The summer after junior year, my college expelled me. Six years later I returned and graduated with honors. During the interregnum, I worked. But finding a decent job was tough.

No matter how easy or rote the gig, every prospective employer listed a bachelor’s degree as a prerequisite to apply. I drifted from temp work to short-term project, barely scraping by. Then I came across a listing by a bank searching for an entry-level administrator. Amazingly, they didn’t say anything about having to have a college degree.

I didn’t lie on my resume. “9/81-5/84 Columbia University” listed the dates I attended. I didn’t state that I’d graduated. Nor did I announce: “DROPPED OUT/LOSER.”

Interviews went well and I was offered the job. It was 1986, my income rose from $10,000 to $17,000, and I felt grand.

On my first day, though, after I’d quit my previous job, my new boss offhandedly asked: “You graduated, right?”

“Yes,” I said. I needed the money too much to be honest.

Four years went by. I was repeatedly promoted and given big raises. I worked on big deals. My boss loved me. We became friends. His kindness was too much. I couldn’t lie to him anymore. I confided the truth.

Something wild happened: he apologized to me.

“I should never have listed that college degree requirement,” he said. “You’re a great employee; if you hadn’t lied I would never have gotten to work with you. I’m sorry you’ve been scared all this time. Thank you for lying.”

He dropped the college credential stipulation from his future job listings.

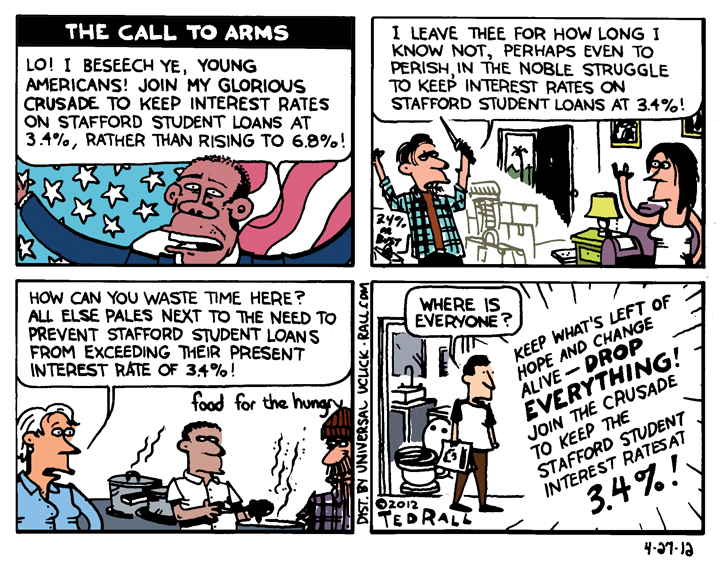

In 1995 I published a widely-circulated and well-received essay for Might magazine titled “College Is For Suckers“ in which I argued that American colleges and universities were perpetuating a multibillion-dollar scam directed at tens of millions of naïve young people and parents.

It’s worse now.

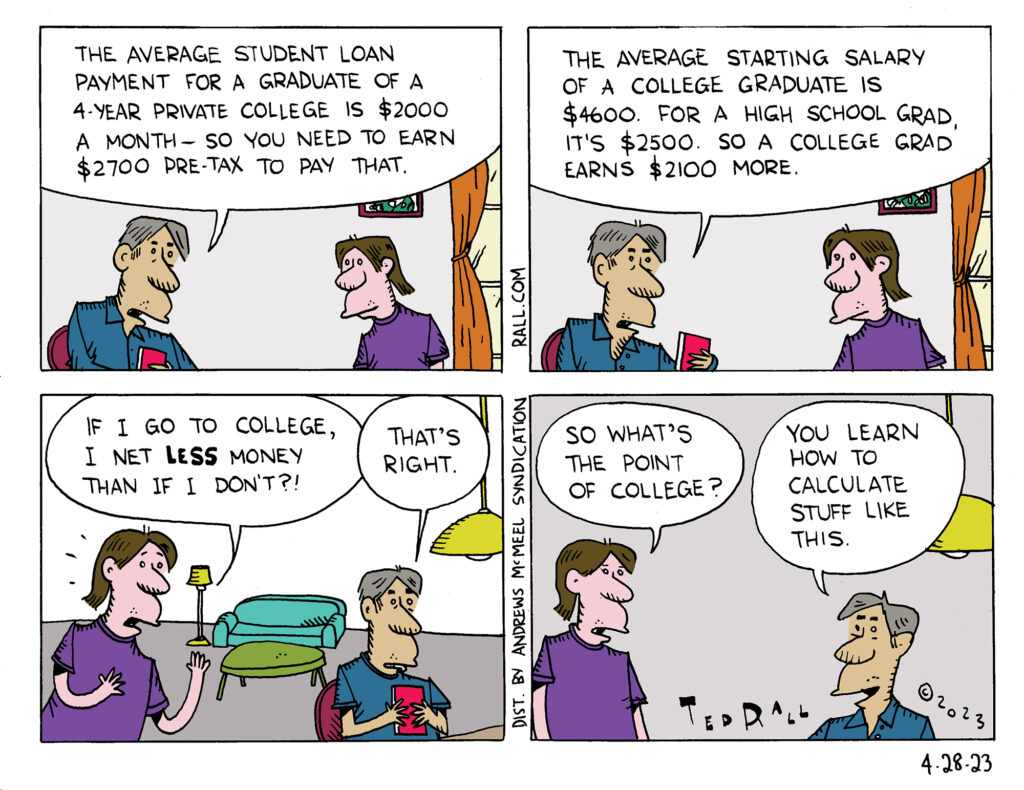

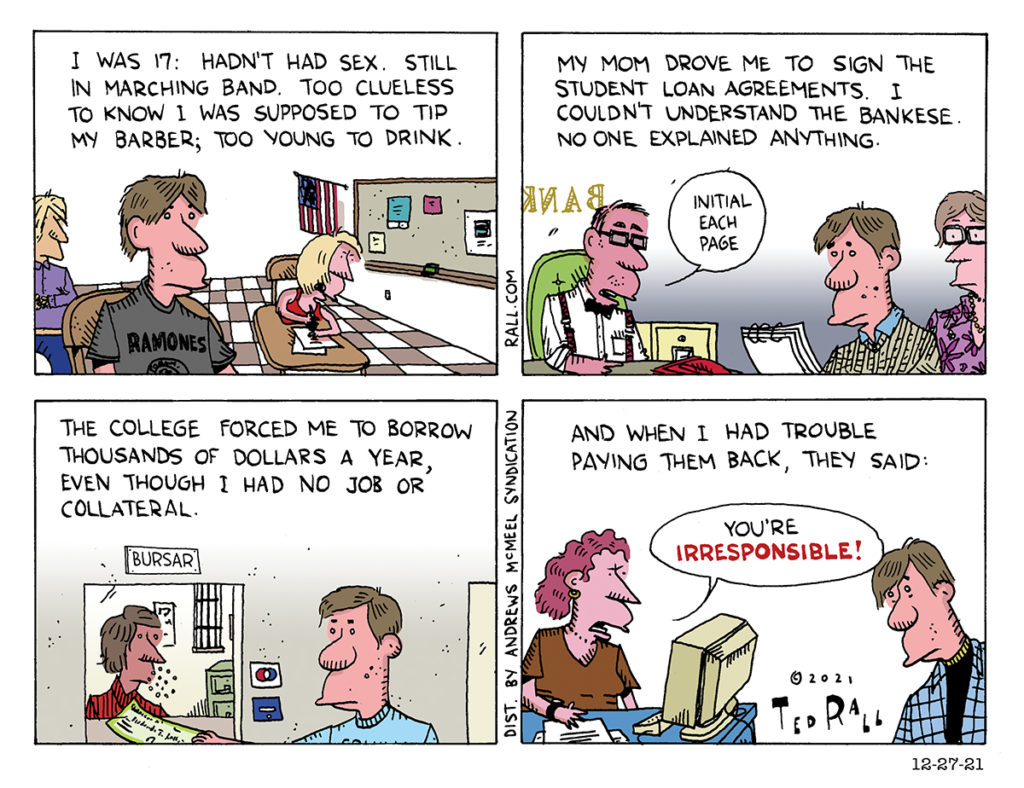

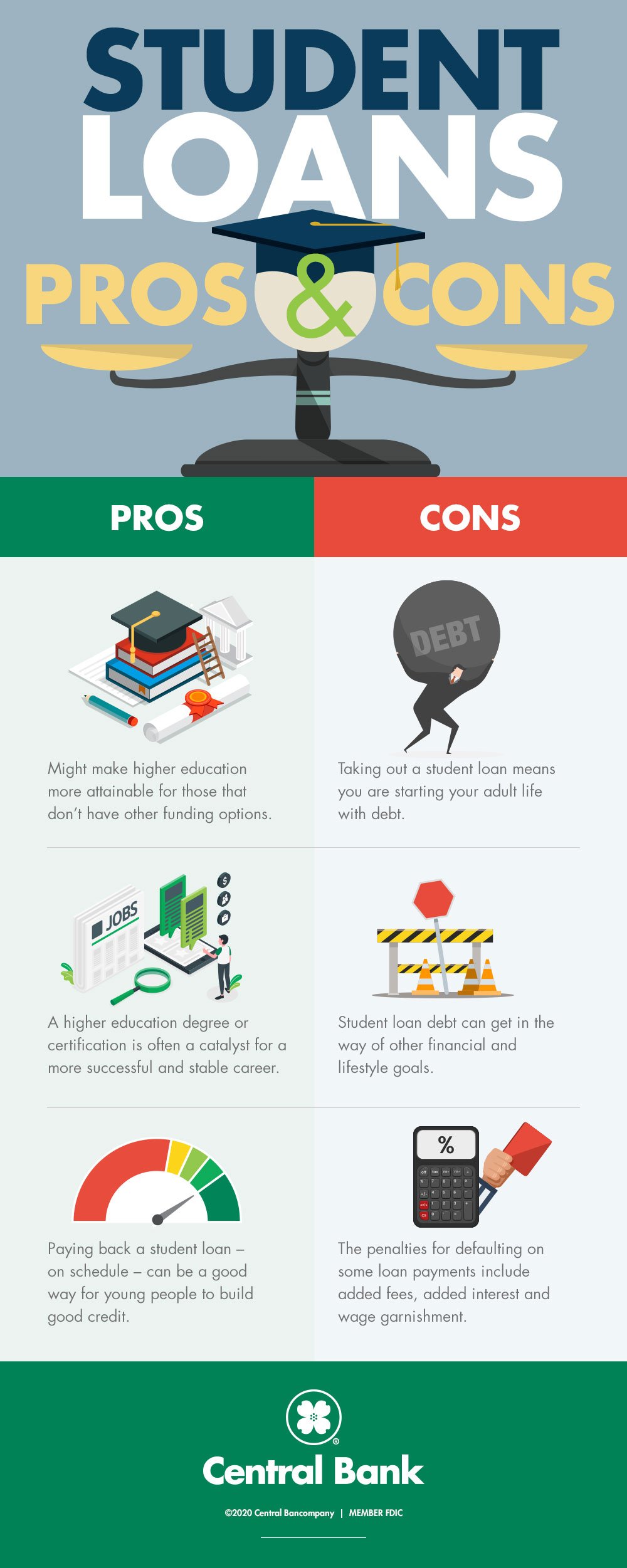

Because you can’t get a professional job without a degree, post-secondary educational corporations—which is what they are—can charge as much as they want. Banks and the government enable the grift by giving 18-year-olds high-interest loans they can never escape, even if they declare bankruptcy. Easy-money loans have allowed colleges to hike tuition five times faster than the rate of inflation since 1970.

Colleges are selling a service we don’t need or necessarily want. Yet we’re coerced into buying at insanely inflated rates.

Many of us pay for that service and don’t even receive it; 42% of college students will never graduate—mostly low-income and minority people—yet they’ll still owe those loans.

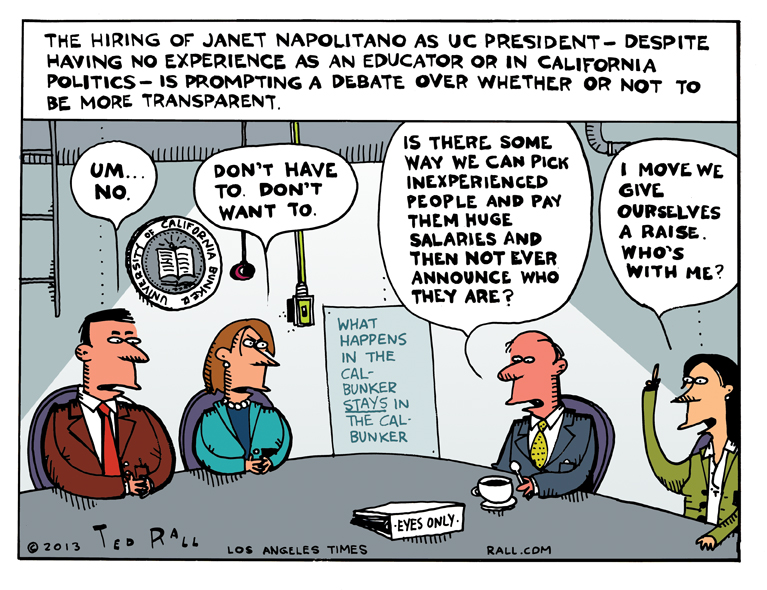

At the root of the student loan-industrial complex is the credentialocracy, a corrupt system in which the college education that people receive serves no practical purpose beyond allowing them to apply for a job. What they study and hopefully learn may be interesting or personally enriching, but it does not provide them with any of the knowledge or training needed to do the job. A mere one out of four graduates works in a field related to their major. Even among that tiny portion, few actually learn stuff at school that they wind up using on the job.

The solution is obvious: employers should stop demanding that applicants obtain an education they don’t need. The Labor Department should issue regulations designed to discourage overcredentialization.

Instead, we’re making the problem worse. We’re saddling families with debt-trap Parent PLUS loans with bigger principals and interest rates higher than traditional government-backed student loans. Student-loan forgiveness schemes dun taxpayers, many of whom don’t go to college, while colleges and banks keep raking in cash and raising rates.

Students loans are a $1.7 trillion business.

Fortunately, the tight labor market has prompted some companies to eliminate silly degree requirements. “Part of it is employers realizing they may be able to do a better job finding the right talent by looking for the skills or competencies someone needs to do the job and not letting a degree get in the way of that,” Parisa Fatehi-Weeks, senior director of environmental, social and governance for the hiring website Indeed told CBS. If history repeats, however, degree inflation will roar back with the next recession.

Credentialocracy is a toxic mindset that prioritizes arbitrary classist certifications over talent and hard work and, as such, should be purged from our collective consciousness. When Hillary Clinton touted her presidential candidacy based on her resume, we ought to have asked: “Impressive list of titles, but what did she accomplish?” When retired generals appear on cable news to analyze the latest foreign crisis, we ought to ignore their honorifics and ask: “Was he one of the neocons who thought Iraq had WMDs?”

Most of the best journalists have never been shortlisted for a Pulitzer. Most of the best musicians are never considered for a Grammy. Awards are BS; diplomas are meaningless. Judge the work, not the plaudits.

(Ted Rall (Twitter: @tedrall), the political cartoonist, columnist and graphic novelist, co-hosts the left-vs-right DMZ America podcast with fellow cartoonist Scott Stantis. You can support Ted’s hard-hitting political cartoons and columns and see his work first by sponsoring his work on Patreon.)