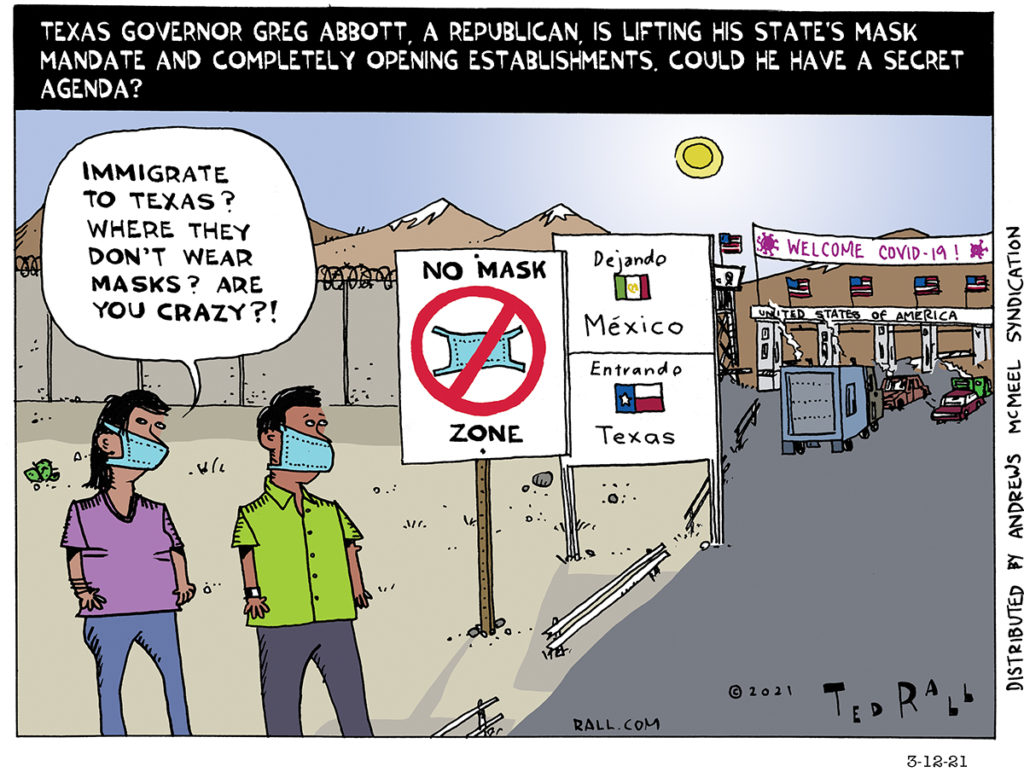

Texas governor Greg Abbott, a Republican, he’s lifting his state mask mandate and completely re-opening establishments. Could he have a secret agenda?

SYNDICATED COLUMN: John Kasich’s Ohio Fantasy

There’s denial.

There’s self-delusion.

There’s hallucination.

Then there’s John Kasich.

It’s just another political horse-race story about another white guy running for president, but “Kasich Looks to Republican Primaries, ‘Ohio Story’ in Hand” in the March 19th New York Times would have made me fall out of my seat had I not been confined by a seatbelt and squished in by a pair of chubby fellow airplane passengers.

John Kasich is the other Scott Walker, another Republican governor of a Midwestern state contemplating a run for president next year.

Kasich runs Ohio. Ohio is my home state.

Says the Times, Kasich is touting his “Ohio story” to make his case for moving into the Oval Office: “On his watch, Ohio’s $8 billion budget shortfall has turned into a $1.5 billion surplus. He has increased funding for mental health services and takes credit for 352,000 new private sector jobs.”

(Note the qualifier “takes credit for.”)

To be fair, the paper quotes Ohio State Senator Joe Schiavoni, who notes that “nearly half of Ohio households are getting by paycheck to paycheck, and 43% of students in public schools are on free or reduced lunch.”

When obscure governors run for president — Carter in 1976, Clinton in 1992, Bush in 2000 — their case to the nation is: Look what I did for my state! Elect me, and I’ll do the same for the country. The fact that Kasich is bragging about what he did to Ohio indicates that he’s (a) politically suicidal and/or (b) has absolutely no idea what’s going on there, especially in the state’s urban centers.

When I looked it up, I was surprised to learn that Kasich has actually visited Dayton, the southwestern Rust Belt city where I grew up. It’s a mess.

To be fair, this disaster predates Kasich by decades. Like many of my friends, I left after we graduated high school in the early 1980s because there were no jobs. Dayton Press, where they printed magazines like Time and Newsweek, closed. Mead Paper moved away. Department stores were boarded up, abandoned and demolished; factories rusted and rotted and were carted away. It got so you could take a nap in the middle of Main Street without being disturbed by traffic.

But things have only gotten worse under Kasich. Dayton’s population has plunged by 40% since I left. The local economy has been devastated since GM’s huge Moraine Assembly plant closed in 2008, throwing 5,000 people out of work.

Forbes listed Dayton as one of the ten fastest-dying cities in America. Four out of 10 were in Ohio. (The others were Youngstown, Canton and Cleveland.)

Forbes tried to put a bright face on Dayton’s problems: “Cash register and ATM manufacturer NCR is based in Dayton, and one of the region’s major employers, the Wright-Patterson Air Force Base, is not going anywhere.”

NCR moved to Atlanta two years later.

Every day I check the Dayton Daily News app on my phone to follow the latest mayhem. Grim accounts of grinding poverty, drug epidemics and random violence are routine. The national story about the boy who found his neighbor’s mummified body while exploring an abandoned house somehow spoke volumes about the collapse of the city of Dayton. Facing foreclosure, the dude had hung himself five years ago. Bank officials never bothered to look inside.

Even the national economy recovered, Dayton’s contracted last year.

Kasich’s “Ohio Story” is a nightmare.

Cleveland, Dayton, Canton and Youngstown aren’t the Buckeye State’s only urban disasters — though they are some of the state’s biggest cities.

Toledo is so broke that its mayor asked residents to cut the grass in public parks. So many Cincinnatians are dying of heroin overdoses that the morgue is facing a budget crisis. The infant mortality rate is soaring in the capital city of Columbus.

Under John Kasich, Ohio is in danger of becoming a failed state.

Just what America needs!

The Ohio political blog Underbund has the goods on Kasich.

“The so-called ‘Ohio Story’ Gov. Kasich is out shilling to ruby red western and southern states will never include the kind of statistics reveled Friday in a report by the Pew Charitable Trust, which painted a different portrait of the state,” writes John Michael Spinelli.

Spinelli quotes the Pew report:

- “In John Kasich’s Ohio, the share of households that are middle class has fallen from 50.9% in 2000 to 45.7% in 2013.

- “Meanwhile, median income has also taken a dive under Gov. Kasich, from an inflation-adjusted amount of $56,437 in 2000 to $48,081 in 2013, a dip of nearly 15%.

- “And the share of households spending at least 30% of income on housing as gone up, from 25% in 2000 to 30% in 2013.”

I have a question for Governor Kasich: If you manage to gain traction in the race for the 2016 Republican nomination, how will you keep reporters away from Dayton?

(Ted Rall, syndicated writer and the cartoonist for The Los Angeles Times, is the author of the new critically-acclaimed book “After We Kill You, We Will Welcome You Back As Honored Guests: Unembedded in Afghanistan.” Subscribe to Ted Rall at Beacon.)

COPYRIGHT 2015 TED RALL, DISTRIBUTED BY CREATORS.COM

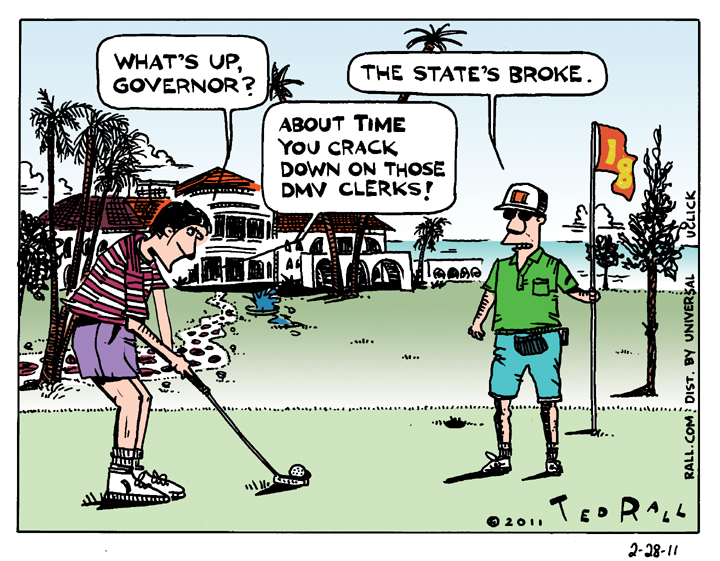

SYNDICATED COLUMN: The Phony Budget Crisis

Forget Austerity. Tax the Rich.

Everywhere you look, from the federal government to the states to your hometown, budget crises abound. Services are being slashed. Politicians and pundits from both parties tell us that the good times are over, that we’ve got to start living within our means.

It’s a lie.

Two case studies have made news lately: California, where new/old governor Jerry Brown is trying to close a $25 billion shortfall with a combination of draconian cuts in public services and a series of regressive tax increases, and Wisconsin, where right-winger Scott Walker says getting rid of unions would eliminate the state’s $137 million deficit.

Never mind the economists, most of whom say an economic death spiral is exactly the worst possible time for government to cut spending. Pro-austerity propaganda has won the day with the American public. A new Rasmussen poll funds that 58 percent of likely voters would approve of a shutdown until Democrats and Republicans can agree on what spending to cut.

The budget “crisis” is a phony construction, the result of right-wing “starve the beast” ideology. There is plenty of money out there—but the pols don’t want it.

There is no need to lay off a single teacher, close a single library for an extra hour, or raise a single fee by one red cent.

Every government can not only balance its budget, but wind up with a surplus.

The solution is simple: tax the rich.

Over the last 50 years tax rates for the bottom 80 percent of wage earners have remained almost static. Meanwhile the rich have received tax cut after tax cut after tax cut. For example, the rate paid by the top 0.01 percent—people who currently get more than $6.5 million a year—fell by half (from 70 to 35 percent).

Times are tough. Someone has to pay. Why not start with those who can most afford it?

Europe has the world’s best food, its best healthcare system and its best vacation policy. It also has one of the fairest ways to generate revenue for government: a wealth tax. In Norway, for example, you pay one percent of your net worth in addition to income tax.

What if we imposed a Norwegian-style wealth tax on the top one percent of U.S. households? We’re not talking upper middle class here: the poorest among them is worth a mere $8.3 million. This top one percent owns 35 percent of all wealth in the United States.

“Such a wealth tax…would raise $191.1 billion each year (one percent of $19.1 trillion), a significant attack on the deficit,” Leon Friedman writes in The Nation. “If we extended the tax to the top 5 percent, we could raise $338.5 billion a year (one percent of 62 percent of $54.6 trillion).”

But that’s just the beginning. Wealthy individuals are nothing next to America’s money-sucking corporations.

Business shills whine that America’s corporate tax rate—35 percent—is one of the world’s highest. But that’s pure theory. Our real corporate rate—the rate companies actually pay after taking advantages of loopholes and deductions—is among the world’s lowest. According to The New York Times, Boeing paid a total tax rate of 4.5 percent over the last five years. (This includes federal, state, local and foreign taxes.) Yahoo paid seven percent. GE paid 14.3 percent. Southwest Airlines paid 6.3 percent. “GE is so good at avoiding taxes that some people consider its tax department to be the best in the world, even better than any law firm’s,” reports the Times‘ David Leonhardt. “One common strategy is maximizing the amount of profit that is officially earned in countries with low tax rates.”

America’s low effective corporate tax rates have left big business swimming in cash while the country goes bust. As of March 2010 non-financial corporations in the U.S. had $26.2 trillion in assets. Seven percent of that was in cash.

The national debt is $14.1 trillion.

Which is a lot. And, you see, entirely by choice.

(Ted Rall is the author of “The Anti-American Manifesto.” His website is tedrall.com.)

COPYRIGHT 2011 TED RALL