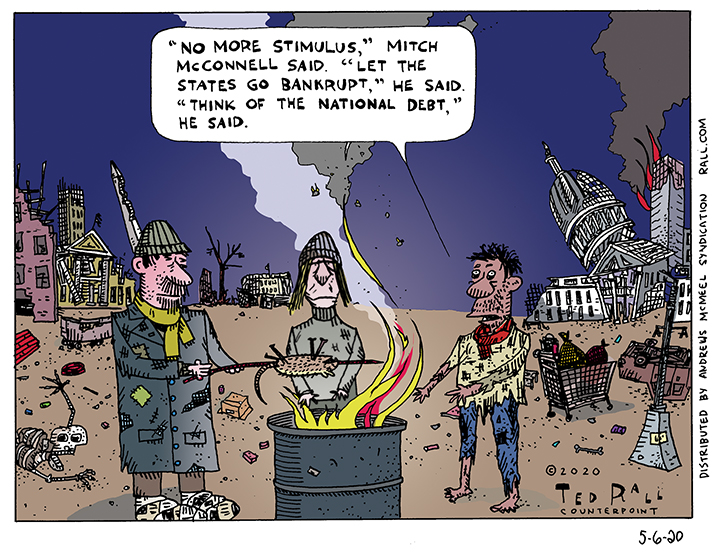

Senate majority leader Mitch McConnell insists that economic stimulus should either halt or slow down due to concerns about the deficit. What kind of world, he asks, will our children and grandchildren inherit? Not a good one if he gets his way.

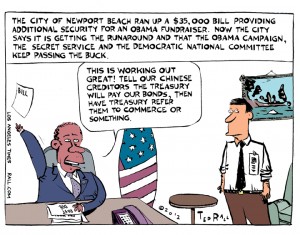

LOS ANGELES TIMES CARTOON: A California Town Gets The Runaround

I draw cartoons for The Los Angeles Times about issues related to California and the Southland (metro Los Angeles).

I draw cartoons for The Los Angeles Times about issues related to California and the Southland (metro Los Angeles).

This week: The city of Newport Beach ran up a $35,000 bill providing additional security for an Obama fundraiser. Now the city says it is getting the runaround and that the Obama campaign, the U.S. Secret Service, and the Democratic National Committee keep passing the buck.

SYNDICATED COLUMN: 7-7-7

Jobless? Face It: Obama’s Not That Into You

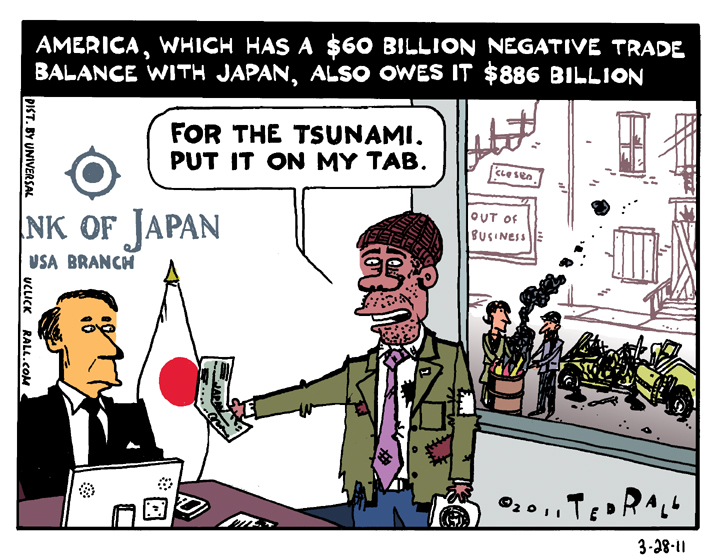

Forget Herman Cain’s 9-9-9. The battle cry for every American ought to be 7-7-7.

7-7-7: for the $7.7 trillion the Bush and Obama Administrations secretly funneled to the banksters.

Remember the $700 billion bailout that prompted rage from right to left? Which inspired millions to join the Tea Party and the Occupy movements? Turns out that that was a mere drop in the bucket, less than a tenth of what the Federal Reserve Bank doled out to the big banks.

Bloomberg Markets Magazine reports a shocking story that emerged from tens of thousands of documents released under the Freedom of Information Act: by March 2009, the Fed shelled out $7.77 trillion “to rescuing the financial system, more than half the value of everything produced in the U.S. that year.”

The U.S. national debt is currently a record $14 trillion.

We knew that the Fed and the White House were pawns of Wall Street. What’s new is the scale of the conspiracy.

Even the most jaded financial reporters were stunned at the extent of collusion: “The Fed didn’t tell anyone which banks were in trouble so deep they required a combined $1.2 trillion on Dec. 5, 2008, their single neediest day. Bankers didn’t mention that they took tens of billions of dollars in emergency loans at the same time they were assuring investors their firms were healthy. And no one calculated until now that banks reaped an estimated $13 billion of income by taking advantage of the Fed’s below-market rates.”

Citigroup earned an extra $1.8 billion by reinvesting the Fed’s below-market loans. Bank of America made $1.5 billion.

Bear in mind, that’s only through March 2009.

“Many Americans are struggling to understand why banks deserve such preferential treatment while millions of homeowners are being denied assistance and are at increasing risk of foreclosure,” wrote Representative Elijah Cummings, a ranking member of the House Committee on Oversight and Government Reform who is demanding an investigation.

Indeed we are.

This stinks. It’s terrible economics. And it’s unbelievably cruel.

First the economics. The bank bailouts were supposed to loosen credit in order to encourage lending, investment, job creation and ultimately consumer spending. It didn’t work. Banks and corporations alike are hoarding cash. President Obama, who promised 4 million net new jobs by earlier this year, has been reduced to claiming that unemployment would have been even higher without the bailouts.

Ask any business executive why nobody is hiring and they’ll blame the lack of consumer demand. If the ultimate goal is to put more money into people’s pockets, why not just, you know, put more money into people’s pockets?

Bank executives used federal taxdollars to pay themselves tens of billions in bonuses and renovate their corporate headquarters. We the people got 0-0-0. What if we’d gotten 7-7-7 instead?

Every man, woman in child in the United States would have received $24,000.

A family of four would have gotten $96,000.

And that’s without an income test.

New data from the U.S. Census Bureau shows that 100 million American citizens—one of out of three—subsists below or just above the official poverty line. Demographers, statisticians and economists were stunned. “These numbers are higher than we anticipated,” Trudi J. Renwick, the bureau’s chief poverty statistician, told The New York Times. “There are more people struggling than the official numbers show.”

For four decades progressive economists have warned that the middle-class was being eroded, that the United States would become a Third World country if income inequality continued to expand. They can stop. We’re there.

These poor and “near poor” Americans comprise the vast majority of the uninsured, un- and underemployed, and foreclosure victims. If Bush-Obama’s 7-7-7 Plan had gone to each one of these 100 million misérables instead of Citigroup and Bank of America, the IRS would have mailed out 100 million checks for $77,700 each.

This would have paid off a lot of credit cards. Kept millions in their homes, protecting neighborhood property values. Allowed millions to see a doctor. Paid for food.

A lot of the money would have been “wasted” on new cars, Xboxes—maybe even a renovation or two. All of which would have created a buttload of consumer demand.

If you’re a “99er”—one of millions who have run out of unemployment benefits—Obama’s plan for you is 0-0-0.

If you’re one of the roughly 20 million homeowners who have lost or are about to lose your house to foreclosure—most likely to a bank using fraudulent loan documents—you get 0-0-0.

If you’re a teacher asking for a raise, or a parent caring for a sick child or parent, or just an ordinary worker hobbling to work on an old car that needs to be replaced, all you’ll get is 0-0-0.

There isn’t any money to help you.

We don’t have the budget.

We’re broke.

You can’t get the bank to call you back about refinancing, much less the attention of your Congressman.

But not if you’re a banker.

Bankers get their calls returned. They get anything they want.

There’s always a budget for them.

They get 7-7-7.

(Ted Rall is the author of “The Anti-American Manifesto.” His website is tedrall.com.)

COPYRIGHT 2011 TED RALL

SYNDICATED COLUMN: The GOP Bets on Bad Judgement

Voters Focus on Spending at Just the Wrong Time

Ross Douthat, the conservative columnist who elevates bland to middle-brow art for The New York Times, thinks Republicans have overreached in their showdown with Obama over the debt ceiling. “[The Republicans’] inability to make even symbolic concessions has turned a winning hand into losing one,” he says.

Advantage, according to Douthat, representing the mainstream media: Obama.

Of course, Obama had already agreed to begin dismantling Social Security and Medicare, surrenders Republicans have craved for decades. If he pulls off this “victory” Obama will have done more damage to the Democratic Party and its core values than any president in our lifetimes. How will he promote what Douthat fears will be a “victory”? I wonder.

Or, to lift a line from “Double Indemnity”: I wonder if I wonder.

Back a few pages, Times reporter Jesse MacKinley finds himself in the curious position of writing that no one really cares about a story that has dominated the headlines for weeks.

“Indeed, the drama of whether the government will raise the debt ceiling (to the chagrin of some conservatives demanding tighter financial belts) or allow it to remain as is (to the horror of the administration and economists who predict financial ruin) seemed largely lost on a populace involved in more pressing—and more pleasant—summer distractions,” asserts MacKinley.

To summarize:

No one cares about the debt ceiling.

And:

Among the few political geeks who understand what’s going on, much less have an opinion, the tide is allegedly turning in favor of Obama because he’s willing to compromise and the Tea Party-led GOP isn’t.

Conventional wisdom floggers like Douthat say that if Congress can’t strike a deal and economic consequences follow—a reduction in the ratings of U.S. government-issued securities and a panic in the securities market—voters will hold Republicans accountable in 2012. Even if things don’t turn that far south, the GOP will pay for their intransigence. Obama wins in a cakewalk.

I’m not so sure.

In the same way that generals usually refight the last war, mainstream political pundits often apply old scenarios to new situations. This is not 1995, when then-House Speaker Newt Gingrich orchestrated a shutdown of the federal government that set the stage for Bill Clinton’s reelection the following year.

Without a doubt, the Republicans’ willingness to imperil the pure platinum credit of Treasury notes and bonds is reckless and irresponsible. There is also no denying their naked hypocrisy and intellectual dishonesty. These so-called “deficit hawks” voted 19 times to raise the debt ceiling by $4 trillion.

If Republicans were serious about balancing the federal budget they’d start by slashing the military, which accounts for 54 percent of discretionary spending—and which hasn’t done anything to defend the U.S. from a real enemy since 1945. The Department of Homeland Security, a vast new bureaucracy created by Bush after 9/11 in order to make us take off our shoes, should be eliminated.

Moreover, the middle of the biggest economic meltdown since the industrial revolution is no time to be cutting debt. Read your Keynes: governments are supposed to spend their way out of downturns, and pay down debt during upswings.

Republicans, it seems, are trying to finish off an economy that is already gravely wounded.

Politically, however, I think they’re onto something. Year after year of warnings about the expanding national debt—remember Ross Perot’s charts?—the American people are finally, genuinely alarmed about the pace and scale of government spending. The current national debt of $14 trillion isn’t the magic number that flips some sort of switch in the public.

It’s simply that, at certain times, public opinion on an issue that has been around for years, divisive and apparently intractable, suddenly coalesces into widespread consensus. Climate change. Gay marriage. The war in Afghanistan, which was so popular in 2008 that Obama won by promising to expand it, but is now seen as stale and unwinnable.

Win or lose on the debt ceiling showdown, GOP strategists are betting than voters will reward them for taking an uncompromising stand on spending against a president who has increased the national debt faster than any of his predecessors. It’s not 100 percent—but I’d say it’s a pretty safe bet.

This is the worst possible time for the American people to start worrying about out-of-control federal spending. But it’s good for the GOP.

(Ted Rall is the author of “The Anti-American Manifesto.” His website is tedrall.com.)

COPYRIGHT 2011 TED RALL

SYNDICATED COLUMN: The Phony Budget Crisis

Forget Austerity. Tax the Rich.

Everywhere you look, from the federal government to the states to your hometown, budget crises abound. Services are being slashed. Politicians and pundits from both parties tell us that the good times are over, that we’ve got to start living within our means.

It’s a lie.

Two case studies have made news lately: California, where new/old governor Jerry Brown is trying to close a $25 billion shortfall with a combination of draconian cuts in public services and a series of regressive tax increases, and Wisconsin, where right-winger Scott Walker says getting rid of unions would eliminate the state’s $137 million deficit.

Never mind the economists, most of whom say an economic death spiral is exactly the worst possible time for government to cut spending. Pro-austerity propaganda has won the day with the American public. A new Rasmussen poll funds that 58 percent of likely voters would approve of a shutdown until Democrats and Republicans can agree on what spending to cut.

The budget “crisis” is a phony construction, the result of right-wing “starve the beast” ideology. There is plenty of money out there—but the pols don’t want it.

There is no need to lay off a single teacher, close a single library for an extra hour, or raise a single fee by one red cent.

Every government can not only balance its budget, but wind up with a surplus.

The solution is simple: tax the rich.

Over the last 50 years tax rates for the bottom 80 percent of wage earners have remained almost static. Meanwhile the rich have received tax cut after tax cut after tax cut. For example, the rate paid by the top 0.01 percent—people who currently get more than $6.5 million a year—fell by half (from 70 to 35 percent).

Times are tough. Someone has to pay. Why not start with those who can most afford it?

Europe has the world’s best food, its best healthcare system and its best vacation policy. It also has one of the fairest ways to generate revenue for government: a wealth tax. In Norway, for example, you pay one percent of your net worth in addition to income tax.

What if we imposed a Norwegian-style wealth tax on the top one percent of U.S. households? We’re not talking upper middle class here: the poorest among them is worth a mere $8.3 million. This top one percent owns 35 percent of all wealth in the United States.

“Such a wealth tax…would raise $191.1 billion each year (one percent of $19.1 trillion), a significant attack on the deficit,” Leon Friedman writes in The Nation. “If we extended the tax to the top 5 percent, we could raise $338.5 billion a year (one percent of 62 percent of $54.6 trillion).”

But that’s just the beginning. Wealthy individuals are nothing next to America’s money-sucking corporations.

Business shills whine that America’s corporate tax rate—35 percent—is one of the world’s highest. But that’s pure theory. Our real corporate rate—the rate companies actually pay after taking advantages of loopholes and deductions—is among the world’s lowest. According to The New York Times, Boeing paid a total tax rate of 4.5 percent over the last five years. (This includes federal, state, local and foreign taxes.) Yahoo paid seven percent. GE paid 14.3 percent. Southwest Airlines paid 6.3 percent. “GE is so good at avoiding taxes that some people consider its tax department to be the best in the world, even better than any law firm’s,” reports the Times‘ David Leonhardt. “One common strategy is maximizing the amount of profit that is officially earned in countries with low tax rates.”

America’s low effective corporate tax rates have left big business swimming in cash while the country goes bust. As of March 2010 non-financial corporations in the U.S. had $26.2 trillion in assets. Seven percent of that was in cash.

The national debt is $14.1 trillion.

Which is a lot. And, you see, entirely by choice.

(Ted Rall is the author of “The Anti-American Manifesto.” His website is tedrall.com.)

COPYRIGHT 2011 TED RALL

SYNDICATED COLUMN: Yes, I Can

Straight Talk on Balancing the Budget

The federal budget deficit is like the weather. Everybody talks about it; except for Bill Clinton, no one ever does anything about it.

President Obama’s bipartisan Fiscal Debt Commission has released a draft report that starts out with a big problem: even talking about reducing spending is insane when you’re in the midst of a Depression. The real unemployment is over 20 percent. Creating jobs ought to be the feds’ top—perhaps sole—priority.

Let the insanity commence.

Triumphant Republicans say they want to balance the budget. So does Obama. Are they serious? Of course not.

Still, theoretical budget-balancing exercises help enlighten us about where our taxdollars really go. So let’s roll up our sleeves and start some back-of-the-envelope slashing.

The 2010 federal budget shows $3.6 trillion in spending and $2.4 trillion in revenues. Net deficit: $1.2 trillion. It’s a doozy, too. It nearly 13 percent of GDP. It’s the highest since 1943, during World War II.

The goal, then, is to close a $1.2 trillion budget gap. Can we find at least $1.2 trillion in budget cuts? News flash: getting rid of the National Endowment for the Arts ($161 million in 2010, or about 0.01 percent of the deficit), ain’t gonna do the trick.

Any serious budget cutter has to start with defense. The reason is simple: it accounts for 54 percent of discretionary (i.e., optional) federal spending. It’s the biggest piece of the pie by far.

(Mainstream news reports usually state that defense accounts for 20 percent of federal outlays. But they’re fudging the facts in order to pretty up the military-industrial complex. For example, they include budget items like Social Security that no one can do anything about—they’re in a trust fund.)

Of that 54 percent, 18 percent is debt service on old wars. There’s nothing we can do about that—though that number should probably give us pause the next time a president wants to invade Panama or Grenada.

Anyway, that leaves 36 percent, or $1.3 trillion to play with. $200 billion a year goes to Afghanistan and Iraq.

Let’s pull out. We’re losing anyway.

New Deficit: $1.0 trillion.

In 2007 Chalmers Johnson wrote a book about the staggering costs of American imperialism. “The worldwide total of U.S. military personnel in 2005, including those based domestically, was 1,840,062 supported by an additional 473,306 Defense Department civil service employees and 203,328 local hires,” he wrote. “Its overseas bases, according to the Pentagon, contained 32,327 barracks, hangars, hospitals, and other buildings, which it owns, and 16,527 more that it leased. The size of these holdings was recorded in the inventory as covering 687,347 acres overseas and 29,819,492 acres worldwide, making the Pentagon easily one of the world’s largest landlords.”

We’re broke. It’s time to bring those 2.3 million men and women home. At an average cost of $140,000 per employee—crazy but true—we could save $322 billion annually.

New Deficit: $676 billion.

After Defense, the other big costs are Social Security, Medicare and Medicaid.

The obvious place to start slashing is wealthy recipients. Why should Bill Gates, worth $58 billion, get Social Security or Medicare benefits? Dean Baker sums up the traditional liberal argument in favor of giving tax money to people who don’t need it: “Social Security enjoys enormous bipartisan support because all workers pay into it and expect to benefit from it in retirement. Taking away the benefits that better-off workers earned would undoubtedly undermine their support for the program. This could set up a situation in which the program could be more easily attacked in the future.”

Yeah, well, whatever. We. Are. Broke. “Means testing”—for example, eliminating benefits for the approximately one percent of families over age 65 who earn over $100,000 a year—could save $150 billion a year.

New deficit: $526 billion.

Now let’s talk about the other side of the equation: income. How can the U.S. government scare up some extra cash?

Allowing the Bush tax cuts for the richest three percent of Americans to expire on schedule would bring in $70 billion a year. Seems like a no-brainer: anyone earning over $250,000 a year is doing awesome. Moreover, if Democrats don’t insist on the expiration of at least some of those “temporary” tax cuts, what’s the point of the deal they cut with the GOP back in 2001?

New deficit: $456 billion.

When it comes to revenues, you have to go where the money is: the wealthy. The rich have gotten richer, which is a big part of the reason we’re in a Depression again. They’re hogging all the goodies. The rest of us can’t spend.

Despite the miserable economy, there are still 2 million American households earning a whopping $250,000 or more per year. (Their average income is $435,000.) If we were to increase these super-rich Americans’ marginal income tax rate from 35 to 50 percent—the same it was during the early 1980s under Reagan—we’d bring in an extra $131 billion a year. If we raised it back to 91 percent—the top rate during the boom years between 1950 to 1963—the Treasury would collect $487 billion.

Budget SURPLUS: $31 billion.

And we haven’t started on corporate taxes.

(Ted Rall is the author of “The Anti-American Manifesto.” His website is tedrall.com.)

COPYRIGHT 2010 TED RALL