Why Aren’t Rioters Burning Down the Banks?

One in ten Americans take such antidepressants as Prozac and Paxil. Among those in their 40s and 50s, it’s 23%. Maybe that’s why we’re so passive.

Like the blissed-out soma-sucking drones of Huxley’s “Brave New World,” we must be too drugged to feel, much less express, rage. How else to explain that furious mobs haven’t burned the banks to the ground?

Last week, as the media ginned up empty speculation about Hillary Clinton’s presidential prospects, and wallowed in nuclear cognitive dissonance — Iran, which doesn’t have nukes and says it doesn’t want them, is repeatedly called a grave threat worth going to war over, while North Korea, which does have them and won’t stop threatening to turn the West Coast of the U.S. into a “sea of fire,” is dismissed as empty bluster, nothing to worry about — the Office of the Comptroller of the Currency and the Federal Reserve released the details of the settlement between the Obama Administration and the big banks over the illegal foreclosure scandal.

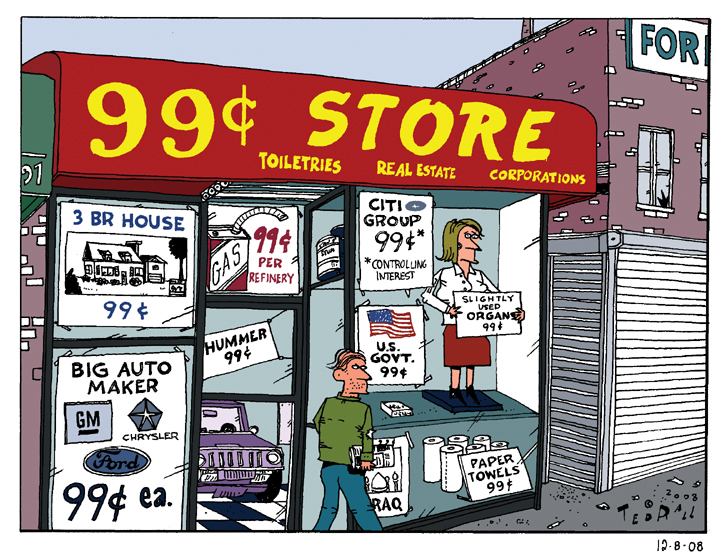

Citibank, JPMorgan Chase, Bank of America, Wells Fargo and other major home mortgage lenders foreclosed upon and evicted millions of homeowners between the start of the housing collapse in 2007 and 2011. Millions of families became homeless, including 2.3 million children. The vast majority of these Americans are still struggling; many fell into poverty from which they will never escape.

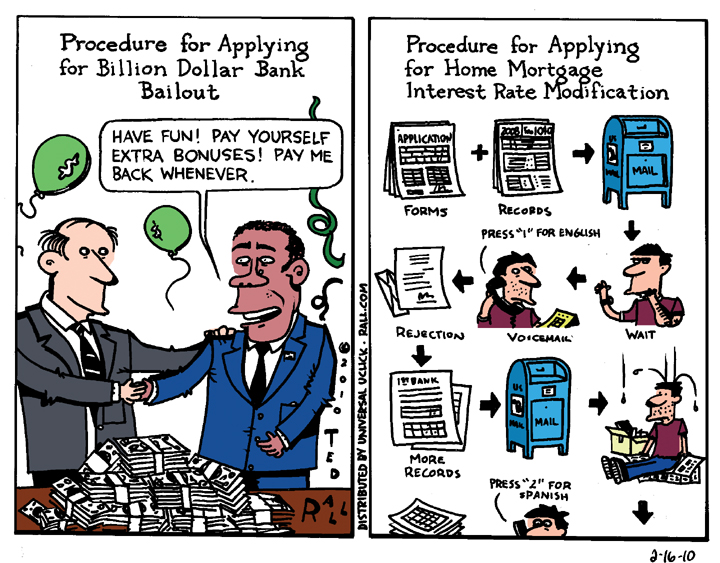

Disgusting, amazing, yet true: the banks had no legal right to evict these people. In many cases, the banks didn’t have basic paperwork, like the original deed to the house. They resorted to “robo-signing” boiler room operations to churn out falsified and forged eviction papers. In others cases, people could have kept their homes if they’d been allowed to refinance — their right under federal law — but the banks illegally refused, giving them the runaround, repeatedly asking for the same paperwork they’d already sent in. Soldiers fighting in Afghanistan and Iraq, protected from foreclosure under U.S. law, came home to find their homes resold at auction. In other cases, banks even repossessed homes where the homeowner had never missed a mortgage payment.

The foreclosure scandal helped spark the Occupy Wall Street movement.

Promising justice and compensation for the victims, President Obama’s Justice Department joined lawsuits filed by the attorneys general of several states.

Last year, Obama announced that the government had concluded a “landmark settlement” with the banks that would “deliver some measure of justice for those families that have been victims of their abusive practices.” The Politico newspaper called the $26 billion deal “a big win for the White House.” $26 billion. Sounds impressive, right?

So…the envelope, please.

How much will the banks have to pay? What will people whose homes were stolen — there is no other word — receive? Now we know the details.

Remember what we’re talking about. Your house is your biggest asset. You own tens of thousands, in some cases hundreds of thousands of dollars in equity. One morning the sheriff comes. He throws you and your family out on the street. Your possessions are dumped on the lawn. You have nowhere to go. Your kids are crying. If you were struggling before, now you’re completely screwed. And the bank that did it had no legal basis whatsoever to do what they did.

They took your house, sold it, and pocketed the profits.

What would happen to you if you walked into Tiffany’s and stole a $200,000 necklace?

The details:

- Even though they qualified for federal loan modifications, the banks seized 1.1 million homes, making 1.1 million families homeless after they were approved for refinancing. Since the average foreclosed home was worth $191,000, the banks stole $210 billion in homes. Under the “landmark settlement,” these wrongfully evicted Americans will receive $300 or $500 each, the value of a modest night out at a nice restaurant in Manhattan (two tenths of one percent of their loss).

- 900,000 borrowers who were entitled under Obama’s Make Home Affordable program to refinancing were denied help and lost their homes. They get $300 or $600.

- 420,000 homeowners who lost their homes while the banks intentionally dithered and “lost” their paperwork get $400 or $800.

- 28,000 families who were entitled to protection against foreclosure under federal bankruptcy law, but got thrown out of their homes anyway, get $3,750 to $62,500.

- 1,100 soldiers entitled to protection against foreclosure because of their military status get $125,000.

- 53 families who weren’t late on their mortgages, never missed a payment, but got thrown out anyway, get $125,000.

So we’ve got more than 2.4 million families — that’s 5 million people — whose homes got bogarted by scumbag banksters. They’re getting a thousand bucks each on average. A thousand bucks for a two hundred thousand dollar theft! Not to mention the heartbreak and stress they suffered.

Why aren’t those five million people stringing up bank execs from telephone poles? It’s gotta be the Paxil.

But what really gets me is the 53 families who are getting $125,000 payouts for losing homes they were 100% up to date on.

Even if you’re a heartless right-winger, you’ve got to have a problem with a bank taking your house when you never missed a payment. Sorry, but these are multinational, multibillion dollar banks. They should pay these families tens of millions of dollars each.

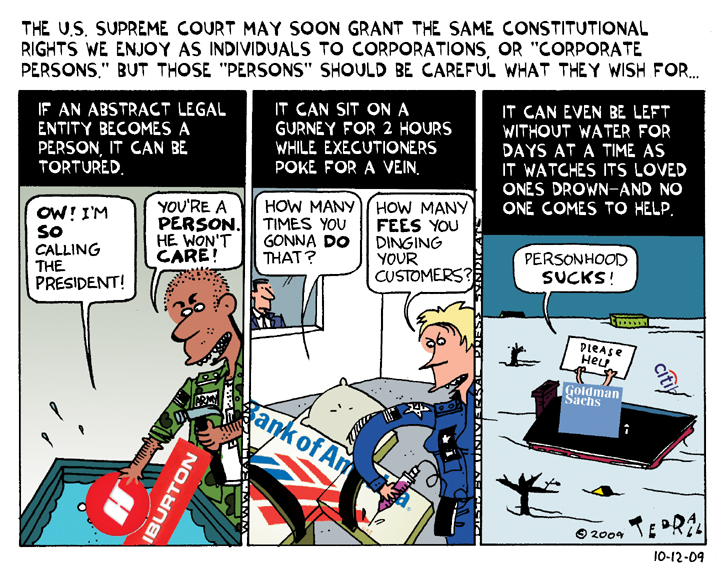

Those 53 families should own Citibank, JPMorgan Chase, Bank of America and Wells Fargo.

Some perspective:

Citigroup CEO Vikram Pandit received $260 million in pay between 2007 and 2012, the height of the foreclosure scandal.

In 2011 alone, JPMorgan Chase CEO Jamie Dimon was given $23 million. In 2012, the company’s board of directors “punished” him for a $6 billion loss in derivatives trading by paying him “merely” $18.7 million.

In 2012 alone, Bank of America paid CEO Brian Moynihan $12 million; Wells Fargo paid $23 million to CEO John Stumpf.

Not bad for some of the worst criminals in history.

That’s how things work in the United States: the criminals get the big payouts. The people whose lives they destroy get $300.

(Ted Rall’s website is tedrall.com. His book “After We Kill You, We Will Welcome You Back As Honored Guests: Unembedded in Afghanistan” will be released in November by Farrar, Straus & Giroux.)

COPYRIGHT 2013 TED RALL