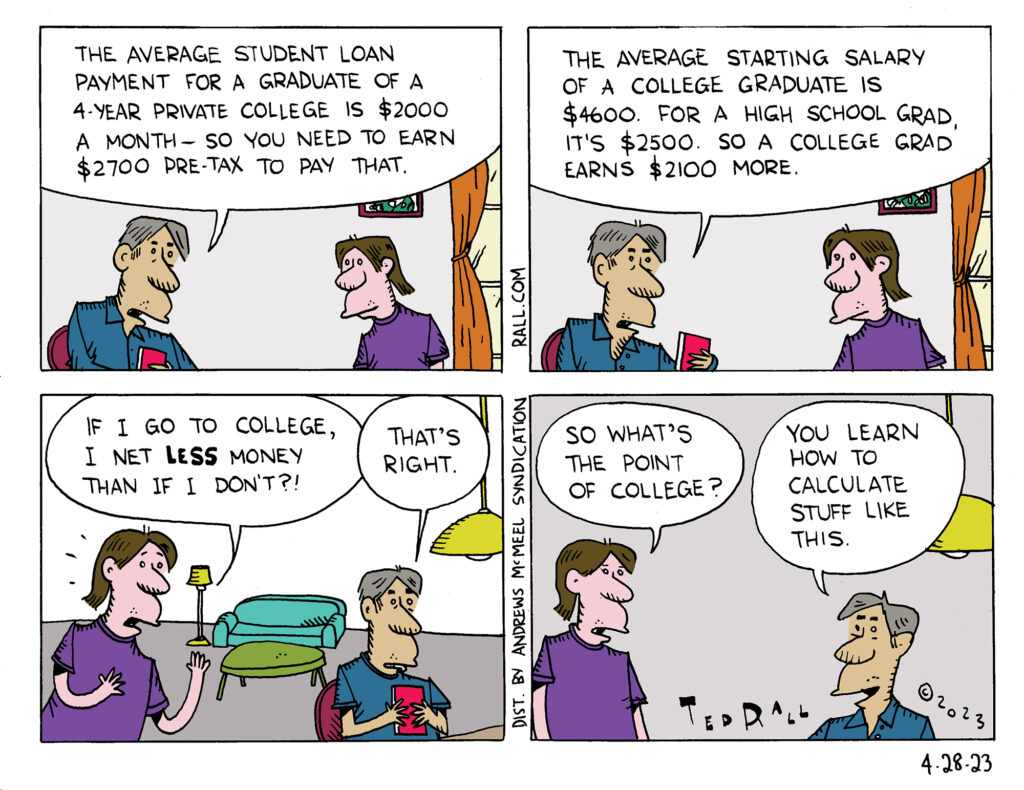

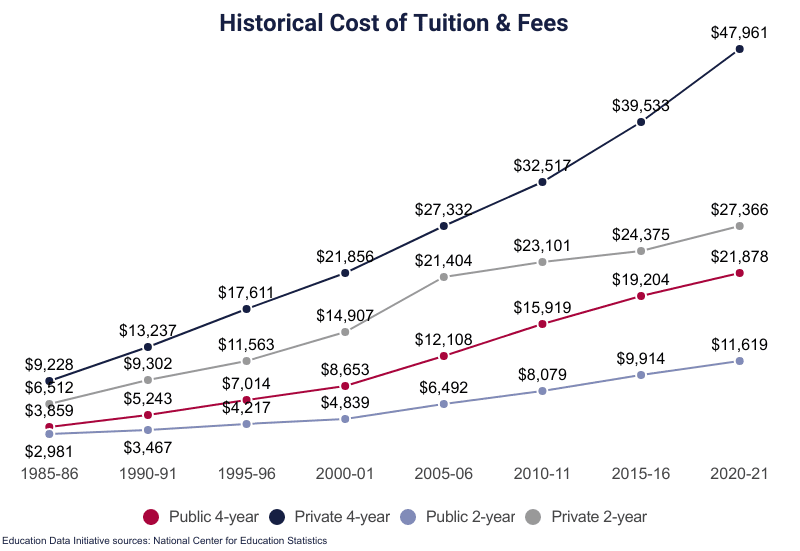

Learning is a societal and individual good. American businesses, however, have weaponized higher education into an overcredentialization racket that coerces millions of young people to borrow hundreds of billions of dollars in tuition, room and board, often to study subjects in which they have little interest, for the chance to be hired for a job. To add insult to usury, the diploma for which they sink into high-interest student loan debt reflects an education with no useful application to the position where they land.

It is tempting, from the standpoint of the Left, to dismiss the soaring price of college tuition, usurious student loan interest rates and overcredentialization as a first-world problem afflicting middle-class suburbanites who, after struggling after graduation, will soon enough pay off their debt and enjoy a significantly higher income than workers with high-school degrees. But no society can afford to ignore the plight of its most highly-educated ambitious young people who, as Crane Brinton reminded us in “The Anatomy of Revolution,” are an essential catalyst to radical political change. College students are a diverse lot; nearly half are people of color and more than 60% are women. Despite the problems within higher education America has no bigger engine for upward economic mobility.

The problem is, the college income premium only accrues to those who finish all four years and get their degree, which includes very few poor and working-class people. 15% of students from the lowest quartile of wage earners make it all the way through, compared to 61% of those in the top quartile.

Too many employers, too lazy to sort job applicants from a broader pool, demand college diplomas even when the job they are hiring for does not require the relevant education and training, as a way of culling the herd. “More than half of Americans who earned college diplomas find themselves working in jobs that don’t require a bachelor’s degree or utilize the skills acquired in obtaining one,” according to CBS News.

Requiring a superfluous college degree brazenly discriminates against poorer people, expanding and prolonging the class divide. Under a Left government, economic disadvantage would become a protected legal class alongside race, age, sex, gender identity, physical handicap and so on. Workers should be able to report job listings that seek overqualified workers to a federal bureau in the Department of Labor, which would have the power to impose substantial penalties, including fines and compensation for applicants who are discriminated against.

“Nearly two-thirds of American workers do not have a four-year college degree. Screening by college degree hits minorities particularly hard, eliminating 76% of Black adults and 83% of Latino adults,” The New York Times reported in 2022. Yet 44% of all U.S. employers required at least a BA or BS for all their openings.

A 2017 Harvard Business School study found that “60% of employers rejected otherwise qualified candidates in terms of skills or experience simply because they did not have a college diploma.”

Requiring employers to do the right, logical and fair thing, and hire qualified high-school graduates, dropouts and GED holders will allow more Americans to avoid college debt traps, incentivize companies to train workers, give working-class families more opportunities and reduce the high-intensity competition for college and university acceptance.

Student loans are a $1.7 trillion for-profit business which gives lenders the ultimate leverage: no matter what they do or how legitimate their inability to pay, distressed borrowers cannot even discharge their college debts in bankruptcy. At this writing, the average interest rate on student loans is 6.9%. The highest rate at which banks borrow money, however, is 5.5%—and the rate for the much longer terms of student loans is lower.

Young scholars are bright, vulnerable citizens with endless potential, not a profit center for transnational lending institutions. If we must have a for-profit system of post-secondary education and student loans to afford it, those loans should be at zero profit to banks or anyone else. And they should be able to be discharged in bankruptcy, just like any other debt.

Because college dropouts do not enjoy the college wage premium, their loans should be forgiven entirely or heavily discounted.

But the duty of leftists is no merely to tinker at the edges to make a troubled system fairer or more efficient. We look at a situation and ask: do we need a complete overhaul? If we were inventing America’s higher education system from scratch, is what we have now anything close to what we would come up with?

It’s hard to imagine that anyone, regardless of their general political orientation, would say that we have the best possible way to educate young people and prepare them for the future of work and life in general. The average household with student loan debt owes $55,000. Over a 10-year term at 6.9%, the total due including interest is $76,000. That’s the cost of a starter home in many parts of the country, and much more than students and their families spend in virtually any other nation.

Thirty-nine nations, including European powerhouses like France and Germany but also poor ones like Greece and Portugal, as well as developing socialist countries like Cuba and Brazil, currently offer their citizens college for free or for nominal fees.

We can too.

Students and parents borrowed $95 billion in the 2021-22 academic year. Going forward, then, replacing every penny borrowed as student loans as a free federal grant would cost the government about $100 billion—a tiny portion of the $4.5 trillion a year we’re currently wasting on the military and other misbegotten budgetary priorities.

There is also an argument for nationalizing public and/or private institutions of higher education. A college education, after all, will remain essential for a significant segment of the population even if we abolish employers’ current obsession with overcredentialization. Goods and services that are essential for contemporary human existence are, by definition, too important to be left to the fickle whims of a boom-and-bust marketplace. A college education surely qualifies. Higher education is too expensive a cost for cities and states to absorb. For the feds, however, it’s not that big a deal. Moving to federal control would create economies of scale and countless efficiencies, such as the ability to negotiate discounted prices for textbooks and equipment, plus the ability to transfer professors and personnel throughout the system in accordance with educators’ desires and regional needs.

Next: What should a Left foreign policy look like?

(Ted Rall (Twitter: @tedrall), the political cartoonist, columnist and graphic novelist, co-hosts the left-vs-right DMZ America podcast with fellow cartoonist Scott Stantis. You can support Ted’s hard-hitting political cartoons and columns and see his work first by sponsoring his work on Patreon.)