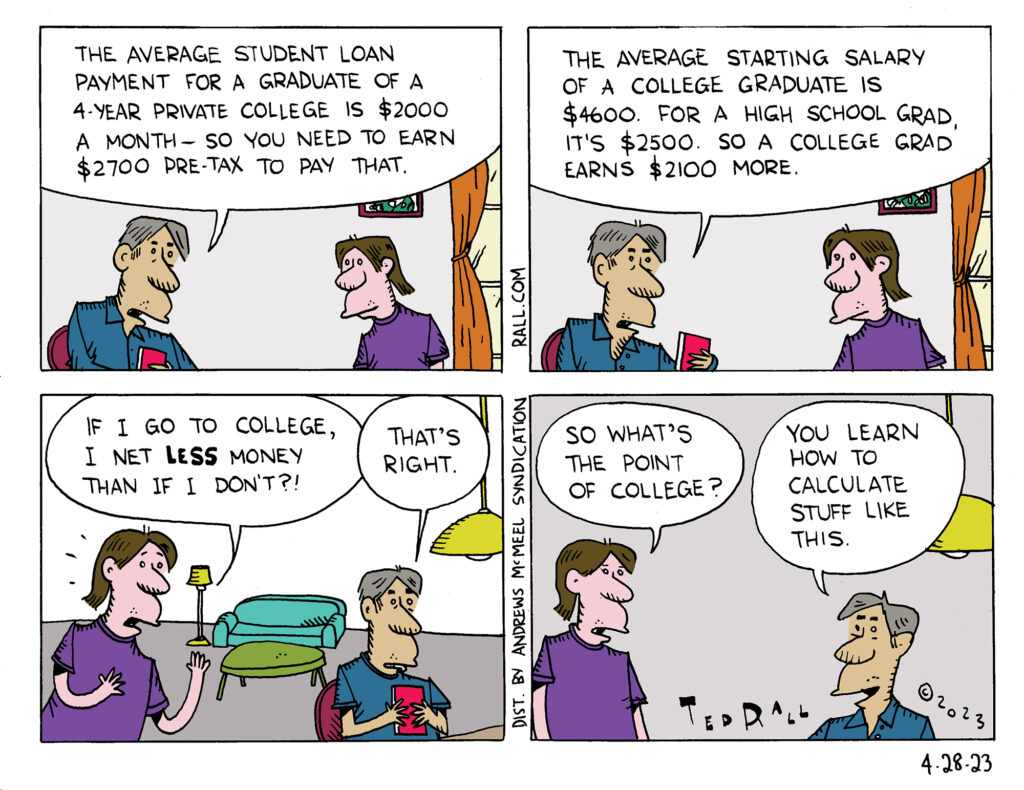

The “college premium”—the extra money you get from having a college degree compared to someone without one—has been eclipsed, more than eclipsed, by staggeringly high tuitions and resulting student loan burdens. There are still good reasons to go to college, but making more money probably isn’t one of them.

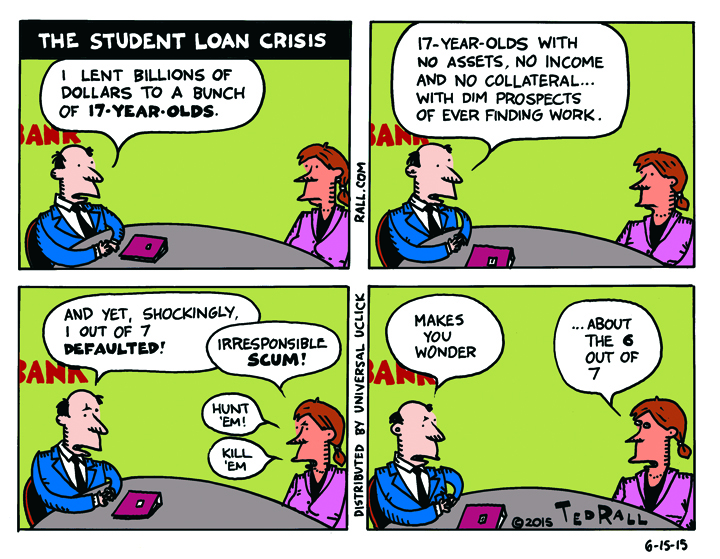

The Student Loan Crisis

Bankers issue student loans to 17-year-old kids. Who’s more irresponsible: the bankers who take a reckless risk? Or the 1 out of 7 impoverished students who default on their obligations?

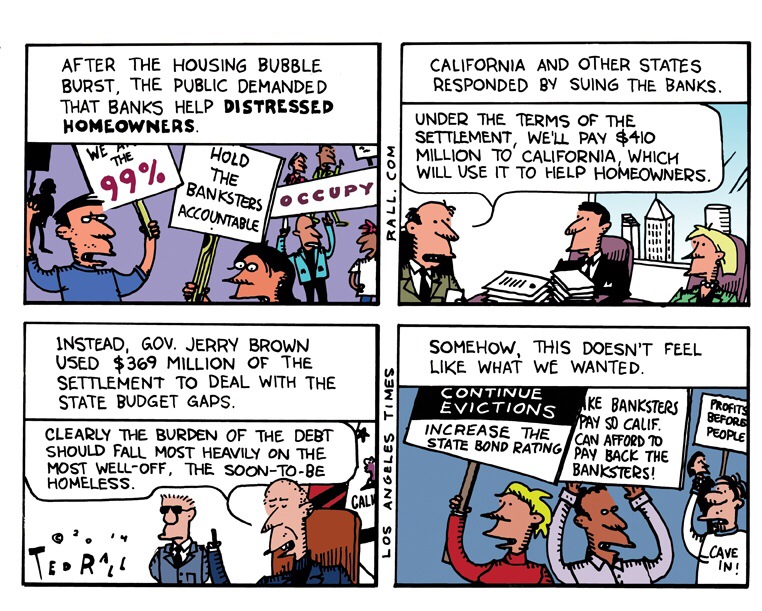

LOS ANGELES TIMES CARTOON: Balancing the Budget on the Backs of the Homeless

As a news junkie and student of the human condition, it takes a lot to make my blood come to a full boil. It takes even more to make me sympathize with wealthy corporations. Hand it to Gov. Jerry Brown — he managed to pull off both feats with the news that he diverted $350 million from California’s share of the 2012 national mortgage settlement in order to reduce the state’s 2013 budget deficit.

Now that California is enjoying a budget surplus, a coalition of homeowner advocates and religious organizations has filed suit against the state to force Brown to restore the money.

Back in 2008-09, the real estate bubble burst, taking the global economy with it. By many measures, especially real unemployment and median wages, we still haven’t recovered.

By 2010 a political consensus had formed. Though politicians were partly to blame, the worst offenders were the giant “too big to fail” banks that had knowingly approved loans to homebuyers who couldn’t afford to pay them back, sold bundles of junk mortgage derivatives to unsuspecting investors and secretly hedged their bets against their clients. After the house of cards came down, they played the other side. They cashed in their chips, refused to refinance mortgages even though interest rates had fallen and deployed “robo-signers” to illegally evict hundreds of thousands of homeowners — including people who had never missed a payment — to ding them with outrageous late fees on their way to profitable (for the banks) foreclosure.

On the Left, anger at the banks coalesced around the Occupy Wall Street movement. Though less widely reported, anti-bank sentiment also found a home in the Tea Party.

Politics ultimately play out in the courts. Lawsuits filed by state attorney generals forced the banks to the bargaining table. In 2012 they agreed to cough up $26 billion as penance.

The money was supposed to compensate people who had lost their homes and to help those who were hanging on by a thread avoid eviction, either by refinancing at lower rates or writing down principal to reflect lower real estate prices.

Enter the governors.

Jerry Brown wasn’t unique. Cash-hungry states siphoned off half of their share of the mortgage settlement to plug holes in their budgets.

We will never know how many families became homeless as a result.

The more you think about it, the more disgusting it is. Obviously it’s important for the state to get its fiscal house in order. But not at the expense of those least able to bear the burden. Desperate families lost — and are still losing — their homes so that holders of California’s state debt, much of it held by the same banks who caused the mortgage crisis, can be repaid.

This outrage is not without precedent.

Rather than the anti-smoking and health campaigns they were supposed to launch, the states siphoned off 47% of the $7.9 billion they received from the 1998 tobacco settlement for general budget purposes.

How many kids might have been reached by tobacco education programs that never got off the ground? How many will die of lung cancer? “Fifteen years after the tobacco settlement, our latest report finds that states are continuing to spend only a miniscule portion of their tobacco revenues to fight tobacco use,” the Campaign for Tobacco-Free Kids said in 2014. In Fiscal Year 2014, the states will collect $25 billion in revenue from the tobacco settlement and tobacco taxes, but will spend only 1.9 percent of it – $481.2 million – on programs to prevent kids from smoking and help smokers quit. This means the states are spending less than two cents of every dollar in tobacco revenue to fight tobacco use.”

This is the kind of behavior that prompts conservatives to characterize these settlements as government shakedowns of big business. It’s hard to disagree. As slimy as the banksters were and are — they’re sabotaging political solutions to the foreclosure crisis — they’re just greedy bastards doing what greedy bastards do. Public officials, on the other hand, are supposed to be on our side.

What Brown and his fellow governors have done with the mortgage settlement money is even more nauseating.

SYNDICATED COLUMN: Our Contempt is Bipartisan

Both Zombie Parties Too Stubborn To Admit They’re Dead

Neither party gets it.

They both think they won. And they sort of did.

But we still hate them.

Democrats are patting themselves on the back, congratulating themselves for a mandate that neither exists–50.4% to 48.1% does not a mandate make–nor, if were real, would be actionable (Republicans still control the House). “Republicans need to have a serious talk with themselves, and they need to change,” Democratic columnist E.J. Dionne sniped in the Washington Post.

Not likely. If Republicans could change anything, it would be the weather. “If you hadn’t had the storm, there would have been more of a chance for the Romney campaign to talk about the deficit, the debt, the economy,” Karl Rove told the Post. (Which leaves out the fact that the places hit hardest by Hurricane Sandy, New York and New Jersey, are not GOP states.)

“We [Congressional Republicans] will have as much of a mandate as he [Obama] will,” claimed Speaker John Boehner.

The donkeys and the elephants think they’re awesome. Their plan to govern America for the next four years? Keep on keeping on. Why change?

Both parties are insane and self-delusional.

Voters are narrowly divided between the Ds and the Rs–because we can’t decide which one we hate most.

One out of three people think the two-party system is broken, and complain that neither party represents their political views.

A staggering number of people are boycotting quadrennial exercises in pseudodemocracy. Despite the advent of convenient early voting by mail, Election Day 2012 saw a “major plunge in turnout nationally” compared to 2008. About 42.5% of registered voters stayed home this year.

There were a substantial number of protest votes.

In one of the most ignored and interesting stories coming out of Election Day, one and a half million people voted for Libertarian Gary Johnson and Green Party candidate Jill Stein. Since Johnson and Stein were even more thoroughly censored than previous third-party candidates–Johnson and Stein were denied interviews on the major networks and locked out of the presidential debates–many of these votes must have been for “none of the above.”

Democrats didn’t win this election.

Neither did the Republicans.

Give the parties credit: They’ve united us in our contempt. Liberals and progressives hate the Democrats, which takes their votes for granted and ignores them. Conservatives hate the GOP for the same reasons. And moderates hate both parties because they don’t get along.

Who won? Not us.

Since the economy collapsed in 2008, Americans have made consistently clear what their number-one priority was: jobs. Yet the two major parties have focused on anything but.

The Tea Party convinced Republicans to campaign on paying down the national debt. Deficits, the debt and entitlements are important–but those problems are not nearly as urgent as unemployment and underemployment. When you’ve lost your job–as millions of Americans have since 2008–you need a new job now. Not next week. Not next year. NOW. You sure don’t need a job next decade–and that’s if you believe that austerity stimulates the economy. “Romney is not offering a plausible solution to the [unemployment] crisis,” Jonathan Chait wrote in New York magazine back in June. Romney never did.

And that’s why he lost.

Jobs were the #1 issue with voters, Obama never reduced unemployment and Romney had a credible narrative as a corporate turnaround expert. By all rights, Romney should have won. But he never delivered what voters wanted: a credible turnaround plan for the terrible jobs market–one with quick results.

Not that Obama and the Democrats have much to celebrate.

The president nearly lost to one of the worst challengers of all time, a bumbling, inarticulate Monopoly Man caricature of an evil capitalist. Democrats only picked up a few seats in Congress–this to a Republican Party whose platform on social issues was lifted from the Taliban, and whose major political figures included two rape apologists.

Like the GOP, Democrats paid lip service to the economy but never put forward a credible proposal that would have created millions of new jobs next week, not next decade. In 2009, while millions were losing their homes to foreclosure, Obama dwelled instead on healthcare reform. Like the deficits, the healthcare crisis is real and important–but it wasn’t nearly as urgent as the jobs catastrophe. Which, planted stories about fictional recoveries to the contrary, continues unabated.

Four years into an existential crisis that likely marks the final crisis of late-stage capitalism, an economic seizure of epic proportions that has impoverished tens of millions of Americans and driven many to suicide, the United States is governed by two parties that don’t have a clue about what we want or what we need.

Change? Not these guys. Not unless we force them to–or, better yet, get rid of them.

(Ted Rall‘s is the author of “The Book of Obama: How We Went From Hope and Change to the Age of Revolt.” His website is tedrall.com.)

COPYRIGHT 2012 TED RALL

SYNDICATED COLUMN: Why Settle for Second Worst?

Democratic Party Needs a Democratic Primary Process

What a comedown!

In 2008 Barack Obama ran on hope and change. His reelection bid relies on fear (of Republicans) and stay-the-course (lest said Republicans slash even more Medicare than Obama is willing to give away).

Inspired yet?

Yeah, yeah, anything can happen in one year—the GOP could nominate Bob Dole again—but it’s getting harder to imagine a scenario in which Obama wins reelection. The tsunami of bad economic news has become so relentless that last week’s story that one out of six Americans have fallen below the poverty line came and went with nary a shrug. (On the bright side, we’re just ahead of Indonesia. On the other side, Russia won the Cold War after all.)

Obama’s threat to veto any debt bill that doesn’t include taxes on the rich is supposed to signal a “new, more combative phase of his presidency, one likely to last until next year’s election as he battles for a second term,” as the New York Times puts it. But it’s too nothing, too late.

Tax increases get rolled back; Medicaid cuts are forever.

Rick Perry thinks the earth is a week old and Mitt Romney wears pink underwear and Michele Bachmann has crazy eyes. Unless they fart into the camera on national television, however, any of the leading Republican candidates will likely trounce a president who did nothing while the labor force shrunk by at least six million.

OK, he did stimulate the Martha’s Vineyard golf club economic sector.

On fifth thought, voters might overlook flatulence.

I had been wondering what accomplishments Team Obama planned to point to next year. Times editor Bill Keller helpfully lays it all out (I use the word “all” loosely) in an op/ed: “Lost in the shouting is the fact that Obama pulled the country back from the brink of depression; signed a health care reform law that expands coverage, preserves choice and creates a mechanism for controlling costs; engineered a fairly stringent financial regulatory reform; and authorized the risky mission that got Osama bin Laden.”

Let’s take these Democratic talking points like the trajectory of the U.S. empire: in reverse.

The trouble with assassinating Osama bin Laden is that once you’ve killed Osama bin Laden no one thinks about Osama bin Laden anymore. The Bushies understood this. Putting the Al Qaeda chief on trial would have been smarter politics (not to mention a sop to basic legal principles).

The new banking and securities regulations were too granular and timid for anyone to notice. Show me a president who bans ATM, overdraft and late credit-card fees, on the other hand, and I’ll show you a shoo-in for reelection. Or sainthood.

I don’t know what kind of health plan they offer on 8th & 42nd, but no one—not conservatives, not liberals, not anyone—likes what we know about Obama’s healthcare reform. The Right thinks it’s socialism. The Left wishes it were. What matters is that it doesn’t matter—Obamacare doesn’t going into effect until 2014. You can’t ask for votes of gratitude for a law that no one has experienced—and that many suspect will be repealed by the GOP or overturned by the courts.

Then there’s Keller’s first assertion: “Obama pulled the country back from the brink of depression.”

Um—Bill? Depression? We’re soaking in it.

The real unemployment rate (the way the government calculated it during the 1930s) is over 24 percent. That matches the highest monthly rate during the Great Depression.

But this Depression is worse than the “Great” Depression. You could buy an apple for a nickel back then. Now there’s high inflation too.

Not only are one out of four Americans out of work, the salaries of the employed are stagnant and getting eroded by soaring food and gas prices.

U.S. state-controlled media outlets like the Times are in the president’s corner. But their “without Obama the economy would be even worse” narrative is reducing their man’s chances next November. If there’s anything worse than losing your job, it’s a media that pretends you that you and your reality don’t exist. There never was a recovery; the economy crashed with the dot-coms in 2000 and never came back, what they called a “stimulus” was nothing more than a giveaway to bank CEOs, and now tens of millions of pissed-off people are itching for a chance to make a noise.

This, as Keller should know from reading the polls in his own paper, is why the liberal-progressive base of the Democratic Party is drifting away from Obama. They won’t vote for Perry or whomever, they just won’t vote.

Not since 1980 have the Democrats headed into a reelection campaign with such a weak incumbent president. Which prompts a question: Why is Obama running unopposed? A Democratic Party, it should go without saying, needs a democratic primary process.

A group of liberals led by former Green Party presidential candidate Ralph Nader has issued a call for one or more progressive leaders to run against Obama in the spring primaries. “Without debates by challengers inside the Democratic Party’s presidential primaries, the liberal/majoritarian agenda will be muted and ignored,” Nader said in a press release. “The one-man Democratic primaries will be dull, repetitive, and draining of both voter enthusiasm and real bright lines between the two parties that excite voters.”

It’s a nice thought, though it would be impossible to raise enough money to successfully challenge Obama at this late stage.

So get ready for The Return of the Republicans. I’m no James Carville, but I’ve seen enough presidential politics to know that anger beats fear.

Especially during an Even Greater Depression.

(Ted Rall is the author of “The Anti-American Manifesto.” His website is tedrall.com.)

COPYRIGHT 2011 TED RALL

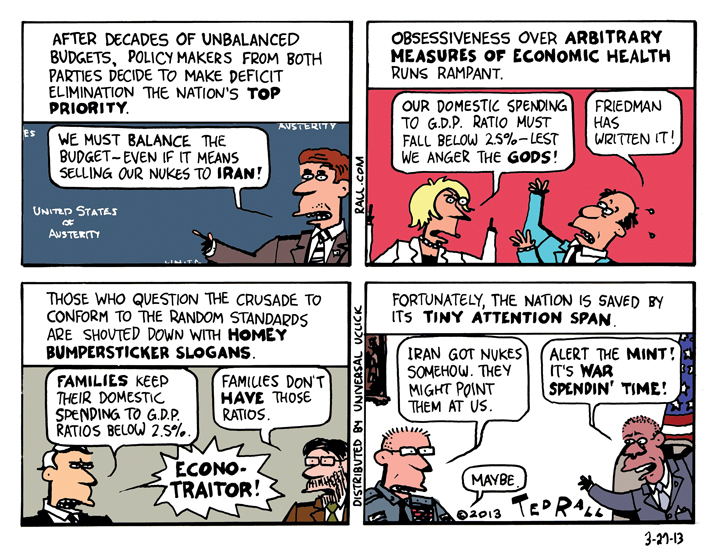

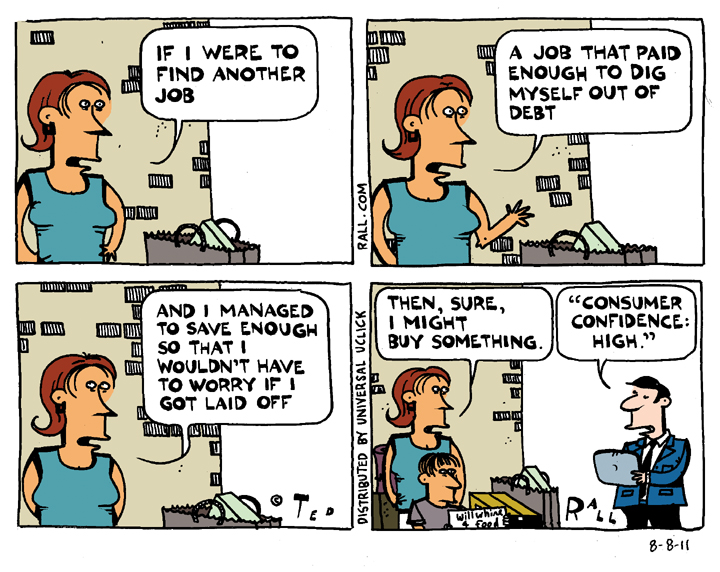

SYNDICATED COLUMN: Thrifty Families and Other Lies

Like Their Government, Americans Live on Debt

his State of the Union address President Obama repeated this ancient canard: “We have to confront the fact that our government spends more than it takes in,” he said. “That is not sustainable. Every day, families sacrifice to live within their means. They deserve a government that does the same.”

Republicans have used this “families balance their budgets, so should government” line for years. Now Democrats are doing it too. Everyone is jumping aboard the pseudo-austerity bandwagon. (Why pseudo? Neither party really wants to balance the federal budget because it can only be done by bringing home the troops, shrinking the Pentagon by 90 percent, ending corporate welfare, and soaking the rich—i.e. major campaign donors—with higher taxes.)

The family budget talking point is a fascinating meme that reflects a rarely considered national blind spot. As with other cases of mass denial (we think we’re generous do-gooders around the world, foreigners see us for the crazy mean torturers we also are), we give ourselves more credit than we deserve.

We Americans value thrift and personal responsibility. We believe we should live within our means. These cultural ideals stem from our Puritan history.

But we don’t live up to our ideals. Not even close.

Americans are up to the ears in debt.

Four out of five individuals have at least one credit card. The average family has an outstanding balance of $10,700. It spends 21 percent of its monthly income to pay interest on that balance.

The average American family has assets: It owns a house worth $160,000. But it owes $95,000 to the bank. As the housing market continues to crash, equity shrinks.

Our average family’s savings are virtually nonexistent: $3,800 in the bank, no retirement account whatsoever (for half of families, average retirement savings $35,000 for the other half), no mutual funds, no stocks, no bonds.

The claim that American families live within their means is a joke.

To be fair, it’s not entirely their fault. The typical American family only earns $43,000. It’s hard to buy much of anything, much less the house that embodies the American Dream, with that. And it’s impossible to save.

So they/we borrow.

As grim as a life of indebted servitude may seem, imagine what the American economy would look like if families really did live within their means, spending no more than they earned. No debt. No credit.

Markets for big-ticket items—homes, automobiles, major appliances—would crash and burn. Countless businesses would go under.

According to the National Association of Realtors 23 percent of homebuyers paid cash in January. That’s more than ever before but that still leaves at least 77 percent relying on mortgage financing. (Why “at least”? Most “cash” transactions include money borrowed from banks and credit unions.) Take 77 percent of purchasers out of the buy side of the equation and million-dollar homes would be worth five figures.

Pop! Credit is the biggest bubble of all.

If credit went away, most Americans’ biggest asset would vanish. Everyone would be “under water” to their lenders. The burbs would soon look like Afghanistan.

The same goes for cars: At least 88 percent of buyers take out a loan.

What would happen if these buyers had to save actual cash money before they could hit the showroom? They wouldn’t buy a car. Air would get cleaner but the economic collapse that began in 2008, which has put one out of five Americans out of work, would accelerate dramatically.

Two-thirds of the U.S. economy directly relies on consumer spending. People can only purchase goods and services using one of three sources: income, savings or credit. As we’ve seen, the average American family doesn’t have savings. Its income has been falling since 1968.

That leaves credit. If consumer credit vanished, the corporato-capitalist system currently prevailing in the U.S. would deteriorate from its current, merely unsustainable form into total chaos. Without credit cards and other loans citizens would seethe, trapped between the mutually irreconcilable forces of falling wages and the aggressive advertising and marketing of products they would never be able to afford. There would only be two possible long-term outcomes: revolution, or the ruling classes would be forced to pay substantially higher wages to workers. To corporate elites, the latter choice would be too unpalatable to countenance.

The typical American family cannot live within its means because it cannot earn enough to sustain its lifestyle. Were it to downgrade its living standards to a level it could afford, there wouldn’t be enough consumer spending to drive the economy. This would force further personal austerity. Eventually we’d all be living outside.

You know what’s funny? Unlike the American family, the U.S. government can spend less than it earns. It can increase revenues by raising taxes. Unlike families, it spends trillions of dollars on stuff—wars—that it doesn’t need and actually makes things worse.

It could even use its power to force employers to pay workers what they deserve. If the government did that, families might not need credit.

They could (finally) live within their means.

(Ted Rall is the author of “The Anti-American Manifesto.” His website is tedrall.com.)

COPYRIGHT 2011 TED RALL