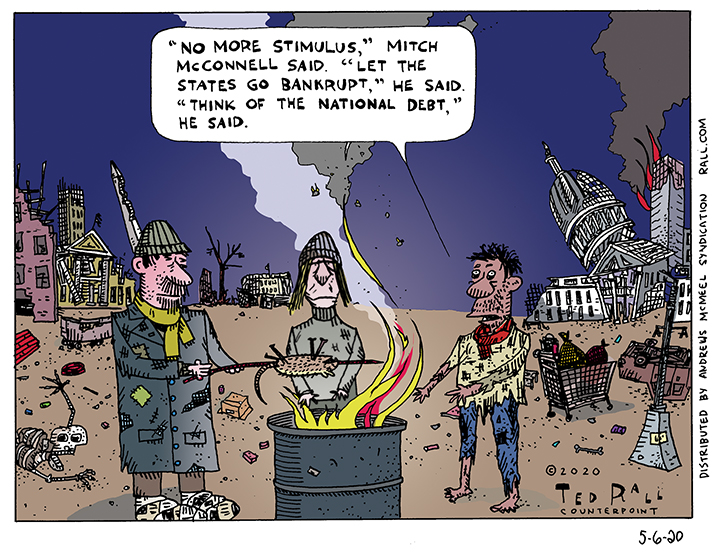

Senate majority leader Mitch McConnell insists that economic stimulus should either halt or slow down due to concerns about the deficit. What kind of world, he asks, will our children and grandchildren inherit? Not a good one if he gets his way.

The Country Is Gone but At Least We Don’t Have a National Debt

6 Comments. Leave new

I freely admit my knowledge of macroeconomics isn’t as good as it should be, but if I have my cipherin’ right:

1. the U.S. debt is past 100% of GDP.

2. the usual cut-off point for creditors is usually 75% or so?

3. the willingness to continue to accept U.S. debt is because the U.S. economy keeps ahead of its debt.

And now we’re right at the edge of a global depression. I type global because once the U.S. goes into a depression, we’re dragging everyone with us. Without our constant buying, China’s in for a hell of a surprise. We’re the shirt sleeve that just got caught in the machinery. My earlier prediction was that we’d hit 25% unemployment (officially declared) around May 7, so I’m looking forward with a lot of unease to this week’s stats.

I hope Pelosi’s got lots of ice cream in that $22,000 refrigerator. And I hope all the readers of Ted’s site are stockpiling rationally. You don’t need 600 rolls of toilet paper. You do need some spare toothbrushes and some extra tubes of toothpaste. Bar soap? It’s not like you won’t go through it eventually. And so on. Don’t buy lots of salty snacks.

The issue of money from the Federal Reserve is not dependent upon the issue of debt instruments.

When the Bankers needed 20 Trillion Dollars to bail them out from their reckless gambling debt there was no delay pending the sale of Treasury Bills, the locus of National debt.

The issue of money and the issue of national debt by the Fed are not necessarily and intrinsically linked.

Economics poses as a science but it lacks the analogs of conservation of energy and conservation of mass, neither of which (unlike value) comes into existence based on a wish or a belief.

Economics is not bound by science but by belief, the same as religion and political theology.

Like Peter Pan, without popular belief money goes out of existence. Only the guns and prisons are left to challenge heretics who refuse to see what is not there and what political theology says is there.

Without its backing by state violence USA currency would only be as useful for wall paper as is the currency of the Confederate States of America.

I’ve been expecting the collapse of the US within my lifetime ever since the collapse of the USSR.

Like two cards leaning against each other, no card can stand on an edge without leaning against another card.

Pull one card away and the other will fall.

This explains the efforts the Clintons both made in maintaining the Cold War.

There are limits on real world economics, farmers can only grow so much per year and factories can old build so many items per year but I agree dollars, euros…ect for the cost of a little electricity be “minted” all day and night. The rich collect the digital dollars through their rents and investments and pay a fraction to their workers. A small amount is used for luxuries, the rest is used to invest and it means a few thousand people have most of the wealth in the nation and can unduly influence politics. When the digital dollars get crushed by a bad market or a disaster they are taken out of the system. The old school eccon cult would say their should be suffering to force wiser choices next time. The investor may have to cut way back on luxuries but it is the workers that suffer the most.

When “Senate majority leader Mitch McConnell insists that economic stimulus should either halt or slow down due to concerns about the deficit,” what he really means is that whatever mistakes may have occurred to give a pittance of relief to the 99.99% of the population during the pandemic will NOT be repeated.

The massive amounts already given to the <0.01% face no such limititation on future installments.

Jack Rasmus, one of the few economists worth reading or hearing, suggests (in his 01May podcast -at following link- JR Podcast ) that the current stimulus is radical in three aspects:

1) its magnitude

2) the unprecedented expansion of the Federal Reserve mandate to use it to bail out NON bank corporations***

3) the pre-emptive nature of the bank bail outs as said banks are officially still solvent

The attitudes of the US and UK governments amid the pandemic has been characterized by Chris Floyd as: “They cannot countenance any effort to save the lives of worthless peasants if it might possibly inconvenience the lives and profit margins of the elite in any way.”

————

*** this keeps the cost of the revered “socialism for the hyper-rich” off the debt ledger, belying the distracting argle-bargle of Sen (M.M.) Turtle in regards “national debt” which no one at his level has ever worried about until the “enlightening” factor of the current pandemic has him, and his vile ilk, worried about the “worthless peasants” angrily realizing that they pay the price of capitalism’s excesses.

O, you will have a national debt alright, Ted, but creditors will never be paid, Isn’t that what Mr Trump and some of those far-seeing Congressmen in your country are suggesting – defaulting on the Treasury bond debt to China ? Another smart move by those «stable geniuses» who populate the upper echelons of political life in the US….

Henri

Well, I nailed it. May 7. Right on the button. I have never been less pleased to have been correct. As of May 7, we are now beyond the real unemployment experienced at the depth of the Great Depression. And we aren’t even close to the end of how many will become unemployed. (I keep waiting, every day, for the metaphorical hand on my shoulder.)

Here’s the link to the May 7 article from Fortune magazine: “Real unemployment rate soars past 24.9%—and the U.S. has now lost 33.5 million jobs”

Friends, again, if you can, start stockpiling some essentials. Rice, beans, pasta, sauce, toothbrushes, underwear, socks. You may find a machete or a baseball bat to be a prudent investment at this time, too. I’d also suggest doing a lot of free book downloads off the internet.

What? You say the internet isn’t going to shut down at some point? Right. And the economy is never going to collapse. Totes unpossible.