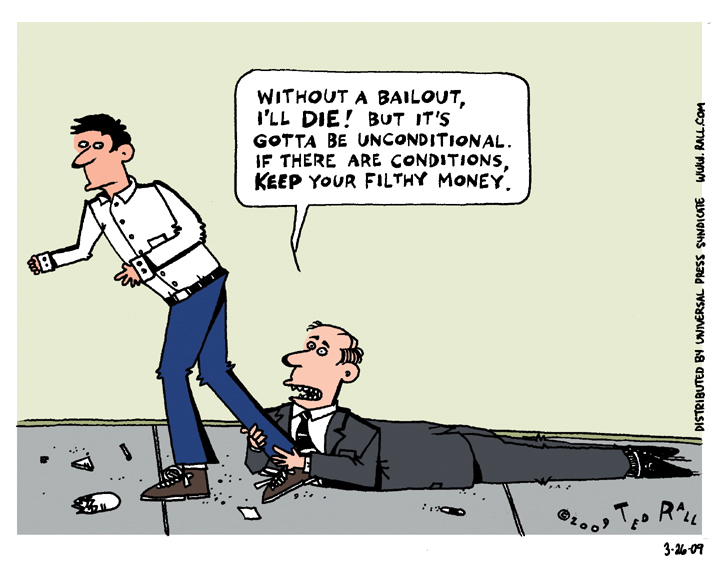

I’m confused. First the banks and other companies requesting government bailouts claimed they would go under if they didn’t get them. Now they’re offering to return the money because the conditions are too onerous. So they didn’t really need the money in the first place, right? Or am I missing something?

Unconditional Begging

Ted Rall

Ted Rall is a syndicated political cartoonist for Andrews McMeel Syndication and WhoWhatWhy.org and Counterpoint. He is a contributor to Centerclip and co-host of "The TMI Show" talk show. He is a graphic novelist and author of many books of art and prose, and an occasional war correspondent. He is, recently, the author of the graphic novel "2024: Revisited."

15 Comments. Leave new

Yeah, huh?

I know I'm missing the part where said companies' leaders are prosecuted for welfare fraud.

You are missing about $1100 or so.

What happens to the money they refuse? Can I have it????

Where's the confusion? It's very simple.

The executives of a company are only interested in their compensation, which includes the massive bonuses.

If they take bailout money under government conditions that says "no bonuses", they company may survive but they don't get their millions. Conversely, if they take the company into bankruptcy, they can at the very least negotiate a portion of their fat bonuses, if not all, leave the company rich and move on to the next thing.

It's all a matter of incentive for the executive. Keep their money, fuck the company.

Lots of healthy banks were forced to take the money.

They already received the benefit of having the reserves when no one knew how bad will the things go. Now when there is a good chance the situation has stabilized they want to give it back with no obligation. Looks like a guy taking out a travel insurance policy and then trying to get a refund because nothing happened on his trip.

"You mean I have to pay back the money you gave me? You're crazy, we own you.

How can you do me a favor? We do you favors! Keep it!"

I think that's pretty much the mentality.

I guess they got used to people giving them money so they can blow it and lending money to people they can screw with later. So if you turn the tables then it's kind of awkward for them.

The other part of it was the decision to give money to the top 11 banks so as not to "stigmatize" the 5 that really needed it. 150 billion extra- $500 for every man, woman, and child in the US- so the bad banks wouldn't look bad.

Hard to know whether to laugh or puke!

Anon 3:25 PM is right. The executives here have absolutely no incentive to negotiate, they do what they do to make the most money for themselves, it's a fundamental flaw with greed-based capitalism, and a consequence of our failure, as a nation, to maintain the highest standards for our policy makers.

They found a better way. Launder the money through AIG and hide the trail.

Aggie Dude,

That's exactly the problem with supply side economics. Greed; greed destroys the very delicate links in the theory.

What's funny is that they are the same people that say Marx never took into account human nature (their code for greed) and yet the espouse a theory which literally puts your eyes out so you can't even think about greed.

You all forgot that Chris Dodd negotiated to allow AIG employees to receive their retention bonuses after the so called bailout, and you forgot to mention the four executives set to receive $1 million from Fannie Mae, and the 90 million Franklin Raines received as CEO of Fannie Mae.

Anon 4:14 PM….nobody forgot about Chris Dodd….The difference between liberals and conservatives is that liberals call out their own leaders, which is exactly what's happening now. Conservatives defend to the bitter end every little mishap, because loyalty is so important.

They're feudal, actually. We're still battling Tories and Whigs in the US…monarchists and federalists….geeez, get a clue dude. It's worse that the better of the two parties is screwing us.

The difference between liberals and conservatives is that liberals call out their own leaders, which is exactly what's happening now.

What liberal is calling out Chris Dodd, Barney Frank or Franklin Raines?