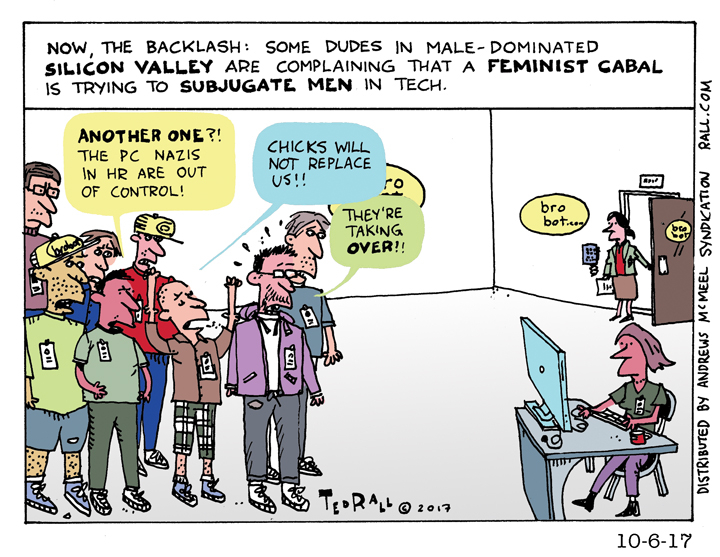

What’s to blame for mass cancellations and dysfunction at the formerly beloved Southwest Airlines? Long Island has a new Congressman-elect, Mark Santos. But nothing he told us about himself seems to be true. Ironically, his lies make him look worse than the reality of his hardscrabble upbringing. Supreme Court is allowing Section 42 to remain in place, trapping tens of thousands of asylum seekers at the Mexico border. Surely there’s a better way. Editorial cartoonists Scott Stantis and Ted Rall break it down for you.

When the Kevin Spacey story first broke, he stood accused of one act of wrongdoing:

When the Kevin Spacey story first broke, he stood accused of one act of wrongdoing:

If you did it once, you’d be fired.

If you did it once, you’d be fired.