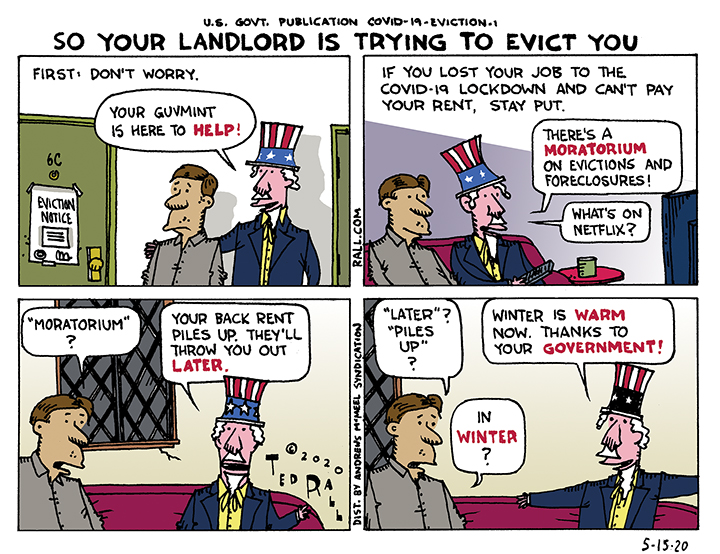

Millions of Americans have lost their jobs, aren’t able to pay rent or their mortgages, and therefore face eviction or foreclosure. Yet the best that even “liberal” politicians are offering is a moratorium on evictions until some future point in time.

So Your Landlord Is Trying to Evict You

Ted Rall

Ted Rall is a syndicated political cartoonist for Andrews McMeel Syndication and WhoWhatWhy.org and Counterpoint. He is a contributor to Centerclip and co-host of "The TMI Show" talk show. He is a graphic novelist and author of many books of art and prose, and an occasional war correspondent. He is, recently, the author of the graphic novel "2024: Revisited."

6 Comments. Leave new

Hmm. Can anyone else recall the point Ted raised back during the previous economic disaster? The one in 2007-08 with all the mortgages turning out to be garbage? When millions got thrown out?

At the time he pointed out that had these people all died on 9/11, they’d have been heroes, and there would have been huge amounts of national grief and outpourings of rage and sorrow and so on.

The more things change …

Count on it. The deferral means that the government is going to simply throw these 30% of the unemployed out in the trash. Winter should kill most of them. The ones who don’t suicide first. Or turn to drugs and pills. Imagine all those student loans that will never be collected …

You think the funeral homes are running full tilt now?

So very much for which to be thankful, Ted !… 😉

Henri

Add in all the utility bills that will be piling up on top of the rent, on top of that…many loans such as student loans are on hold right now. When the locks are off you better have two three checks in your pocket to start dealing with the bill surge heading your way.

I could see congress passing a program to save some people I.E. the people that risk their health and rush back to work once the restrictions are lifted. If your rush back to work leads to a long hospital stay E/R visit your bills will drive you to bankruptcy. If you pass on you are free but the bill collectors will come for anything of value left in your estate.

The R’s distaste for helping workers will shoot down bills with ungenerous direct payments so that leaves very low interest relief loans targeted at workers with back rent/house payments. It will sound good at first but I am sure the program will be hard to get in to and the people getting loans unless they land a top notch job will be paying on their relief loan for many years.

How many people can pay an extra 400 or more per month? How many people will get their old job back and how many will find out their company has gone bankrupt, downsized or s l o w l y rehiring due to the lack of consumer spending. People with no income or have falling incomes won’t get a relief loan and instead the downtrodden will get all the stock clichés it’s you fault for taking the wrong major in college and picking the wrong career, try harder, reinvent yourself…..ect.

So much money will go to back payments, many good jobs like pilot will in less demand so get ready for a long depression.

You’ve hit it on the head, Oldvet. It’s like an old-time grift. You’ve fallen $10,000 behind. Here’s five thousand. You’ll use it to pay off the minimum amounts on everything for as long as you can. THEN, the bottom drops out again and it’s a straight shot to the bottom. So you paid off $4,000 of what you owed, and used the other thousand to just stay alive. Now you owe $6,000. And one month later, with late fees and so forth, you owe $6,500. The next month? $7,100. In six months or so, you’re right back to $10,000 debt and you have no prospects (because six months is zero time when there are no jobs), and you’ve lost that $5,000 you were given.

That’s the whole plan all the way along. And the unwashed masses fall for it over and over.

Don’t forget, we have to vote Biden because he’s not Trump.

Look on the bright side Ted. It is Spring. Summer is soon and the living will be easy. People living in their cars. People sleeping in their shoes. We have enough time to make it to Florida for the winter. Like the Okies did California during the Dust Bowl.

Well it looks like most homeowners are covered…as long as they can land a job that pays the bills at the end this but the banks and loan companies have been spreading lies to scare people in to paying more.

Thanks to federal coronavirus relief measures, consumers with federally backed mortgage loans can

can skip up to 12 months of payments by securing what’s called a forbearance (how long does it take to get?). Afterward, they can choose to repay the missed payments on top of a year’s worth of upcoming payments, shift the missed payments to the end of their loan or lengthen the loan and lower their payment.

That relief is guaranteed in federal law, and by guidance issued to mortgage loan servicers by federal guarantors that own a combined 70 percent of all U.S. home loans — Fannie Mae, Freddie Mac, the Federal Housing Administration, the U.S. Department of Agriculture and the Veterans Administration.

Yet consumers have flooded social media pages with complaints that their loan servicers said they could skip payments for only three months and must repay all skipped payments in a lump sum on the fourth month. Some say they’re worried about signing up for the relief, mindful of how victims of the 2008 housing crash were exploited when they sought promised modifications and refinancing.

So what about the other 30%of homeowners

What about renters

What about the people that take months/years to find work that pays all the bills at then end of epidemic