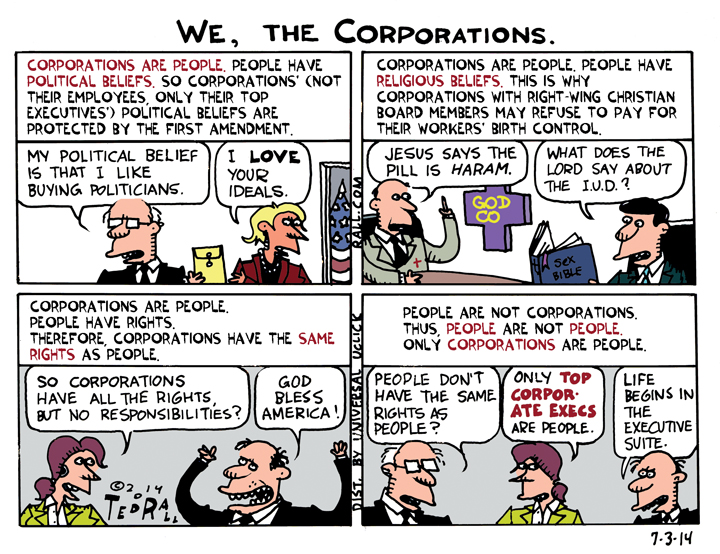

The US Supreme Court has expanded the “corporate personhood” ruling in Citizens United, which expanded individual First Amendment rights to corporations that are established in order to evade personal liability, to allowing them to express their religious beliefs (actually the beliefs of their top executives) via, among other things, what health care benefits they’re willing to provide.

We, the Corporations

Ted Rall

Ted Rall is a syndicated political cartoonist for Andrews McMeel Syndication and WhoWhatWhy.org and Counterpoint. He is a contributor to Centerclip and co-host of "The TMI Show" talk show. He is a graphic novelist and author of many books of art and prose, and an occasional war correspondent. He is, recently, the author of the graphic novel "2024: Revisited."

26 Comments. Leave new

I have a solution to the problem, Ted – at birth, at the same time that the ID chip is installed, all persons are to be publicly incorporated under the laws of the country (in the US, the state) in which they are born. Thus, automatically, the rights due corporations will accrue to them. At the same time, stock in them will be subject to being bought and sold in the market place (with adequate provisions to stockbrokers to compensate them for their arduous work to the benefit of us all), and subscriptions by hedge funds and private equity funds will be most welcome. Now that the 4th Amendment to the US Constitution has gone down the tubes, it’s time for that hoary old 13th Amendment was replaced by something more attuned to modern times….

Henri

While we’re modernising constitutional amendments to current standards, we might as well fix some other documents which have, in the course of the last century or so, become quaint and antiquated, e g : «… that we here highly resolve that these dead shall not have died in vain; that this nation shall have a new birth of freedom; and that this government of the corporations, by the corporations, for the corporations, shall not perish from the earth.»

Henri

Bartholomew: Corporate society takes care of everything. And all it asks of anyone, all it’s ever asked of anyone ever, is not to interfere with management decisions

The framers of the Constitution, Taney famously wrote, believed that blacks “had no rights which the white man was bound to respect; and that the negro might justly and lawfully be reduced to slavery for his benefit. He was bought and sold and treated as an ordinary article of merchandise and traffic, whenever profit could be made by it.”

And now for the modern version:

A Natural Person “had no rights which the Corporate Person was bound to respect; and that the Natural Person might justly and lawfully be reduced to slavery for the Corporate Person’s benefit. The Natural Person was Rented for Hire and treated as an ordinary article of merchandise and traffic, whenever profit could be made by it.”

for “reduced to slavery”

substitute “reduced to feudal serfdom”

Well, Glenn, certain corporations, mainly those active in the «circenses» part of «panem et circenses» (apologies to derlehrer !), already seem to have the «right» to buy and sell their employees, i e, chattel slavery rather than serfdom. The prologue to the omen coming on ?…

Henri

I certainly felt sold when a few companies I worked for were bought by another.

New management meant old working relationships and understandings all went out the window.

Some of these management teams expected the whole engineering team to move to a different city and state, the same as would a baseball team.

I fully expect the next SCOTUS decision will allow these “closely-held” corporations to refuse to employ or to serve gays, based upon religious convictions. (?)

What did I say?

http://www.theatlantic.com/politics/archive/2014/07/hobby-lobby-is-already-creating-new-religious-demands-on-obama/373853/

🙁

Moreover, derlehrer, their special tax-exempt status provides these organisations with the financial muscle to push their «faith-based» demands : http://taxthechurches.org/ ….

Henri

The decision that started the whole mess was Santa Clara vs. Southern Pacific Railroad, wherein it was stipulated that a corporation should be entitled to the same tax deductions as people.

So, wha hoppen? How come they now have *greater* tax deductions than people? A corp can buy a car & write it off – I can’t. A corp can write off research & development – I can’t. A corp can hire someone & write off his salary – I can’t.

Wanna fix the budget? Simple: give corps the same tax write offs I get, just like the decision says…

What do you think about a flat tax rate, across the board? Say, 10 cents on every dollar?

I like the idea of simplifying the code, fer shur. But I also believe in a progressive tax rate. Those who have benefited most from our system should pay the most for the privilege of (ab)using it.

Just think about it, though. If one of the Waltons takes in $5,000,000 in a year, 10% tax equals $500,000. If I earn $50,000, my tax is $5,000. No deductions, no juggling, no cooking the books. Isn’t that equitable? (Of course a lot of accountants would be out of work.) 😀

Mein geschätzter Lehrer, I suspect that you, like myself, are old enough to remember that during the Administration of that radical communist, Dwight David Eisenhower, the max tax rate on earned income was over 90 %, which explains why the US economy at the time was such a complete disaster. But remember, smart tax lawyers and accountants are always ready – for a considerable fee – to transmogrify «income» into something else for bookkeeping and tax purposes. A flat tax rate, as advocated by people like Malcolm Stevenson Forbes, would hardly solve this problem, and would place a tax burden on people who can scarcely afford it, while allowing the super rich to continue to milk the country – and the world ! – for all it’s worth….

Henri

A flat tax is regressive. We need to tax the rich much more heavily than the poor.

In my world of “Over the Rainbow” I envision that if your income is $1.00, you pay a dime. There would be none of the loopholes and none of the multitudinous deductions. A corporation that takes in $5,000,000 owes $500,000 in taxes. Tax on income, not tax on profits. If no deductions are allowed, no exemptions from tax are allowed. Thus, the company car is not tax-deductible; the payroll to employees is not tax-deductible. The bottom line becomes: How much money did you acquire from your customers? It’s like asking an individual, what was your gross income? Pay 10% of that. (Pie in the sky, I know.) 😀

derleher – here’s the deal about a flat tax rate.

Using your figures, we’ll compare the $500,000 guy to the $50,000 guy. But we need one more figure, so I’ll make that up, too.

Let’s say that it takes a salary of 40,000 to get the necessities of life: enough food, shelter, clothing, to get by but no mansions or BMWs.

So, the 50 guy has 10,000 left over after necessities & he’s gonna give half of it to the gubbmint.

But the rich guy has $460,000 left over – he gives 50,000, but that’s only 11% of his disposable income. And he’s still got 410k left to play around with – that’s 41 times as much as the other guy got.

The guy making 500k has obviously benefited *more* from the socioeconomic system we live in. Shouldn’t his price of admission be proportionally higher?

There’s an ongoing price as well. In a purely capitalistic system, that means that the 500k guy can give his kids a better leg up than the 50k guy. So the next generation does a little better – the 500k guy’s kids get their college paid for, while the 50k kids rack up massive student loans. While they’re slaving away to pay off the interest, the 500k kids can invest it all. They might even get a free house from dear ol’ dad – that’s even more they can invest.

So *THEIR* kids get an even bigger leg up, while the 50k grandkids are losing ground.

After a few generations, we’ve got the kind of income disparity we supposedly revolted against in 1776; the rich get richer while the poor do all the work. Hey! That’s where we are now!

*Hey! That’s where we are now!*

.

Not quite. You are speaking of individuals, whereas my suggestion is that corporations would (as “people”) be subject to the same rules.

.

Nowadays, many corporations pay zero income taxes. If they also paid 10¢ on every dollar of income, the U.S. could address the issues of infrastructure, education, heath-care, etal.

.

The proportionality of individual income vs taxes is, in my opinion, not the issue – nor is the availability of expendable income. The Waltons can’t take their money with them when they die.

.

Were corporations and the wealthy to pay a fair share, student loans would be a moot question, and unemployment wouldn’t be a problem as long as the Nation’s problems were addressed properly with the available revenue. Somehow, “Taxation Without Representation” comes to mind, since our government caters to the 1% and tells the 99% to go to hell.

🙂

«Were corporations and the wealthy to pay a fair share, student loans would be a moot question, and unemployment wouldn’t be a problem as long as the Nation’s problems were addressed properly with the available revenue.» Aye, there’s the rub – addressing the country’s problems with the available revenue, rather than extracting taxes to feed the insatiable maw of the MIC….

Henri

Agreed, Ted, but I must admit that taxing the income of corporations in the same manner as that of (other) people would not be without its charm. But as he writes, pie in the sky (why do I think of Joel Emmanuel Hägglund, aka as Joe Hill, when i see that phrase ?)…

Henri

Henri, I’m always learning something new from you. I had no idea about that song. [http://en.wikipedia.org/wiki/The_Preacher_and_the_Slave ]

🙂

Great song !…

Henri

Everything everybody is talking about here is dealing downstream from the real problem, that being the manner of banking being wielded against any civilization. When dealing with the wish-fulfillment thinkers of fractional banking (e.g., the Federal[not] [ghost]Reserve), EVERY TIME, it is this evil brand of criminal money-changer who will own EVERYBODY’S bacon (in the long run), simply by inventing the fantasmic exchange medium of “ownership” out of thin air.

Functionally, fractional-reserve bankers produce nothing but debt. For this service, they (can afford to) set themselves up as tyrannically oppressing, global oligarchs. FLAT TAX? PROGRESSIVE TAX? NO TAX? It really doesn’t matter. Fractional banking IS economic slavery. How do they do it? Well, if you read “The Creature from Jekyll Island,” you will begin to get an idea about just how far along the world’s financial trail of tears that you’ve been walking..

http://www.amazon.com/The-Creature-Jekyll-Island-Federal/dp/0912986212

http://www.bigeye.com/griffin.htm

http://free.yudu.com/item/details/430875/The-Creature-From-Jekyll-Island

http://yourfreeware.org/file/the-creature-from-jekyll-island-online-free/

http://nesaranews.blogspot.com/2012/07/creature-from-jekyll-island-e-book-free.html

DanD

I read the book, Dan.

It’s amazing how so many economists are blind to the money creation function of the fractional reserve system. They seem to buy into the idea that banks can only lend out money from the money others deposit.

Steven Keen is worthy of a read for his analysis of this systemic weakness that so many so-called “Nobel” winners completely overlook.

Glenn, You’ve got the basic idea !

https://duckduckgo.com/?q=Steven+Keen+fractional+reserve+banking&v=n

This is why “Fractional-Reserve-Banking” should more appropriately be branded: FICTIONAL-RESERVE BANKING.

DanD