Mistreated Customers Fuel Populist Rage

“Populist anger in America is the anger of dispossession,” writes Newsweek‘s Rick Perlstein. “The delinking of effort and reward has become all too manifest. That always makes Americans angry. We do not like to reward those who do not produce.”

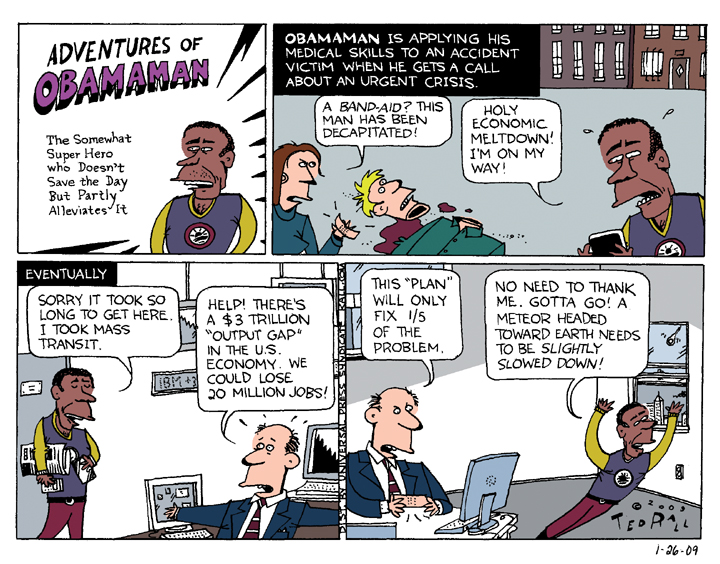

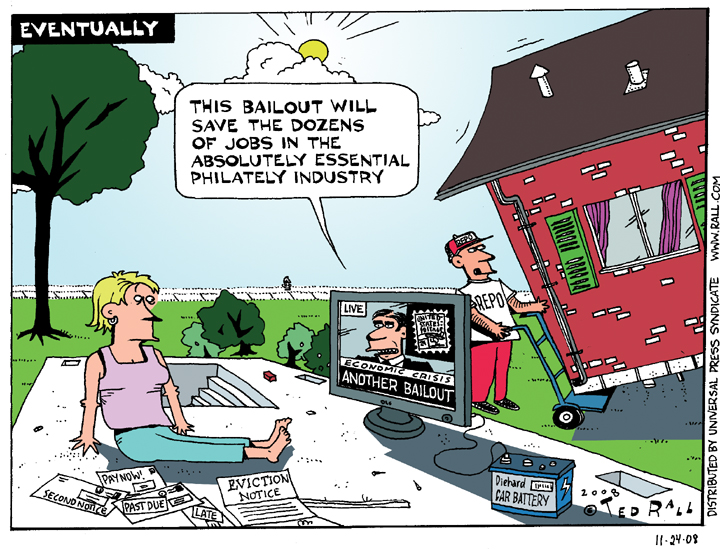

That’s not it. This is about abused customers. After decades of insults, they can’t believe they’re being made to save companies that treat them like crap.

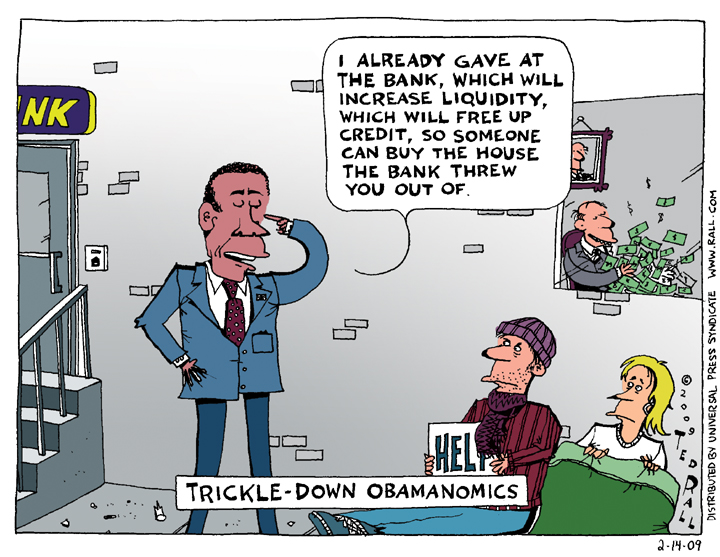

I’m a calm person. Yet my most recent bank statement featured three items that brought my blood to a fast boil. One was a $10 “income wire transfer fee.” A newspaper that publishes this column paid for it by wiring the money to my account. The bank charged me ten bucks–for depositing money! Money that, by the way, they invest in what the banking industry calls “the overnight call float.”

The same statement included a $3 fee for using an ATM that belongs to a different bank. Compared to my bank, loan sharks are sweethearts. If I take out $20 every day and pay three dollars each time, that’s 15 percent interest a day–or 5,475 percent a year. Did I mention that the fee was a mistake? I never use ATMs at other banks. To straighten out this $3 fee, I’ll have to waste my time explaining myself to someone at a call center in India, typing my account number into a keypad so I can repeat it by voice after waiting on hold.

Then there’s what my bank calls AN IMPORTANT CHANGE CONCERNING THE PROCESSING OF YOUR CHECKS EFFECTIVE MARCH 20, 2009: “As checks you have written are presented to us for payment during the course of a business day,” they explain, “we will place a hold on available funds in your account of those checks, resulting in a reduction in your available account balance throughout that day.” This is Bankese for: “You will pay bounce fees even when you have enough money in your account for checks to clear.”

I won’t even mention the time they hit me with a $120 fine in a single month–twelve separate fees at $10 a pop–for being stupid enough to use the line of credit they once begged me to take.

I hate my bank. My bank is Citibank. Citibank sucks.

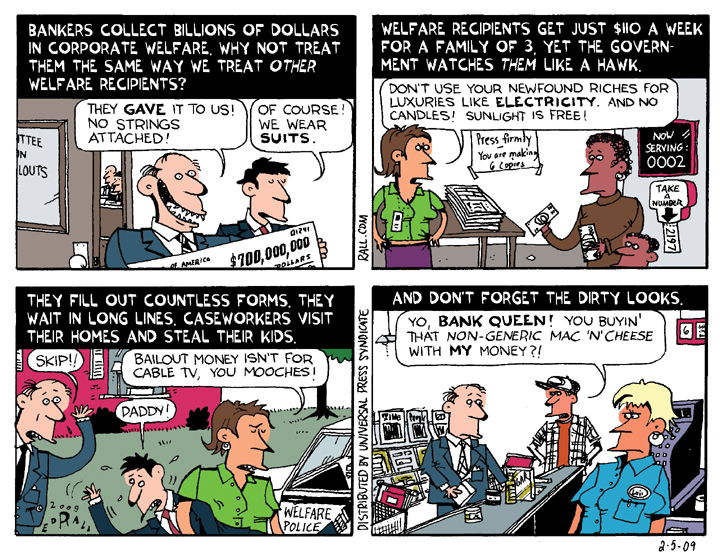

If Citibank wasn’t an evil, customer-hating band of fee vultures, I might not be quite so annoyed at the fact that its parent company, Citigroup, had just received $20 billion in direct investment plus $306 billion in loan guarantees from the U.S. government (i.e. us), of which I am a subsidiary. That’s $1,100 per American citizen, plus compound interest paid to Chinese investors who buy U.S. Treasury obligations. The fact that Citigroup “didn’t produce” has nothing to do with it. I would rather set $1,100 on fire than hand it over to Citigroup.

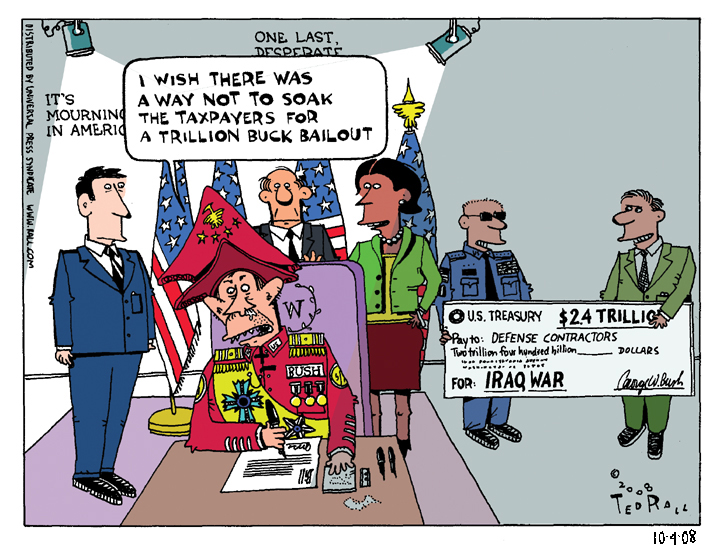

Which brings us to the American International Group. As you know, AIG executives sparked populist anger by paying themselves $165 million in bonuses after accepting a government bailout. “Take away taxpayers’ sense of ownership stake in an issue (especially, as with AIG, when taxpayers literally own the company) and their rage will not go away,” says Perlstein. “It festers…And that’s when the ‘bad’ kind of populism–the hateful kind; the violent kind; the demagogic kind–can flourish.”

Wrong again. Americans’ “ownership stake” in AIG isn’t why they’re in torches-and-pitchforks mode. Those bonuses only amount to 55 cents per person–no biggie. The Iraq War will cost us at least $10,000 each. The reason we’re enraged is that AIG is an insurance company.

We hate insurance companies.

Health insurers are the worst. They repeatedly deny claims they know are legitimate because many sick patients will give up fighting and eat the expense. They arbitrarily decide that tests, procedures, and even life-saving operations are “optional.” They literally murder their customers! Insurers even “make use of sophisticated data tools dubbed ‘denial engines,’ which are touted to reduce reimbursements by three to ten percent,” says U.S. News & World Report. But homeowner insurance companies aren’t better. State Farm’s refusal to pay victims of hurricane Katrina because their policies covered wind but not flooding is typical. “They said, ‘If a tornado came through and two days later the water came, it’s all flood,” remembers a Katrina victim in Louisiana.

They were lucky State Farm told them anything. Other storm survivors spent hours on hold, trying in vain to get through to companies that had happily collected their premiums for years.

Banks like Citibank and insurance companies like AIG may well be “too big to fail,” as Obama’s team at Treasury argues. So don’t let them fail. Nationalize them instead. And send their current and former executives to Bagram.

Also writing for Newsweek, Robert J. Samuelson calls our contempt for corporate leeches “a dangerous mindset” that “justifies punitive taxes, widespread corporate mandates, selective subsidies and more meddling in companies’ everyday operations.” Gee, how terrible that would be, what with them doing so well without meddling from the guvmint.

I have a suggestion for Mr. Samuelson and the high-flying captains of industry he champions: If banks and insurance companies want taxpayers to save their steak-fattened butts, let them accept some changes that will make Americans like them better. For banks, no more fees on checking or savings accounts. Period. For credit card companies, reset all interest rates at one percent over prime. Give customers a full month to pay their bills. No more unilateral changes in rates. For insurance companies, the presumption should be that all claims are legitimate unless proven otherwise. If a doctor approves it, pay out without being asked twice.

Oh, and one more thing: Get rid of phone trees. Fire the half-a-world-away call centers. Ban voice recognition systems–“say yes or no–I’m sorry, I didn’t get that.” Hire actual people to answer the phone. Make them pick it up on the first ring and transfer calls to the proper department.

I’d pay $1,100 for that.

COPYRIGHT 2009 TED RALL