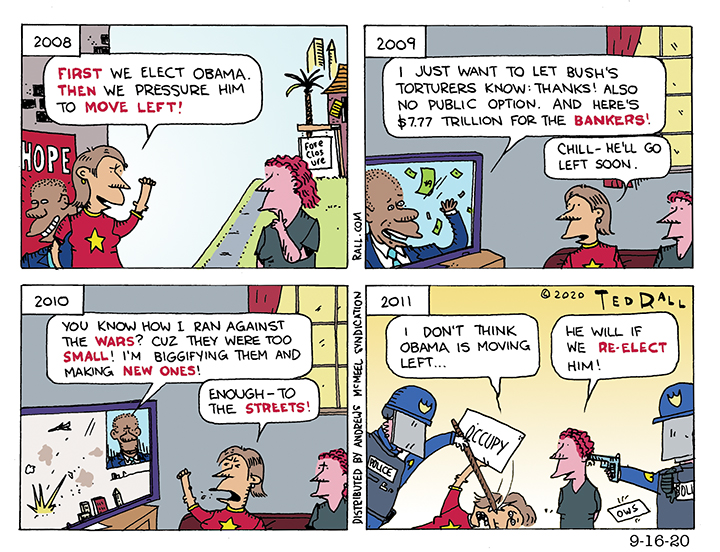

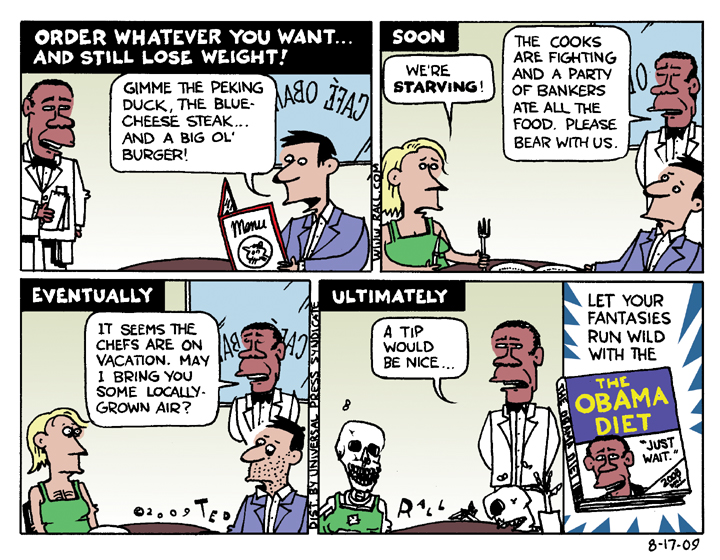

Some liberals see politics like football, in which moving the ball closer to the goal means you are winning. Thus they are encouraging progressives to vote for Joe Biden, arguing that Biden’s centrism would be an improvement over Trump. Biden, they say, can be pressured more easily from the left than Trump. But that’ds not at all what happened when Biden’s boss was president.

SYNDICATED COLUMN: Get Pissed Off and Break Things

Why Are Americans So Passive?

There’s a reason “Keep Calm and Carry On” is everywhere. When people lose everything — their economic aspirations, their freedom, their privacy — when there’s nothing they can do to restore what they’ve lost — all they have left is dignity.

Remember Saddam? Seconds before he was hanged, disheveled and disrespected, the deposed dictator held his head high, his eyes blazing with contempt as he spat sarcastic insults at his executioners. He “faced death like a lion,” said his supposed body double, Latif Yahia, and no one could argue. He left this life with the one thing he could control intact.

Dignity. That’s what “Keep Calm and Carry On” is all about. That’s what we think of when we think of the Battle of Britain. As German bombs rained down, the English went about their business. Like the iconic photo of the milkman tiptoeing over rubble. Like the bomb-damaged stores whose shopkeepers posted signs that read “We are still open — more open than usual.”

Man, that is so not us.

You’ve seen the T-shirts, with their clean Gill Sans-esque lettering and iconic crown. There are mugs, postcards and posters. Of course. It’s a reproduction of a propaganda poster from World War II, an (unsuccessful, because it wasn’t distributed) attempt by the British government to steel jittery citizens during the Blitz.

“Keep Calm and Carry On” merch dates to 2000 but really took off after 9/11; the popularity of the image, the stoicism of its call to stiffen upper lips everywhere, and numerous parodies (“Stay Alive and Kill Zombies”) has generated millions of dollars of profits, inevitably sparking lawsuits and inspiring a song by John Nolan.

Why is a meme originally prepared for a possible German invasion of the UK (which is why it wasn’t released) popular now? Zizi Papacharissi, communications professor at the University of Illinois at Chicago, points to the crappy economy. “We are undergoing a profound and fairly global economic crisis, so it is natural to revisit the saying: Keep calm and carry on. It reminds us of courage shown back then, and how courage shown helped people pluck through a crisis.”

It’s also a reaction to terrorism — or more accurately a reaction to the initial reaction to the 9/11 terrorist attacks: hysteria, jingoism, multiple wars of choice, all doomed. More than any other factor, Obama owed his 2008 victory to his (Maureen Dowd called him) Vulcan personality: cool, implacable, possibly non-sentient, the anti-Dubya.

What wouldn’t we give for a 2001 do-over? No invasions, no Patriot Act, no Gitmo, no “extraordinary renditions,” no New York Times op-ed pieces arguing in favor of “enhanced interrogation techniques.” Treat 9/11 like a crime, let the FBI go after the perps. Reach out to Muslims, reconsider our carte blanche to Israel, and most of all: go slow. Don’t freak out.

Perspective: 3,000 deaths is awful. 9/11 was shocking. We killed 2 million Vietnamese people, yet they’re going strong. With a minimum of whining.

And yet…

Sometimes you need some perspective to your perspective.

There are times when it’s appropriate to freak out. When, in fact, it’s downright weird and unhealthy and wrong not to flip your lid. For example, when you get diagnosed with a terrible disease. When someone you love dies.

There are also times when big-picture, impersonal stuff, including politics and the economy, ought to make you crazy with rage or grief or…something. Not nothing. Not just keeping calm and carrying on.

Keeping calm and carrying on was an appropriate response to the Blitz. Short of moving away from the targeted area, there’s nothing you can do about bombs. Living or dying is a matter of happenstance. Keeping calm might help you make smart decisions. Panic is usually more dangerous than self-control.

The same is true of terrorism. Terrorists will kill you, or not — probably not. You can’t fix your fate.

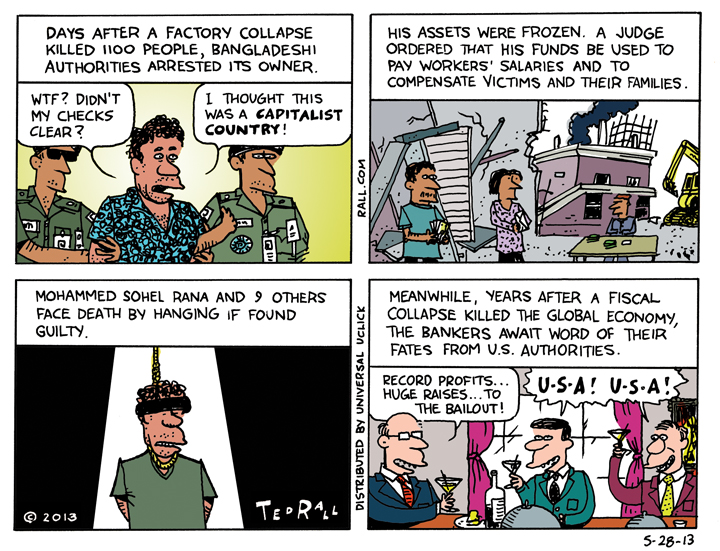

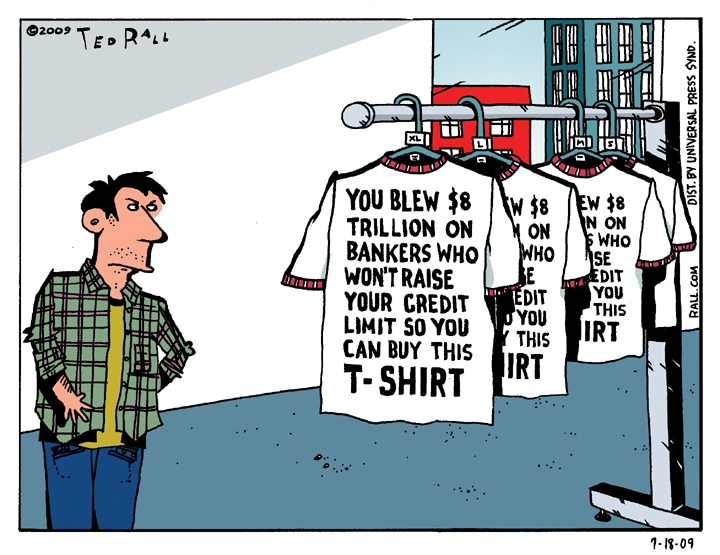

But that is decidedly not true about the economy. Not when what is wrong with the economy is not something no one can control — a giant meteor, bad weather, panic in the markets — but something that most assuredly can and indeed should be, like the systemic transfer of wealth from the poor and middle-class to the rich that has characterized the class divide in Western nations since the 1970s. The appropriate, intelligent and self-preserving response to mass theft is rage, demands for action, and decisive punishment of political and economic leaders who refuse to change things.

As one revelation about the National Security Agency’s spying follows another, the “Keep Calm and Carry On” meme seems less like an appeal to dignity and calm reserve than the much older, classic response of the power elite to their oppressed subjects: Shut the Fuck Up.

(Ted Rall’s website is tedrall.com. His book “After We Kill You, We Will Welcome You Back As Honored Guests: Unembedded in Afghanistan” will be released in March 2014 by Farrar, Straus & Giroux.)

COPYRIGHT 2013 TED RALL

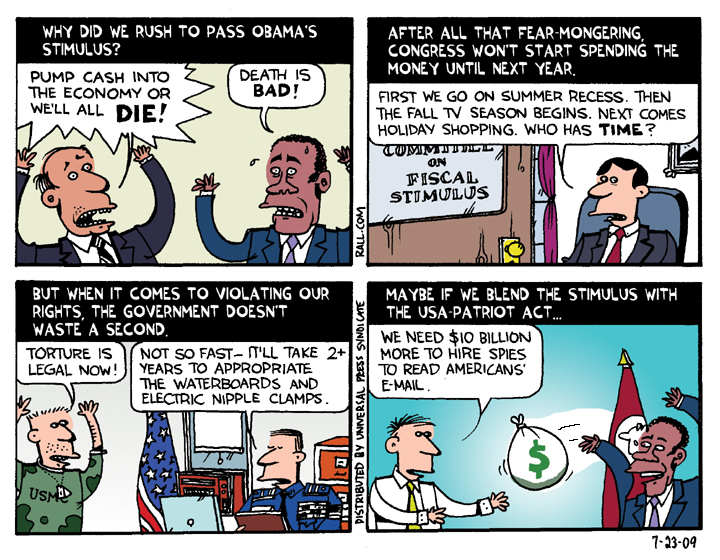

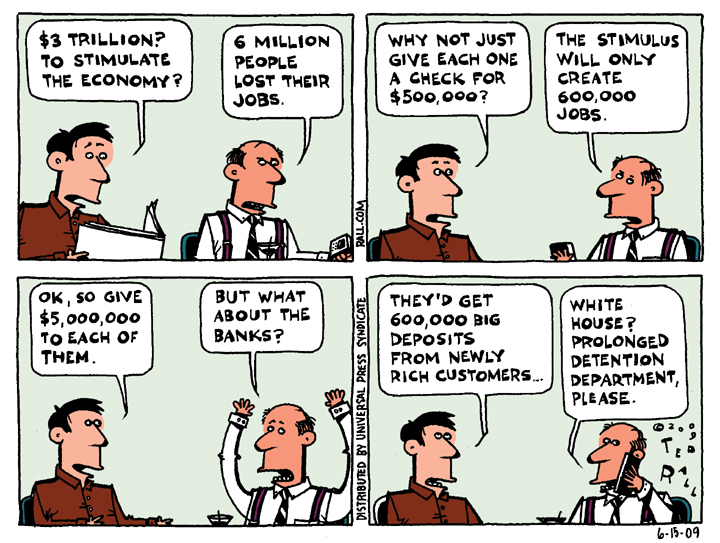

Blend the Stimulus

This one was inspired by a conversation with Matt Bors. We were wondering aloud why Obama was in such a rush to pass the bailout bills, only to drag his ass in actually distributing the money. It’s not like they can’t do things quickly.

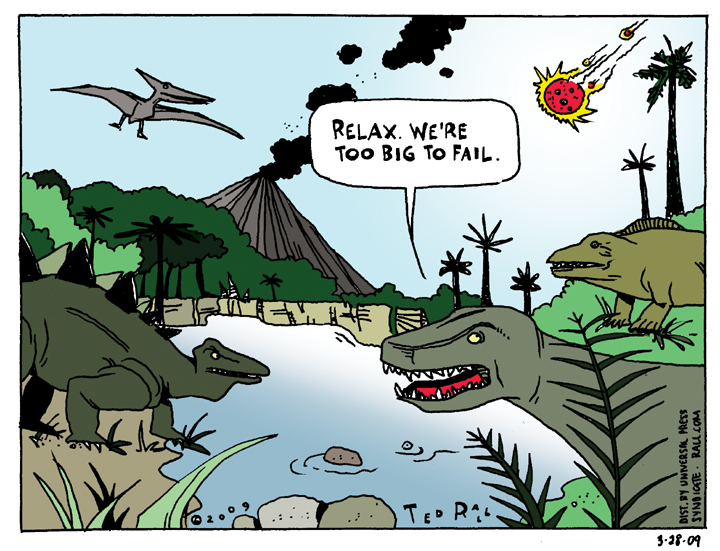

Too Big to Fail

This is the kind of cartoon I expected lots of my mainstream cartoonist colleagues to have come up with.

But I couldn’t find any, so I went ahead with the idea anyway. I hope I’m right and that I was first and only, in which case this is an instant classic. Otherwise it’s just another typical mainstream cartoon.

Drawing dinosaurs was fun, though.

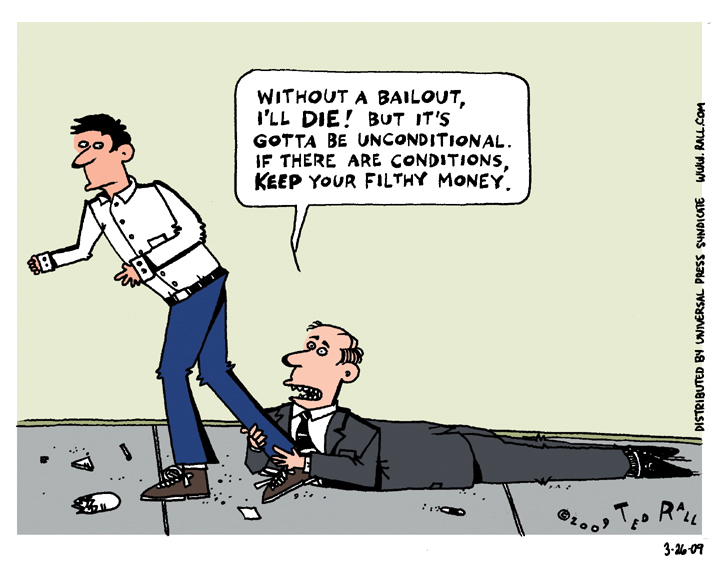

Unconditional Begging

I’m confused. First the banks and other companies requesting government bailouts claimed they would go under if they didn’t get them. Now they’re offering to return the money because the conditions are too onerous. So they didn’t really need the money in the first place, right? Or am I missing something?