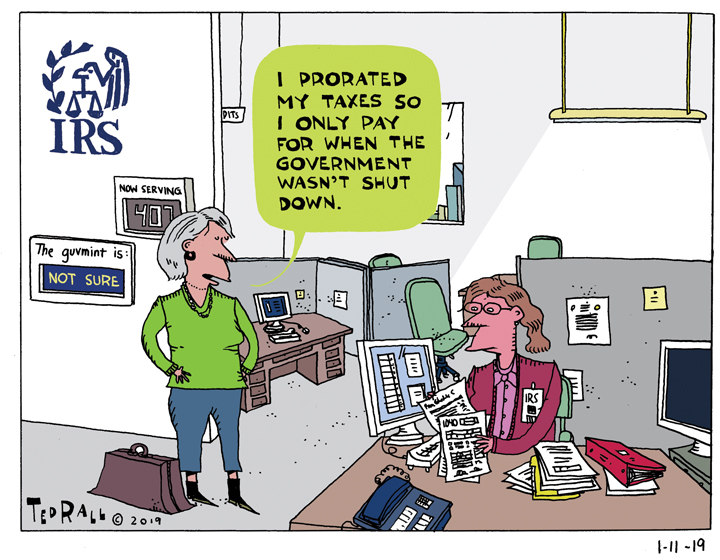

A standoff over a border wall between Congressional Democrats and Republicans has led to a government shutdown of various agencies. Surely Americans who are denied services shouldn’t have to pay their full taxes.

We Didn’t Get a Full Year of Government This Year. Why Should We Pay a Year of Taxes?

6 Comments. Leave new

From what I’m given to understand, Ted, the IRS is one of the US governmental agencies most affected by the shutdown. But not to worry – the US military’s ability to make war on all and sundry, despite the absence of a congressional declaration of war, as mandated by the US Constitution, remains unaffected….

Henri

Another crushing abandonment of the people by a government submitting to extortion.

When Obama submitted to the extortion of finance capitalists, millions lost their homes to foreclosure while the criminal capitalists took performance bonuses out of the 26 trillion dollar welfare payments made to the exploiters to keep them solvent.

Now the most explicitly capitalist government thinks nothing of bringing federal workers more of the same.

If only these two parties could strangle each other, so that a government designed to serve living working people (instead of dead fictitious capital) could be implemented, one regulated to serve the interests of working people, these who are the real creators of wealth, instead of the extorting and exploiting parasites who now live fat and happy on expropriations from working people.

The IRS was slashed long before the shutdown so the rich and corporations have plenty of room to play fast and loose with their taxes

Here are some excepts from the IRS story on ProPublica

An eight-year campaign to slash the agency’s budget has left it understaffed, hamstrung and operating with archaic equipment. The result: billions less to fund the government. That’s good news for corporations and the wealthy.

Without enough staff, the IRS has slashed even basic functions. It has drastically pulled back from pursuing people who don’t bother filing their tax returns. New investigations of “nonfilers,” as they’re called, dropped from 2.4 million in 2011 to 362,000 last year. According to the inspector general for the IRS, the reduction results in at least $3 billion in lost revenue each year. Meanwhile, collections from people who do file but don’t pay have plummeted. Tax obligations expire after 10 years if the IRS doesn’t pursue them. Such expirations were relatively infrequent before the budget cuts began. In 2010, $482 million in tax debts lapsed. By 2017, according to internal IRS collection reports, that figure had risen to $8.3 billion, 17 times as much as in 2010. The IRS’ ability to investigate criminals has atrophied as well.

Investigations of People Who Don’t File a Return Have Plunged

Corporations and the wealthy are the biggest beneficiaries of the IRS’ decay. Most Americans’ interaction with the IRS is largely automated. But it takes specialized, well-trained personnel to audit a business or a billionaire or to unravel a tax scheme — and those employees are leaving in droves and taking their expertise with them. For the country’s largest corporations, the danger of being hit with a billion-dollar tax bill has greatly diminished. For the rich, who research shows evade taxes the most, the IRS has become less and less of a force to be feared.

The story has been different for poor taxpayers. The IRS oversees one of the government’s largest anti-poverty programs, the earned income tax credit, which provides cash to the working poor. Under continued pressure from Republicans, the IRS has long made a priority of auditing people who receive that money, and as the IRS has shrunk, those audits have consumed even more resources, accounting for 36 percent of audits last year. The credit’s recipients — whose annual income is typically less than $20,000 — are now examined at rates similar to those who make $500,000 to $1 million a year. Only people with incomes above $1 million are examined much more frequently.

The rest: https://www.propublica.org/article/how-the-irs-was-gutted

Lincoln would no doubt be overjoyed to see that government of the rich, by the rich, and for the rich has not perished from the Earth. So long as the military – and the military industrial complex – gets its due, god’s in his heaven and all’s right with the world….

Henri

Eh, yeah – how come congresscritters get paid during a shutdown? We should cut off their salaries until such time as they go back to work. Most of ’em are millionaires anyway, they could miss a paycheck more easily than, say, a park ranger.

For that matter, how about we only pay them for the days they actually show up AND accomplish something even when there is a budget? That’d trim some fat out of the budget.

Those of us who were paying attention know that Herr Drumpfenstein said he’d be “Proud” to shut down the government. Absolutely he is, it reinforces his opinion of himself as being a Real Important Guy. He doens’t give damn about all the pain and suffering he’s causing – it’s all about him. As usual.

The best thing congress could do for the country would be to pass a budget with enough voters to override the Preznit. His tiny, little, brain might explode. Good times!

The Sixteenth Amendment is the worst thing to happen to American citizens.

Prior to the Sixteenth, the Federal Government had to beg tax money from the States and justify its spending to the States before funneling State taxes collected from their citizens to the Feds.

If the Federal government wanted more money from the States than the citizens thought was reasonable, the State legislatures could judiciously choose what of Federal government spending to fund, knowing that later the State legislatures would face the States’ citizens in State elections and have to justify their funding decisions to their electorate.

Now, after the Sixteenth, the States have to beg and justify their own spending on their citizens to the Federal government to receive allocations from the Federal government, who now tax citizens of the States’ directly, and with MUCH LESS accountability.

I like the idea of having an elected State legislature standing between the citizens of the States and the IRS, rather than an accountant, for a fee I can afford, who may or may not be able to navigate the ever-changing myriad legislative loopholes purchased by the wealthy with campaign donations.