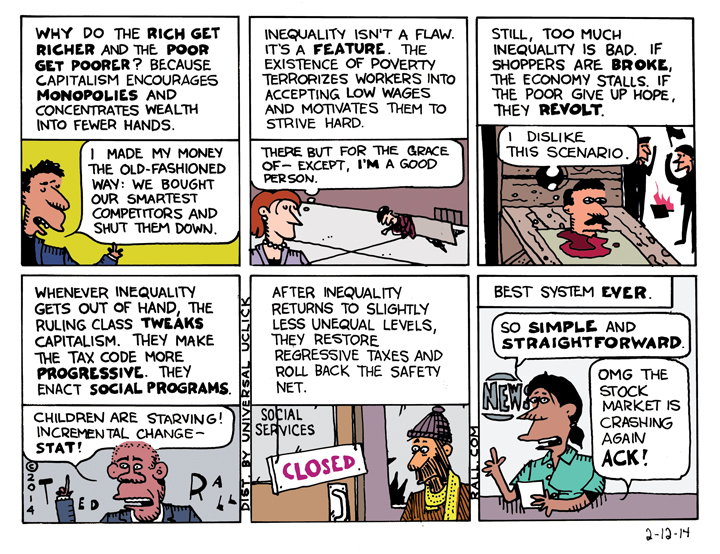

President Obama and the Democrats have finally decided, five years after his election, to begin talking about the issue of income inequality, which has been increasing since the early 1970s. But their rhetoric makes it sound like inequality is a weird byproduct of capitalism when, in fact, it is a key feature of an economic system that relies on poverty and exploitation. This is the best system ever conceived?

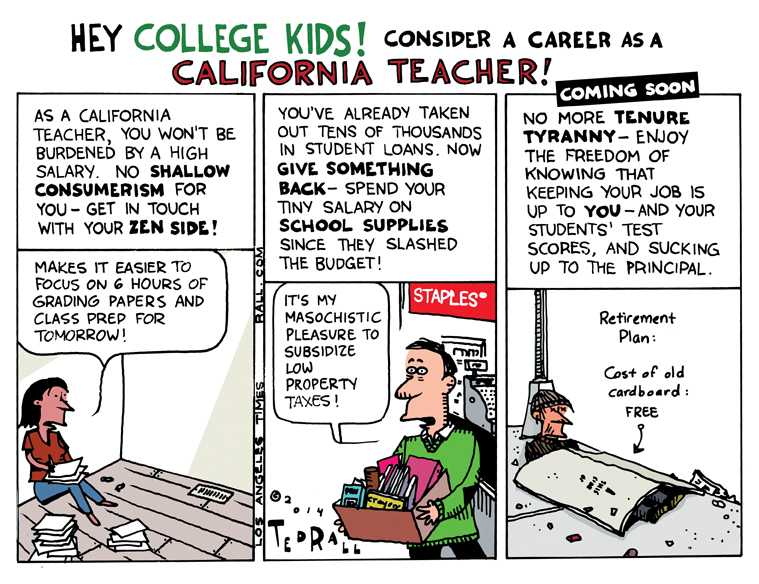

LOS ANGELES TIMES CARTOON: The War on Teacher Tenure

This week:

My mother retired recently from teaching under pretty much the best possible working conditions one could expect in an American high school: she taught high school French in an Ohio suburb whose demographics are at least 90% white, ranging from middle to upper-middle class. By the end of her career, she was relatively decently paid. Her students weren’t hobbled by poverty or challenged due to not having mastered English. Since French was an elective, her kids pretty much wanted to be there (though getting cut due to low enrollment was a worry).

Still, it was a tough job. Sure, class is 8 to 3 and she got those long summer vacations. But I remember watching her get up at 5:45 so she could prepare for class during the calm before the morning bell. She rarely got home before 5 — there’s always some meeting to attend — and then she had to grade papers and prepare the next day’s classes. Teaching is a performance. You’ve got roughly six hours to fill, keeping the kids entertained and engaged enough to get them to pay attention to what they need to learn. It’s exhausting, especially when you were up until 11 the night before correcting tests and averaging grades.

The summers were nice, but my mom spent the last half of June and the better part of July crashed out, recuperating. As for the last half, it wasn’t like we could afford to go on any trips. Not on a crummy teacher’s salary. For the first few decades of a teacher’s career, the pay is crap.

Raises don’t keep up with inflation. Parents constantly complain, often without cause. Administrators constantly lard on more responsibility, more paperwork, more rules, always more stuff to do on the same crummy salary. Moreover, budgets are always being cut. Even in lily-white districts like my mom’s, teachers find themselves hitting the office supply store to buy stuff for their students — out of that crummy paycheck.

During the last few decades, particularly since Reagan, the Right has waged war on teachers and their unions. From No Child Left Behind to the sneakily anti-unon, anti-professionalization outfit Teach for America to the Common Core, conservatives are holding teachers accountable for their kids’ academic performance. Sometimes it’s fair. Sometimes it’s not. Even the smartest and hardest-working teacher is going to have trouble getting good state test scores out of a classroom full of kids brutalized by abuse at home, poverty, crime and neglect.

The latest skirmish in the edu-culture war is over tenure, and it’s unfolding this week in Los Angeles County Superior Court. Superintendent John Deasy of the Los Angeles Unified School District is supporting a lawsuit, backed by a right-wing front group called Students Matter, that would eliminate teacher tenure as we know it in California. Tenure, say nine students recruited as plaintiffs, makes it too hard to fire bad teachers.

Not so fast, counter the unions. “Tenure is an amenity, just like salary and vacation, that allows districts to recruit and retain teachers despite harder working conditions, pay that hasn’t kept pace and larger class sizes,” James Finberg, a union lawyer, told the court. It also protects workers/teachers from being fired over their political beliefs, gender and religion — or just being too “mouthy,” i.e., speaking out against budget cuts.

As a parent, it’s easy to see why it would be good to make it easier to fire bad teachers. As the son of a hard-working teacher, it’s easier to see why teachers would need tenure. As in any other workplace, which teachers are judged “good” or “bad” falls to the boss — in this case, usually the school principal — who may or may not render a fair judgment free of personal bias based on personality or philosophy. Accusations of wrongdoing or incompetence levied by parents may or may not be fair.

Until my mom got tenure, she was afraid of disciplining students. She didn’t dare be active in her union. She didn’t want to reveal, in a Republican town, that she was a Democrat. Tenure didn’t make her lazy after she got it, but it did make her more relaxed, less terrified of her boss. Which made her a better, wiser, smarter teacher.

Tenure doesn’t prevent districts from firing teachers. It makes it hard. (Not impossible: two percent of teachers get fired for poor performance annually.) Which, frankly, is something that every worker who has ever experienced an unfair review should be able to empathize with. If anything, the only thing wrong with tenure is that only teachers can get it.

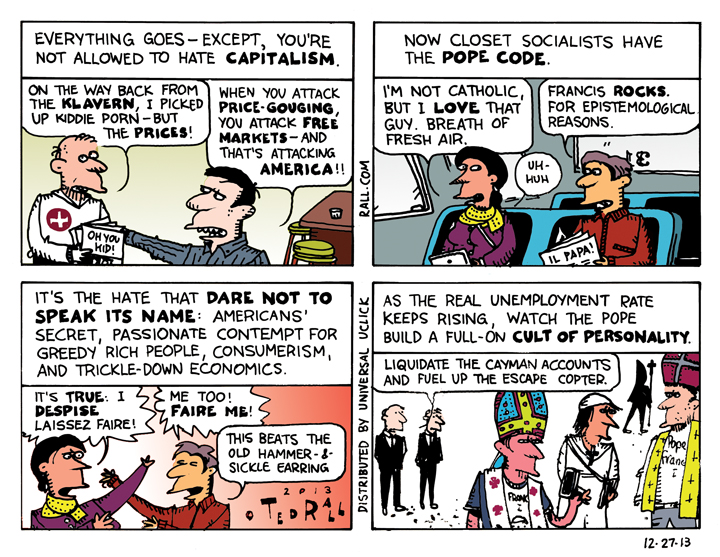

The Pope Code

65% of Americans say they agree with Pope Francis I’s critique of capitalism. But because we’re not allowed to publicly voice our opposition to capitalism, we resort to a sort of “dog whistle” — a “pope code” — in which we express our approval of the pope as an acceptable way to transmit our closet sympathies for socialism and communism.

SYNDICATED COLUMN: How I’d Spend My Powerball Winnings

Musings of a Wannabe Newspaper Warlord

Asked how they’d spend the $293.7 million they won in November’s record Powerball lottery, a Missouri couple told reporters they planned to buy a Camaro. They plan to travel to China. They might adopt a second daughter. They’ll up their grandkids’ college tuition. OK, so that leaves $293.6 million.

They obviously have absolutely no idea how much money $293.7 million is.

Mark and Cindy Hill seem like an average couple in their early 50s. Working class. Salt of the earth.

But man, what a waste of money to give all that loot to them! $200,000 would have been more than enough to change their lives. Not really knowing what to do with such a massive sum, the Hills will likely waste most of it on America’s self-perpetuating charity industry, which says that spending up to 35% of donor money on six-figure executive salaries and other luxuries is perfectly acceptable.

It is, of course, the Hills’ quarter-billion-plus to spend/squander. Not mine. I get it; I grew up under capitalism.

Let’s get something straight. I’m not jealous. I can’t envy the Hills because there is no way I could have won. This is because I don’t buy tickets. Whether I play or not, I figure the odds of winning are basically the same.

However, I do know how I’d spend their money.

Like the Hills, I’m a Midwest boy without fancy tastes. I’d pay off my mortgage and credit cards. My mom loves the beach; I’d buy her a house over the ocean. My car is eight years old; I’d buy one of those new Challengers.

Which would leave me $293.4 million.

Lottery winners always talk about helping their families. What about their friends? I have friends whose lives would be instantly transformed by $5 million checks. Brilliant cartoonists who could quit grueling day jobs and focus on developing their careers. Ailing writers who could finally get medical care for chronic conditions. Aspiring entrepreneurs who could capitalize their great ideas. People who are stressed out because work is scarce or nonexistent and are having trouble making ends meet. I have a couple dozen of friends like that. Helping them out would cost me about $100 million. Money well spent.

I want to help transform the media. That’s my big dream. Unfortunately, I will never realize it because I don’t have access to the kind of capital necessary.

The disintegration of print newspapers and the failure/refusal of digital media to deeply invest in serious journalism and smart commentary and satire is making Americans stupider, allowing evil corporations and corrupt, lazy politicians to thrive.

Warren Buffett is a smart man, picking up newspapers at rock-bottom prices. Personally, I’d buy The Los Angeles Times now that its parent, the Tribune Company, has emerged from bankruptcy. Experts guesstimate you could pick the Times for $185 million or less.

(Full disclosure: I draw cartoons for the Times.)

Aside from the fun of running a major metropolitan daily newspaper—12 pages of full-color comics! Hire a kick-ass investigative reporter to infiltrate government for a year or two and then cough up all the dirty secrets! Create an editorial page that runs no one to the right of Mao Tse-Tung!—I think the Times would be a fab investment.

People say newspapers are dying. Specific companies are hurting, many are dying, but the dead tree form is here to stay. They said radio was dead after TV came along, but radio is bigger today than ever. TV killed old-timey radio—plays, variety shows. New formats—album-oriented rock, news talk—emerged. Old-fashioned fat lazy newspapers basically minting money from gigantic office towers in the centers of major cities are on the ropes, but as long as print can do something that digital can’t, it will survive and thrive. TV can’t replace radio because you can’t (or at least shouldn’t) watch TV while you drive. Similarly, an iPad or a Kindle can’t replace a print newspaper’s awesome disposability, portability and—an advantage that people are just starting to become aware of—memory retention.

Print magazines and newspapers will get their groove back when they understand what they are for. The Internet is for short updates. The Web and apps tell you what happened and who won the game. Print is for long-form analysis. Print tells you why you should care about what happened, walks you through how the game was won and how the season is shaping up.

We need serious analysis. But no one wants to read 15,000 words on a smartphone.

These days, the clueless barons of print are screwing up big time; Tina Brown just closed Newsweek after using the glossy to try to out-Internet the Internet with full-page photographs, vacuous “charticles,” and more lists than you can shake a Daily Beast at. The publications that are doing okay are those that are embracing in-depth feature stories, like the Economist and Vanity Fair. Publishers are going to figure out that that the destiny of print is more, longer, smarter, edgier content.

The future of newspapers in the United States will look a lot like Europe, where nations have a few big national newspapers, each of which serves a particular political orientation or interest, like sports or finance, and individual communities are served by hyperlocal outlets and, possibly, regional ones that would go to, for example, people in the Southwest.

We already have a few big national newspapers. USA Today was first, but it lost its way before it found one. The New York Times is our big national paper of news and high culture. The Wall Street Journal, of course, is the national paper of finance. (Under Rupert Murdoch, the Journal is muscling in on the Times’s territory.) The Washington Post should be the big national political paper, but its management doesn’t get it, so there’s an opening there. Anyway, there should be a big national newspaper focused on entertainment—video games, film, music, I’d also include books—and the logical candidate is the Los Angeles Times. They have the contacts, the location, and the brand recognition to pull it off. What they need is for someone to point them in the right direction.

Imagine if it worked! Not only would you make a killing, you’d establish a template to revive American journalism. Don’t forget, over 90% of all news stories originate in newspapers.

Which would leave me with about $8 million. Call me the man who would be king minus the panache of Sean Connery, but the salary of a soldier in the Afghan national army is about $2000 a year. The Taliban pay closer to $4000. So I could hire 2000 badass Afghan mercenaries for a year for my spare Powerball change and take over a province or two after the U.S. pullout and the civil war heats up. I’m not exactly sure whom we’d fight. Maybe Turkmenistan because, well, why not? Perhaps we’d just sit in the Hindu Kush and shoot at pictures of Arianna Huffington while reading back issues of the Los Angeles Times. I’ve always wanted to test-fire an RPG.

I may never win a Pulitzer, but no one can ever take having been a cartoonist-columnist-newspaper-baron-warlord away from you.

(Ted Rall is the author of “The Book of Obama: How We Went From Hope and Change to the Age of Revolt.” His website is tedrall.com.)

COPYRIGHT 2012 TED RALL

SYNDICATED COLUMN: You’re Not Underemployed. You’re Underpaid.

The Case for Shiftlessness

No bank balance. Nothing in your wallet.

“I’m broke,” you say. “I need a job.”

Or:

Perhaps you have a job. Then you say:

“I’m broke. I need a better job.”

You’re lying. And you don’t even know it.

You don’t need a job.(Unless you like sitting at a desk. Working on an assembly line. Non-dairy creamer in the break room. In which case I apologize. Freak!)

You don’t need a job. You need money.

We’ve been programmed to believe that the only way to get money is to earn it.

(Unless you’re rich. Then you know about inheritance. In 1997, the last year for which there was solid research done on the subject, 42 percent of the Forbes 400 richest Americans made the list through probate. Disparity of wealth has since increased.)

It’s time to separate income from work.

For two reasons:

It’s moral. No one should starve or sleep outside or suffer sickness or go undereducated simply due to bad luck—being born into a poor family, growing up in an area with high unemployment, failing to impress an interviewer.

It’s sane.

“American workers stay longer at the office, at the factory or on the farm than their counterparts in Europe and most other rich nations, and they produce more over the year,” according to a 2009 U.N. report cited by CBS. Thanks to technological innovations and education, worker productivity—GDP divided by total employment—has increased by leaps and bounds over the years.

U.S. worker productivity has increased 400 percent since 1950. “The conclusion is inescapable: if productivity means anything at all, a worker should be able to earn the same standard of living as a 1950 worker in only 11 hours a week,” according to a MIT study.

Obviously that’s not the case. American workers are toiling longer hours than ever. They’re not being paid more —to the contrary, wages have been stagnant or declining since 1970. Numerous analyses have established that, especially since 1970, the lion’s share of profits from productivity increases have gone to employers.

Workers are working longer hours. But fewer people are working. Only 54 percent of work-eligible adults have jobs—the lowest rate in memory. Which isn’t surprising. Because there are fixed costs associated with employing each individual—administration, workspace, benefits, and so on—it makes sense for a boss to hire as few workers as possible, and to work them long hours.

This witches’ brew—increased productivity coupled with higher fixed costs, particularly healthcare—have led companies to create a society divided into two classes: the jobless and the overworked.

Unemployment is rising. Meanwhile, people “lucky” enough to still have jobs are creating more per hour than ever before and are forced to work longer and harder.

Crazy.

And dangerous. Does anyone seriously believe that an America divided between the haves, have-nots and the stressed-outs will be a better, safer, more politically stable place to live?

Sci-fi writers used to imagine a future in which machines did everything, where people enjoyed their newfound leisure time exploring the world and themselves. We’re not there yet—someone still has to make stuff—but we should be closer to the imagined idyll of zero work than we are now.

If productivity increases year after year after year, employers need fewer and fewer employees to sustain or expand the same level of economic activity. But this sets up a conundrum. If only employees have money, only employees can consume goods and services. As unemployment rises, the pool of consumers shrinks.

The remaining consumers can’t pick up the slack because their wages aren’t going up. So we wind up with a society that produces more stuff than can be sold: Marx’s classic crisis of overproduction. Hello, post-2008 meltdown of global capitalism.

Silicon Valley entrepreneur Martin Ford warns that the Great Recession is just the beginning. In his 2009 book “The Lights in the Tunnel: Automation, Accelerating Technology and the Economy of the Future” Ford, “argues that technologies such as software automation algorithms, artificial intelligence (AI), and robotics will result in dramatically increasing unemployment, stagnant or falling consumer demand, and a financial crisis surpassing the Great Depression,” according to a review in The Futurist.

The solution is clear: to guarantee everyone, whether or not he or she holds a job, a minimum salary sufficient to cover housing, transportation, education, medical care and, yes, discretionary income. Unfortunately, we’re stuck in an 18th century mindset. We’re nowhere close to detaching money from work. The Right wants to get rid of the minimum wage. On the Left, advocates for a Universal Living Wage nevertheless stipulate that a decent income should go to those who work a 40-hour week.

Ford proposes a Basic Income Guarantee based on performance of non-work activities; volunteering at a soup kitchen would be considered compensable work. But even this “radical” proposal doesn’t go far enough.

Whatever comes next, revolutionary overthrow or reform of the existing system, Americans are going to have to accept a reality that will be hard for a nation of strivers to take: we’re going to have to start paying people to sit at home.

(Ted Rall’s next book is “The Book of Obama: How We Went From Hope and Change to the Age of Revolt,” out May 22. His website is tedrall.com.)

COPYRIGHT 2012 TED RALL

SYNDICATED COLUMN: Want More Wars? Raise Taxes on the Rich

Tax Fairness Won’t Reduce Inequality

Reacting to and attempting to co-opt the Occupy Wall Street movement, President Obama used his 2012 State of the Union address to discuss what he now calls “the defining issue of our time”—the growing gap between rich and poor.

“We can either settle for a country where a shrinking number of people do really well, while a growing number of Americans barely get by,” Obama said. “Or we can restore an economy where everyone gets a fair shot, everyone does their fair share, and everyone plays by the same set of rules.”

No doubt, the long-term trend toward income inequality is a major flaw of the capitalist system. From 1980 to 2005 more than 80 percent in the gain in Americans’ incomes went to the top one percent. This staggering disparity between the haves and have-nots has created a permanent underclass of underemployed, undereducated and alienated people who often turn to crime for survival and social status. Aggregation of wealth into fewer hands has shrunk the size of the U.S. market for consumer goods, prolonging and deepening the depression.

How can we make the system fairer?

Liberals are calling for a more progressive income tax: i.e., raise taxes on the rich. Obama says he’d like to slap a minimum federal income tax of 30 percent on individuals earning more than $1 million a year.

Soaking the rich would obviously be fair. GOP frontrunner/corporate layoff sleazebag Mitt Romney earned $59,500 a day in 2010—and paid half the effective tax rate (13.9 percent) of that paid by a family of four earning $59,500 a year.

Fair, sure. But would it work? Would increasing taxes on the wealthy do much to close the gap between rich and poor—to level the economic playing field?

Probably not.

From FDR through Jimmy Carter it was an article of faith among liberals that higher taxes on the rich would result in lower taxes on the poor and working class. This was because the Republican Party consistently pushed for a balanced budget. Tax income was tied to expenditures, which were more or less fixed—and thus a zero-sum game.

That period from 1933 to 1980 was also the era of the New Deal, Fair Deal and Great Society social and anti-poverty programs, such as Social Security, the G.I. Bill, college grants and welfare. These government handouts helped mitigate hard times, gave life-changing educational opportunities that allowed class mobility, closing the gap between despair and hope for tens of millions of Americans. As the list of social programs grew, so did the tax rate—mostly on the rich. The practical effect was to redistribute income from top to bottom.

Democrats think it still works that way. It doesn’t.

The political landscape has shifted dramatically under Reagan, Clinton and the two Bushes. Budget cuts slashed spending on student financial aid, food stamps, Medicaid, school lunch programs, veterans hospitals, aid to single mothers. The social safety net is shredded. Most federal tax dollars flow directly into the Pentagon and defense contractors such as Halliburton.

As the economy continues to tank, there’s only one category to cut: social programs. “Eugene Steuerle worked on tax and budget issues in the Reagan Treasury Department and is now with the Urban Institute,” NPR reported a year ago. “He says one reason no one talks about preserving the social safety net today is that lawmakers have given themselves little choice but to cut it. They’ve taken taxes and entitlements, such as Social Security and Medicare, off the budget-cutting table, so there’s not much left.”

Meanwhile, effective tax rates on the wealthy have been greatly reduced. Which isn’t fair—but not in the way you might think.

Taxes on middle-class families are at their lowest level in 50 years, according to the Center on Budget and Policy Priorities, a liberal thinktank.

What’s going on?

On the revenue side of the budget equation, the poor and middle-class have received tiny tax cuts. The rich and super rich have gotten huge tax cuts. Everyone is paying less.

On the expense side, social programs have been pretty much destroyed. If you grow up poor there’s no way to attend college without going into debt. If you lose your job you’ll get 99 weeks of tiny, taxable (thanks to Reagan) unemployment checks before burning through your savings and winding up on the street.

Military spending, on the other hand, has soared, accounting for 54 percent of federal spending.

In short, we’re running up massive deficits in order to finance wars in Afghanistan, Iraq, and so on, and so rich job-killers can pay the lowest tax rates in the developed world.

I’m all for higher taxes on the rich. I’m for abolishing the right to be wealthy.

But liberals who think progressive taxation will mitigate or reverse income inequality are trapped in the 1960s, fighting the last (budget) war in a reality that no longer exists. The U.S. government’s top priority is invading Muslim countries and bombing their citizens. Without big social programs, invading Muslim countries and bombing their citizens is exactly where every extra taxdollar collected from the likes of Mitt Romney would go.

The only way progressive taxation can address income inequality is if higher taxes on the rich are coupled with an array of new anti-poverty and other social programs designed to put money and new job skills directly into the pockets of the 99 percent of Americans who have seen no improvement in their lives since 1980.

You have to rebuild the safety net. Otherwise higher taxes will swirl down the Pentagon’s $800 toilets.

If you’re serious about inequality, income redistribution through the tax system is only a start. Whether through stronger unions or worker advocacy through federal agencies, government must require higher minimum wages. It should set a maximum wage, too. A nation that allows its richest citizen to earn ten times more than its poorest would still be horribly unfair—yet it would be a big improvement over today. Shipping jobs overseas must be banned. Most free trade agreements should be torn up. Companies must no longer be allowed to layoff employees before eliminating salaries and benefits for their top-paid managers—CEOs, etc.

And a layoff should mean just that—a layoff. First fired should be first rehired—at equal or greater pay—if and when business improves.

Once a battery of spending programs targeted to the 99 percent is in place—permanent unemployment benefits, subsidized public housing, full college grants, etc.—the tax code ought to be radically revamped. For example, nothing gives the lie to the myth of America as a land of equal opportunity than inheritance. Aristocratic societies pass wealth and status from generation to generation. In a democracy, no one has the right to be born into wealth.

Because everyone deserves an equal chance, the national inheritance tax should be 100 percent. While we’re at it, why should people who inherited wealth but have low incomes get off scot-free? Slap the bastards with a European-style tax on wealth as well as the appearance of wealth.

Now you’re probably laughing. Even Obama’s lame call for taxing the rich—so the U.S. can buy more drone planes—stands no chance of passing the Republican Congress. They’re empty words meant for election-year consumption. Taking income inequality seriously? That’s so off the table it isn’t even funny.

Which is why we shouldn’t be looking to corporate machine politicians like Obama for answers.

(Ted Rall is the author of “The Anti-American Manifesto.” His website is tedrall.com.)

COPYRIGHT 2012 TED RALL