Corporations enjoy many of the same rights and protections as an individual citizen, the Supreme Court ruled in 2010. Not only may a corporation claim the right of freedom of religion to, for example, refuse to cover birth control under employee insurance, Citizens United v. Federal Election Commission found that the First Amendment grants it the right of free speech.

As every child knows and Spider-Man preaches, privileges come with responsibilities. The corporation, on the other hand, is antisocial nearly to the point of being psychotic. It exists primarily to protect its hidden puppet masters (its CEO, board of directors and other decisionmakers) from being held legally or criminally responsible if something it does or makes causes harm. If and when victims succeed at securing a substantial verdict or judgement, often after overcoming daunting hurdles, the corporation can and often does declares bankruptcy, leaving its principals free to slither off to their next endeavor without ever being held accountable.

After a Left-led revolution, there would likely not be any place for the corporate structure, at least not one designed specifically for the purpose of avoiding responsibility. Until then, however, we are left with the problem of the corporation and how it should be modified in order to make it, if it must be considered a citizen under American law, a corporate “person” that (who?) doesn’t murder, poison and steal with impunity.

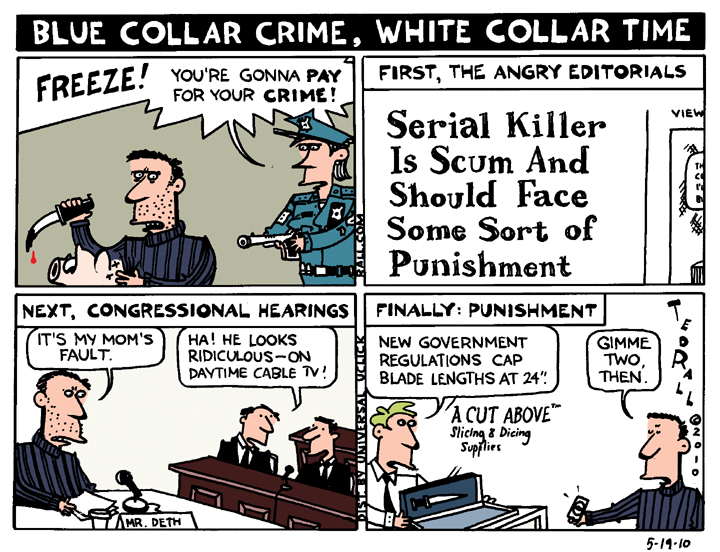

The Left should begin with the reasonable demand that, if corporations enjoy personhood under the law, they ought to face analogous consequences when they do something wrong. When a corporation commits a serious crime, what for you and me would be a felony, it should face the corporate equivalent of what we would get slapped with: prison time, high fines, maybe even life imprisonment or capital punishment. The pain a criminal corporation faces, in other words, ought to be commensurate with what a convicted American individual would have to deal with if they were convicted of a legal offense.

Beginning in 2012 and for the next ten years, Bank of America created fake credit-card accounts under their customers’ names without asking or obtaining their consent, charging them millions of dollars in fraudulent fees and hurting their credit ratings. They charged customers double bounce fees—one for insufficient balance and another for returning the check—which is also illegal. This, by the way, was their second offense; federal regulators caught them doing the same thing in 2014 and fined them $727 million.

Clearly, those fines were like a cheap speeding ticket—not enough to disincentivize them from returning to their corrupt lifestyle. So what did the Consumer Financial Protection Bureau, the Bernie Sanders-Elizabeth Warren brainchild that was supposed to protect us from the worst excesses of scumbag capitalism, do this time? They fined them a third as much as the first time, $250 million.

To put that penalty into context, Bank of America’s market capitalization is more than $325 billion and it has $3.2 trillion in assets. For acting like total degenerate maniacs for year after year, leaving a trail of hundreds of thousands of mugging victims in their wake, they were dinged less than one one-thousandth of their net worth.

Let’s say that your net worth, including your savings, 401(k) and house equity, is the national average: $1 million. A thousandth of $1 million is $1,000. A $1,000 fine sucks, to be sure. But you can afford it and quickly put it behind you. Basically, it’s an unexpected car repair.

What would you get from even the softest, most liberal, kindest judge around, if you stole tens of millions of dollars from tens of thousands of people? Whether you held them up at gunpoint or hacked it out of their bank accounts like B of A, you’d be lucky to get out of prison before 20 years. You’d be ordered to make your victims whole and pay some hefty, life-altering fines. And you’d come out with a prison record that would guarantee that you would never find a good job—certainly not a finance job—again.

To punish B of A as a “corporate person,” then, you’d need to impose sanctions that looked something like this:

- Not allowed to do any business for at least 20 years.

- Fines amounting to at least half of market capitalization, in this case about $162 billion.

- Stripped of its banking license.

Effectively, B of A would be put out of business.

But, I hear you saying, under this system of ours, as those of us who lived through the 2008-09 subprime mortgage meltdown recall, giant banks like Bank of America are “too big to fail.” They are essential to the economy. If one goes under, it takes many of us with them.

Fair enough. If that’s true, there’s a solution that does not allow rogue institutions to escape responsibility for their crimes: nationalization. The corporation lives. But it becomes government property.

The government owns it, runs it, appoints its CEO and Board of Directors, and sets its policies. The bank officials who broke the law are kicked out. And the government collects the profits.

Nationalization is economic blasphemy in the United States. But governments can and do run banks elsewhere. The three biggest banks in Norway, the entire Mexican banking system, every Finnish savings bank, four Israeli banks, also every Icelandic bank and a bunch of British banks are among the banks that have been nationalized by their governments. Even in the U.S., there are de facto nationalizations, as when the FDIC took over three-quarters of GMAC and the flailing insurance company AIG and a third of Citigroup. Nothing says that the FDIC cannot or should not seize an institution like Bank of America—or any other corporation—if it abuses its corporate personhood to commit crimes.

(Ted Rall (Twitter: @tedrall), the political cartoonist, columnist and graphic novelist, co-hosts the left-vs-right DMZ America podcast with fellow cartoonist Scott Stantis. His latest book, brand-new right now, is the graphic novel 2024: Revisited.)