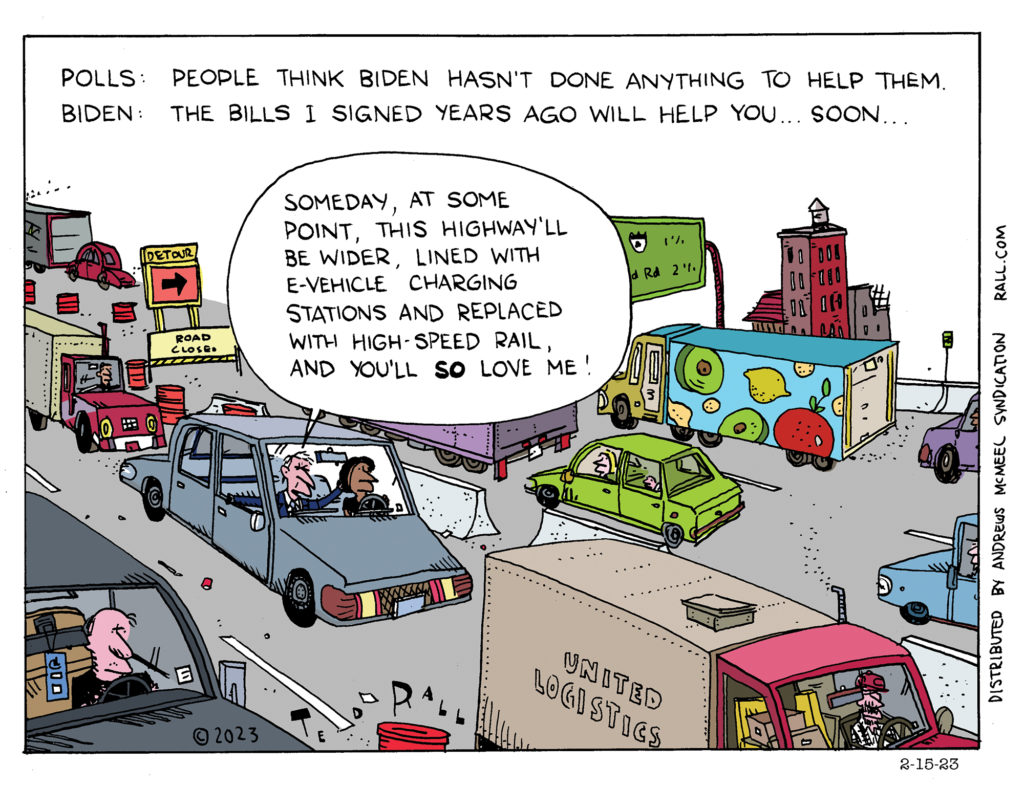

President Biden rolled out the likely theme of his possible reelection campaign during his State of the Union address: “Finish the Job.” The slogan, which he repeated several times, argues that the infrastructure and other legislation he signed a year and a half ago, are only just beginning to impact the everyday lives of the American people, who should be patient because good things are on the way. But if good things are on the way anyway, does it really matter whether Democrats or Republicans are in charge by the time they arrive?

Don’t Worry, Everything Will Get Back to “Normal”

When will things get back to normal? Everyone is asking.

The economic lockdown prompted by the COVID-19 pandemic has caused a mass unemployment shock, forced countless businesses into bankruptcy and is driving many Americans crazy. But this shall pass.

The good old days will be back.

The coronavirus worried city officials. Tens of thousands of New Yorkers were sleeping “head-to-toe in dormitory-style shelters” for homeless people that were “vectors for widespread COVID-19 infection.” So New York’s mayor invited some of the homeless to move out of shelters and off the streets into some of the city’s 100,000 vacant hotel rooms at city expense. New Orleans, Los Angeles and San Francisco have followed suit.

Do not worry! Tourism will resume, hotels will full up and those rooms will be needed for capitalism’s winner class. The homeless will resume their rightful place on the streets and/or crowded into squalid shelters. With an average life expectancy of 50, they will die bereft and alone, their bodies unclaimed before being dumped into mass graves. No more fear that their vulnerability to virus imperils us, no more there-but-for-the-grace-of-God sympathy, no recognition of coexistence. It will be as it was in February 2020.

COVID-19 replaced the post-9/11 pantheon of heroic workers—cops, firefighters and soldiers—with employees who earn far less while taking much bigger risks. Now we thank workers in hospitals and nursing homes, those who prepare food, deliver mail and drive trucks “for their service.” Grocers are offering hazardous duty pay.

Not for long.

After it’s deemed safe, furloughed bank analysts and efficiency experts will return to their climate-controlled corporate suites to resume their job: maximizing the short-term returns of equity investors. They will pore over Excel spreadsheets displaying payroll records, draw the capitalist conclusion and issue their usual recommendations that salaries be reduced, hours lengthened and benefits curtailed in service of company bottom lines. With the hazard of coronavirus gone, the extra $2 an hour will vanish as well. Those who care for the infirm and make our dinners will return to their previous state of diminished socioeconomic status, a role reinforced by orders to wear ugly frocks adorned by ID badges. No longer heroes, zeroes once more to be ground up by the gears of the machine—certainly no thank-yous or scheduled shouts of gratitude from open windows.

Desperate to avoid a Soviet-style economic collapse, politicians of both parties graced the unemployed with an extra $600 a week for a national average total weekly jobless benefit of $947. That’s roughly the same as the national median income.

Here too, we will return to normal.

Once the ruling elites have determined that the danger of collapse and with it the loss of their real estate and securities assets has passed, they will order their pet Congressmen to allow expanded unemployment benefits to lapse. Those who are out of work will again try to make do with $347 a week, taxable. When they fail, which is inevitable, the jobless will be slammed with months of back rent and mortgages, plus interest and late fees, plus all the other bills that had been deferred yet unforgiven by landlords, telecoms and other owner-class types during the COVID-19 lockdown. Homelessness and poverty will skyrocket.

Like before.

Fear not. Factories will go back to cranking out Yobama action figures, mint-flavored condoms and Mercedes SUVs that retail for $220,000 while getting 12 miles a gallon. Choked highways will slow to a crawl. Skylines will plunge back under a sea of haze.

Coyotes and mountain lions will scamper back into the mountains. The birds will fly away again.

No one will check on grandma or grandpa.

There won’t be any need.

(Ted Rall (Twitter: @tedrall), the political cartoonist, columnist and graphic novelist, is the author of the biography “Bernie.” You can support Ted’s hard-hitting political cartoons and columns and see his work first by sponsoring his work on Patreon.)

SYNDICATED COLUMN: The Phony Budget Crisis

Forget Austerity. Tax the Rich.

Everywhere you look, from the federal government to the states to your hometown, budget crises abound. Services are being slashed. Politicians and pundits from both parties tell us that the good times are over, that we’ve got to start living within our means.

It’s a lie.

Two case studies have made news lately: California, where new/old governor Jerry Brown is trying to close a $25 billion shortfall with a combination of draconian cuts in public services and a series of regressive tax increases, and Wisconsin, where right-winger Scott Walker says getting rid of unions would eliminate the state’s $137 million deficit.

Never mind the economists, most of whom say an economic death spiral is exactly the worst possible time for government to cut spending. Pro-austerity propaganda has won the day with the American public. A new Rasmussen poll funds that 58 percent of likely voters would approve of a shutdown until Democrats and Republicans can agree on what spending to cut.

The budget “crisis” is a phony construction, the result of right-wing “starve the beast” ideology. There is plenty of money out there—but the pols don’t want it.

There is no need to lay off a single teacher, close a single library for an extra hour, or raise a single fee by one red cent.

Every government can not only balance its budget, but wind up with a surplus.

The solution is simple: tax the rich.

Over the last 50 years tax rates for the bottom 80 percent of wage earners have remained almost static. Meanwhile the rich have received tax cut after tax cut after tax cut. For example, the rate paid by the top 0.01 percent—people who currently get more than $6.5 million a year—fell by half (from 70 to 35 percent).

Times are tough. Someone has to pay. Why not start with those who can most afford it?

Europe has the world’s best food, its best healthcare system and its best vacation policy. It also has one of the fairest ways to generate revenue for government: a wealth tax. In Norway, for example, you pay one percent of your net worth in addition to income tax.

What if we imposed a Norwegian-style wealth tax on the top one percent of U.S. households? We’re not talking upper middle class here: the poorest among them is worth a mere $8.3 million. This top one percent owns 35 percent of all wealth in the United States.

“Such a wealth tax…would raise $191.1 billion each year (one percent of $19.1 trillion), a significant attack on the deficit,” Leon Friedman writes in The Nation. “If we extended the tax to the top 5 percent, we could raise $338.5 billion a year (one percent of 62 percent of $54.6 trillion).”

But that’s just the beginning. Wealthy individuals are nothing next to America’s money-sucking corporations.

Business shills whine that America’s corporate tax rate—35 percent—is one of the world’s highest. But that’s pure theory. Our real corporate rate—the rate companies actually pay after taking advantages of loopholes and deductions—is among the world’s lowest. According to The New York Times, Boeing paid a total tax rate of 4.5 percent over the last five years. (This includes federal, state, local and foreign taxes.) Yahoo paid seven percent. GE paid 14.3 percent. Southwest Airlines paid 6.3 percent. “GE is so good at avoiding taxes that some people consider its tax department to be the best in the world, even better than any law firm’s,” reports the Times‘ David Leonhardt. “One common strategy is maximizing the amount of profit that is officially earned in countries with low tax rates.”

America’s low effective corporate tax rates have left big business swimming in cash while the country goes bust. As of March 2010 non-financial corporations in the U.S. had $26.2 trillion in assets. Seven percent of that was in cash.

The national debt is $14.1 trillion.

Which is a lot. And, you see, entirely by choice.

(Ted Rall is the author of “The Anti-American Manifesto.” His website is tedrall.com.)

COPYRIGHT 2011 TED RALL