Unemployment is low—lower than at any time since the Vietnam War. Real wages are increasing. Inflation, voters’ top concern for the last several years, is slowing. Democrats are confident enough about how things are going that “Bidenomics” is at the center of their case for another four years in the White House.

Unemployment is low—lower than at any time since the Vietnam War. Real wages are increasing. Inflation, voters’ top concern for the last several years, is slowing. Democrats are confident enough about how things are going that “Bidenomics” is at the center of their case for another four years in the White House.

Yet this is a rosy picture few voters can see. Americans consistently give President Biden low marks for his handling of the economy.

“I’ve never seen this big of a disconnect between how the economy is actually doing and key polling results about what people think is going on,” Heidi Shierholz, president of the Economic Policy Institute, a liberal think tank, tells the New York Times.

What gives?

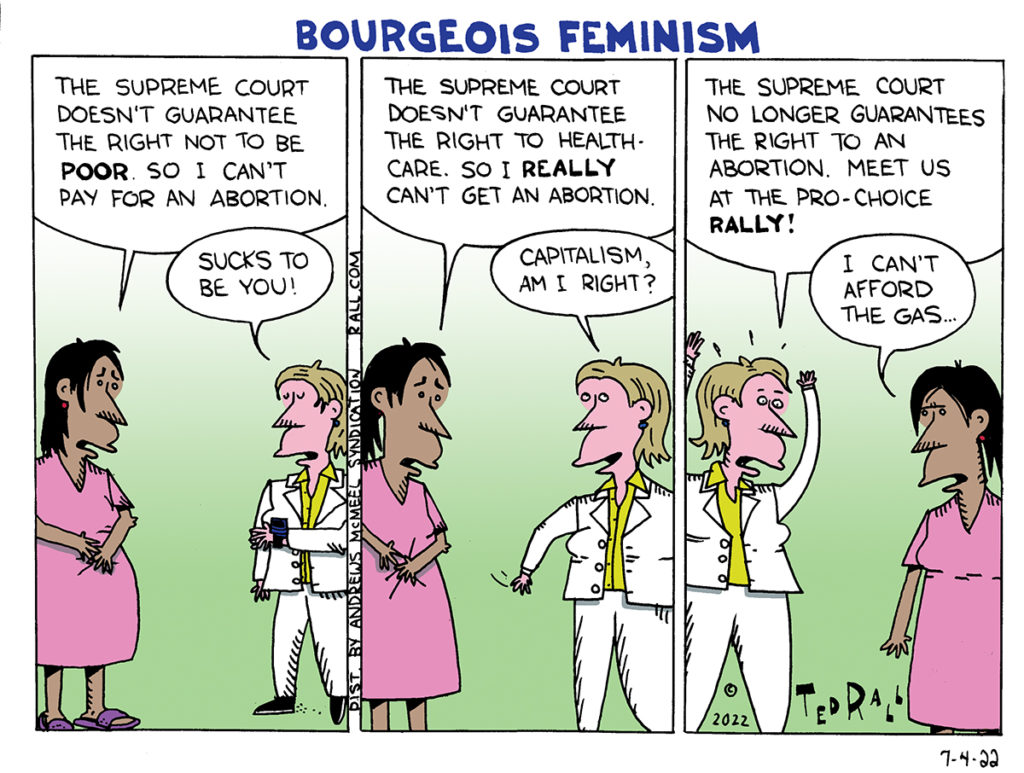

Jason Furman, who served as chairman of the Council of Economic Advisers under Obama, points to a years-long trend that only ended recently: wages haven’t kept up with inflation, leaving the average worker $2,000 worse off than under Trump’s final year. “The way to think about that is people were in an incredibly deep hole because of inflation and we’re still not all the way out of that hole,” Furman says.

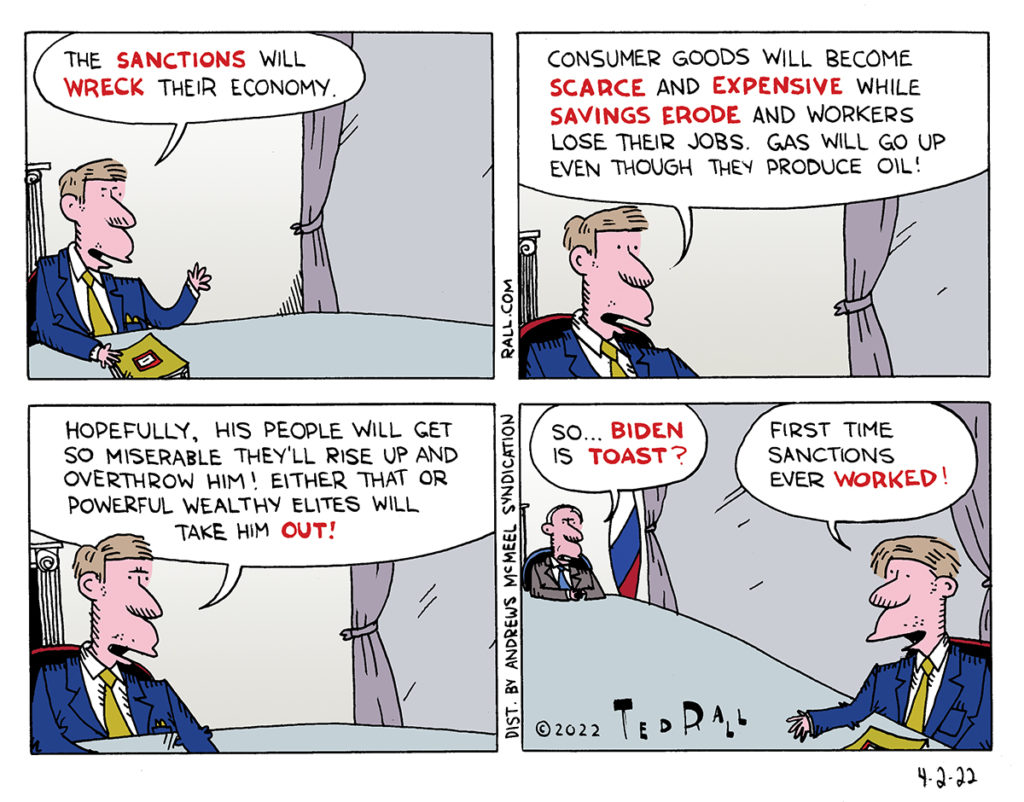

The problem for Biden is, what people would need to have happen in order to feel that inflation was truly behind them would be horrible for the economy, not to mention his prospects for reelection: deflation.

During our lifetimes, ideal economic conditions in a healthy economy feature an annual official inflation rate in the single digits, a policy economists call inflation targeting. Prices rise, but if wages go up even faster employees are happy. Low inflation incentivizes consumers to buy sooner rather than later, when prices will be higher. But, as Furman points out, that hasn’t been the case lately. Airfares went up 28.5% in 2022. Butter rose 31.4%. Eggs a whopping 59.9%. So we’re displeased.

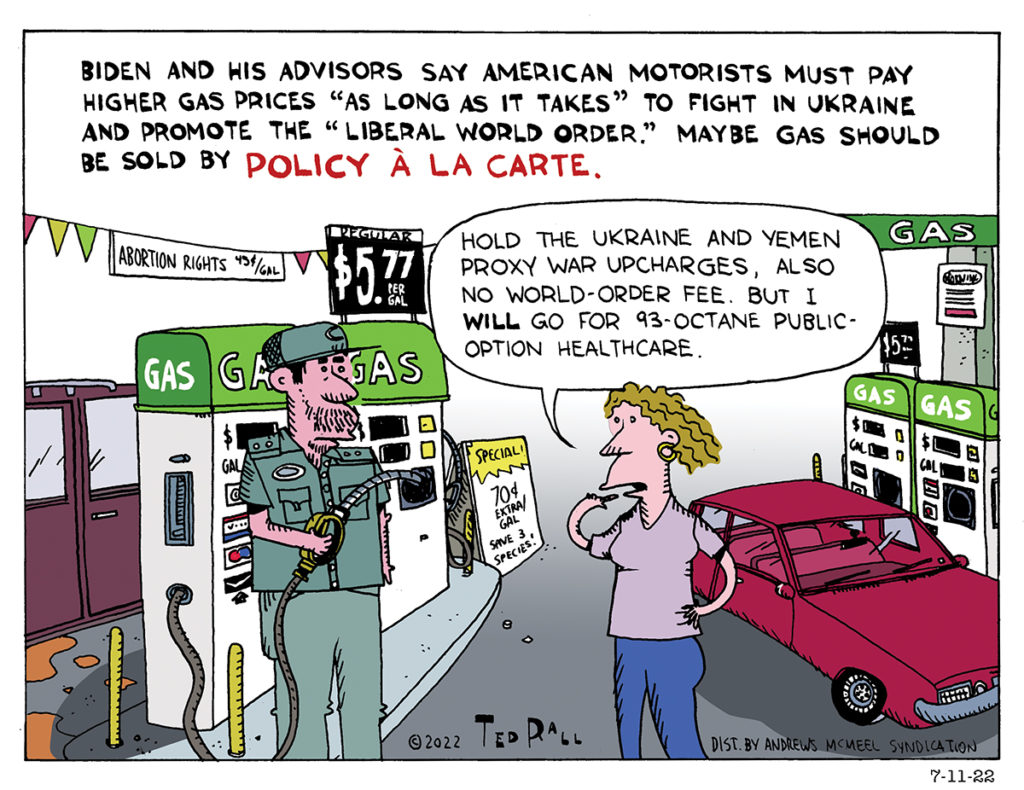

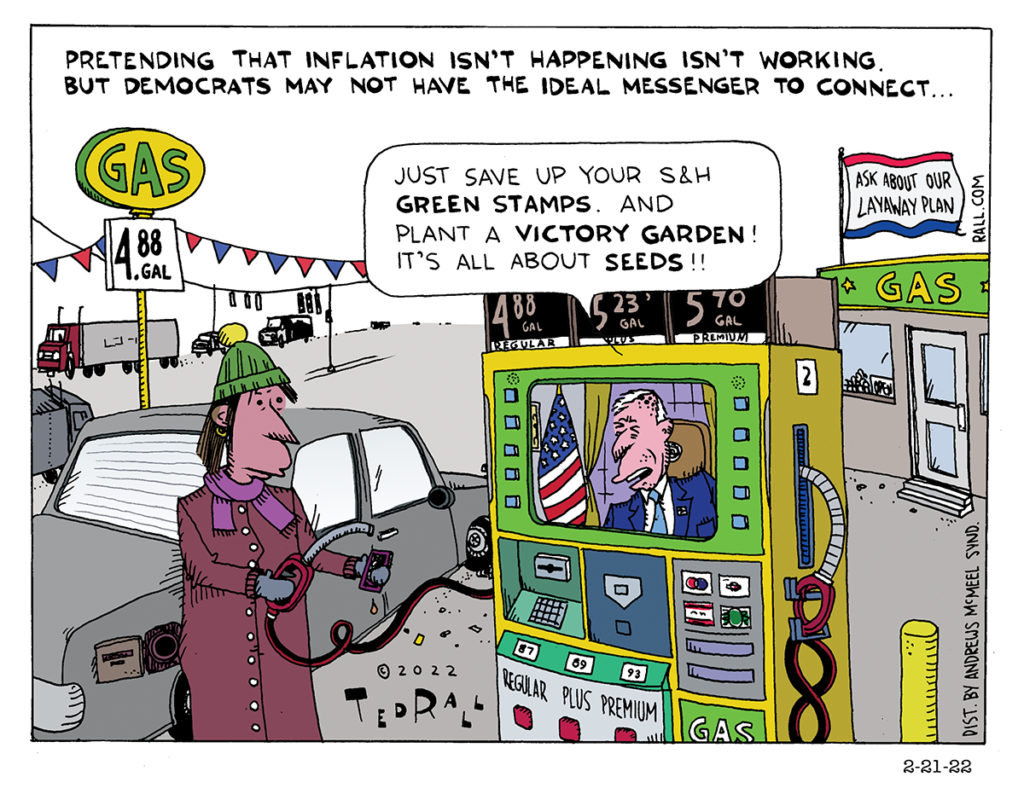

What will it take to convince voters that inflation is no longer a problem? In the short term — i.e., between now and the presidential election—prices would need to fall back to pre-Biden levels. The average US gas price in January 2021 when Biden took office was $2.42 per gallon. Now it’s $3.95.

The Federal Reserve Bank’s efforts to reduce inflation appear to be working. Prices are rising at a slower rate. And that’s the problem for Democrats.

Mechanical physics provides a helpful parallel. Many economists and political analysts seem to think of inflation rate as analogous to velocity. In their view, reducing the inflation rate from 8% to 3% is a victory for inflation-targeting fiscal policy. Indeed, if a 3% inflation rate (coupled with wages that rise faster than 3%) remains in effect indefinitely, people will eventually feel good (or less bad) about the economy. As the economist John Maynard Keynes observed a century ago, however, “In the long run, we will all be dead.” And the Democrats’ calendar is much shorter than that, a mere 14 months.

Before inflation-affected consumers can be persuaded to tap their feet to “Happy Days Are Here Again,” they’ll have to pass through several stages of recovery. First, they’ll feel less bad. Then comes meh. Penultimately, they’ll see themselves paying off credit card and other debts they ran up during the inflationary period. Only after those lingering financial hangovers are past will they be able to achieve what feels like the final stage, prosperity: earning enough to pay one’s bills while setting a surplus aside in the form of savings.

With Americans’ credit card debt hitting the staggering benchmark of $1 trillion and rising, we are currently in the “less bad”/”meh” stage. But it’s hard to see what Biden or the Fed or anyone else can do in order to promote a sunnier view of the economy.

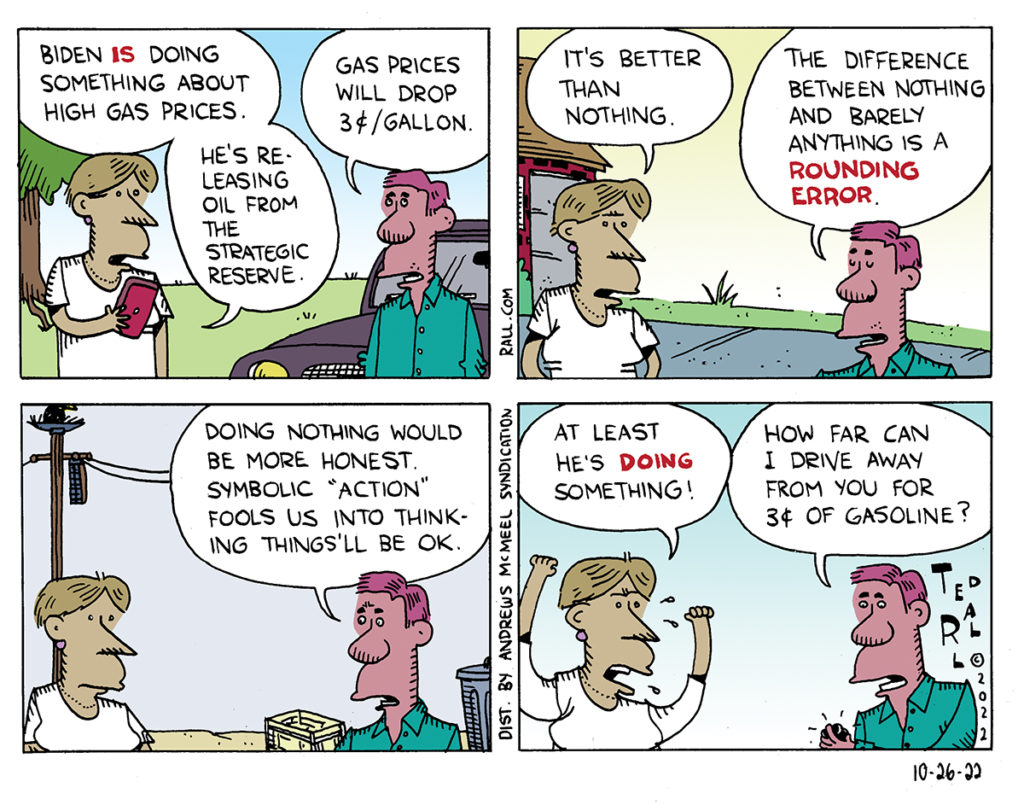

A lower inflation rate—even an ideal one in the low single digits—still means higher prices. We will probably not see $2.42 per gallon gas, the price in early 2021, any time soon, if ever. Gas prices will likely continue to increase, to $4.00 and $4.05 and $4.10 and on and on and on, adding minor injury to gaping wound.

Inflation is really like acceleration—the rate at which speed increases. If you fall off the roof of a tall building, your speed at the beginning of your plunge will be exponentially lower than when you hit the ground. The ground approaches, not at a steady rate, but faster and faster. As your body rushes toward doom, you’d likely welcome a physical intervention to reduce the rate of acceleration. You’d live a smidge longer but it wouldn’t save you. Reducing the acceleration rate to zero might help, assuming your initial rate of descent was low. But what you need in this dire situation is negative acceleration—a force that neutralizes gravity and then some, returning you back up to the roof of the building.

Negative inflation would, in many people’s minds, set things straight. If Biden could return prices to pre-2021 levels, that would look and feel like a return to a period of normalcy.

But negative inflation is deflation, the disaster last experienced in this country to a significant extent during the Great Depression, when prices dropped 7% each year between 1930 and 1933. Knowing that goods and services were becoming cheaper, Americans were incentivized to horde cash. Consumer spending declined, triggering a doom loop in which manufacturers laid off workers and cut salaries, further reducing spending and prices. Given a choice, economists choose inflation over deflation.

From an economics standpoint, Biden’s only option is to hope for a quicker trip through the psychological stages of economic recovery than Americans have seen in their lifetimes.

(Ted Rall (Twitter: @tedrall), the political cartoonist, columnist and graphic novelist, co-hosts the left-vs-right DMZ America podcast with fellow cartoonist Scott Stantis. You can support Ted’s hard-hitting political cartoons and columns and see his work first by sponsoring his work on Patreon.)