If you’re a webpage designer, information architect, or SEO specialist with a left-leaning bent and an interest in being on the ground floor of a startup out to change the world, I’d love to hear from you.

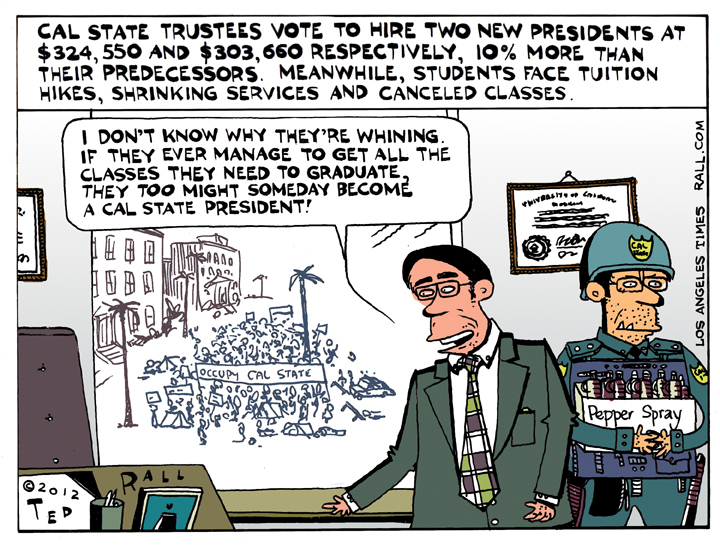

Los Angeles Times Cartoon: Cal State Presidents Cash In

I draw cartoons for The Los Angeles Times. This week’s offering: Cal State trustees have voted to hire two new presidents at high salaries, 10% more than their predecessors. Meanwhile, students face class cancellations and budget cuts.

SYNDICATED COLUMN: Handicapped

Conventional Wisdom Is Wrong. It’s Romney’s To Lose.

Catching Barack Obama in a rare moment of candor, an open mic found the president confiding to his Russian counterpart that he expects to win this fall. “This is my last election,” he told Russian President Dmitry Medvedev.

Last, yes. But I wouldn’t bet on Obama winning.

The corporate pundit class has largely conceded the general election to Obama, already looking ahead to 2016. The mainstreamers have their reasons. Their analysis is based on good, solid, reasonable (inside the box) logic. All things considered, however, I would (and have) put my money on Mitt Romney this fall.

This isn’t wishful thinking. I voted for Obama last time and wanted him to succeed. He failed. His accomplishments have been few and have amounted to sellouts to the right. Even so, the prospect of watching Mitt Romney move into the White House fills me with as much joy as an appointment for a colonoscopy. And I think he’s going to win.

For me, the D vs. R horserace is a parlor game with minor ramifications for our daily lives. Whichever corporate party wins, unemployment and underemployment will continue to worsen, income disparity will widen, and most of our taxes will fund the worst approach to international affairs since a former Austrian corporal blew out his brains out in a bunker under Berlin.

Thanks to the Occupy movement, real politics is back where it belongs—in the streets. That’s what I’ll be watching and working. With a lot of luck (and even more pepper spray) this will be a year of revolution rather than more electoral devolution.

Revolution is inevitable. But we don’t know when it’s coming. So the 2012 campaign may still matter. Besides, handicapping elections is a game I enjoy and am good at. During 17 years of syndication my pick to win has only lost once (for the 2004 Democratic nomination). So, on the off chance that you’re one of those who still cares about our husk of a democracy, who hangs on every meaningless development of a political process devoid of politics—or you’re just a betting person, here’s my thinking.

Barring an assassination or a scandal, Mitt Romney will be the Republican nominee.

Obama currently leads Romney by about four to five points. But that’s not nearly enough of a lead to carry him to November. History shows that Republican nominees steadily increase in popularity throughout the summer and fall of an election year.

In April 2004, for example, John Kerry led George W. Bush by eight points. But Swift Boating erased that lead, and then some.

In order to win, a successful Democratic nominee has to begin with a big margin. That early lead must be large enough to wind up in the black, after months of being whittled away, when the votes get counted in November. I can’t see Obama pulling far enough ahead soon.

Incumbency is a huge advantage. If the election were held tomorrow, Obama would prevail. But the election is not being held tomorrow. It’s being held in November.

By the time they head to the polls this fall, voters’ brains will be drowning in months of hundreds of millions of dollars of slick, demographically targeted, pro-Romney attack ads. Republican campaigns are more effective at this sort of thing, and as Newt Gingrich and Rick Santorum can attest, Romney’s consultants pull no punches. Obama’s current lead will be a faded memory.

Every political campaign comes down to a contest of narratives. In 2008 Obama developed an effective sales pitch: Hope and Change for a nation exhausted by eight years of Bush, 9/11, war, taking off your shoes at the airport, and a full-fledged global economic crisis to boot. Obama’s advisers turned his biggest weaknesses—his inexperience, race, unusual name and foreign background—into assets. Here was a new kind of president. Just the guy to lead us out of the Bad Old Days into something better. McCain-Palin’s narrative—a cranky old ex-POW paired with a zany housewife-gone-wild—didn’t stand a chance.

This year the narratives favor Romney.

Romney is already pointing to the biggest issue on people’s minds, the economy, and claiming that his background as a turnaround artist qualifies him to fix what ails us. His prescriptions are Republican boilerplate, vague and counterproductive, but at least he’s doing something Obama hasn’t—talking a lot about creating jobs. Voters prefer useless attentiveness to calm, steady golfing (Obama’s approach). And—despite its illogic—they like the run-government-like-a-business narrative (c.f. Ross Perot, the Bushes).

Obama is boxed in by three-plus years of inaction on, well, pretty much everything. He’ll argue that he’ll be able to “finish the job” during a second term, but that’s a tough sell when you haven’t tried to start the job—in 2009, when Democrats had huge majorities in both houses of Congress. His single signature accomplishment, healthcare reform, is disliked by two-thirds of the electorate. The recent “good news” on the economy has been either insignificant (net positive job creation of 100,000 per month for two months, less than one-tenth of one percent of the 25 million jobs needed) or falsified (discouraged workers no longer counted as unemployed).

Despite what Obama tells them, Americans know things are still getting worse. Similarly, Obama’s recent, feeble, impotent rhetorical attempts to shore up his support among his Democratic Party’s disappointed liberal base will probably not generate enough enthusiasm to counter other factors that favor Romney.

You can’t vote for the first African-American president twice. Unless he picks a woman as vice president, a vote for Obama will be a vote for the same-old, same-old. The history-making thrill is gone.

At this writing the Republican Party appears to be in disarray. No doubt, Romney is emerging from the primaries battered and bruised. His awkward and demented soundbite stylings (“corporations are people,” “the trees are the right height”) will provide fodder for countless YouTube parodies. But Romney hasn’t been damaged as much as the official political class seems to think.

Republicans are a remarkably loyal bunch. United by their many hatreds (liberals, blacks, gays, poor people, Mexicans, Muslims, foreigners, etc.), they will set aside their comparatively low simmer of anti-Mormon bigotry this fall. Picking a standard-issue white Anglo Christianist thug as veep will cinch the deal.

The GOP enjoys a huge fundraising advantage, especially via the new-fangled SuperPACs. Romney has raised $74 million against $151 million for Obama, but look for that ratio to flip after he locks up the nomination. Cue those vicious, potent ads mentioned above.

About the only major factor working for Obama is the presidential debates. Romney doesn’t stand a chance against the cool, articulate Obama.

Of course, it’s a long way to November. A lot can happen. It’s very possible for Obama to win. But that’s not how it looks now.

(Ted Rall’s next book is “The Book of Obama: How We Went From Hope and Change to the Age of Revolt,” out May 22. His website is tedrall.com.)

Happy Birthday Twitter – the best and worst of 6 years

Happy Birthday Twitter – the best and worst of 6 years

by Anastasia Churkina

RT America

March 22, 2012

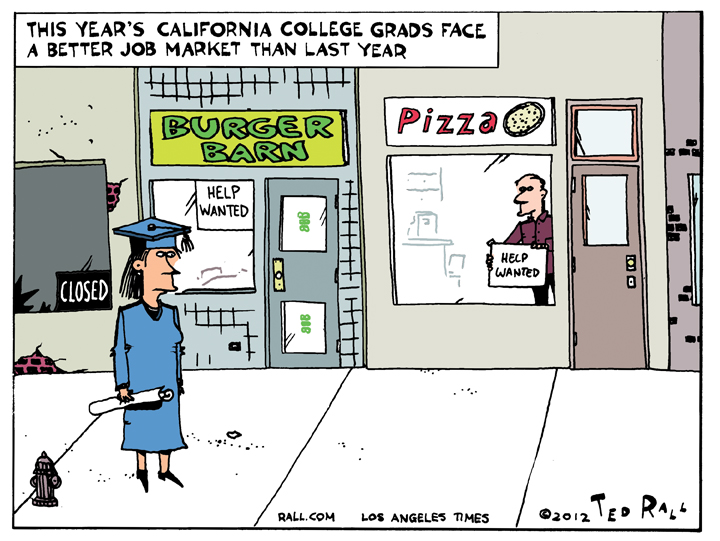

Los Angeles Times Cartoon: More Bad Jobs

I draw cartoons for The Los Angeles Times. This week comments on the “good news” that recent college grads are getting more job offers than last year.

SYNDICATED COLUMN: We Have Found the “One Bad Apple” And It Is Us

Excuses Ring Hollow in U.S.-Occupied Afghanistan

Staff Sargeant Robert Bales is the man accused of going on a March 11th shooting spree that left 16 civilians dead in southeastern Afghanistan. As the New York Daily News put it: “The killings sparked protests in Afghanistan, endangered relations between the two countries and threatened to upend American policy over the decade-old war.”

Why the fuss? This is nothing new. Not to the Afghans.

Over the last ten years U.S. forces have been slaughtering Afghan civilians like they were going out of style. There have been countless massacres of supposed “insurgents” or “terrorists.” Who invariably turned out to have been ordinary men, women and children going about their daily routines.

The only difference between the Bales massacre and other acts of bloodshed is that he acted on a freelance basis, minus orders from his commanding officer. Bales’ actions were so similar to the “normal” behavior of U.S. soldiers that Afghan witnesses weren’t surprised.

Atrocities are business as usual. Afghans have learned that their lives are cheap–not to them, but to the young men and women who patrol their streets and man explosives-laden drone planes from the other side of the world.

On July 7th, for example, an airstrike in Khost province killed at least 13 civilians, mostly women and children. On December 19th, U.S. occupation troops and Afghan collaborators conducting a “night raid” on the home of an anti-narcotics official in Paktia province shot and killed his pregnant wife. At least eight children died in a February 9th airstrike in Kapisa province. A helicopter gunship opened fire on a school in Nangahar province on February 22nd, injuring nine girls.

I literally don’t have enough space to provide a complete accounting of recent U.S. atrocities in occupied Afghanistan. Here’s a brief taste: U.S. Special Forces operatives alone admit killing over 1,500 Afghan civilians in night raids alone during 10 months in 2010 and early 2011.

Afghans know the deal.

Americans don’t.

It’s intentional. The U.S. government doesn’t want ordinary American citizens to know how their “heroic” soldiers behave in remote combat zones. America’s cult of militarism, so important to the Congressmen whose careers depend on defense contractor contributors and to the media outlets for whom war means higher ratings, requires a placid, compliant populace lulled into the ridiculous belief that the U.S. military is defending freedom.

Sgt. Bales is a PR problem. His decision to blow away women and children for no reason whatsoever belies the hero-troops narrative. It’s too icky for even a “support our troops”-besotted public to ignore. So Sgt. Bales has become a political football.

Shortly after the suspect turned himself in, the Army spin machine revved up.

“When it all comes out, it will be a combination of stress, alcohol and domestic issues–he just snapped,” an unnamed “senior government official” told The New York Times. Just one of those things. What can you do?

Pointing to the fact that Bales’ spree took place while he was on his fourth tour of duty, his lawyer is laying the groundwork for a PTSD defense. “We all know what’s going on over there [in Afghanistan], but you don’t really know it until you listen to somebody like him,” John Henry Browne said to reporters. In other words: war makes people nuts. Blame war, not my client.

After incidents like this, one can always count upon the political class to unleash the “one bad apple” chestnut.

“This incident is tragic and shocking, and does not represent the exceptional character of our military and the respect that the United States has for the people of Afghanistan,” President Obama read from a prepared statement. “Obviously what happened this weekend was absolutely tragic and heartbreaking, but when you look at what hundreds of thousands of our military personnel have, have achieved under enormous strain, you can’t help but be proud generally and I think it’s important for us to make sure we are not in Afghanistan longer than we need to be,” he added in a Denver TV interview.

Don’t blame the war, says Obama. Don’t blame the troops. Whether they’re shooting up their high school or their post office, some people go nuts sometimes. Can’t be helped.

Of course, from the Afghan point of view, this is low-grade, elementary-school-level spin.

Afghans don’t wonder whether the former All-American footballer from Norwood, Ohio was driven crazy by combat, was like that all along, or if this is another Jessica Lynch/Pat Tillman Pentagon lie that will wind up as something completely different than what we’re being told now.

Afghans don’t care why.

The way the Afghans see it is straightforward. The U.S. invaded their country. Without just cause. The U.S. has imposed a ruthless and cruel occupation that has left tens of thousands of their countrymen dead or seriously wounded. The U.S. has installed and propped up Hamid Karzai’s corrupt puppet regime in Kabul.

To the Afghans, Sgt. Bales didn’t kill those 16 people in Kandahar province. The U.S. did. Obama did. We did. After all, if we hadn’t invaded and occupied Afghanistan, Bales wouldn’t have been there in the first place.

Reporters are digging up dirt on Sgt. Bales’ marriage and supposed drinking problems in order to distract us from this simple fact.

(Ted Rall’s next book is “The Book of Obama: How We Went From Hope and Change to the Age of Revolt,” out May 22. His website is tedrall.com.)

Thank You!!!

Thank you, computer fundraiser donors! For the first time in ten years (!) I have a new computer with which to process and deliver my cartoons and columns. And it’s a beauty: a loaded 27-inch iMac. It’s so awesome that it should, with a little luck, take me all the way up to 2022.

I just got it up and running yesterday and haven’t done any Photoshopping yet but I’m sure it’ll rock. Thanks to those who recommended VueScan scanning software so I could continue to use my old HP Scanjet 7400c scanner…it seems to work great.

Thanks again, everyone. I’ve been pulling out roughs and other goodies to send out to you donors, and they’ll go out shortly. You’ll be getting more than I promised because, well, just because.

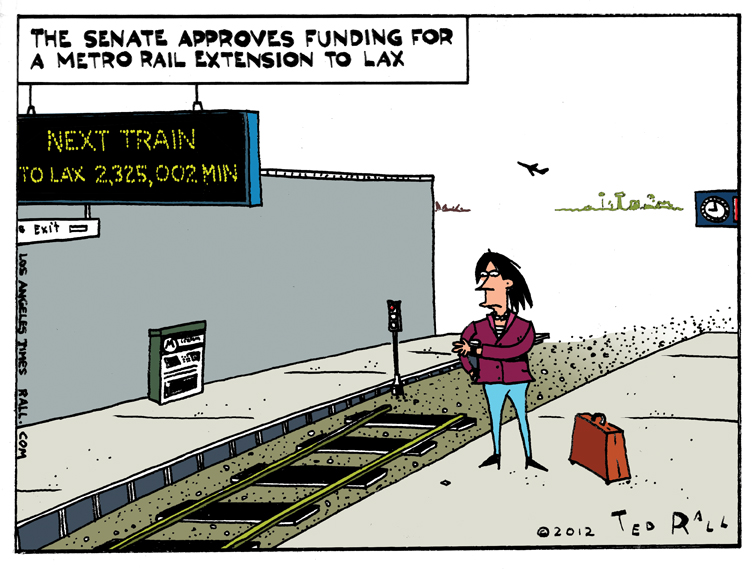

Los Angeles Times Cartoon: Waiting

I draw cartoons for The Los Angeles Times. This week we look at the possible imminent conclusion to the long wait LA commuters have endured until their Metro system finally makes it all the way to Los Angeles International Airport.

Some people I showed this to asked why I depicted a woman instead of a man because you know, the “generic human” is a white male in his 50s (perhaps, in an editorial cartoon, wearing a hat). As readers know, I try to avoid such tired tropes as much as possible. Women take trains too.