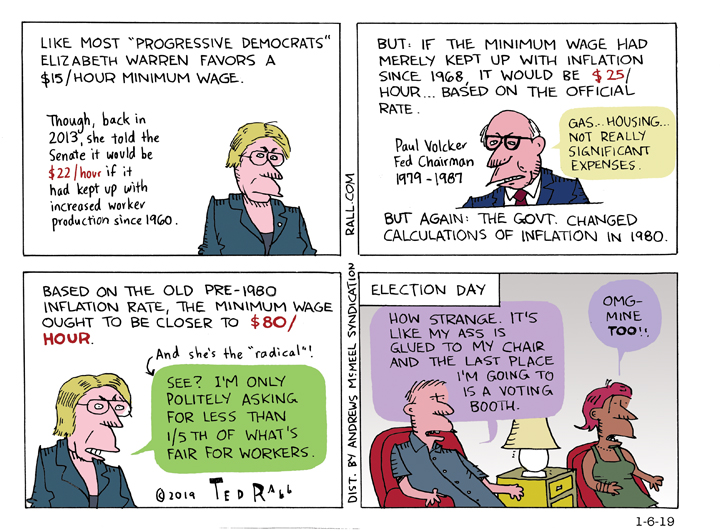

Elizabeth Warren wants $15 an hour minimum wage, even though she herself says it ought to be $22 an hour. And if you calculate what it would be if we accounted for the actual inflation rate, even the “radical” Warren comes up woefully short of what workers need and deserve.

Progressive Democrats Like Elizabeth Warren Want a Higher Minimum Wage That Is Way Too Low

10 Comments. Leave new

Buh-buh-buh $80 an hour would mean I could afford a home and fund a retirement. You fucking communist. Next you’ll want everyone to be able to read and write! It’s people like you that are the problem, with your putting people ahead of profit. Go back to Massachusetts, pinko.

Applause!

Funny, but be careful, Alex.

Some of the New McCarthyite Righties hanging around here might not be slick enough to catch your humor.

While I agree with the premise – everyone should get a living wage – I question the 80 / hr figure. That’s $164,000 / year. The US median income is $59,039.

Hell, I’d work at McBurger’s for 164 K.

CrazyH,

I think the math supports $80/hr. The current “wisdom” is that you will need a retirement account of $2 million for what could be a 30-year retirement.

So let’s say you make $80 an hour. My deductions (tax and otherwise) before I even get “my” money is about 1/3. So call it $55 an hour. Times 2,000 hours in a workyear: $110,000.

So let’s tote up the minimums: transport, food, rent/mortgage, utilities, clothing, unavoidable incidentals, etc.

(At this point, I went online and found a national average as given by ValuePenguin. Perhaps other statistics are available, but this is the first one that came up on Google, and I don’t want to be guilty of fishing for stats. I have no idea what’s coming.)

Housing, $10K. Transport, $9K. Utils/Household operation costs, $7K. Food, $6.6K. Entertainment: $2.5K. Clothes: $1.6K. Vices/Miscellaneous: $0.6K.

That’s $38,000 a year, just on what I’ll call the baseline. So now we’re at $72K left.

TIAA says that at least–AHEM, “AT LEAST!!!!”–20% of each check should go to retirement. So let’s be prudent and make that 25% (or $18K). So now we’re down to $54,000.

Now things get a little vague. Average credit card debt? $6,500 (at, call it, 16%).

Average amount of student loans this year? $40,000. That’s eight years at $500 a month (with a 5% loan). So that’s $6K a year for almost a decade. That’s about another $100 a month for eight years. So take off $7,200 a year for eight or so years: $32,500 left.

So $32,500 to $40,000 a year all for you after you’ve paid the essentials and the not-really essentials but nice all the sames?

Okay. Here’s something from an NPR article: “The cost of putting a parent into professional assisted-living care can be daunting. MetLife says that kind of care averages about $42,000 a year. A private room in a nursing home averages more than $87,000.”

You’re now, AT LEAST!!!, two grand in the hole. And you make $80 bucks an hour. I didn’t even get to owning a pet. It’s a little over a thousand. Until the day the cat’s teeth have to be pulled because they’re rotten (cat teeth rot from within) or your six-year-old dog gets cancer and you don’t count the cost and put $3,000 on the credit card without hesitation because the dog is ALWAYS happy to see you?

And what about kids? The actual two-legged version? A lunch box? A My Little Pony backpack because that’s what Jane Smith has and your daughter hates her and hopes she dies? What about John Smith’s karate lessons? The second car eventually and all the clothes? Don’t forget tuition at a high school that will help improve your kid’s chances of getting into a top-tier school. Christ, I haven’t even thought of all the Christmas presents and birthday parties and all the other goddamned expenses that a kid will spring on you? What about–I WANNA GO TO MCDONALD’S. I WANNA GO TO MCDONALD’S!–all that? Don’t forget braces. And don’t forget all those cookies and chocolates you’re going to have to buy to fund the activities at the school because you don’t want your kid raped in some stranger’s house trying to sell a box of pralines to fund the high school production of Romeo & Juliet.

I live small. I don’t live small because I want to. I’ve conditioned myself to do it because I cannot survive any other way. Salaries are stagnant. People look at me when I ask about whether there are raises or bonuses. I’ve stopped talking to a lot of people older than me because many of them, somehow, have trust funds or got in on the end of the gravy train–the Baby Boomers took care of their entire cohort, it seems–and don’t seem to even comprehend that a lot of Gen Xers have been working for a pittance pretty much since they started working. I’d love to have a car. I’d love to have a one-bedroom apartment in New York somewhere. On my salary (when I have a job), the cheapest one I can find that would actually be livable runs to about 75% of my after-tax salary. A car? Bless my soul, not with insurance premiums what they are. I have tens of thousands in student debt. I have about $10K in credit cards (thanks to being laid off and–spendthrift that I am–tapping into my 401k after running out of all other money sources). I am about eight months behind on my rent, but my landlord understands and isn’t going to bounce my ass out the door until April.

$80 an hour? That actually sounds pretty damned minimum to me.

Oh, c’mon Alex – I watch TV. I know that young New Yorkers can afford spacious, well appointed condos with a view overlooking … uh … water of some sort.

Water? Why, when I was a lad, we had to live in a folded up bit of newspaper at the bottom of a lake

All the billionaire freeloaders would scream like babies if their incomes were scaled back to pre-1980s levels, while the wages of the real wealth producers were being scaled up to that level.

Imagine the horror the freeloader’s lives would have been without Obama’s $26 Trillion welfare package of post-2008. It makes me feel all warm and fuzzy just to think of it.

The Dem’s need to come up with a plan to boost bottom 75% of the income scale to break down resistance.

Opposition to 15 dollar per hour (dph) min wage comes from several directions, one of them is workers that are one are two steps up the ladder, making 18 to 25 dph. Often the 18-25 dph workers had to take student loans to get the degree that was required to land their curent position. The 18-25 dph crowd living in a high employment areas with high prices looks at their budget: loan payments, rent, transportation, high health care premiums and copays often means having to delay medical or dental treatments….they feel so close to the edge they are sensitive to any threat. The fear is that minimum wage gains will come at 18-25 dph workers expense through frozen wages, staff reductions dumping more work on them and price increases. A 15 dph min wage also lowers the value and status of a four year degree if it only makes an extra 3-10 dph.

Helping the bottom 75% could take many forms: loan redcutions, making sure corprate raiders don’t drain retirement funds, housing and other assistance based on local prices that fades out as you move up. Fast commuter rail projects that can allow more moderate wage workers to find a small clean apartment in a place they can afford.

A separate minimum wage for community college degrees…say 18 dph….a four year degree….21 dph…a six year degree…..you get the idea. Of course that opens a can of worms, would having a six year degree in a low demand field make a person even less employable than the current situation. You could tell people to avoid low demand degrees but with A.I. gaining ground and outsourcing, today’s high demand field could turn into a field to avoid in decade.

Many people could up with ideas to benefit the majorly but the fear of losing big donors will drive the political parties to crush or totally water down any plan to aid the majority.

> The Dem’s need to come up with a plan to boost bottom 75% of the income scale

Plan A involves the 1% and Dr. Guillotine’s Patented Headache Remedy.

Plan B is still in committee.

Baring a total economic meltdown by the time trickle up economics has drained the masses and filled the streets with angry mobs that given up on the blame game.The 1% will have robotic security forces to deal with the masses.

The blame game, good old fashion divide and rule:

Blame the poor (lazy), undereducated (not ready for todays jobs), overeducated (don’t understand the common man) immigrants and outsiders (often brought in on work visas by the 1%), too much regulation, lazy infective government workers or all the other groups the 1% want us to vent our anger against.