Why Is Obama Running on His Record?

“It’s not clear what [President Obama] is passionate to do if he is elected for another four years,” writes David Brooks, conservative columnist for The New York Times. “The Democratic convention is his best chance to offer an elevator speech, to define America’s most pressing challenge and how he plans to address it.”

Addressing the DNC Wednesday night, Bill Clinton came as close as any Democrat has this year to answering Brooks: “In Tampa, the Republican argument against the president’s reelection was pretty simple: We left him a total mess, he hasn’t finished cleaning it up yet, so fire him and put us back in. I like the argument for President Obama’s reelection a lot better.”

Nicely done—though this argument only works for voters stuck in the two-party trap. But the biggest piece is still MIA: Obama’s domestic and foreign policy agenda for a second term.

Two principal arguments are being advanced in favor of Obama’s reelection: first, that he “took out” Osama bin Laden; second, that we are “absolutely” better off economically than we were four years ago. These arguments, if they continue to be the Democrats’ main talking points, will lead Obama to defeat this fall.

U.S. history shows that the candidate who presents the most optimistic vision of the future usually prevails. The future he sells doesn’t have to be specific (Romney’s 12 million new jobs, say). Ronald Reagan, who projected vague aw-shucks optimism reflected by a 100%-pabulum campaign slogan, “It’s Morning in America,” defeated Jimmy “Malaise” Carter and Walter “Let’s Tell the Truth About Taxes” Mondale. (Never mind that Carter and Mondale were more honest, smarter and nicer.)

Obama followed the Reagan model in 2008: hope, change, charming smile, not a lot of specifics. And it worked. (It didn’t hurt to run against McCain, the consummate “get off my lawn, you damn kids” grouch.) So why is Obama trading in a proven winner? Why is he running on his first-term record?

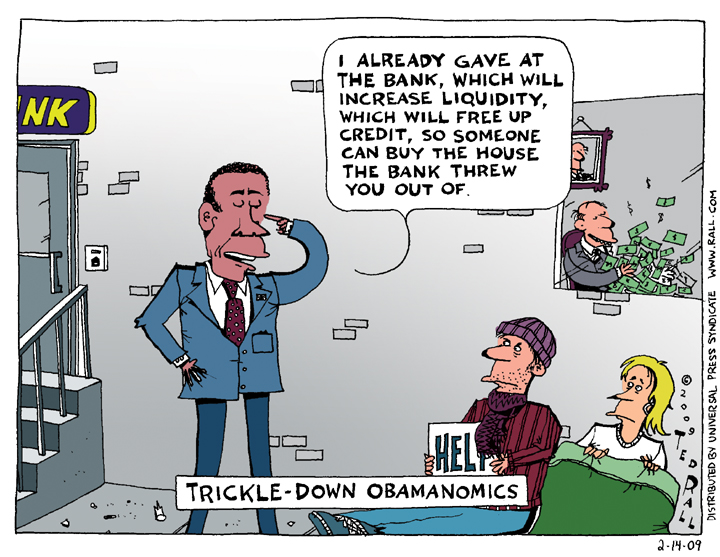

Obama’s entourage has obviously talked themselves into believing that the president’s record is better than it really is—certainly better than average voters think it is. Grade inflation is inevitable when you evaluate yourself. (In 2009, at the same time the Fed was greasing the banksters with $7.77 trillion of our money—without a dime devoted to a new WPA-style jobs program—he gave himself a B+.)

First, the extrajudicial assassination of bin Laden, an act of vengeance against a man in hiding who had been officially designated to pose no threat since at least 2006, makes some people queasy. Sure, many voters are happy—but getting even for crimes committed more than a decade ago still doesn’t spell out an optimistic vision for the future.

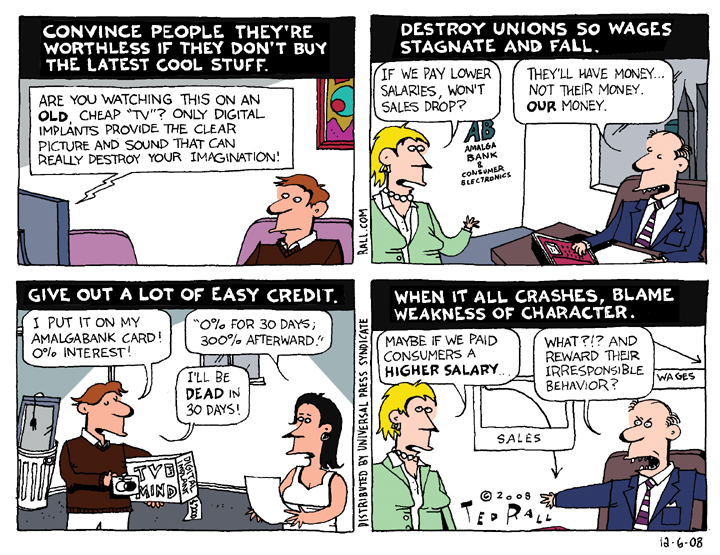

Similarly, and perhaps more potently since jobs are the most important issue to Americans, claiming that we are better off than we were four years ago, either personally, or nationally, is a dangerous argument for this president to make. Four years ago marks the beginning of a financial crisis that continues today. GDP remains a low 1.7%. Credit remains so tight that it’s still strangling spending.

Four million families lost their homes to foreclosure, millions more were evicted due to nonpayment of rent, and a net 8 million lost their jobs under Obama. Structural unemployment is rising. New jobs are few and pay little.

Most Americans—by a nearly two-to-one margin—feel worse off now than they did four years ago. Coupled with the media’s ludicrous claim that the recovery began in mid-2009, Obama’s “who are you going to believe, me or your lying eyes” (or pocketbook) sales pitch is so insulting and reminiscent of George H.W. Bush’s tone-deaf attitude during the 1992 recession that it can only prove counterproductive.

The historical lesson for Obama is 1936. Franklin Roosevelt is the only president in recent history to have won reelection with unemployment over 8%, as it is currently (it was 17%). Why? FDR’s New Deal showed he was trying hard. And things were moving in the right direction (unemployment was 22% when he took office). Fairly or not, Obama can’t beat Romney pointing to improvement statistics don’t show and people don’t feel.

Obama must articulate a new vision, relaunching and rebranding himself into something completely different—in other words, running as though the last three four years had never happened. Like this was his first term.

New image. New ideas. New policies. New campaign slogan.

Not only does Obama need to float big new ideas, he needs to convince voters that he can get them through a GOP Congress. Not an easy task—but there’s no other way.

It isn’t enough to simply say that Romney will make things worse. Lesser-evil arguments are secondary at best. As things stand now, with people angry and disappointed at government inaction on the economy, Romney’s “Believe in America” meme—though stupid—is more potent than Obama’s reliance on fear of a Ryan budget.

(Ted Rall’s new book is “The Book of Obama: How We Went From Hope and Change to the Age of Revolt.” His website is tedrall.com. This column originally appeared at NBCNews.com’s Lean Forward blog.)

COPYRIGHT 2012 TED RALL