Into You

Forget Herman Cain’s 9-9-9. The battle cry for every American ought to be 7-7-7.

7-7-7: for the $7.7 trillion the Bush and Obama Administrations secretly funneled to the banksters.

Remember the $700 billion bailout that prompted rage from right to left? Which inspired millions to join the Tea Party and the Occupy movements? Turns out that that was a mere drop in the bucket, less than a tenth of what the Federal Reserve Bank doled out to the big banks.

Bloomberg Markets Magazine reports a shocking story that emerged from tens of thousands of documents released under the Freedom of Information Act: by March 2009, the Fed shelled out $7.77 trillion “to rescuing the financial system, more than half the value of everything produced in the U.S. that year.”

The U.S. national debt is currently a record $14 trillion.

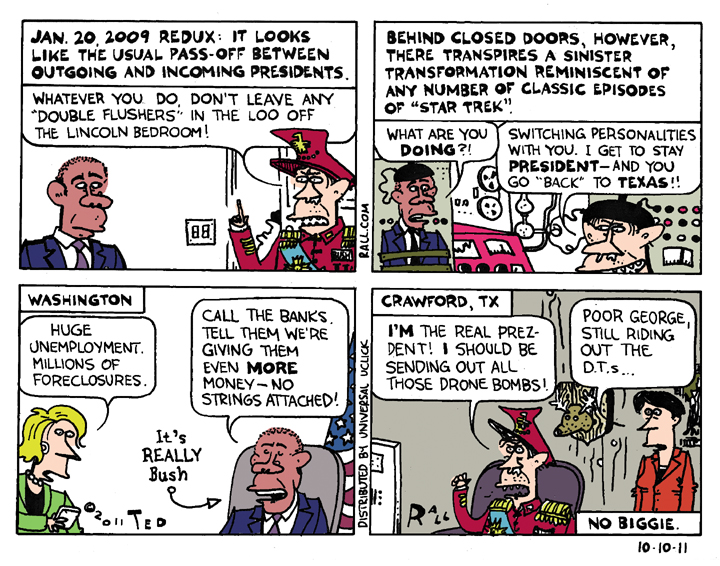

We knew that the Fed and the White House were pawns of Wall Street. What’s new is the scale of the conspiracy.

Even the most jaded financial reporters were stunned at the extent of collusion: “The Fed didn’t tell anyone which banks were in trouble so deep they required a combined $1.2 trillion on Dec. 5, 2008, their single neediest day. Bankers didn’t mention that they took tens of billions of dollars in emergency loans at the same time they were assuring investors their firms were healthy. And no one calculated until now that banks reaped an estimated $13 billion of income by taking advantage of the Fed’s below-market rates.”

Citigroup earned an extra $1.8 billion by reinvesting the Fed’s below-market loans. Bank of America made $1.5 billion.

Bear in mind, that’s only through March 2009.

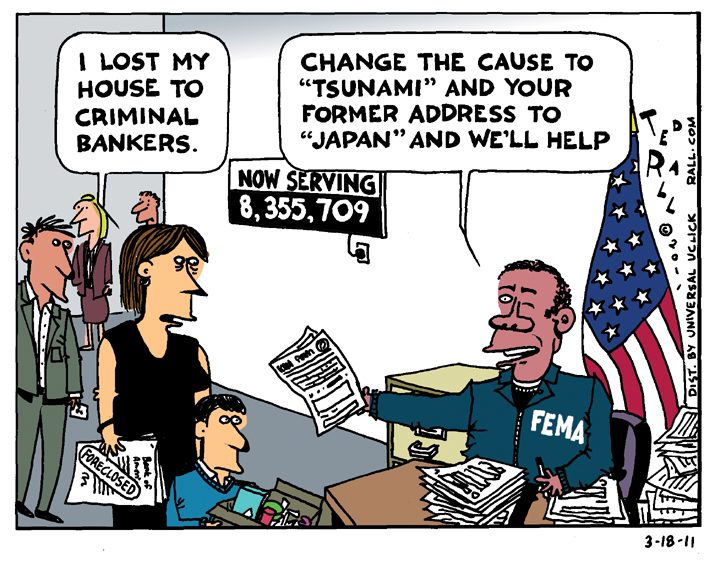

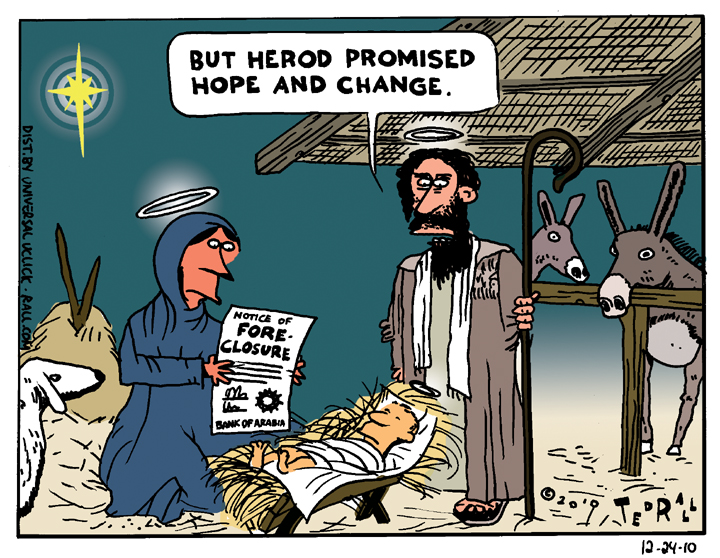

“Many Americans are struggling to understand why banks deserve such preferential treatment while millions of homeowners are being denied assistance and are at increasing risk of foreclosure,” wrote Representative Elijah Cummings, a ranking member of the House Committee on Oversight and Government Reform who is demanding an investigation.

Indeed we are.

This stinks. It’s terrible economics. And it’s unbelievably cruel.

First the economics. The bank bailouts were supposed to loosen credit in order to encourage lending, investment, job creation and ultimately consumer spending. It didn’t work. Banks and corporations alike are hoarding cash. President Obama, who promised 4 million net new jobs by earlier this year, has been reduced to claiming that unemployment would have been even higher without the bailouts.

Ask any business executive why nobody is hiring and they’ll blame the lack of consumer demand. If the ultimate goal is to put more money into people’s pockets, why not just, you know, put more money into people’s pockets?

Bank executives used federal taxdollars to pay themselves tens of billions in bonuses and renovate their corporate headquarters. We the people got 0-0-0. What if we’d gotten 7-7-7 instead?

Every man, woman in child in the United States would have received $24,000.

A family of four would have gotten $96,000.

And that’s without an income test.

New data from the U.S. Census Bureau shows that 100 million American citizens—one of out of three—subsists below or just above the official poverty line. Demographers, statisticians and economists were stunned. “These numbers are higher than we anticipated,” Trudi J. Renwick, the bureau’s chief poverty statistician, told The New York Times. “There are more people struggling than the official numbers show.”

For four decades progressive economists have warned that the middle-class was being eroded, that the United States would become a Third World country if income inequality continued to expand. They can stop. We’re there.

These poor and “near poor” Americans comprise the vast majority of the uninsured, un- and underemployed, and foreclosure victims. If Bush-Obama’s 7-7-7 Plan had gone to each one of these 100 million misérables instead of Citigroup and Bank of America, the IRS would have mailed out 100 million checks for $77,700 each.

This would have paid off a lot of credit cards. Kept millions in their homes, protecting neighborhood property values. Allowed millions to see a doctor. Paid for food.

A lot of the money would have been “wasted” on new cars, Xboxes—maybe even a renovation or two. All of which would have created a buttload of consumer demand.

If you’re a “99er”—one of millions who have run out of unemployment benefits—Obama’s plan for you is 0-0-0.

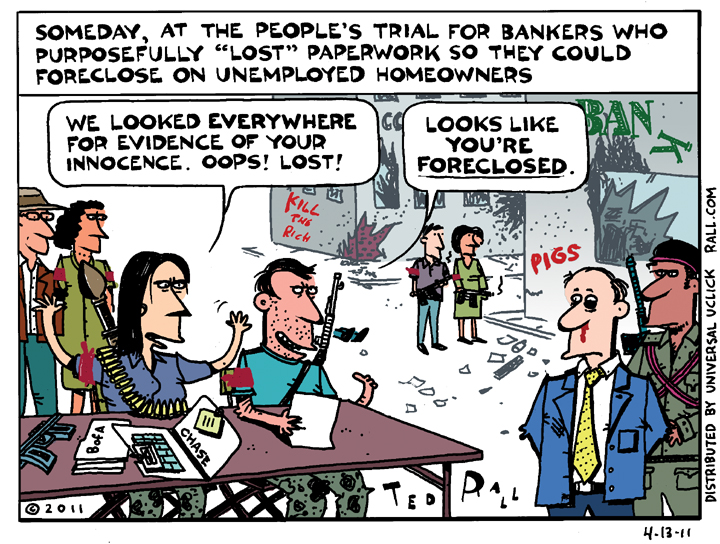

If you’re one of the roughly 20 million homeowners who have lost or are about to lose your house to foreclosure—most likely to a bank using fraudulent loan documents—you get 0-0-0.

If you’re a teacher asking for a raise, or a parent caring for a sick child or parent, or just an ordinary worker hobbling to work on an old car that needs to be replaced, all you’ll get is 0-0-0.

There isn’t any money to help you.

We don’t have the budget.

We’re broke.

You can’t get the bank to call you back about refinancing, much less the attention of your Congressman.

But not if you’re a banker.

Bankers get their calls returned. They get anything they want.

There’s always a budget for them.

They get 7-7-7.

(Ted Rall is the author of “The Anti-American Manifesto.” His website is tedrall.com.)

COPYRIGHT 2011 TED RALL

SYNDICATED COLUMN: Quit Whining About Student Loans

Time for #OWS to Broaden Its Appeal

It has been 30 days since Occupy Wall Street began. The movement hasn’t shaken the world à la John Reed—not yet—but at one thousand occupations and counting, it can’t be ignored.

OWS has become so impressive, so fast, that it’s easy to forget its half-assed origin. No matter. The fact that the French Revolution was partly set off by the drunken ravings of the Marquis de Sade hardly reduces its importance.

Soon the Occupiers will have to face down a number of practical challenges. Like weather. Winter is coming. Unless they move indoors, campers at Occupy Minneapolis and Occupy Chicago will suffer attrition. But indoor space is private property. So confrontation with the police seems inevitable.

As I saw at STM/Occupy DC, there is an ideological split between revolutionaries and reformists. Typical of the reformists: This week OWSers urged sympathizers to close their accounts with big banks like Citibank and Bank of America and move their savings to credit unions and local savings and loans. If revolutionaries get their way, there will be no banks. Or one, owned by the people.

There is no immediate rush, nor should there be, to issue demands. The horizontal democracy format of the Occupy movement’s General Assemblies is less about getting things done than giving voices to the voiceless. For most citizens, who have been shut out of politics by the fake two-party democracy and the corporate media, simply talking and being heard is an act of liberation. At some point down the road, however, the movement will come to a big ideological fork: do they try to fix the system? Or tear it down?

The Occupiers don’t have to choose between reformism and revolution right away—but they can’t wait too long. You can’t make coherent demands until you can frame them into a consistent narrative. What you ultimately want determines what you ask for in the time being—and how you ask for it.

Trotsky argued for the issuance of “transitional demands” in order to expose the uncompromising, unjust and oppressive nature of the regime. Once again, an “epoch of progressive capitalism” (reformism, the New Deal, Great Society, etc.) has ended in the United States and the West. Thus “every serious demand of the proletariat” de facto goes further than what the capitalist class and its bourgeois state can concede. Transitional demands would be a logical starting point for an Occupy movement with a long-term revolutionary strategy.

Both routes entail risk. If the Occupiers choose the bold path of revolution, they will alienate moderates and liberals. The state will become more repressive.

On the other hand, reformism is naïve. The system is plainly broken beyond repair. Trying to push for legislation and working with establishment progressives will inevitably lead to cooption, absorption by big-money Democrats and their liberal allies, and irrelevance. (Just like what happened to the Tea Party, a populist movement subsumed into the GOP.)

Revolution means violence in the streets. Reform means failure, and the continued, slow-grinding violence by the corporate state: poverty, repression, injustice.

At this point, job one for the movement is to grow.

I don’t mean more Facebook pages or adding more cities. The day-to-day occupations on the ground need to get bigger, fast. The bigger the occupations, the harder they will be for the police to dislodge with violent tactics.

More than 42 percent of Americans do not work. Not even part-time. Tens of millions of people, with free time and nothing better to do, are watching the news about the Occupy movement. They aren’t yet participating. The Occupiers must convince many of these non-participants to join them.

Why aren’t more unemployed, underemployed, uninsured and generally screwed-over Americans joining the Occupy movement? The Los Angeles Times quoted Jeff Yeargain, who watched “with apparent contempt” 500 members of Occupy Orange County marching in Irvine. “They just want something for nothing,” Yeargain said.

I’m not surprised some people feel that way. Americans have a strong independent streak. We value self-reliance.

Still, there is something the protesters can and must do. They should make it clear that they aren’t just fighting for themselves. That they are fighting for EVERYONE in “the 99 percent” who aren’t represented by the two major parties and their compliant media.

OWSers must broaden their appeal.

Many of the Occupiers are in their 20s. The media often quotes them complaining about their student loans. They’re right to be angry. Young people were told they couldn’t get a job without a college degree; they were told they couldn’t get a degree without going into debt. Now there are no jobs, yet they still have to pay. They can’t even get out of them by declaring bankruptcy. They were lied to.

But it’s not about them. It’s about us.

The big point is: Education is a basic right.

Here is an example of how OWSers could broaden their appeal on one issue. Rather than complain about their own student loans, they ought to demand that everyone who ever took out and repaid a student loan get a rebate. Because it’s not just Gen Y who got hosed by America’s for-profit system of higher education. So did Gen X and the Boomers.

No one will support a movement of the selfish and self-interested.

The Freedom Riders won nobility points because they were white people willing to risk murder to fight for black people. Occupiers: stop whining about the fact that you can’t find a job. Fight for everyone’s right to earn a living.

The Occupy movement will expand when it appeals to tens of millions of ordinary people sitting in homes for which they can’t pay the rent or the mortgage. People with no jobs. Occupy needs those men and women to look at the Occupiers on TV and think to themselves: “They’re fighting for ME. Unless I join them, they might fail.”

The most pressing issues for most Americans are (the lack of) jobs, the (crappy) economy and growing income inequality. The foreclosure and eviction crisis is also huge. OWS has addressed these issues. But OWS has not yet made the case to the folks watching on TV that they’re focused like a laser.

It takes time to create jobs. But the jobless need help now. The Occupy movement should demand immediate government payments to the un- and underemployed. All foreclosures are immoral; all of them ruin neighborhoods. The Occupy movement should demand that everyone—not just victims of illegal foreclosures—be allowed back into their former homes, or given new ones.

For the first time in 40 years, we have the chance to change everything. To end gangster capitalism. To jail the corporate and political criminals who have ruined our lives. To save what’s left of our planet.

The movement must grow.

Nothing matters more.

(Ted Rall is the author of “The Anti-American Manifesto.” His website is tedrall.com.)

COPYRIGHT 2011 TED RALL

SYNDICATED COLUMN: Toxic Assets

Many Foreclosed Houses Are Infested by Mold

The next time someone tells you that capitalism is efficient, remember the mold houses.

I used to be a banker. Some of my customers had trouble making their loan payments. We usually had recourse to some sort of collateral—often real estate. But my bank really didn’t want to foreclose.

“We’re bankers,” my boss told me the first time this issue came up. “Not landlords.”

Back in the 1980s most banks held this view. Bankers sat on their butts in air-conditioned offices. They didn’t want to manage vacated properties, much less try to sell them. They understood banking. Banking was a straightforward business: take deposits, issue loans, collect the difference in interest as profit.

It was boring. Just the way they liked it.

My bank did a lot to avoid declaring a default. We lowered interest rates. We allowed skipped payments. Sometimes we even reduced principal.

Banking became exciting during the 1990s. Glass-Steagall got repealed, allowing formerly staid bankers to compete with high-flying Wall Street financiers in the securities business. Bank consulting firms invented big new fees for services that used to be free, like using an ATM.

Banks issued millions of home loans to borrowers whom they knew couldn’t afford to pay them back. Crédit Suisse estimates that such “liars’ loans” accounted for 49 percent of originations by 2006. Why they’d do it? Like mobsters, bank executives were “busting out” their companies—generating false short-term profits in order to collect annual performance bonuses. By the time the toxic chickens came home to roost, as they did in the form of the September 2008 financial crisis, they and their paychecks had moved on.

As the global financial system was in the midst of total collapse, greedy bankers conjured up a way to profit from the very misery they had caused. Rather than work with distressed homeowners who faced foreclosure (for example, refinancing subprime and adjustable rate mortgages into old-fashioned 30-year fixed mortgages) they dragged out the process in order to collect more late fees.

Banks were eager to foreclose. They were merciless. They evicted homeowners while they were on active-duty serving in Iraq and Afghanistan, a violation of federal law. They even evicted people who didn’t owe them a cent.

Now banks are sitting on top of nearly a million homes. “All told, [banks] own more than 872,000 homes as a result of the groundswell in foreclosures, almost twice as many as when the financial crisis began in 2007, according to RealtyTrac, a real estate data provider,” reports The New York Times. “In addition, they are in the process of foreclosing on an additional one million homes and are poised to take possession of several million more in the years ahead.”

Which is where the wonderful tragic tale of the mold houses comes in.

“In most homes,” reported NPR recently, “as residents go in and out and the seasons change, natural ventilation sucks moisture up to the attic and out through the roof. It’s called the ‘stack effect.’ And in many parts of the country, it’s driven by air conditioning in the summer and heat in the winter. But no one is going in or out of most foreclosed homes—regardless of climate—and the effects can be devastating.”

Far from the profit center imagined by freshly-minted analysts with MBAs, empty houses depreciate faster than a new car driving off the lot. They fall apart quickly. Mildew and mold sets in, some of it toxic.

“In some states, it’s estimated that more than half of foreclosed homes have mold and mildew issues,” reported NPR. “Realtors across the country say they’re seeing the problem in everything from bungalows to mansions.”

Turns out those old-fashioned bankers were on to something. Bankers shouldn’t become landlords.

A minor mold problem starts at $5,000 and can easily run $20,000 or more. Considering that the average house in the Midwest is valued at $136,000, that’s not insignificant. Many houses with toxic mold have to be demolished.

Greed may be good. But it doesn’t always pay.

(Ted Rall is the author of “The Anti-American Manifesto.” His website is tedrall.com.)

COPYRIGHT 2011 TED RALL