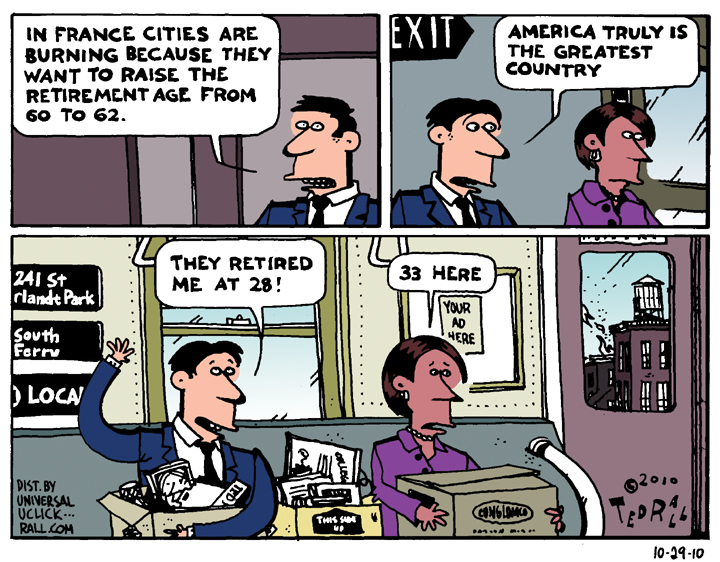

The French are rioting to keep the retirement age at 60. We’re way ahead of them.

Early Retirement

Ted Rall

Ted Rall is a syndicated political cartoonist for Andrews McMeel Syndication and WhoWhatWhy.org and Counterpoint. He is a contributor to Centerclip and co-host of "The Final Countdown" talk show on Radio Sputnik. He is a graphic novelist and author of many books of art and prose, and an occasional war correspondent. He is, recently, the author of the graphic novel "2024: Revisited."

14 Comments. Leave new

As much as the “syndicats” may riot, the reform is indeed going to go through. The French may love their “safety net”, but they also know accounting magic can only be stretched so far. I have no doubt a few true believers here will remark that S.S. is safe and sound for time to come. We’ll see…

I think the retirement age SHOULD be lower….all these old people who are making bloated salaries and keeping younger people out of jobs for years while they wait to retire. I mean, how many people are actually all that productive the last 10 years of their careers?? And pensions? F* pensions…or extended health care benefits. In fact, shut down medicare completely. . . it’s age discrimination at it’s worst to allow all these bitter old fogies who sap medicare money to keep their fat, unhealthy asses in those power chairs while they sit at tea party rallies sipping oxygen masks.

This country freakin’ belongs to geezers who satisfy their delusions of American supremacy by voting to send thousands of young people off to die like it’s some $(*& John Wayne movie.

I say no more, cut old people off completely….and THEN we will begin the conversation about justice and equality all over again. . . .I’m tired of it, and I’m tired of the masses of retards who, in the face of reality, insist that the French system just doesn’t work. . . .when in reality. . .the French system has worked FOR A LONG TIME and is only undercut by the same off-shoring of jobs to slave-labor countries that undercuts the US. It’s a race to the bottom.

At this rate, we could only dream of a day when those Death Panels become a reality. F~ old people!!!

Wow Aggie.

Aggie, you’re right on some things, but wrong on this: the French system is based on the same accounting prestidigitation/Ponzi scheme as the American one (or most anywhere else, really). It is being undercut by an aging/declining population, which makes the contributing base (i.e. those in the labor force now) dwindle in comparison to the entitled, I mean, socially secured retirees. Off-shoring has little to do with it, European politicians of all stripes know this, that’s why most of them look to immigration as a life buoy to keep the system afloat.

Dear Dead Horse of Alexander, Please point to the accounting problems of Social Security that could not be solved by increasing the tax rate for those who make beyond hundreds of thousands of dollars, eliminating corporate tax loopholes and prosecuting tax evasion via offshore accounts.

Thank You

TLW

“the French system is based on the same accounting prestidigitation/Ponzi scheme as the American one (or most anywhere else, really).”

That’s a really retarded statement dude. I’m just going to stop there. . .if people aren’t smart enough to laugh at that…forget it.

LTW, if you have to fund the supposedly self-funded S.S. with increases in unrelated taxes, you’re pretty much admitting it has an accounting problem, right?

Aggie, you do well to stop there, with pronouncements “ex cathedra” and name calling. Now, here’s how my retirement fund works: every month I put a portion of my earnings in the fund, and the company matches the contribution. When I retire, I’ll take monthly installments for a fixed period of time on whatever my share of the fund yielded. Finite money yields finite money, and is enjoyed for a finite time: no guarantees of fixed income for indefinite time. Tell me exactly how S.S. works, and if is anyway similar to this arrangement, which involves no accounting magic.

Is it kept in a savings account? Is it used to buy twenty year treasury bonds? Screw self funding, taxation will have to be done. I think the crux of this argument is whether we tax to fund social security or we let it wither and die.

Personally, I’m for supporting the baby boom till they all croak around 2050. Admittedly it’ll be a few years after I have entered social security age, but with the cost of living having doubled or something since the last boomer was born, with real wages (basically dividing the current nominal wage by accumulated inflation since the 1970’s) being stagnant since the 1970’s, the new argument comes to, again, do you increase taxes to fund social security or do you let the program die. I’ll shoulder the debt for those boomers and I’ll fight to get the rich to pay for the society around them.

When I retire, I’ll take monthly installments for a fixed period of time on whatever my share of the fund yielded. Finite money yields finite money, and is enjoyed for a finite time: no guarantees of fixed income for indefinite time

So you DO believe in physics. You DO believe wealth follows the laws of thermodynamics. So you believe, like I do, that wealth (like everything) cannot be created or destroyed. Glad to have you. 🙂

Great wealth is like a buildup of static electricity in a poorly designed circuit. Some other part of the circuit has been robbed of some electrons which, for no good reason, have piled up on one component of the circuit. That component doesn’t deserve the spare electrons. Any system in the real world is plagued by excess and deficiency. Only “experts” in economic systems ascribe some importance to preserving these inefficiencies.

@bucephalus you are right that having to raise taxes to fund what is supposed to be a self funded system is a sign of something wrong. In the case of social security though this is just a sign of politicians like Regan, and many others, raiding the social security trust for hundreds of billions of dollars which they used to help fill in the massive US debt predominantly created by their own wars and other subsidization of the military industrial complex while giving their wealthy friends and backers unneeded tax cuts and corporate welfare. Social Security wouldn’t be in the pinch it is in if it hadn’t been raided time and time again.

OK…just going to say this once. Wealth is a social construction. The degree to which it is arbitrarily applied to certain individuals to justify their relative share of goods and services is completely dependent upon the degree of BS rhetoric we are willing to tolerate. However the concept of wealth is a rhetorical rationalization of giving some people a quantitatively more abundant life than others. It is separate from that abundance.

Throw chunks of rhetorical crap at each other all you want. Both efforts are futile.

It’s a nice day for a little postmodernism. is terminally short on it.

Don’t you mean “abundantness”.

Angelo,

I don’t understand your point, I just told you the fund accrues, i.e. it gains value. That has nothing to do with wealth creation, btw. Wealth is created by the companies tue fund invest in. Or not.

Between your crazed physics analogies and Aggie’s sociologist non-sequiturs it’s clear to me you guys have little understanding of economics. And Aggie, you still haven’t explained why S. S. is solvent just cause you say so, and claiming otherwise is “retarded.”

Buceph, if you can tell me where sociology ends, and your economics begins, I will be very impressed. The economics you talk about looks like a few juicy assumptions about human nature wrapped in a flaky crust of mathematical heuristics.