If Romney Loses, Blame His Running Mate

Unless something surprising and dramatic happens, Obama will win the election. Earlier this week the Associated Press released an analysis of public and private polls that put “within reach of the 270 electoral votes needed to win a second term.” Obama is running ahead in many major swing states, including Ohio—a necessity for a GOP candidate to win. Yeah, yeah, this week’s presidential debates could make a difference—but they rarely do.

What went wrong with the Romney campaign? (Insert the usual fat-lady-not-over-blah-blah-anything-could-happen disclaimer here.)

All things being equal, this should have been a cakewalk for Romney—or any half-decent Republican. The economy is still awful. The official unemployment rate is over 8%, a magic number that historically kills reelection campaigns. Since Obama hasn’t promised any big jobs programs, neither Hope nor Change is on offer. And Romney has/had a sales pitch tailored for hard times: he turned around companies; his business experience will/would help him turn around the U.S. economy.

This election is/was Romney’s to lose—and apparently he has. The cause can be summed up in two words: Paul Ryan.

Sure, there were plenty of other missteps. His bizarre “47%” remark turned out to be a game changer that alienated swing voters. Like the (unfair) story about how George H.W. Bush was so out of touch that he’d never seen a supermarket price scanner (no wonder that preppy pipsqueak didn’t care about Americans who’d lost jobs under the 1987-1992 recession), Romney’s 47% slag fit neatly with our overall impression that Romney is a heartless automaton of a CEO who doesn’t feel our pain. Worse, he’s a man with something to hide; his refusal to release his taxes proves it.

Though greeted by Very Serious pundits as a canny combination of intellectual heft and Tea Party cred, the selection of running mate Paul Ryan has been a bigger disaster than Sarah Palin in 2008. (To be fair to John Cain, Palin was a Hail Mary pass by a campaign that was way behind.) As Paul Krugman pointed out in the New York Times, the selection is beginning to shape up as a “referendum” on the legacy of the New Deal and the Great Society, on Social Security, Medicare and, yes, Obamacare, which represents an extension of that legacy.”

Which is Ryan’s fault.

Before the veep announcement, the campaign was a referendum on Obama’s stewardship over the economy. Which was good for Romney. Since August it has been about Paul Ryan, known for his plan to trash reform entitlement programs. Misfire! The one time you don’t attack the safety net is when people are feeling squeezed and pessimistic about the future.

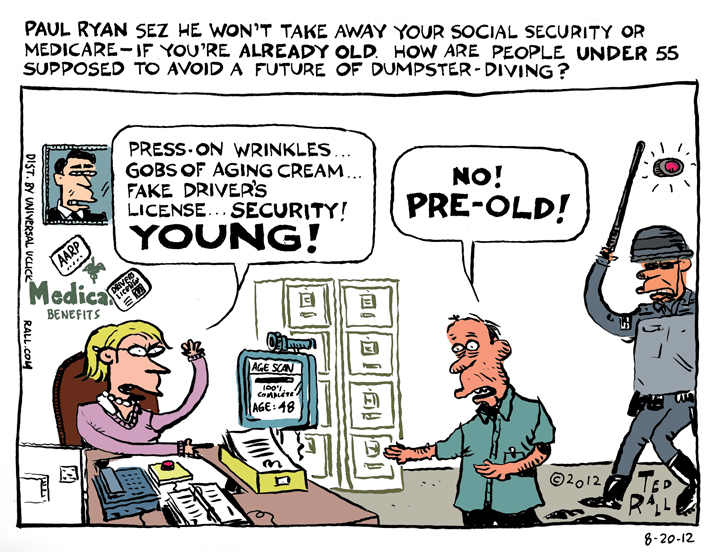

Sensing resistance, Republicans walked back Ryan’s extreme agenda using the classic “divide and conquer” approach, guaranteeing that people over 55 would keep their Medicare and Social Security. No sale. Romney-Ryan forgot something: senior citizens have children and grandchildren. Older Americans want younger people to enjoy the same benefits they’re getting now. Many senior citizens no doubt see the slippery slope of austerity: taking away Social Security for people under 55 next leads to going after those over 55. Finally, with the U.S. Treasury squandering trillions of dollars on wars, it’s hard to argue that the sick and old ought to resort to Dumpster-diving.

The Romney–Ryan campaign understood that voters were pissed at Obama. But they didn’t understand why.

There were two types of anger against Obama. Mostly prompted by Obamacare, right-wingers hate the president for growing an intrusive federal government. But there is also liberal resentment—shared by many moderates—at Obama’s refusal to help the jobless and foreclosure victims. Lefties also dislike Obamacare—but because, minus a public option, it’s a sellout to the insurance conglomerates. Romney could have seduced these voters with his own plans to help the sick and poor. Instead, he went with Ryan—who would destroy programs that are already too weak—and frightened disgruntled Democrats back into Obama’s camp.

Romney ignored the time-tested tactic of moving to the center after winning your party’s nomination. Romney repackaged himself as a right-winger to win the GOP nomination. In the general election, he needed to appeal to Democrats and swing voters. Choosing Paul Ryan sent the opposite signal.

This is not to say that President Obama will have an easy second term. Unlike 2008, when the vast majority of Americans felt satisfied that they had made the right choice, Obama is only likeable enough (the words he used to describe Hillary Clinton) compared to Romney. The only reason Obama seems headed to victory this November is that he was lucky enough to run against one of the most staggeringly inept campaigns in memory, headed by an unbelievably tone-deaf plutocrat.

(Ted Rall‘s new book is “The Book of Obama: How We Went From Hope and Change to the Age of Revolt.” His website is tedrall.com. This column originally appeared at NBCNews.com’s Lean Forward blog.)

COPYRIGHT 2012 TED RALL