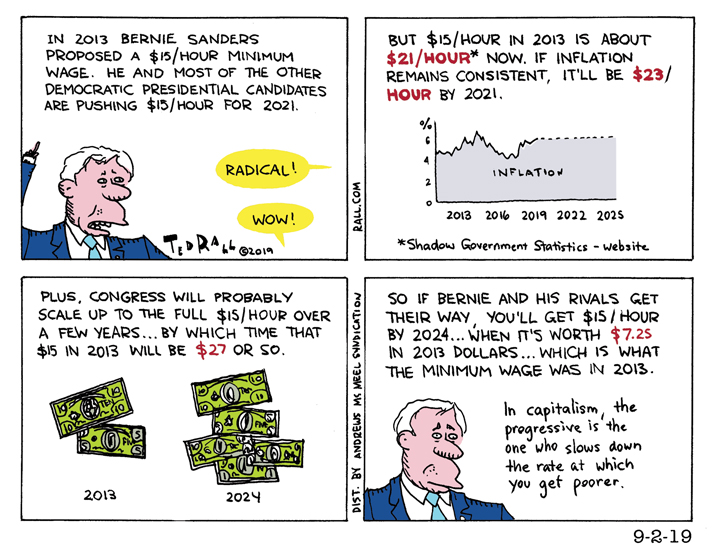

On the issue of the minimum wage, no top contender for the presidency has been as aggressive as Bernie Sanders. But for workers, that’s not nearly enough. For the last six years, Sanders has been pushing a $15 an hour minimum wage. That’s a major improvement over the current rate but it’s not nearly enough to keep up with inflation. Even under Sanders, workers would, at best, fail to lose more ground. They wouldn’t gain anything. Just another case study of how capitalism is not reformable.

Bernie Sanders Is the Best on the Minimum Wage and It’s Not Near

16 Comments. Leave new

Whatever would Karl Heinrich say ?…

Henri

Ted,

Excellent points. However, this is one of those issues that is about more than what it’s about.

After decades of wage stagnation (going by your numbers, it’s more like wage shrinkage) the people are conditioned to think that not getting raises is just simply how it is. And they’re right. Unless you’re in a union, you usually get a nothing raise.

If Sanders got up there, today, and said the minimum wage had to go to $27, it would be politically impossible. Why? Well, when Sanders started with $15 back in 2016, the dipped-in-blood-to-her-eyeballs war criminal Hillary Clinton pushed back with $12. And her vapid gang of supporters nodded their heads about how fair that was and the DNC anointed her for the queenship.

Even I, the crazy guy who thinks everyone should have healthcare, accept that there’s a technique to getting certain things. Sanders is trying to get the voters to understand how well and truly effed over they’ve been all these years. $15 is still a pittance, agreed. But if he goes much higher, all the slaves in their chains will look at each other and say, “Oh, he’s crazy. We have to vote sensibly, for small incremental change over many years. We can’t waste our votes on someone who isn’t realistic.”

Capitalist economists try to emulate physicists. With their use of mathematics they present economics as a science, even a natural science, which it’s not.

Physics assigns numerical value to energy and mass successfully because of the law of conservation of mass and the law of conservation of energy (and the equivalence of mass and energy) that makes physics mathematically calculable.

If a pound-mass ( 0.4535924 kg) varied from day to day and from place to place, the science of physics would fail for its mathematical inconsistency. The “science” of economics is a fraud for this reason.

THERE ARE NO LAWS OF CONSERVATION OF VALUE FOR EITHER MONEY OR GOODS IN THE PSEUDO-SCIENCE OF ECONOMICS.

The valuation of money and goods are merely manipulated beliefs, as variable as beliefs in gods and angels. It is not, however, without consequence as a “truth of the mob” if this fraud is held to be true by holders of a currency.

But the fraudulent use of complex mathematics is merely the means used to move understanding of monetary value beyond the reach of those who labor to earn money, in order to facilitate the inequality of exchange that makes the extreme wealth of the wealthy who profit from “unearned income” and the declining wealth of the many who are paid an “earned income” for their labors.

If inflation is assumed (to make this explanation easier) to be a straight line at 4% annually and raises are given once annually in a stair step of 4%, a wage increase for the wage earner will fall behind because the value of the dollar falls behind the 4% straight line on the first day after the raise.

The annual wage increase to 4% meets the line of 4% annual inflation at only one point in time (on the day of the raise) and then falls beneath the line the day after the wage increase.

In order to not fall behind, the wage would have to increase continually each day (not once annually) in order to not lose value.

One way to maintain parity with inflation would be a “bonus” that accrues periodically (say monthly) to make up for earnings lost to inflation in each month after the raise.

The area bounded beneath 1) the line of inflation and 2) the fixed wage line and 3) the stair step increase, would need to be paid to a worker in order to maintain the real earned income value.

If the 4% wage increase is given at the start of each year instead of at the end of each year then the wage earner would always be slightly ahead of inflation instead of slightly behind, yes?

A wage increase at the beginning of a time period would be a response to a prediction of a future value relative to a present value, whereas a wage increase at the end of a period would be response to a measurement of past value to a present value.

The point I was trying to make is that to stay at a fixed wage over a period of time would require compensation that would track inflation on a continuous basis rather than a onetime wage increase of X% to match an X% inflation rate at only one point in time, the time of the annual wage increase.

The deviation the dollar value would have to be made up continually in order to avoid the real wage value falling behind. Or alternatively, periodically compensate wage value loss with a onetime payment.

If a 4% inflation was known to occur in a period of time, then an 8% wage increase would be needed in the middle of that time so that the wage dollar value gain made during that period would match the real wage dollar value loss.

Draw a straight level wage line describing the fixed number of dollars to be paid annually.

Draw a line representing a 4% inflation rate line sloping up above the wage line.

At the midpoint of the 4% inflation line draw a vertical 8% stair step increase of the wage line above the 4% inflation rate line, and continue the new wage line to the end of the period of time for this example.

There will be two triangle areas, one showing an increase of real wage value and another showing loss of real wage value.

When the 8% wage increase triangle area above the inflation line is equal to the dollar value loss triangle area due to inflation are of equal area, the wage value increase is equal to the wage value loss, and the real wage has held steady over that time period.

The conspiring wealthy (See Adam Smith) will say everything is getting cheaper because of the continuous decline in real wage value and so wages do not need to increase to maintain labor’s standard of living.

They lie.

Of course, one more thing to keep in mind is that minimum wage is exactly that: minimum wage. It’s as low as you can go (with a few exceptions, like table-waiting). There’s a lot of dirty tricks the companies pull (like staggered shifts, cutting your shifts, keeping you under a certain number of hours to prevent you from getting full-time status, etc.) but I don’t think I’ve ever worked a job that was, literally, minimum wage because even a shitty boss realizes that he is giving the employee absolutely no motive whatsoever to stick around.

@Ted, I am curious to know what measure of inflation you are using; I bet it is not aggressive enough and that your point is even stronger than you realize! When measuring, say, defense spending or healthcare spending, it is almost always measured as a percentage of gross domestic product (GDP), rather as compared to some measure of inflation. That’s because there are a number of reasons we expect prices to change, inflation, productivity, and technology — GDP incorporates all three but inflation does not. (For example, having wages keep up with inflation makes sure that you can buy as many video cassette recorders (VCRs) as you could buy 20 years ago, but because of increases in technology, who cares how many VCRs you can buy now? — the real question is whether you can buy the new and improved technology that everyone who used to have a VCR now has. GDP captures that automatically in every case but measures of inflation have to be tweaked case by case and never capture the full effect.)

Dividing GDP by the population of the country gives Per Capita GDP. You would ask have minimum wages grown percentage-wise as quickly as Per Capita GDP? (Sneak peek: heck no!) If not then even if our minimum wages were keeping up with the VCRs, they would nonetheless not be keeping up with the technology and productivity improvements that benefit the general population.

Point may be good, but the math is off.

$15 in 2013 is $16.52 today.

http://www.in2013dollars.com/us/inflation/2013?amount=15

From: https://www.multpl.com/us-gdp-per-capita/table/by-year

12/31/2012 nominal per capita GDP: $51,945.49

12/31/2018 nominal per capita GDP: $63,696.80

That’s an increase of 22.62%. (That is, the country is producing 22.62% more per person.) If $15 increased as much that would be $18.39.

Yep – the increased wealth is most definitely not evenly distributed. The rich get richer and the poor vote them into office.

Looking further back: the minimum wage was first set 10/1/1960, to $1, at least in the state of New York. The nominal per capita GDP then was $2,969.28 (12/31/1960). The nominal per capital GDP is now $63,696.80 (12/31/2018), which is 21.45 times as big. To keep up, the minimum wage should have increased to $21.45 over that time period.

Hey, Lee – not sure where you’re headed here, but your math is good so I’m happy to bat it around.

Increased productivity & technology gains lead to decreased prices, I can buy a computer today for a $100 that would have cost $10,000 in 1989.

That would tend to argue for decreased wages as the GDP increased – as I can now buy more with the same wages.

I am not arguing for such, merely playing with the math. I am for distributing the increased wealth a little more evenly: A rising tide raises all boats. (Corollary: if it doesn’t raise all boats, it’s not a rising tide)

Regardless of the details, the CPI accurately reflects what it costs to live. Maybe I can buy a fancier computer, but I still need food to eat and a place to eat it. Those prices are most definitely increasing faster than my wages.

@CrazyH, Yes, you provide a good example. Perhaps it is the case that the $10,000 computer now costs only $100, but you are carrying a $1,000 iPhone in your pocket instead. If minimum wage goes with the $100 figure for the current price then you are left much further behind the general population than if it instead included the $1,000 iPhone. (I am not arguing that minimum wage should support an iPhone; merely that if it used to support, say, 10% of a lifestyle that included a $10,000 computer then it should now support 10% of a lifestyle that includes a $1,000 iPhone, not 10% of a $100 piece of equipment that no one uses anymore.)

@Lee – so what would you do in a recession?

If wages were rigidly tied to the GDP, then wages would be cut to compensate as the GDP dropped. That would exacerbate the problem since one of the causes of a recession is a drop in consumer spending.

Just ‘kicking it around’ – it’s an interesting idea. I like the idea of the common man’s wealth increasing in direct proportion to the growth of the economy.

Some argue that under Communism, we’d divide the GDP by the population and give everyone an equal piece. Marx himself did not believe this was a desirable goal – and neither do I – but we could certainly use a lot less inequality.

National minimum wages…no…minimum wages should set locally, the cost of living varies too widely to be covered by one number..

The Federal Government and or the courts should monitor localities that drag their feet on providing a modren minimum wage and overule them when necessary.

How to set the wage:

Two people sharing a no frills clean studio apartment and no frills life style should be able to make it on two full time minimum wage jobs…without getting second job/gigs

So add up the numbers……

Rent check

Utilities check

Food….check but dining out should be a very rare event

A basic clothing budget…check

Basic transportation…check the cost of a public transit pass, older cars in areas with little or no public transit

Health care YES

Lastly on list: A few dollars left over at the end of the month: Freedom means that some workers will save wisely ( to be ready to move to a better job or an unexpected expenses) others will spend all of it every month.