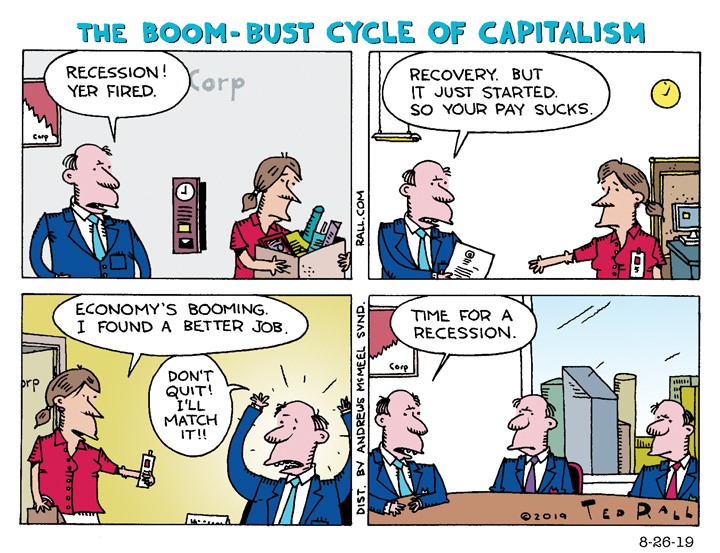

With salaries representing the biggest expense for employers, it’s not paranoid to suggest that, as soon as workers begin to gain advantage in a tight labor market, bosses are ready to tank the economy to keep workers’ wages in check.

The Boom-Bust Cycle of Capitalism

Ted Rall

Ted Rall is a syndicated political cartoonist for Andrews McMeel Syndication and WhoWhatWhy.org and Counterpoint. He is a contributor to Centerclip and co-host of "The TMI Show" talk show. He is a graphic novelist and author of many books of art and prose, and an occasional war correspondent. He is, recently, the author of the graphic novel "2024: Revisited."

10 Comments. Leave new

Bosses….make the bumps rougher and tougher but they are not the cause of recessions, boss have to dance to the Wall Street tune (directly or indirectly). The workers are pawns, so the bosses must be the rooks…we need to head up to the top.

Wall Street, major investors and the big players in global capital, they can see and to some degree time the waves of boom and bust. They can short the market before hitting news with dire predictions. Then the big boys can scoop up undervalued stocks and real estate as the market starts its recovery. The big boys of capital also are major influences on government. If you have friends in right places writing policy it easier to see which investments will pull of a recession first.

To top it off add in human nature: The boom bust cycle, investors run in to market when prices are going up and things tend to become over valued, then tend to panic in falling market, millions of small and mid sized investors dumping their stocks and other investments can drag any market down.

«Wall Street, major investors and the big players in global capital, they can see and to some degree time the waves of boom and bust. They can short the market before hitting news with dire predictions. Then the big boys can scoop up undervalued stocks and real estate as the market starts its recovery. The big boys of capital also are major influences on government. If you have friends in right places writing policy it easier to see which investments will pull of a recession first.» Cf the manner in which Mr Trump et consortes are running the current US war on China’s economic and technglogical development. Talk about opportunites to make oodles of money in a bumpy market !… 😉

Henri

«Wall Street, major investors and the big players in global capital, they can see and to some degree time the waves of boom and bust. They can short the market before hitting news with dire predictions. Then the big boys can scoop up undervalued stocks and real estate as the market starts its recovery. The big boys of capital also are major influences on government. If you have friends in right places writing policy it easier to see which investments will pull of a recession first.» Cf the manner in which Mr Trump et consortes are running the current US war on China’s economic and technglogical development. Talk about opportunites to make oodles of money in a bumpy market !… 😉

Henri

… and the bossiest boss of them all – the one in the oval office – keeps sending out tweets that cause the stock market to drop.

The good news is that the fat cats who wanted a rich bitch for president are getting skrewt right along with the rest of us.

Haha! stoopitt bastids.

That fat cats that will suffer in a DT slump are the one industry moguls down to the totally annoying maga guy down the street that just got a pick up half the size of semi by cashing in some of his market gains. The really big players that shift money all around the stock market and globe know how to make money in falling market.

Short-selling allows investors to profit from stocks or other securities when they go down in value. In order to do a short sale, an investor has to borrow the stock or security through their brokerage company from someone who owns it. The investor then sells the stock, retaining the cash proceeds.

Then there are brokerage fees on millions of small investors selling stocks or trading into other investments

Slashing wages and staff faster than prices, pressuring governments around the world to slash regulations.

Wiping out or buying out you competitors means higher prices come the dawn.

A flat market, that is when it hard to gin up profits…well there is always creative accounting.

There is a lot of truth to that, but it’s not the whole story.

Market volatility only works in your favor if you can predict the cycles. Trump’s sheer randomness makes it difficult to predict. Should I invest in nuclear weapons ‘cuz we’re gonna nuke hurricanes? Oh, wait, that was yesterday – I’ll invest in Korean manufacturing ‘cuz China – oh, wait, that was day-before-yesterday…

OTOH, a market downturn is similar to a sale. If I’ve got the cash on hand, then I can buy cheap to sell dear later on. Who’s got the cash on hand? (Hint: It’s not me) The game absolutely is rigged in favor of those with the deepest pockets.

Let’s play poker! You bring $100 stake to the table, I’ll bring a million. Doesn’t matter how good a player you are, I’m going to go home with $1,000,100.00

Add one more thing: Credential inflation plays into boom bust cycles.

You needed a H/S diploma or a two degree to land your position (it paid the rent even if you struggled with the big bills from time to time), The rescission hits and you are dumped into the gig economy (you are couch surfing, living a room…ect). When things improve and a similar position comes back you will need a four degree or even a masters degree to land an interview and you will be competing against younger people for the spot.

Do you get a student loan to compete? Great you got the degree and the position but you will still be renting a room for a very long time to pay off the banks and investors.

Ain’t capitalism grand ?!!… 😉

Henri

Wage increases can be regulated by increasing the transitional rate of unemployment.

This is the non-zero rate of unemployment that serves as full employment for government economists.

Crank the nominal transitional rate of unemployment up and demands for wage increases will magically decline, accompanied by an increase in the precariat, (a social class formed by people suffering from the condition of existence without predictability or security, affecting their material and psychological welfare) populating the reserve workforce willing to work for less, also along with an increase in right wing nationalist racist mass murderers.

Put a few wealthy men in a room together and they will soon conspire against the public and come up with some travesty like the US Constitution.

… and eat live puppies! And hack the DNC servers and blame Russia! And kill Kennedy and Lincoln and MLK and fake the moon landing and deal three card monte! Pee in the shower, spit on the sidewalk, and shit on a shlngle! They ran a kiddie prostitution ring out of a pizza parlor! They stole Christmas, released Thing 1 & Thing 2, and damaged the old, moss-covered, three-handled family gradunza that hung on the family tree!

https://www.youtube.com/watch?v=7ygh5f-B99A