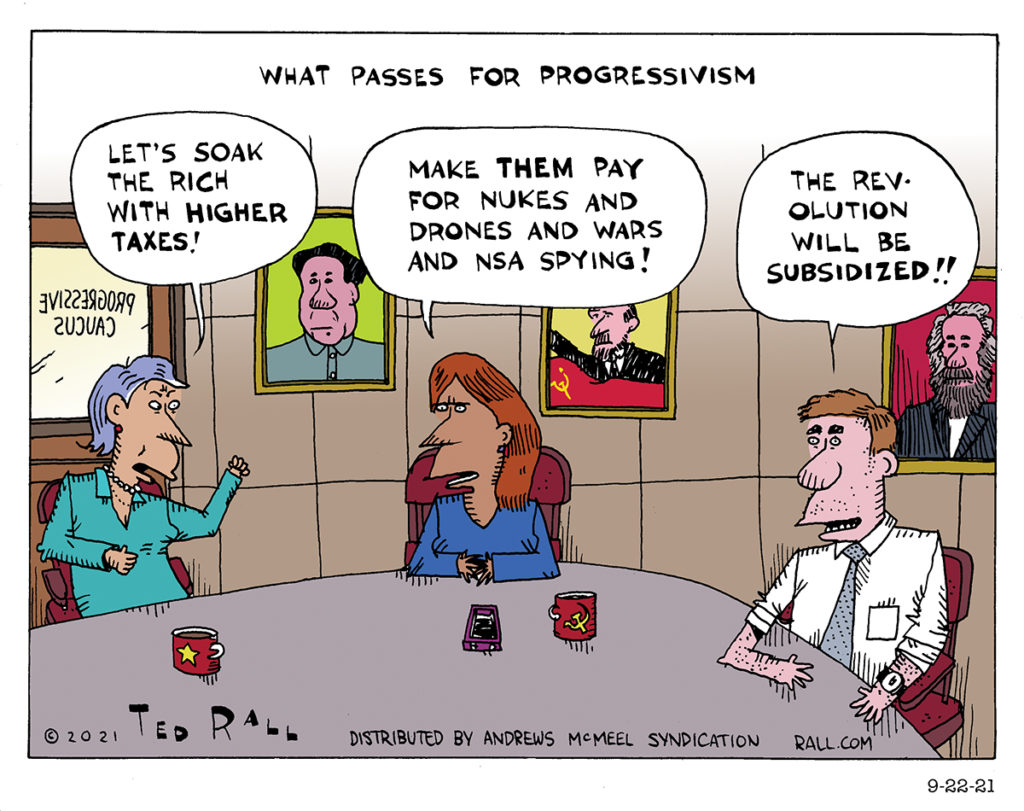

There is no left in the United States. Certainly not in Congress. Even “progressive” Democrats like AOC argue that the rich should pay higher taxes, a stance perfectly aligned with mainstream DNC leadership. No one argues about where those taxes should be going.

“Far Left”? There’s No Such Thing in This Democratic Party

America has lots of leftists. Forty percent of voters say that they would prefer to live in a socialist country than a capitalist one.

Yet America has zero leftists running for president.

Think about that the next time someone tells you that we live in the greatest country on earth, or for that matter, that this is a democracy. If the United States was democratic or, more precisely, had a truly representative form of government, 40% of the electorate would have someone to vote for.

According to the mainstream media, the Democratic Party is left. And the current crop of contenders for president has never been more left.

Beto O’Rourke, Fox News says, had a “far-left presidential platform.” He likes pro-corporate jobs-exporting free trade agreements, backs a blank check to Israel’s right-wing government and wants to send teenagers to prison for 15 years for sexting. If that’s far left, I have a Palace of the Soviets I’d love to sell you.

“If Democrats select a nominee who is unelectable because of a far-left or socialist agenda, then their beds will be made,” frets The Hill.

“As a left-wing San Francisco liberal I can say to these people [progressive candidates]: What are you thinking?” asks Nancy Pelosi. How can you be “a left-wing San Francisco liberal” and vote to invade Afghanistan?

It’s BS but over time, even the most strong-minded among us succumb to the never-ending tsunami of propaganda. Like Winston Smith in “1984,” we doubt ourselves and believe the lies. No wonder 47% of Americans say that the Democratic Party has moved too far left.

Now more than ever, we need a reality check. Electoral politics has no space whatsoever for the real, actual left: Communism, socialism, left anarchism, left libertarianism, etc. Corporate journalistic outlets employ no actual leftists. There is no organized left in the United States.

Under a socialist economy, workers own the means of production. This is important because it means they are no longer exploited. As Karl Marx wrote: “From each according to his ability, to each according to his contribution.” So those who aren’t able to work due to physical or mental infirmities, for example, have equal access to the good things in life.

Though the “green new deal” espoused by Bernie Sanders would theoretically employ millions of Americans as government workers, those employees wouldn’t own their workplaces. Similarly, “Medicare for all” would abolish private insurance but it wouldn’t put healthcare workers on the government payroll as is the case in other countries. Those two ideas, if implemented, would resemble New Deal-era programs like the WPA and CCC. Contrary to the dogma of the conservatives who currently control the national political dialogue, if it’s socialism for the government to hire somebody, then any place with a single cop is a socialist country.

None of the 2020 candidates for president in the Democratic primaries favor the nationalization of currently private businesses that would be required to achieve a socialistic economy. You can’t have a far left without nationalization or socialism.

None of the Democratic candidates oppose war in the manner of pacifists, much less adapt to the analysis of the left that there should be no war but class war. “The main enemy is at home,” noted the German Spartacist Karl Liebknecht, referring to the ruling classes. “We differ from the pacifists,” Lenin wrote during World War I, “in that we understand the inevitable connection between wars and the class struggle within a country; we understand that wars cannot be abolished unless classes are abolished and socialism is created; we also differ in that we regard civil wars, i.e. wars waged by an oppressed class against the oppressor class, by slaves against slaveholders, by serfs against landowners and by wage workers against the bourgeoisie, as fully legitimate, progressive and necessary.”

A left—certainly a “far left”—candidate for president of United States would categorically oppose all wars of aggression, imperialism, and neocolonialism. Contrast that leftist ideal to the most anti-militaristic Democrats in the current race.

Tulsi Gabbard, arguably the most stridently antiwar candidate in the cycle, nevertheless touts her military service even as she declaims “regime change wars.” She praised President Trump’s order to assassinate ISIS leader Abu Bakr al-Baghdadi. She took $100,000 in campaign contributions from arms dealers. “When it comes to the war against terrorists, I’m a hawk,” she said. “When it comes to counterproductive wars of regime change, I’m a dove.”

Bernie Sanders, also on the left flank of the Democrats, told me that he would continue the drone assassinations that have killed thousands of innocent people. He voted for the authorization to use military force after 9/11, and 20 years before, to allow Bill Clinton to bomb Serbia.

We will never get the chance to live in that better world embodied by the ideal of socialism and communism unless we understand that we have an awful lot of work to do before we can get there. Allowing commentators and the Democrats themselves to describe anything that’s going on in mainstream electoral politics as “far left” is self-destructive and an endorsement of the worst kind of lie, the fiction that the most important ideals are represented by anyone in American political life.

(Ted Rall (Twitter: @tedrall), the political cartoonist, columnist and graphic novelist, is the author of “Francis: The People’s Pope.” You can support Ted’s hard-hitting political cartoons and columns and see his work first by sponsoring his work on Patreon.)

SYNDICATED COLUMN: You’re Not Underemployed. You’re Underpaid.

The Case for Shiftlessness

No bank balance. Nothing in your wallet.

“I’m broke,” you say. “I need a job.”

Or:

Perhaps you have a job. Then you say:

“I’m broke. I need a better job.”

You’re lying. And you don’t even know it.

You don’t need a job.(Unless you like sitting at a desk. Working on an assembly line. Non-dairy creamer in the break room. In which case I apologize. Freak!)

You don’t need a job. You need money.

We’ve been programmed to believe that the only way to get money is to earn it.

(Unless you’re rich. Then you know about inheritance. In 1997, the last year for which there was solid research done on the subject, 42 percent of the Forbes 400 richest Americans made the list through probate. Disparity of wealth has since increased.)

It’s time to separate income from work.

For two reasons:

It’s moral. No one should starve or sleep outside or suffer sickness or go undereducated simply due to bad luck—being born into a poor family, growing up in an area with high unemployment, failing to impress an interviewer.

It’s sane.

“American workers stay longer at the office, at the factory or on the farm than their counterparts in Europe and most other rich nations, and they produce more over the year,” according to a 2009 U.N. report cited by CBS. Thanks to technological innovations and education, worker productivity—GDP divided by total employment—has increased by leaps and bounds over the years.

U.S. worker productivity has increased 400 percent since 1950. “The conclusion is inescapable: if productivity means anything at all, a worker should be able to earn the same standard of living as a 1950 worker in only 11 hours a week,” according to a MIT study.

Obviously that’s not the case. American workers are toiling longer hours than ever. They’re not being paid more —to the contrary, wages have been stagnant or declining since 1970. Numerous analyses have established that, especially since 1970, the lion’s share of profits from productivity increases have gone to employers.

Workers are working longer hours. But fewer people are working. Only 54 percent of work-eligible adults have jobs—the lowest rate in memory. Which isn’t surprising. Because there are fixed costs associated with employing each individual—administration, workspace, benefits, and so on—it makes sense for a boss to hire as few workers as possible, and to work them long hours.

This witches’ brew—increased productivity coupled with higher fixed costs, particularly healthcare—have led companies to create a society divided into two classes: the jobless and the overworked.

Unemployment is rising. Meanwhile, people “lucky” enough to still have jobs are creating more per hour than ever before and are forced to work longer and harder.

Crazy.

And dangerous. Does anyone seriously believe that an America divided between the haves, have-nots and the stressed-outs will be a better, safer, more politically stable place to live?

Sci-fi writers used to imagine a future in which machines did everything, where people enjoyed their newfound leisure time exploring the world and themselves. We’re not there yet—someone still has to make stuff—but we should be closer to the imagined idyll of zero work than we are now.

If productivity increases year after year after year, employers need fewer and fewer employees to sustain or expand the same level of economic activity. But this sets up a conundrum. If only employees have money, only employees can consume goods and services. As unemployment rises, the pool of consumers shrinks.

The remaining consumers can’t pick up the slack because their wages aren’t going up. So we wind up with a society that produces more stuff than can be sold: Marx’s classic crisis of overproduction. Hello, post-2008 meltdown of global capitalism.

Silicon Valley entrepreneur Martin Ford warns that the Great Recession is just the beginning. In his 2009 book “The Lights in the Tunnel: Automation, Accelerating Technology and the Economy of the Future” Ford, “argues that technologies such as software automation algorithms, artificial intelligence (AI), and robotics will result in dramatically increasing unemployment, stagnant or falling consumer demand, and a financial crisis surpassing the Great Depression,” according to a review in The Futurist.

The solution is clear: to guarantee everyone, whether or not he or she holds a job, a minimum salary sufficient to cover housing, transportation, education, medical care and, yes, discretionary income. Unfortunately, we’re stuck in an 18th century mindset. We’re nowhere close to detaching money from work. The Right wants to get rid of the minimum wage. On the Left, advocates for a Universal Living Wage nevertheless stipulate that a decent income should go to those who work a 40-hour week.

Ford proposes a Basic Income Guarantee based on performance of non-work activities; volunteering at a soup kitchen would be considered compensable work. But even this “radical” proposal doesn’t go far enough.

Whatever comes next, revolutionary overthrow or reform of the existing system, Americans are going to have to accept a reality that will be hard for a nation of strivers to take: we’re going to have to start paying people to sit at home.

(Ted Rall’s next book is “The Book of Obama: How We Went From Hope and Change to the Age of Revolt,” out May 22. His website is tedrall.com.)

COPYRIGHT 2012 TED RALL

AL JAZEERA COLUMN: How the US Media Marginalizes Dissent

The US media derides views outside of the mainstream as ‘un-serious’, and our democracy suffers as a result.

“Over the past few weeks, Washington has seemed dysfunctional,” conservative columnist David Brooks opined recently in The New York Times. “Public disgust [about the debt ceiling crisis] has risen to epic levels. Yet through all this, serious people—Barack Obama, John Boehner, the members of the Gang of Six—have soldiered on.”

Here’s some of what Peter Coy of Business Week magazine had to say about the same issue: “There is a comforting story about the debt ceiling that goes like this: Back in the 1990s, the U.S. was shrinking its national debt at a rapid pace. Serious people actually worried about dislocations from having too little government debt…”

Fox News, the Murdoch-owned house organ of America’s official right-wing, asserted: “No one seriously thinks that the U.S. will not honor its obligations, whatever happens with the current impasse on President Obama’s requested increase to the government’s $14.3 trillion borrowing limit.”

“Serious people.”

“No one seriously thinks.”

The American media deploys a deep and varied arsenal of rhetorical devices in order to marginalize opinions, people and organizations as “outside the mainstream” and therefore not worth listening to. For the most part the people and groups being declaimed belong to the political Left. To take one example, the Green Party—well-organized in all 50 states—is never quoted in newspapers or invited to send a representative to television programs that purport to present “both sides” of a political issue. (In the United States, “both sides” means the back-and-forth between center-right Democrats and rightist Republicans.)

Marginalization is the intentional decision to exclude a voice in order to prevent a “dangerous” opinion from gaining currency, to block a politician or movement from becoming more powerful, or both. In 2000 the media-backed consortium that sponsored the presidential debate between Vice President Al Gore and Texas Governor George W. Bush banned Green Party candidate Ralph Nader from participating. Security goons even threatened to arrest him when he showed up with a ticket and asked to be seated in the audience. Nader is a liberal consumer advocate who became famous in the U.S. for stridently advocating for safety regulations, particularly on automobiles.

AL JAZEERA COLUMN: The Emperor Has No Economy

Corporate Profits Up, Consumer Income Down, Orwellian Talking Points Soar

The Associated Press’ Paul Wiseman had one of the snappier headlines last week: “The Economic Recovery Turns Two—Feel Better?”

“After previous recessions, people in all income groups tended to benefit,” Wiseman wrote. “This time, ordinary Americans are struggling with job insecurity, too much debt and pay raises that haven’t kept up with prices at the grocery store and gas station. The economy’s meager gains are going mostly to the wealthiest…A big chunk of the economy’s gains has gone to investors in the form of higher corporate profits.”

Wiseman quoted David Rosenberg, chief economist at Gluskin Sheff + Associates in Toronto: “The spoils have really gone to capital, to the shareholders.”

Karl Marx, call your office.

More than at any previous time in their lives, Americans looking for answers and facts are forced to read between the lines of press and broadcast accounts that bear little resemblance to reality “on the ground,” as they say on cable news. Truth, when it can be coaxed out of propaganda so patently ridiculous that it has become indiscernible from the standard-issue “everything is great, our leaders know best” nonsense of the world’s autocracies, is revealed in sloppy contradictions. Wiseman, though flying on the side of the agenda-busting angels, is no exception: is the U.S. economy generated “meager gains” or “spoils”? Hm.

On its face the official narrative is false to a laughably Orwellian extreme. The recession is over; the recovery is well underway, they say. However, as The Wall Street Journal reports, the recovery is slow and mainly benefiting big business. “While the U.S. economy staggers through one of its slowest recoveries since the Great Recession,” the paper wrote July 5th, “American companies are poised to report strong earnings for the second quarter—exposing a dichotomy between corporate performance and the overall health of the economy.”

The same “dichotomy” afflicts every industrialized nation except for Germany and Luxembourg, both of which have seen unemployment return to the levels before the global fiscal crisis that began in September 2008.

Logical holes in the argument gape so wide you could drive a truck through it—if it was worth putting it out on the road without goods to fill it with, or consumers to buy them.

First, high bottom lines don’t necessarily reflect healthy companies. A company can suffer declining sales and market share yet still increase profits by laying off workers, thus reducing payroll expenses. For example, the Internet search giant Yahoo! saw revenues decline 12 percent in late 2010 yet doubled its profits. How’d they do it? They fired one percent of their workforce. If Yahoo! were to continue this trend, it would soon cease to exist.

Second, First World economies are two-thirds reliant on consumer spending. Consumers in the United States, as well as those throughout the world, are in big trouble. The official U.S. unemployment rate is 9.1 percent but the “real rate”—the one calculated the way most other countries do theirs, which includes people whose unemployment benefits have lapsed—is closer to 20 percent, higher than those of Tunisia and Egypt at the start of the Arab Spring. People who still have jobs have suffered pay cuts both visible and invisible, the latter from galloping inflation in fuel and other costs that government agencies intentionally omit from calculations of consumer price indices.

Question one: Can an economy “recover” without its people?

Airports and shopping malls throughout the United States are empty. Advertising space on billboards and newspapers go begging. Storefronts from Fifth Avenue in New York to the Las Vegas Strip to small towns in the Midwest are boarded up. The price of homes, which for middle-class Americans are often their sole substantial form of savings, continues to decline after the real estate bubble burst in 2008. Consumer confidence, the measure of people’s willingness to part with cash to buy goods and services, is in the tank.

When 60 percent of Americans rate the economy as poor, don’t count on them to buy stuff.

They’re not.

“Workers’ wages and benefits [now] make up 57.5 percent of the economy, an all-time low,” wrote the AP’s Wiseman. “Until the mid-2000s, that figure had been remarkably stable—about 64 percent through boom and bust alike.”

Corporate CEOs may be whistling past the graveyard, raking in huge bonuses and pay raises approved by compliant boards of directors, but the overall state of the economy is a disaster. Recovery? Forget it—there isn’t one. Are we still in a recession? That would be an improvement. By most measures—unemployment, collapsing gross domestic product, falling incomes—this is a global depression. But the government won’t even admit that there’s a problem—except for unemployment and falling wages.

“Who are you going to believe?” the comedian Groucho Marx asked. ” Me, or your lying eyes?”

In the role of Mr. Marx is one Barack Obama. Like his outgoing predecessor George W. Bush, Obama’s response to the 2008 meltdown was to transfer trillions of dollars out of the U.S. treasury into the portfolios of investment banks, insurance companies, airlines and automobile manufacturers, no questions asked. This corporate-based approach relied upon Reagan-style trickle-down economics, the repeatedly failed theory that wealth transferred to the highest echelons of the ruling classes eventually “trickles down” in the form of increased spending, economic activity and hiring to the middle- and working classes. Not surprisingly, this non-response response succeeded in one area: increasing the salaries and perks of corporate executives. Job growth has been non-existent.

When Bush’s invading armies failed to find weapons of mass destruction in Iraq, his administration’s answer was to claim that, in fact, they had. Obama’s economic strategy takes the same tack, repeatedly “talking up” the economy despite the hard evidence right before his listeners—in their paychecks or lack thereof—that there is little to brag about. Back in April 2009, Obama claimed that his pseudo-stimulus banker-enrichment program was “starting to generate signs of economic progress.”

The president stayed the course in 2010. “Make no mistake, we are headed in the right direction,” Obama said in July, while allowing: “We are not headed there fast enough for a lot of Americans. We’re not headed there fast enough for me either.”

January 2011: “We know these numbers can bounce around from month to month, but the trend is clear…The economy added 1.3 million jobs last year, and each quarter was stronger than the previous quarter, which means that the pace of hiring is beginning to pick up.”

Obama omitted the fact that the U.S. economy must add a net of 1.2 million jobs annually just to keep up with the increasing size of the labor force due to immigration and population growth.

June 2011: “There will be bumps on the road to recovery.”

Question two: What happens when you try to convince people who are suffering that, in fact, they are just fine?

Either Obama’s powers of persuasion are lacking or the American people have wised up. Whatever the reason, they don’t believe him. According to the Gallup poll, which asks whether respondents think the economy is improving or getting worse, the mood has become increasingly pessimistic along the bumpy road to recovery.

The Department of Labor announced this week that the U.S. economy had added a mere 18,000 jobs in June, a net loss of 82,000. Eight million jobs were lost during the 2008-09 debacle; some two to three million more since the “recovery” began.

The respected website Shadow Government Statistics currently places the real unemployment rate at 22.8 percent—equivalent to the worst months of the Great Depression of the 1930s.

With nearly one out of four Americans jobless and countless more underemployed, tensions are emerging between classes in this traditionally “classless” society in which both the rich and poor identify themselves as “middle class.” Though the wealthy always do better during tough times (well, during any times!), the gap is widening at an astonishing rate. “U.S. workers averaged $46,742 in 2010, up 2.6 percent from 2009,” according to USA Today. Bear in mind, with a real inflation rate (calculated the same way as inflation is calculated by other Western countries) of 11.2 percent, these workers are losing ground. Meanwhile, the paper noted, “average compensation among S&P 500 CEOs rose to $12 million in 2010, up 18 percent from 2009—and that’s not counting the potential multimillion-dollar value of stock or stock options, which are granted at set prices and provide holders profits as stock values rise.”

The numbers are jaw-dropping. John Hammergren, CEO of the McKesson healthcare services firm, received $150.7 million in 2010. Fashion maven Ralph Lauren paid himself $75.2 million. “Some of the gains are humongous,” said Paul Hodgson of GovernanceMetrics.

To the citizens of countries for whom $46,000 a year would seem like a king’s ransom, Americans’ resentment of CEOs who receive annual salaries on par with the gross domestic products of some nations no doubt seems petty if not a little silly. Yet they (and the CEOs) should ignore the prosperity chasm at their own peril. American politics, already more divisive as seen through such phenomena as the nativist Tea Party movement on the far right and the anarcho-libertarians of the left, will fracture further until the center (what center?) no longer holds.

Americans may be better off than most people on the planet. But they don’t feel like it. Perception becomes reality when people are scared.

The world cannot feel safe when its sole remaining superpower is falling apart at the seams. If patriotism is the last refuge of the scoundrel, militarism is the desperate last act of an oppressive government in a state of economic collapse.

At the core of the when-is-a-recovery-not-a-recovery question is vocabulary. What is a recession? How do we know when it’s over?

Beginning in the 1970s American economists began to define recession as being in effect when GDP falls during two consecutive fiscal quarters.

One result of this definition is that a recession is often not officially “declared” by mainstream economists until it is over—i.e., when GDP begins to rise again. This contributes to a strange reality gap: We are not in a recession until we are in a recovery. Effectively, then, it is rare for the American news media to state at any given time that the U.S. economy is then in a recession. Naturally, this contributes to the perception that newspapers and TV stations lie to them, and that they do so on behalf of an uncaring regime.

The 2008 collapse was exceptionally long. Nevertheless, this rule of the undeclared recession held. On December 1, 2008 the National Bureau of Economic Research declared that a recession head begun on December 1, 2007. They later declared it over as of June 2009. Thus a recession that had lasted one and a half years was only officially acknowledged for six months.

Moreover, the definition of recession is obviously faulty.

For most ordinary people, unemployment is the leading economic indicator. A secondary indicator is income.

Do I have a job?

Can I find a job?

How much can I earn?

The answers to those questions provide the most accurate indicators of economic health. When two-thirds of the economy (or 59 percent now) relies on consumer spending, who gives two figs about whether GDP goes up or down during two consecutive quarters? The fact that the press takes this non-people-based definition of recession seriously provides strong insight into its mindset: People are irrelevant.

“The average American does not view the economy through the prism of GDP or unemployment rates or even monthly jobs numbers,” top presidential advisor David Plouffe says, nearly sounding human. “People won’t vote based on the unemployment rate. They’re going to vote based on: ‘How do I feel about my own situation? Do I believe the president makes decisions based on me and my family?'”

Based on that assessment, Obama should start packing. He has not done anything that might have helped the unemployed: extending jobless benefits, forcing banks to renegotiate mortgages for homeowners, imposing national commercial and residential rent control, substantial tax credits for the poor and working class. And it shows: the consumer who lays the golden egg has no money to spend—and economic activity has all but ceased.

People are furious. But they are angrier at the thought that the rich are getting richer and that the president isn’t actively searching for solutions than they are about the fact that they can’t pay their bills.

Two years into Obama’s presidency “we are still treading water at the bottom of a deep hole,” summarizes economist Heidi Shierholz.

In the not-so-long run, however, things could get a lot uglier than the Democrats taking a beating in America’s November 2012 elections. The R-word—not recession, but revolution—could be in the offing.

Ted Rall is an American political cartoonist, columnist and author. His most recent book is The Anti-American Manifesto. His website is rall.com.

SYNDICATED COLUMN: Some Weasels Are More Equal Than Others

Liberal BS on Income Inequality

Everyone talks about income inequality, but no one does anything about it.

Lately they’ve been talking more than ever.

“The United States is the rich country with the most skewed income distribution, ” Eduardo Porter asserts in his upcoming book “The Price of Everything: Solving the Mystery of Why We Pay What We Do.”

Porter continues: “According to the Organization for Economic Cooperation and Development, the average earnings of the richest 10 percent of Americans are 16 times those for the 10 percent at the bottom of the pile. That compares with a multiple of 8 in Britain and 5 in Sweden. Not coincidentally, Americans are less economically mobile than people in other developed countries. There is a 42 percent chance that the son of an American man in the bottom fifth of the income distribution will be stuck in the same economic slot. The equivalent odds for a British man are 30 percent, and 25 percent for a Swede.”

For students of history and economics, this is shocking stuff. Europeans came to America in search of opportunity, for a better chance at a brighter future. How can it be that it’s easier to get ahead in Britain—famously ossified, rigidly class-defined Britain?

Yet it’s true. David Leonhardt of The New York Times writes: “Income inequality, by many measures, is now greater than it has been since the 1920s.”

According to Nicholas Kristof, also at the suddenly class-conscious Times, we live in a time of “polarizing inequality” during which “the wealthiest 1 percent of Americans possess a greater collective net worth than the bottom 90 percent.”

This, we are informed, is bad. Not just for us. Income inequality hurts everybody—including the rich.

Cornell economics professor Robert Frank notes the correlation between financial stress and social dislocation. “The counties with the biggest increases in inequality also reported the largest increases in divorce rates,” reports Frank. Children of divorce are more likely to become a societal burden, committing crimes against everyone, including the wealthy.

Frank argues that our quality of life is suffering across the board due to income inequality. For example, traffic jams are getting worse: “Families who are short on cash often try to make ends meet by moving to where housing is cheaper—in many cases, farther from work. The [U.S.] counties where long commute times had grown the most were again those with the largest increases in inequality.” Everyone sits in traffic, even millionaires.

The “middle-class squeeze,” Frank explains, pressures voters to vote against higher taxes that would support improvements in public infrastructure. We all pay: “Rich and poor alike endure crumbling roads, weak bridges, an unreliable rail system, and cargo containers that enter our ports without scrutiny. And many Americans live in the shadow of poorly maintained dams that could collapse at any moment.”

Is it wrong to giggle at the thought of selfish millionaires being washed away by a flood?

Citing the work of the British epidemiologists Richard Wilkinson and Kate Pickett, Kristof blames just about every societal ill on income inequality. Among the highlights: infant mortality, drug abuse, teen pregnancies, heart disease, even higher obesity among people who don’t eat more than others. This may be why high-unemployment Michigan has some of the nation’s fattest people. (The hormone cortisol, released when humans are stressed, increases fat retention.)

Porter notes that the income gap is increasing across the spectrum—including among high earners. One study shows that in the 1970s the top ten percent of corporate executives earned twice as much as the average exec. Now they get four times more. “This has separated the megarich from the merely very rich,” he says.

Rising income inequality means trouble. Not just for our waistlines, but for the system that has created the problem: corporate capitalism.

“If only a very lucky few can aspire to a big reward,” Porter warns, “most workers are likely to conclude that it is not worth the effort to try.” That would lead to less legitimate innovation, fewer new businesses. The best and the brightest will conclude, as they have in post-Soviet Russia, that crime is the only economic activity that pays.

So what is to be done?

Here the income-inequality-is-bad crew falls flat on its collective face.

Kristof’s prescription: “As we debate national policy in 2011—from the estate tax to unemployment insurance to early childhood education—let’s push to reduce the stunning levels of inequality in America today.”

Push? How?

Porter’s solution: “Bankers’ pay could be structured to discourage wanton risk taking.” But bankers aren’t the only culprits. How would this restructuring take place? Who would force bankers to accept it?

Frank’s answer: “We should just agree that it’s a bad thing—and try to do something about it.”

Workers of the world, try to do something about uniting!

I’m going to climb out on a limb here: The guys I’ve quoted are all smart. They know exactly what is causing this relentless increase in income inequality. Ruling elites have exploited globalization and technological advances to increase corporate profits through deregulation, union busting, and lobbying for federal subsidies and tax benefits. We’re witnessing exactly what Karl Marx predicted at the dawn of industrialization: capitalism’s natural tendency to aggregate wealth and power in the hands of fewer people and entities, culminating in monopolization so complete that the system finally collapses due to lack of consumer spending.

The pundits are also smart enough to know that there’s only one way to equalize income: revolution.

Increasing riches leads to increasing influence. No matter how nicely we ask, why would the rich and powerful give up their wealth or their power? They won’t—unless it’s at gunpoint.

Nothing short of revolution stands a chance of building a fair society. Not “pushing.” Not “restructuring.” If working within the Democratic Party and the election of Obama prove anything, it’s that reform within the system is no longer a viable strategy for progressives.

We’re way past “trying to do something about it.”

The sooner we start talking about revolution, the closer we’ll be to a non-BS solution to the social and political ills caused by inequality of income.

(Ted Rall is the author of “The Anti-American Manifesto.” His website is tedrall.com.)

COPYRIGHT 2011 TED RALL