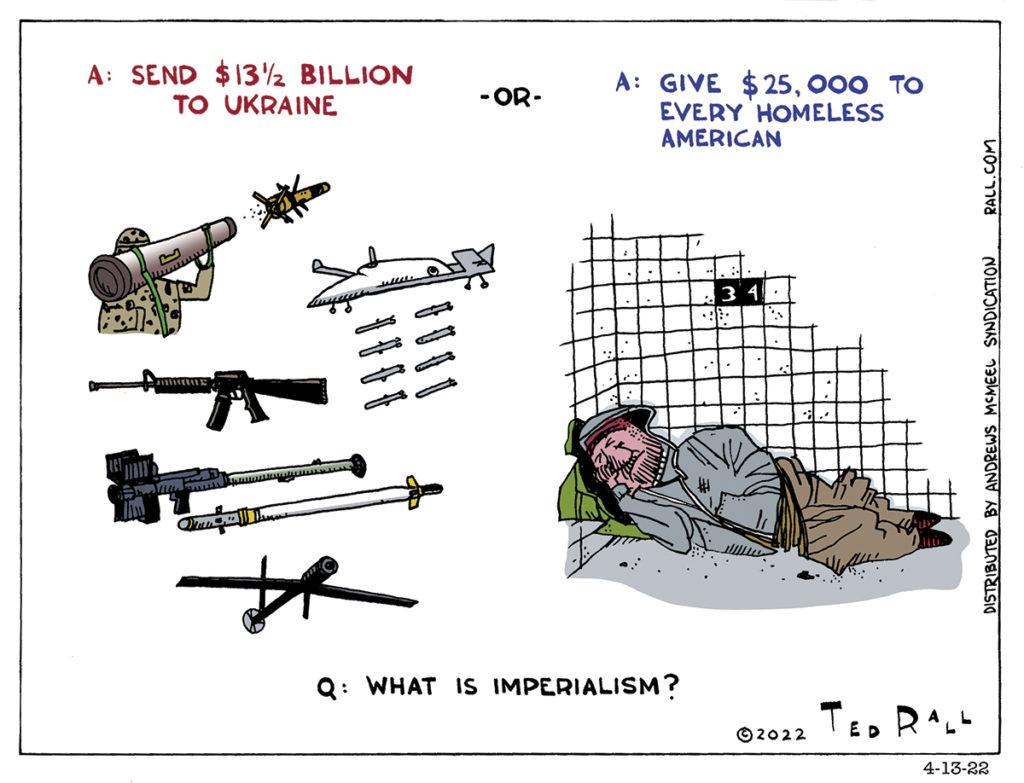

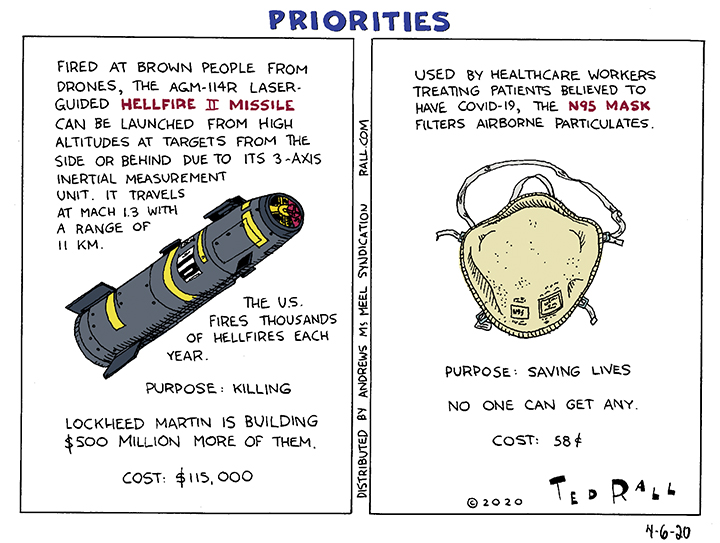

The $1.6 trillion we waste each year on the Pentagon is an irresistible target for leftists looking for funds to appropriate to the human wants and needs that are currently going un- and under-addressed. Let’s redirect those funds to something more worthwhile than slaughtering innocent people around the planet—i.e., anything else. But why stop there?

The U.S. federal budget is full of poor spending choices and waste caused by bureaucratic inefficiency.

One item you might not immediately think of as flexible or fungible is interest on the national debt, which came to $659 billion in the 2023 fiscal year. That derives from past spending. We don’t have a time machine, so what can be done about that?

Quite a lot, actually. That figure reflects an increase of $184 billion, or 39%, from the previous year and is nearly double that for fiscal year 2020. The culprit for that massive spending spike is the Federal Reserve Bank’s optional, unnecessary, totally reversible decision to repeatedly raise interest rates following the COVID-19 lockdown, including on government-issued Treasury bonds and notes that finance the debt, in order to fight a spike in inflation that probably would have eased without any action by monetary regulators. And it’s only going to get worse. The Congressional Budget Office projects that interest on the debt, which currently amounts to two percent of GDP, will rise to six percent by 2030.

In other words, American taxpayers would have saved $184 billion had the Fed chosen not to increase interest rates. Which, if our society valued labor more than capital, it would not have. Not only is the Fed’s obsessive fear of inflation a paranoid and anachronistic vestige of a 1970s economy that no longer exists and in any event was not nearly as bad for workers as we’ve been told, it repeatedly leads them to risk recession because, in the worst-case scenario from business’ vantage point, layoffs and wage cuts rein in the power of labor, which amounts to about two-thirds of the expenses of a generic U.S. corporation.

The federal government issues about $250 billion per year to individuals and corporations that objectively do not qualify for the subsidies, including $1 billion a year to dead people.

Nearly $2 billion per year goes to maintaining 77,000 empty buildings.

Then there’s the revenue side—or lack thereof. In 2021, the last year for which statistics are officially available, the Internal Revenue Service failed to collect $688 billion in unpaid taxes because it didn’t bother to send dunning letters or to conduct audits of wealthy individuals or corporations.

And that’s not even touching the fact that income taxes can, and should be increased on high income, individuals and corporations.

For this exercise, we are omitting other expenses that are arguably wasteful, like most of the budget of the Department of Homeland Security, the $70 billion a year foreign-aid budget and outlandish headline-grabbing projects like federally-supported studies of how Russian cats walk, and how the fur color of Labrador retrievers affects their internal body temperatures. Taxpayer money should never be wasted. But here we are looking for the biggest reservoir of foolishly-spent money, not the latest Bridge to Nowhere.

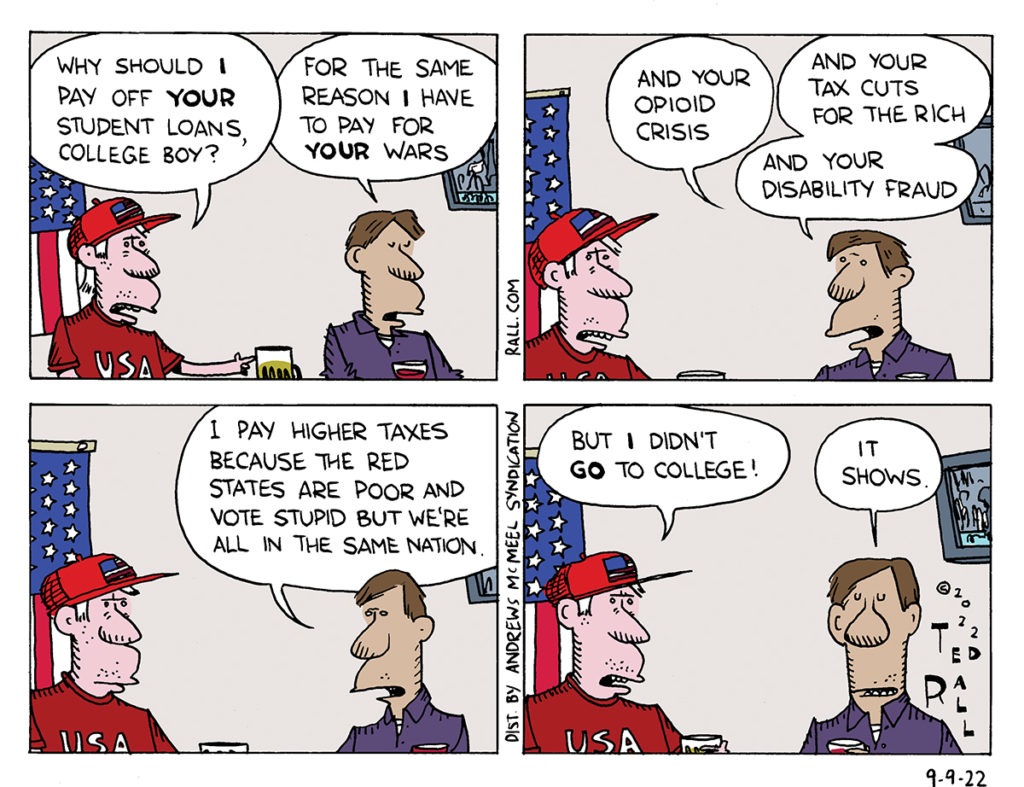

Leaving the tax structure as it is, at least $3.5 trillion per year is currently being wasted, squandered, thrown away for no good reason whatsoever. Meanwhile, Americans live in terror because they are one or two paychecks away from economic ruin, don’t know what they would do if they were diagnosed with a terrible disease and are going into insane amounts of debt in order to send their kids to college.

Now imagine if large corporations and wealthy individuals were made to pay their fair share of taxes. Six out of 10 voters say they resent how low taxes are for the rich and big companies.

Currently, for example, families don’t pay Social Security withholding taxes on income over $250,000 per year. Eliminating the highly regressive cap would bring in an additional $100 billion per year.

A 2% or 3% wealth tax on people worth more than $50 million—a tax on assets rather than income, as other developed countries have—would bring in at least $200 billion annually.

Taxing capital gains at the same rate as income would bring in an additional estimated $100 billion a year.

Corporate income taxes as a percentage of GDP have steadily fallen since 1950, peaking at 6% during the Korean War, hitting 3% in 1970 and plunging to 1% during the Reagan years, where they are now. Companies are sponging off the greatest consumer market on earth; they should be made to pay if they want to continue to play. If we returned to that 3% rate, when the economy was booming by the way, the Treasury would bring in an additional $500 billion annually.

All told, we are looking at roughly $4.5 trillion per year. $4.5 trillion a year that could be used to alleviate hunger, house the unhoused, treat the sick, build infrastructure, educate the young, and retrain older workers.

Next week: Americans’ biggest worries and how the Left could reallocate those $4.5 trillion in ways to make us all better off.

(Ted Rall (Twitter: @tedrall), the political cartoonist, columnist and graphic novelist, co-hosts the left-vs-right DMZ America podcast with fellow cartoonist Scott Stantis. You can support Ted’s hard-hitting political cartoons and columns and see his work first by sponsoring his work on Patreon.)