Extreme Problems Require Extreme Solutions

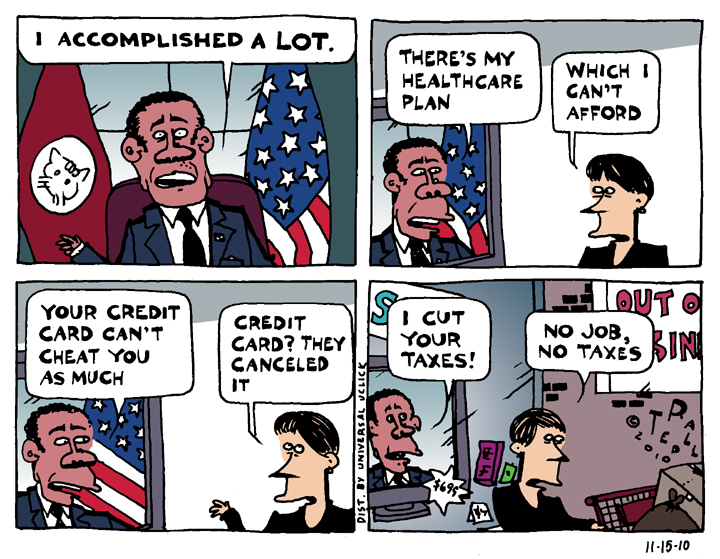

Given his druthers, Obama will pursue the most left-leaning course that he can get away with.” So says Jennifer Rubin, a right-wing pundit at the neoconservative-leaning Washington Post. “Obama,” Rubin claims, “would have marched through his entire liberal agenda—if he had the votes.”

This, of course, assumes that Obama ever had a liberal agenda. There’s not much evidence of that. Moreover, Obama did have the votes in Congress to get almost everything that he wanted. But he chose not to even try.

It is also not true. He did have the votes. In recent years, for example, minority Republicans in the Senate have threatened filibusters on most major Democratic initiatives. When they have 60 or more votes, Democrats file a cloture motion to stop filibusters before they start. In practice, Democrats say—and the media has been repeating their meme—that it now takes 60 votes to pass a bill in the Senate.

It isn’t true. Not now. Not ever.

What Dems fail to understand is that they are depriving themselves of a big political opportunity by embracing automated parliamentary procedure. If Republicans want to filibuster, let them drag out their District of Columbia white pages and start reading on C-Span. Footage of GOP senators stonewalling popular legislation—extensions of unemployment benefits, eliminating tax breaks for individuals who earn more than $1 million a year, or healthcare benefits for 9/11 first responders—would make for awesome attack ads in 2012.

When the Bush Administration enjoyed a razor-thin 50-vote majority in the Senate, it only needed a simple majority in order to pass major bills. Even though they should have, Democrats didn’t filibuster. Democrats lack nerve. And voters hate them for it.

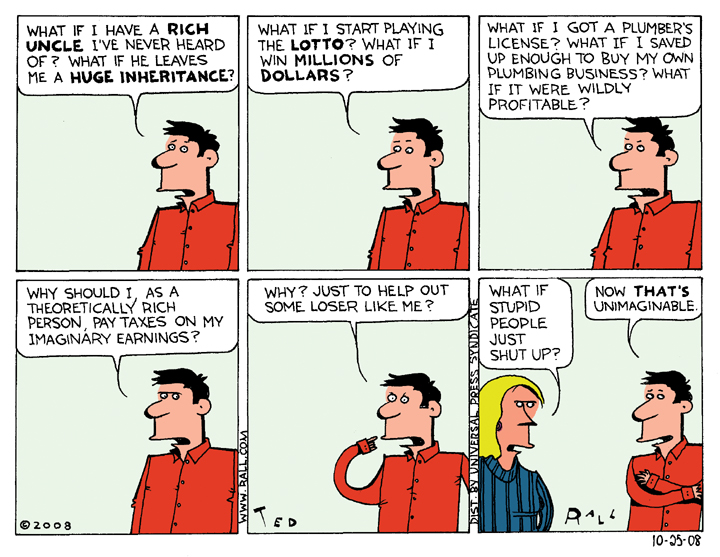

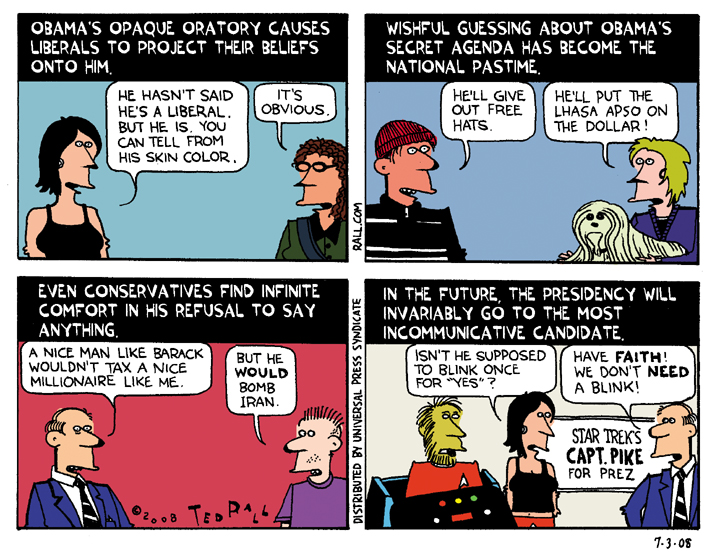

There’s another factor at work: self-delusion. Much liberal disappointment with Obama stems from the fact that, on several issues, he is doing exactly what he said he was going to do during the campaign. He told us that we were going to go deeper in Afghanistan. Liberals simply chose to pretend that he was lying. It’s not Obama’s fault if people are in denial. At the same time, Obama failed to realize that the world had changed dramatically between September and November of 2008.

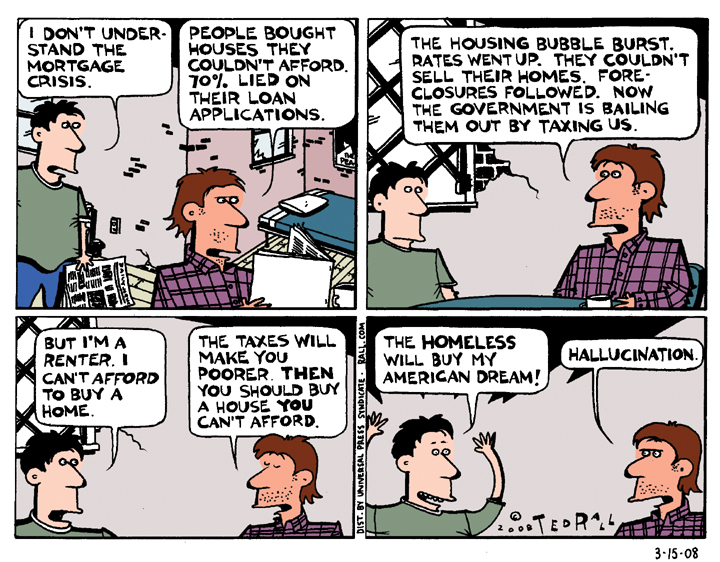

During the summer of the 2008 campaign, there was a plausible argument to be made that the American people were fundamentally moderate. But after the economic meltdown of September 2008, a crisis of capitalism and consumer confidence that continues today with no end in sight, the electorate moved decidedly to the left. Six months into Obama’s term, most Americans told pollsters they preferred socialism to capitalism. In early 2010 one in five Republicans said they have a positive view of socialism.

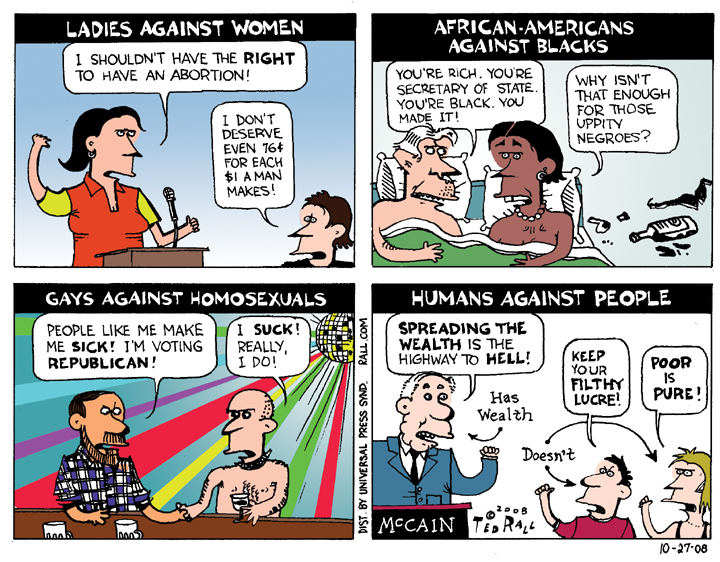

Meanwhile, the right became more radical too. This is what happens during a crisis when the “mainstream” system is unresponsive. Moderation? There are no more moderates.

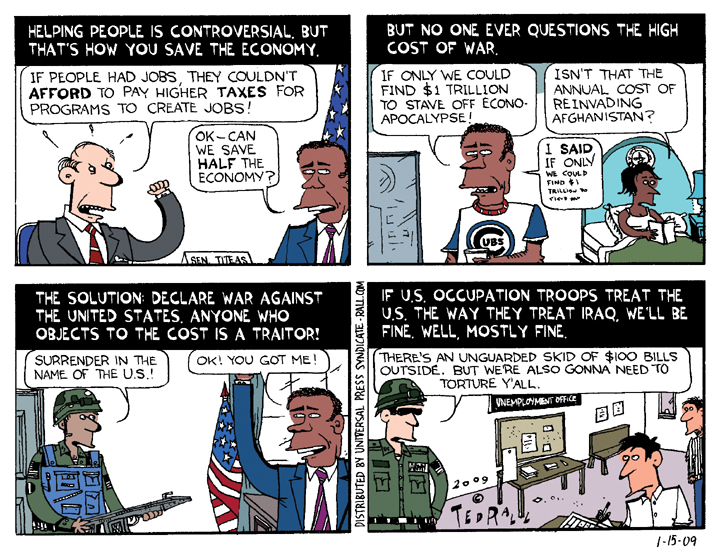

As we have seen time and time again in American history, compromises usually mean no solution at all. From the status of Missouri as a slave state to last week’s tax deal between Democrats and Republicans, compromise usually means kicking the can down the road for another generation of people and politicians to contend with.

Yet the myth persists: moderation equals common sense. I don’t know about my fellow lefties, but I find more common ground with Tea Party types who are angry as hell and don’t want to take it anymore than I do with squishy soft liberals who think everything is fine as long as Barack Obama gets reelected in 2012.

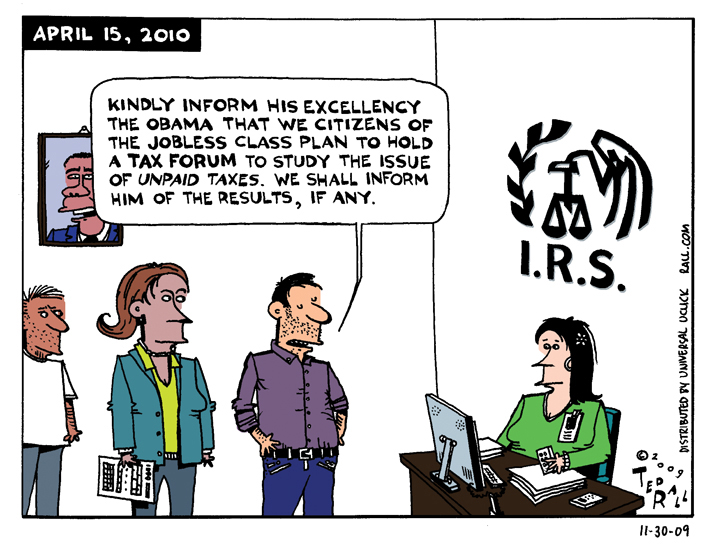

Nothing is fine. The unemployment rate is over 9.8 percent officially and about 20 percent unofficially. Yet neither party has lifted a finger to even talk about proposing a jobs program. Tax cuts? Unemployed people don’t pay taxes. Depression-level joblessness is fiscal poison. If we don’t create tens of millions of new jobs soon, social and political unrest will increase dramatically.

Chris Hedges recently put out a book titled “The Death of the Liberal Class.” A better title might have been “The Death of Moderation.” No one better embodied the American brand of political moderation than traditional liberals. They supported income redistribution, but only through a slightly progressive income tax: not enough to make a difference, but plenty to make right-wingers spitting mad. They consistently voted for huge defense budgets and war after war, yet were successfully framed as wimps by Republicans whose rhetoric matched their similar bellicosity.

The smug and the complacent love moderation precisely because it can’t change the status quo.

Look at ObamaCare: that’s what happens when you compromise. The insurance companies get to soak even more Americans than usual—and charge those of us who are already in the system more. Like many other issues, the “extremes” work better than the centrist, “common sense” solution. If I can’t have full-fledged socialized medicine, give me free markets.

Moderates know their time has past. New York Mayor Michael Bloomberg recently brought 1,000 people together to create a militant moderate organization called No Labels. Like Jon Stewart’s Million Moderate March, No Labels is meant “not to create a new party, but to forge a third way within the existing parties, one that permits debate on issues in an atmosphere of civility and mutual respect,” say organizers.

Sweet.

Because, you know, you should always be civil and respectful to people who think torture and concentration camps are A-OK.

For those who despair of the rise of political extremism, I ask: From multi-trillion dollar deficits to endless war to mass die-offs of species and climate change, are the problems America face so trivial that they can be resolved with more half-assed compromises?

(Ted Rall is the author of “The Anti-American Manifesto.” His website is tedrall.com.)

COPYRIGHT 2010 TED RALL