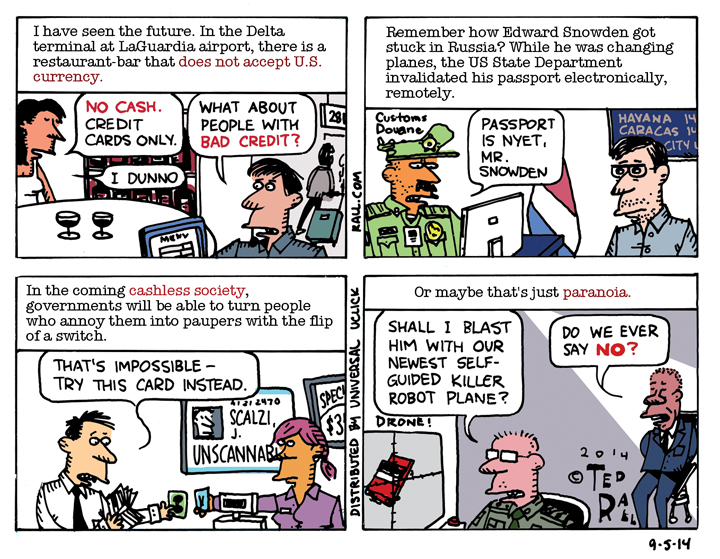

I have seen our future dystopian cashless society. What could go wrong? After all, it’s not the government would ever use its power to shut off people’s access to their money with a flip of a switch.

SYNDICATED COLUMN: Stamped Out

The Statue of Liberty Stamp Error and the End of America

It may seem like a minor thing. Objectively it is a minor thing. But the Great Statue of Liberty Stamp Screw-up of 2011 presents a picture-perfect portrait of a society in the midst of collapse.

You can tell a lot about the state of a country from its stamps and its currency. At a nation’s peak its graphic iconography tends to be striking, elegant and original. As it begins to wane abstraction gives way to self-caricature, innovative design to self-parody, high art to kitsch.

Look at U.S. stamps and paper money from 100 or 50 or even 30 years ago and you’ll see my point. Quarters were nearly sterling silver; now they’re mystery metal (nickel-copper-zinc alloy).

America: we’re not what we used to be.

A century ago President Theodore Roosevelt commissioned the famous Beaux Art sculptor Augustus Saint-Gaudens to redesign the nation’s coinage. Among the results were Saint-Gaudens’ breathtaking $20 gold “double eagle”; numismatists consider it one of the most elegant coins of the 20th century.

How the mighty have fallen! According to U.S. Mint officials recent revamps of the $100, $50, $20, $10 and $5 bills were undertaken without the slightest consideration for aesthetics. They didn’t even consult an art director. Stymieing counterfeiters was the sole concern.

Now the U.S. Postal Service has issued its newest first-class “forever” stamp. As the most widely used denomination, a new forever is a big deal.

The new stamp features a photo of the head of the Statue of Liberty. Well…not exactly. Instead of the Statue of Liberty paid for by coins donated by French schoolchildren, the proud iconic figure which has greeted millions of immigrants to New York, the stamp bears the visage of the small replica which stands in front of the New York-New York casino in Las Vegas.

Mistakes happen. As every philatelist knows, another error—the 1918 “Jenny Invert,” which features an image of an upside-down airplane—is one of the most prized collectibles in philately because Post Office officials destroyed all but one sheet of the 100 stamps.

That’s the usual response to a catastrophe in stampdom. Ten years ago Postal Service recalled and destroyed the entire run of a stamp that wrongly placed the Grand Canyon in Colorado.

But that was before the economic collapse that began in 2008. The Postal Service is broke. Quality standards? Can’t afford them. Incredibly, postal officials are allowing this monstrosity, this bastard creation, this artistic obscenity—the face is clearly the wrong one—to be sold at your local post office.

“We still love the stamp design and would have selected this photograph anyway,” USPS spokesman Roy Betts told The New York Times.

Uh-huh.

“The [postal] service selected the image from a photography service, and issued rolls of the stamp bearing the image in December,” reported the newspaper. “This month, it issued a sheet of 18 Lady Liberty and flag stamps. Information accompanying the original release of the stamp included a bit of history on the real Statue of Liberty. Las Vegas was never mentioned.”

It’s bad enough that they use photographs. Stamps should be engraved. Engraved stamps look classier and more substantial.

But whether they are using an engraver, illustrator or photographer, a U.S. stamp ought to be a big gig. For an assignment such as this I would expect the USPS to hire a professional and pay huge money—six-figures huge. It’s a stamp, for Chrissake.

Nope. The U.S. Postal Service buys stock photos. For stamp design. That’s right—the same cheesy clipart you can download for your kid’s birthday party invitation.

Insane.

In and of itself, this is no big deal. These are lean times. Austerity abounds. Why not save a few bucks?

It matters because symbolism matters. The kind of country that puts stock photos on its stamps is the kind of country that puts a single air traffic controller in charge of one of its biggest airports. The kind of country that doesn’t fix its mistakes is the kind that tells people under the age of 55 that they can go to hell and die when they get old and sick because it’s more important to cut taxes for rich scum than to fund Medicare.

As for the symbolism of a phony Statue of Liberty that stands in front of a casino in the nation’s gambling capital—well, that’s obvious.

It would be fine if the money being saved by printing crappy stamps went to new textbooks in inner-city schools. But it doesn’t. It goes to Halliburton and Bill Gates. Now that American workers have been hung out to dry, robbed and fleeced, wrung out and burned out, the government and its associated agencies (the USPS is quasi-governmental) have turned on themselves in service to the 21st century robber barons.

Don’t get mad about the stamps. Get mad at what they mean.

(Ted Rall is the author of “The Anti-American Manifesto.” His website is tedrall.com.)

COPYRIGHT 2011 TED RALL

SYNDICATED COLUMN: Next: Digital Totalitarianism

The Conspiracy to Abolish Cash

For many years figures on the political fringe, especially on the right, have claimed that the government and its corporate owners want to transform us into a cashless society. Their warnings about the conspiracy against paper money fell on deaf ears, primarily because the digitalization of financial transactions seemed more like the result of organic business trends than the manifestation of some sinister conspiracy.

Now, however, those who want to do away with liquid currency are stepping out of the shadows. They talk about increased efficiency and profit potential, but their real agenda is nothing less than enslavement of the human race.

“Physical currency is a bulky, germ-smeared, carbon-intensive, expensive medium of exchange. Let’s dump it,” argued David Wolman in Wired.

Citing a 2002 study for the Organization for Economic Development that states “money’s destiny is to become digital, ” a Defense Department-affiliated economics professor has authored an Op/Ed for The New York Times that asks: “Why not eliminate the use of physical cash worldwide?” Jonathan Lipow urges President Obama to “push for an international agreement to eliminate the largest-denomination bills” and urges the replacement of bills and coins by “smart cards with biometric security features.”

Lipow’s justification for calling for the most radical change to the fundamental nature of commerce since industrialization is, of all things, fighting terrorism. “In a cashless economy, insurgents’ and terrorists’ electronic payments would generate audit trails that could be screened by data mining software; every payment and transfer would yield a treasure trove of information about their agents, their locations and their intentions,” Lipow writes. “This would pose similar challenges for criminals.”

Terrorism is a mere fig leaf. According to the annual “Patterns of Global Terrorism” report compiled by the U.S. State Department, the highest total death toll attributed to terrorism in the last 20 years occurred in—surprise—2001. Including 9/11, only 3,547 people were killed in 346 acts of violence worldwide. Tragic. Obviously. But, in the overall scheme of things, terrorism is not a big deal.

Measured in terms of loss of life and economic disruption, terrorism is a trivial problem, hardly worth mentioning. According to the UN, 36 million people die annually from hunger and malnutrition. Over half a million die in car wrecks—but you don’t hear people like Lipow demanding that we get rid of cars. A more legitimate concern is the “loss” of taxes upon the underground economy, estimated by the IMF at 15 percent of transactions in developed nations.

What the anti-cash movement really wants is digital totalitarianism: a dystopian nightmare in which the entire human race is enslaved by international corporations and their pet governments. An anti-establishment gadfly like WikiLeaks founder Julian Assange could be instantly deprived of money—and thus freedom of movement—with a couple of keystrokes. (We saw a preview of this when PayPal and Amazon shut down WikiLeaks donation mechanism and web server, respectively.) The high-tech hell depicted by the film “Enemy of the State” would become reality.

It is true that, in a society where every good and service has to be paid for with a debit or credit card, terrorist groups would find it much harder to operate. Don’t forget, however, that today’s terrorists often become tomorrow’s liberators. Anti-British terrorists George Washington and Thomas Jefferson wouldn’t have stood a chance if the Brits had been able to intercept wire transfers from France.

Decashification would establish digital totalitarianism, a form of corporo-government control so rigid, thorough and all-encompassing that by comparison it would make Hitler and Stalin look like easygoing surfer dudes. The abolition of unregulated financial transactions would freeze the political configuration of the world, making it impossible for opposition movements—much less revolutionary ones—to challenge the status quo.

A society without dissent has no hope. Even if we lived in a perfect world where everyone was ruled by wildly popular, benevolent, scrupulously honest regimes—ha!—eliminating the slightest possibility of opposition would lead to barbarism.

We’re already more than halfway to a cashless society. In the U.S. few young adults still use checks. In many countries debit and credit card transactions now exceed those made via cash and checks combined. In 2007 the chairman of Visa Europe predicted the abolition of cash by 2012. Obviously he was wrong. But that’s where we’re headed. The U.K. plans to abolish checking accounts by 2018.

Even if you love your government, don’t want it to change, and think political opponents belong in prison, you ought to worry. As things currently stand, we know the big banks can’t be trusted. Remember when they introduced ATM cards? Banks wanted us to use them so they could lay off tellers. Then they instituted “convenience fees.” Which they have raised, and raised, to the point that taking $20 out of an out-of-town ATM could cost you $5 in fees ($2 for their bank, $3 for yours).

Imagine what your life will look like under digital totalitarianism. Your pay is direct-deposited into your bank account. You’ll pay for small purchases with your cellphone; if you owe a few bucks to a friend you’ll be able to bump your phone against your friend’s to settle up. Nowadays, some corporations allow you to control when your bills get deducted; in the future they’ll demand that you authorize them to do it automatically. What if you have a disputed charge? They’ll already have your dollars, or work credits, or whatever they’ll call them. Good luck trying to get it back from the Indian call-center guy.

As corporate ownership becomes increasingly monopolized and intertwined, your overdue phone bill might be owned by the same outfit as your bank, which would simply take what it says you owe.

The law of unintended consequences is getting a serious workout thanks to digitalization. Motorists in New York were thrilled when the EZPass system allowed them to breeze past lines at toll bridges—at a discount, no less. Then divorce lawyers began subpoenaing EZPass records to prove that a spouse was cheating. Next police set up EZPass scanners on the bridges; if you pass two of them too fast, a speeding ticket is automatically generated. The next step is to eliminate cash lanes entirely; non-EZPass tag holders will soon have their license plates scanned and receive a bill by mail—plus a $2 to $3 “handling” fee.

Think there are too many fees now? If you think you can’t trust banks now, imagine how badly they’ll gouge you when they control every single commercial transaction down to the purchase of a pack of gum. Angry about taxes? When tax agencies can take the money out of your account without asking, they will. Unlike cash, that phone bump to pay your friend will be a trackable, data mineable, fully taxable commercial transaction.

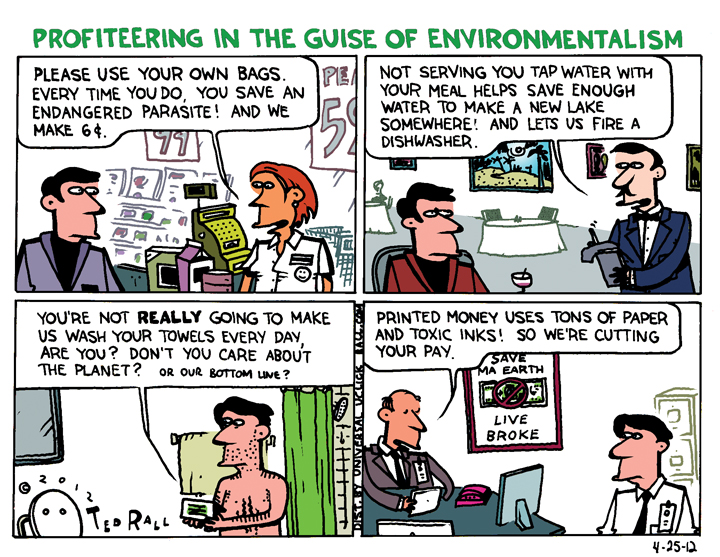

As if the post-2008 economic collapse hadn’t proven that no one is looking out for We the People but ourselves—and then barely so—the digivangelists tell us not to worry, that Big Brother, Inc. will smooth out the rough patches on the road to techno-fascist domination. From Wolman in Wired: “Opponents used to argue that killing cash would hurt low-income workers—for instance, by eliminating cash tips. But a modest increase in the minimum wage would offset that loss; government savings from not printing money could go toward lower taxes for employers.” Sure. The same way banks passed on the savings they earned by replacing tellers with ATMs to their customers.

Americans are skipping into the digital inferno wearing a smile and relishing the smell of their own burning flesh. Countless friends and acquaintances pay all their bills online. “I’m all about using my checking account in place of cash and would love to be able to eliminate cash entirely from my life,” gushed PCWorld’s Tony Bradley recently.

“Give me convenience or give me death” was the title of an album by the punk band Dead Kennedys.

We’ll get both.

(Ted Rall is the author of “The Anti-American Manifesto.” His website is tedrall.com.)

COPYRIGHT 2010 TED RALL