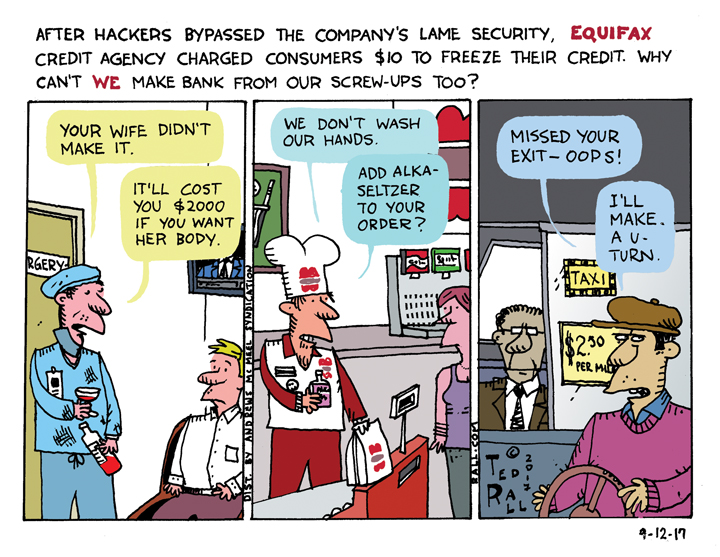

After hackers bypassed the company’s lame security, the credit reporting agency Equifax charged consumers to freeze/protect their credit. Why can’t we make money from our screw-ups?

Why Can’t We Make Money From Our Mistakes Like Equifax?

Ted Rall

Ted Rall is a syndicated political cartoonist for Andrews McMeel Syndication and WhoWhatWhy.org and Counterpoint. He is a contributor to Centerclip and co-host of "The TMI Show" talk show. He is a graphic novelist and author of many books of art and prose, and an occasional war correspondent. He is, recently, the author of the graphic novel "2024: Revisited."

20 Comments. Leave new

I never gave Equifax permission to collect my personal information, so from my perspective they stole my property and owe me.

Next these pigs will kidnap children and charge parents for their safe keeping. (Privatized schools, Devos?)

If the internet could be made secure criminals and governments would have a fit.

It’s not possible to remain vulnerable to some unwanted intruders and not others. A way in is a way in for anybody who finds it.

> I never gave Equifax permission to collect my personal information

No, but if you applied for credit anywhere you gave the lender permission to give your info to Equifax. It’s not like you had a choice, if you want a home loan you play by their rules. You can’t get a loan without a credit rating, and you can’t get a credit rating without a taking on a loan.

It’s monopoly or collusion or racketeering, it doesn’t matter what you call it – it’s technically illegal. But since it’s a matter of big guys screwing little guys, nobody in power gives a rip.

True.

But they start collecting information long before I signed the release for a loan, that’s how they have it without my permission and when it becomes vulnerable to theft.

@ Glenn –

“But they start collecting information long before I signed the release for a loan, that’s how they have it without my permission and when it becomes vulnerable to theft.”

*

I’ll admit, I have been out of the loop eleven years now, but I submit: They can’t collect information that you haven’t somewhere voluntarily surrendered. It might have been something as insignificant as a computer purchase at Best Buy. Maybe it was an application for a credit card. They cannot access it without your having given it somewhere along the line. Then it becomes accessible.

I’m grateful to be in a society where cash is the normal rule. Sadly, Mexico is now learning the United States method of robbery by use of the credit card, and Mexicans go nuts with their newly acquired “wealth,” accumulating much more debt than they can pay off in a lifetime.

I’m just glad to have escaped that vicious cycle.

It gets worse – now the info’s out there where even those with whom you have no credit can see it.

e.g. Insurance companies can see it – so, for instance, if one member of your household has trouble with credit cards then both of you will pay higher auto insurance premiums.

Say WHAT?! They noticed a correlation between bad credit and bad driving. It doesn’t prove that any one person with bad credit is a bad driver, nor does it prove that a person with good credit is a good driver. It just gives them an excuse to [hypothetically] raise your rates if your [theoretical] spouse doesn’t know when to put the [rhetorical] credit card back in her damned [made up purely for illustrative purposes] pocket.

@derlehrer on September 12, 2017 at 3:55 PM

“They can’t collect information that you haven’t somewhere voluntarily surrendered.”

True. At least not that we now know of.

I just keep thinking that every internet operation, if not now, will at some time in the near future operate on the Facebook mode of theft and sale of personal information; and if they aren’t stealing it themselves, they will be buying it from Facebook or someone who did.

A few years ago collecting cell phone location information and tying it to personal data was not supposed to be happening; it was supposed to be anonymous data collected only to measure shop window traffic.

A VP of a computer company said that wouldn’t happen, maybe because in his mind it wouldn’t have been ethical, and so unthinkable. But it does happen.

They’re offering a year’s free credit check-up for affected customers, aren’t they? PROBLEM SOLVED! 😀

Problem solved for a year, only.

Once someone has your SS number, for example, it’s good until you change it, or forever.

Unless you are in a government witness protection plan, for example, and they give you a new identity.

Tongue-in-cheek, Glenn.

MoveOn.org has a petition out there to force them to make their offer good for the customer’s lifetime.

Got it!

Merely another example of the innovative power that is released when the dead hand of regulation is removed from business. More of the same !…

Henri

The big banks got 20 trillion dollars from Obama for their screw-up.

And bonuses.

From what I’ve learned of The Great Depression, the same damned thing happened back then. The banks and investment companies got the money, and the little guys, average and ordinary citizens, were left high and dry. I thought we were supposed to learn from history.

Will Rogers said it best (and I paraphrase): The money should have gone to the little guy, and by night-fall it would have gone to the top. But at least the little guy would have had it in his hands for a while. (The gist is: The bailouts could have saved many of

I guess I screwed up again. Here’s what I meant to post:

From what I’ve learned of The Great Depression, the same damned thing happened back then. The banks and investment companies got the money, and the little guys, average and ordinary citizens, were left high and dry. (I thought we were supposed to learn from history.)

Will Rogers said it best (and I paraphrase): The money should have gone to the little guy, and by night-fall it would have gone to the top. But at least the little guy would have had it in his hands for a while. (The gist is: The bailouts could have saved many of the ordinary citizens who were in debt; they would have paid off their debt, and the top guys still would have received their money. But the little guys wouldn’t have lost their homes, etc.)

Either bailouts or forgiving debt will set a precedent.

So my guess is that the well connected wealthy would see recurring bailouts as preferable to recurring debt forgiveness for the relatively honest debtors.

The ruling class is not shy about the violence they put on small time borrowers.

Economist Michael Hudson agrees with you and Will Rogers.

People got kicked out of their homes and became homeless, home prices dropped because of excess inventory, so homes went to ruin and were destroyed to bring prices up, so mortgages weren’t underwater anymore.

Excess production is a problem for capitalism. Food and cars have had to be destroyed to keep prices up so investors wouldn’t lose money.

Capitalists sometimes have to go to extremes to keep the poor people poor.

«(The gist is: The bailouts could have saved many of the ordinary citizens who were in debt; they would have paid off their debt, and the top guys still would have received their money. But the little guys wouldn’t have lost their homes, etc.)» Heaven forfend, mein verehrter Lehrer ! Bailing out the little guys entails what is known in the economics racket as «moral hazard». For some odd reason, the concept never seems to apply to giving thousands of millions to save the wealth of owners of banks considered essential to the system…. 😉

Henri

Three Equifax bosses sold company stock just days after the intrusion was detected on July 29, and therefore about a month before details of the mega-hack were announced today. Chief financial officer John Gamble flogged $946,374 in shares while senior execs Joseph Loughran and Rodolfo Ploder dumped $584,099 and $250,458 respectively.

The biz’s stock price is now down 13.52 per cent in after-hours trading to $123.42 apiece.

More details at: https://www.bloomberg.com/news/articles/2017-09-07/three-equifax-executives-sold-stock-before-revealing-cyber-hack

Such a blatant case of insider trading that we can all rest assured that they will pay their debt to society …

… oh, who am I kidding?

On September 6, Irma reached its peak intensity with 185 mph (295 km/h) winds and a minimum pressure of 914 mbar (914 hPa; 27.0 inHg), making it the strongest tropical cyclone worldwide so far in 2017.

7 Sep 2017

Vid Global credit reporting agency Equifax admitted today it suffered a massive breach of security that could affect almost half of the US population.

In a statement, the biz confessed that hackers managed to get access to some of its internal data in mid-May by exploiting a vulnerable website application. They remained on the system until they were discovered on July 29.