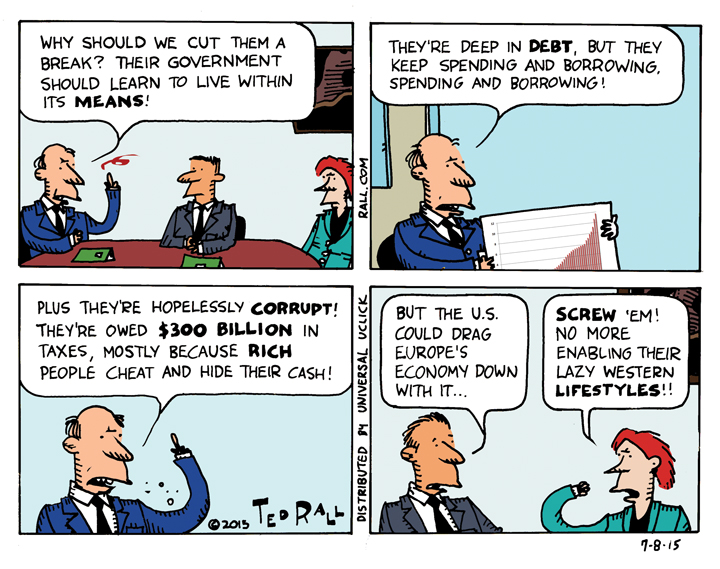

The European Union, led by Germany, refuses to make major concessions to Greece on the grounds that it spends profligately and doesn’t collect enough taxes from scofflaws. Most Americans agree with them, but the same exact criticisms could be made of the United States.

Shiftless Americans

Ted Rall

Ted Rall is a syndicated political cartoonist for Andrews McMeel Syndication and WhoWhatWhy.org and Counterpoint. He is a contributor to Centerclip and co-host of "The Final Countdown" talk show on Radio Sputnik. He is a graphic novelist and author of many books of art and prose, and an occasional war correspondent. He is, recently, the author of the graphic novel "2024: Revisited."

15 Comments. Leave new

The thing is, they *tried* austerity. According to the voodoo economists, this should have resulted in a better economy; according to the Keynesians it would only make matters worse.

It got worse.

Time & again, the Keynesians’ predictions have come true, while the voodoo-ists’ have failed to materialize. If the voodoo-ists were right, both Reagan and Baby Bush would have left office with a booming economy. Instead, we got recessions.

“Don’t keep doing what doesn’t work” – attributed to Thomas Edison & Molly Ivins among others.

Ultimately, every time an economy bases its monetary system on debt, there will always be more money owed to the bankster-class than is in existence to pay off the debt. Though at the beginning of such systems, the money seems to cost almost nothing (it really doesn’t, as the bank simply invents at least a minimum more during each new cycle to cover any extra costs) as the public debt grows with the passage of time, that debt-based system of management becomes more unstable, until ultimately, it implodes on itself … mostly because the numbers just become too unrealistic to confidently manage.

Keynes developed his economic theory while there was still a(n at least marginal) gold standard still being used by most monetary systems of the world. Finally, when Nixon “decoupled” the dollar completely off the gold-standard, more even than in 1912, money really did cost nothing. Just the price of ink and paper.

That’s where America — and its Federal Reserve system — is at right now. So, why are there no crooked TBTF banksters in jail (in America, anyway)? Because when they do fail, civilization for most of us will end. In that ‘America functionally infected the rest of the world with its banking paradigm at the end of WWII, NOBODY (even the Chinese, who’ve bought a virtual lock on global gold markets) can’t evade the implosion.

I wonder, is it a conspiracy theory to know that there is a globally encompassing, resource-sustaining and economically developing, SHTF moment?

DanD

… NOBODY — can — evade …

(it’s too late in the evening)

DanD

Iceland did it right.

France did it better. >;->

shhhhhhhh-THWUCK (plunk)

One less taker and free entertainment for the masses.

Ted’s right on the mark here! Back in 2008, my sister, a VP at a major bank, laughed away the idea that the US banks and financial institutions would go bankrupt or fall. She said, “the taxpayers will pay for it all”, and Gosh Darn, we did! Now, with a similar situation where a country in the EU has racked up bad debt, which is impossible to pay – like all the US financial institutions did with mortgages and property that could never be repaid, the EU is faced with the same situation – either forgive part or all the debt, and have the EU members pay for it. Only now, look as some of the reaction over in Europe, with so many refusing to forgive any of the debt they helped and facilitated form, and instead, trying to squeeze water out of a rock. Really ironic, considering that when Germany racked up a pile of debt it could not pay after WWII, much of it was forgiven to allow them a better chance to recover. I get it, the EU ain’t gonna go for enabling any lazy, western lifestyles, eh?

The U.S. is the greatest debtor in the history of the earth: somewhere around 15 trillion dollars.

When the ruling plutonomy finds itself burdened with a bad balance sheet, it just creates tens of trillions of dollars out of nothing, without complaint from its debt holders; for the failure of the U.S. debt would be the collapse of the debt instruments their creditors hold back into the nothingness from which it came.

And besides, the U.S. debt is backed by the most powerful military means of destruction, able to threaten any upstarts who would create their own international rival currency with annihilation.

“the U.S. debt is backed by the most powerful military means of destruction”

Love it! Kinda the opposite of your friendly neighborhood loan shark. Maybe if I waterboarded that annoying bill collector he’d quit bugging me…

From Robert Reich:

People seem to forget that the Greek debt crisis — which is becoming a European and even possibly a world economic crisis – grew out of a deal with Goldman Sachs, engineered by Goldman’s Lloyd Blankfein. Several years ago, Blankfein and his Goldman team helped Greece hide the true extent of its debt — and in the process almost doubled it. When the first debt deal was struck in 2001, Greece owed about 600 million euros ($793 million) more than the 2.8 billion euros it had borrowed. Goldman then cooked up an off-the-books derivative for Greece that disguised the shortfall but increased the government’s losses to 5.1 billion euros. In 2005, the deal was restructured and the 5.1 billion euro debt was locked in. After that, Goldman and the rest of Wall Street pulled the global economy to its knees – whacking Greece even harder.

Undoubtedly, Greece suffers from years of corruption and tax avoidance by its wealthy. But Goldman Sachs isn’t exactly innocent. It padded its profits by catastrophically leveraging up the global economy with secret, off-balance-sheet debt deals. Did any of its executives ever go to jail? Of course not. They all got fat bonuses and promotions. Blankfein, now CEO, raked in $24 million in 2014 alone. Meanwhile, the people of Greece struggle to buy medicine and food.

Doesn’t seem right, does it?

> Greece suffers from years of corruption and tax avoidance by its wealthy

Bull Dookey! Rich people are NEVER to blame. Everyone knows it’s really because the worker class didn’t work hard enough.

Don’t listen to those jerks Robert Reich and Paul Krugman, just ‘cuz they got professorships and credentials and a wussy Noble Prize in Economics, it doesn’t mean they know what they’re talking about!

Get a job, you bum!

Signed,

. . Rich Limbone

. . Charles Krauthammer

. . Anne Coltface

. . Ayn Rand (the other end of the horse)

. . . . . and a cast of hundreds.

hmmm, “Krauthummer?”

Did you see Jeb’s latest faux pas? He claims that if Americans worked longer hours, it would lead to a greater economy. (I’m paraphrasing; I got it from Rachel Maddow.)

🙂

Well, he is right … in theory. Wealth comes from the productivity of the working class. But our problems are systemic (you know’d dat already)

We *could* implement his suggestion by putting the parasite class to work. Hell, Trump alone could power several wind generators. Put Bezos to work in one of his own warehouses and you can bet working conditions would improve PDQ.

Here’s the link:

http://www.msnbc.com/rachel-maddow-show/jeb-bushs-plan-americans-should-work-longer-hours?cid=sm_fb_maddow

Interesting is the paragraph that begins with: “For what it’s worth, the Florida Republican, not long after his interview, clarified that his comments were about part-time vs. full-time employment.”

If one regards the so-called Greek crisis as primarily an economic crisis, one is bound to go astray – if both major (read : Germany) and minor (read : the Baltic States and Finland) are so tough on Greece for economic reasons, why then are they throwing nearly € two thousand million into the black hole that is the Ukraine (http://www.europarl.europa.eu/news/en/news-room/content/20150324IPR37363/html/European-Parliament-approves-€1.8-billion-EU-loan-to-Ukraine) ? Rather, the crisis is primarily a political issue, which has, among other things, with how the so-called Eurozone is to be run and who gets to call the shots : http://yanisvaroufakis.eu/2015/07/11/behind-germanys-refusal-to-grant-greece-debt-relief-op-ed-in-the-guardian/#more-8970….

Henri